Payments May Not Be Credited

Loan servicers seem to have a separate pocket labeled Suspense into which they sometimes dump your payment. Theyve got your money, they just havent credited it to the amount you owe. The money is in Suspense.

The only reason for putting funds in suspense that seems justified is when the payment is too little to make a full payment on the loan. Servicers dont have to credit partial payments.

So, they put the money in suspense until they receive enough money to make the regular payment.

For reasons no servicer has ever adequately explained, Ive seen suspense accounts in the tens or even a hundred thousand dollars.

So, a mortgage statement that doesnt address any funds held in suspense doesnt tell the whole story.

What Happens If You Cant Pay Your Mortgage

If you find yourself facing financial hardship due to a payment increase, there are a few things you can do: First, shop around for new insurance. The cost of a homeowners policy can change from provider to provider. Shopping around for a lower rate may make enough of a difference in your monthly mortgage payment that you feel comfortable again. Remember to contact your lender to ensure theyve received the updated information, and to request a new escrow account review because most lenders will only calculate escrow payments during the annual review cycle unless requested.

If youre still experiencing a financial hardship due to a payment increase, be sure to contact your lender. Some are willing to extend your shortage repayment, or offer forbearance or loan modification if you have a loss or reduction in income. Its always worth a call to discuss your situation.

Borrower Notification Letter Faqs

Did you receive a Borrower Notification Letter from Freddie Mac? Learn more about what it is and what you should do next.

Q: Why did I receive this notification letter from Freddie Mac?

A: By law, were required to notify you that your mortgage was sold to us. The letter includes more information about your mortgage as part of our continued efforts to promote long-term, successful homeownership.

Q: Should I send my mortgage payments to Freddie Mac?

A: No. There is no change to the way you make your mortgage payment. You must continue to send your payments to the company listed on your mortgage statement.

Q: Do I need to take action on this notice?

A: No. This notice requires no action on your part. It is for informational purposes only. We recommend that you file your borrower notification letter with your other mortgage documents.

Q: Do I contact Freddie Mac if I have questions about my mortgage payment?

A: No. If you have questions about your mortgage or mortgage payment, please contact your lender/servicer using the contact information in the notification letter you received from Freddie Mac or on your mortgage statement.

Q: Why did my lender sell my mortgage to Freddie Mac?

Q: Why is the balance in the letter different than the balance on my mortgage payment?

Q: Does Freddie Mac allow making or applying partial payments to my mortgage?

Q: Will I continue to receive correspondence from Freddie Mac?

Also Check: How To Get Someone Off A Mortgage

Surprising Facts About Partial Mortgage Payments

Try not to make a mortgage payment for less than the amount due . The servicer typically does not apply a partial payment to your mortgage. Instead the servicer may return your partial payment check back to you un-cashed. If so, you should set the money aside and not use it to pay other bills, so you can use it later to help with your mortgage payments. In the worst case scenario, if foreclosure becomes inevitable, you will have some money saved for moving expenses.

Other servicers keep your partial payment in a suspense account until you pay the remaining amount due for that one monthly payment and instead assess you a late fee. As a result, it is easy to get confused as to how much you owe. To avoid problems, check your most recent mortgage statement for the monthly payment amount, since it can change over time. Also check your statement each month to be sure last months payment was applied correctly. If a partial payment is put in a suspense account, the statement must explain what you must do for the payment to be applied.

Frequently Asked Questions About Insurance

What types of home insurance policies are available?

Homeowners insurance ensures that your home will be replaced or the damage will be repaired, up to the amount of coverage obtained, for losses from fire and other hazards covered by the standard extended coverage endorsement.

Flood insurance is required in areas where the dwelling is located in a Special Hazard Flood Area. The flood insurance policy should reflect the same zone as the property rating as determined by a Special Flood Hazard Determination.

Flood insurance is highly recommended for all clients, regardless of flood zone, to fully protect their interest. Please contact your insurance agent if you have questions regarding requirements for flood insurance. The flood insurance policy should also meet the National Flood Insurance Program requirements or the Federal Emergency Management Agency guidelines for a private flood insurance policy.

For condominium units, the homeowners association typically provides the minimum hazard and flood insurance required by us. You should consult an insurance professional for advice on any additional insurance you may need for your own protection. Keep in mind that if the associations policy is not sufficient, then you will be required to obtain additional coverage.

Earthquake insurance is usually carried on a voluntary basis.

What are my homeowners insurance responsibilities?

Should I inform Truist if I make changes to my homeowners insurance policy?

Insurance mailing address:

Don’t Miss: Who Should I Get A Mortgage From

Exceptions To The Periodic Statement Rule

Some types of loans are exempt from the requirements of the periodic statement rule, including:

- open-end lines of credit or home equity lines of credit

- timeshare loans

- loans serviced by small servicers or a Housing Finance Agency , and

- fixed-rate loans with coupon books containing certain information such as the payment due date, interest rate, etc. .

How To File Form : Mortgage Interest Deduction

Taxpayers don’t need to actually include Form 1098 with their tax returns because the information included in the form has already been provided to the IRS. Rather, taxpayers use the information provided on Form 1098 if they plan to deduct their mortgage payments. If you’re planning to file your tax return electronically, you enter the information from the form into the appropriate boxes on your tax return to record your interest deduction information.

If you’re receiving a Form 1098 for the first time, you may wonder how to make sense of it. There are 11 boxes to take note of when reviewing your statement.

- Box 1: Mortgage interest received from the borrower. This box shows how much interest you paid to your lender for the year.

- Box 2: Outstanding mortgage principal.This box shows how much is owed on the principal of the loan.

- Box 3: Mortgage origination date. This shows the date when your mortgage originated.

- Box 4: Refund of overpaid interest. If you overpaid mortgage interest that was refunded, it would be listed here.

- Box 5: Mortgage insurance premiums.If you’re paying private mortgage insurance or mortgage insurance premiums for the loan, those amounts are entered here.

- Box 6: Points paid on the purchase of the principal residence. This box shows mortgage points you may be able to deduct.

- Boxes 7 through 11.These include information about the mortgage and the property itself.

Also Check: What Is Lender Credit On A Mortgage

Final Word On Escrow Statements

Escrow statements make it easy for you to get a breakdown of where your monthly payments are going. Keep an eye out for shortages in the account. Conversely, if you qualify for a property tax abatement or a cheaper home insurance policy, be sure to pursue it and if things change, make sure to contact the custodian of your escrow account, to keep the payments accurate.

Do Escrow Accounts Earn Interest

In general, banks and other servicers are not required to generate interest on money held in escrow accounts. Thats why some homeowners may cancel their escrow account and move their money into a savings account with an interest rate. They can still use the account to pay the insurance and property taxes while collecting interest on the remaining balance.

You May Like: What Is Today’s Mortgage Interest Rate At Chase Bank

How Can I Tell Who Owns My Mortgage

You can look up who owns your mortgage online, call, or send a written request to your servicer asking who owns your mortgage. The servicer has an obligation to provide you, to the best of its knowledge, the name, address, and telephone number of who owns your loan.

Its not always easy to tell who owns your mortgage. Many mortgage loans are sold and the servicer you pay every month may not own your mortgage. Whenever the owner of your loan transfers the mortgage to a new owner, the new owner is required to send you a notice.

If you dont know who owns your mortgage, there are different ways to find out.

How Can I Get An Electronic Periodic Mortgage Statement

If you want to receive your mortgage statement electronically, tell your mortgage servicer.

The CFPB doesnt prohibit servicers from sending periodic mortgage statements electronically, as long as your servicer has your consent.

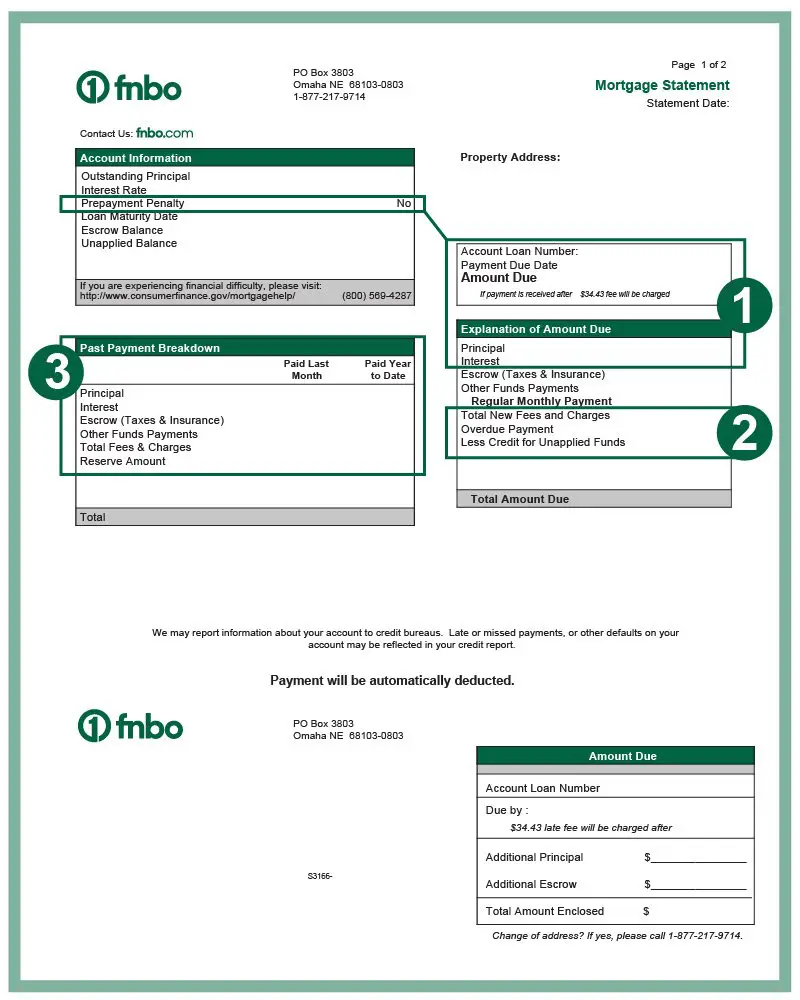

Under CFPB rules, your mortgage servicer is generally required to provide a periodic mortgage statement to you each billing cycle. That statement should cover basics such as:

- An explanation of your amount due

- Your payment and transaction history

- Your account information

- The contact information for your servicer

The CFPB rules do not require mortgage servicers to provide electronic statements, but they do allow servicers to give you the option of receiving your periodic statements electronically instead of through the mail. As long as your servicer gets your consent in advance, it can send electronic periodic statements to you. In fact, if you currently receive electronic statements from your servicer for any account , CFPB rules say that your servicer should consider you to have already agreed to receive electronic periodic mortgage statements.

Depending on your individual circumstances, you may prefer to receive paper or electronic statements. Mortgage servicers may be capable of offering you the option for electronic statements.

If you have a problem with your mortgage, you can submit a complaint with us online or by calling 411-CFPB .

Dont Miss: Chase Mortgage Recast Fee

Recommended Reading: What Do Lenders Check For Mortgage

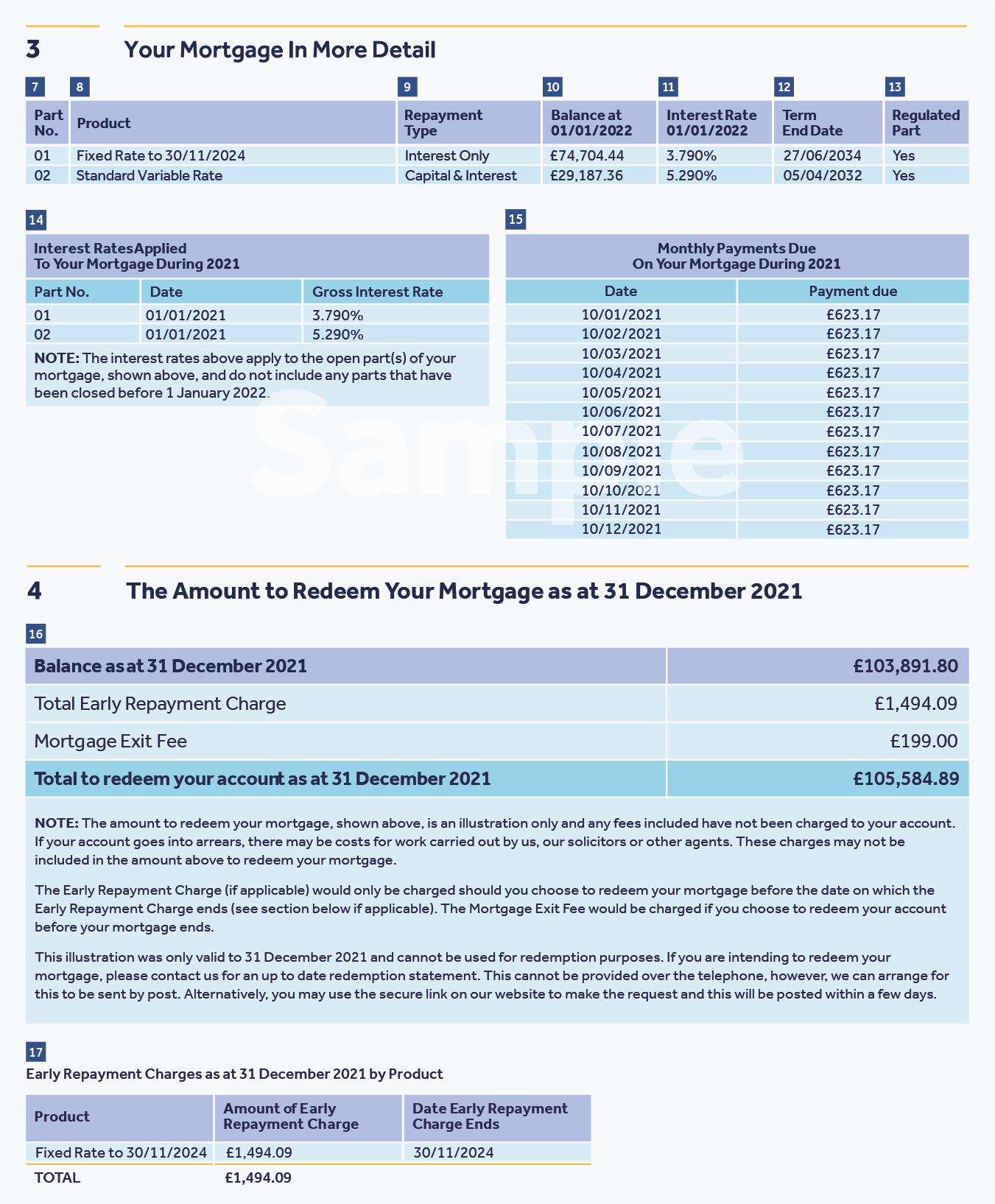

What Does A Mortgage Statement Look Like

First and foremost, your statement will contain the amount due, clearly showing the principal , the current interest rate for your loan, the cost of interest for the period, and whether there are any prepayment penalties. This information will help you to understand where your money is going each month and over the life of your loan, as well as any advantages or disadvantages to paying your home loan off early.

Next, you should see any fees the lender is assessing for the month, such as late charges. If your lender is holding money in escrow for future property taxes and insurance bills, that balance will also be clearly presented on your statement.

Lastly, your statement will show any amounts credited to your loan since the last billing cycle. Its a good idea to check this section carefully to ensure that your payments are being received and applied correctly, especially if you make additional payments to escrow and/or principal. If your statement shows that your mortgage is delinquent, you should take prompt action to correct the situation to avoid adverse credit reporting.

Raise And Resolve Disputes Or Errors

If the servicer made a mistake or charged you a fee you dont owe, correct it as soon as possible. But keep making your regular monthly mortgage payment. Dont subtract the disputed amount from your mortgage payment. Some servicers will refuse to accept what they consider a partial payment. They could return your check and charge you a late fee, or claim that your mortgage is in default and start foreclosure proceedings.

Dont write your dispute on your payment coupon or a copy of your monthly mortgage statement. Instead, contact your servicer in writing and explain the problem

- Use the Sample Complaint Letter to write your request, including your account number and an explanation of why you think your account is incorrect.

- Gather any documents that support your request. Your records should include copies of your statements, coupon book, and paperwork showing that you made your payments . These can serve as proof of your payment history and your interactions with the servicer.

- Send your letter and copies of any documents that support your request to the mortgage servicers customer service address by certified mail, and request a return receipt. This may be a different address from where you send your payments.

- Keep a copy of your letter and the originals of the documents you sent.

Also Check: Why Are Condo Mortgage Rates Higher

How Can I Find My Mortgage History

Go to the county recorder’s office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder’s office. Check with the tax assessor or other municipal office where you live for more details.

Look At The Big Picture

Your mortgage statement allows you to assess the big picture. Buying a home is the largest purchase most people ever make. And taking on the accompanying mortgage is a huge commitment. You need to be well-prepared to make the monthly payments for several years. Unfortunately, many people take on more than they can handle. If you see that you are always struggling to pay your mortgage, you should consult with a financial advisor who may recommend a second mortgage or modifying your existing loan to make payments you can more comfortably afford.

You May Like: What Does Prequalification For A Mortgage Mean

Enjoying Your New Home

Purchasing a home is one of the biggest investments you will probably ever make. Understanding the information on your statement and annual escrow review, as well as how your loan is serviced, will help you successfully plan for a financial future that ensures happy days in your home for years to come.

Reviewing A Mortgage Statement

Like a credit card statement or , a mortgage statement is an important disclosure document for the buyer for a number of reasons. First, it keeps the borrower aware of the current mortgage balance, allowing the borrower to check the balance for discrepancies. It should be reviewed upon receipt for errors, and if errors are found, the mortgage holder should be notified immediately. Mortgage holders can double check the number appearing on the statements by using mortgage calculators like the ones on this site.The mortgage statement should provide the borrower with the amount of time left in the mortgage term. Having this information tells the borrower when their mortgage is up for renewal and gives them notice to decide if they want to stay with their current lender or if they want to shop around for a different interest rate.

Need help reviewing your mortgage statement? Contact us anytime!

Recommended Reading: What Were Mortgage Interest Rates In 2006

Why Is There A Minus Figure In The Debit Column

These are credits to your account that reduce the balance and may occur when a capital repayment is made, therefore reducing the balance and the amount of interest charged. This difference in interest charged will be shown on your account. Any charge required for early repayment will also be shown in the Debit column.

Disputing The Amount Due

You can dispute the amount the servicer says is due in a monthly statement. For example, your servicer may have failed to or incorrectly credited your payment, neglected to make payments out of your escrow account and instead forced you to pay for extra insurance, charged unnecessary or duplicative fees, or improperly refused to accept a payment. Contact the servicer right away.

Dealing with your mortgage servicer can sometimes be frustrating. Many mortgage servicers are large companies that handle tens of thousands or even hundreds of thousands of mortgages. You may speak to a different person each time you call, and you may get conflicting or confusing information from one person to the next. Make a note in a notebook each time you talk to someone at the mortage servicing company, including the date, time, name of the person you spoke with, and what you talked about.

Provide any documentation that the servicer requests and keep copies for yourself. Make a note in your notebook of what you provided, when you provided it, and how you sent it to the servicer . If the servicer does not provide you with the information you requested or if you dispute how the servicer is handling your account, you may send the servicer a more formal request, called a notice of error or request for information, to ensure that they respond in a timely manner and correct any errors.

Here is an example of such a letter to the servicer:

You May Like: Can I Use My Partner’s Income For A Mortgage

Start: Understanding Arrear Payments

Unlike most loans, mortgage principal and interest are paid in arrears or paid after interest is accrued. So, when buying a home, your first payment is due at the beginning of the first full month after closing. If you close on April 10, your first payment is not due until June.

However, when you close on your mortgage loan, the lender will collect interest on all remaining days of the month you close. If you close on the 15th of a 30-day month, there will be 16 days of interest collected the number of days remaining in the month, including the 15th. This ensures all payments are the same amount. The closer you are to an end of month closing, the less interest you owe that month .

Key takeaway:

As you likely expected, you eventually pay all of the interest that’s due neither more nor less. If youre in need of lower closing costs, you can discuss seller concessions with your realtor or assistance programs with your mortgage lender.