Ensure Your Id And Address Documents Are Up To Date

If you need to provide proof of ID or address to satisfy money laundering requirements it must be the original document, not a copy, and be current and valid.

- Passport must not be expired

- Driving License must have your current address

- Council tax statement – latest one available

- Utility Bills usually dated within 3 months

- Bank statements physical statements are required if you use these as proof of address

If Youre Applying For A Mortgage Its A Good Idea To Start Prepping Your Financial Documents

Lenders will request paperwork for your mortgage application that proves things like how much money you make and your debts. The exact forms you need for a home loan depend on your situation. For example, someone who is self-employed will likely have to provide different forms than someone who is employed by a company.

Although the exact forms might vary, Todd Huettner, owner of Huettner Capital, a residential and commercial real estate lender, says a lender can get a good sense of your likelihood of being approved by checking out your recent pay stubs, bank statements, W-2 forms and tax returns.

Huettner says that with these documents, hes able to make a good assessment of the borrower. These documents allow me to tell what they can and cannot do with a very high level of certainty, he says.

Depending on your unique financial situation, here are seven mortgage documents you might need when applying for a home loan.

Next Steps: Can You Afford To Buy A House

Your lenders goal is to assess you as a borrower and ensure you can make your payments on time.

If youre thinking about a home purchase in the near future, these are some good questions to ask yourself to prepare for the home-buying process.

- How much down payment can you afford? A higher down payment is often a good sign for the lender about your finances.

- What is your debt-to-income ratio? Youll likely need to keep this number below 43%.

- What monthly mortgage payment can you comfortably afford in your budget?

- Are you prepared for closing costs, such as an appraisal or prepaid property taxes?

Recommended Reading: What Is Prime Rate For 30 Year Mortgage

Decide On A Loan Type Yourself

I see it all the time a loan officer or broker will basically put a borrower in a certain type of loan without so much as asking what theyd like.

Not everyone wants or needs a 30-year fixed mortgage, even though its far and away the most popular loan program out there.

An adjustable-rate mortgage may suit you, or perhaps a 15-year fixed is the better play.

Whatever it is, do the research yourself before the interested parties get involved.

This ensures its a more objective choice, and not just a blind, generic, or biased one.

Why Your Lender Wants Documents

Your mortgage lender has an obligation to lend responsibly. They need to verify that you can afford to repay the loan based on your current financial circumstances.

To make that call, they need know a lot about your income and your expenses. Its not enough to merely tell them. You need to show evidence with the right documentation.

Heres what most lenders will ask you to prove and the documents they will accept.

Read Also: Who Has The Best Reverse Mortgage Rates

Locking In Your Interest Rate

Since interest rates fluctuate frequently, things can change between the day you apply for your loan and the day you close. If you want to protect yourself against rising interest rates and ensure that the loan terms you used to build your budget are locked, you might consider locking in your rate with your lender when you fill out your loan application.

A rate lock, also known as a rate commitment, is your lenders assurance that the interest rate and discount points are guaranteed until the rate lock expiration date. The lender will provide the terms of the rate lock to you in writing, including the agreed-upon interest rate, the length of the lock and any discount points you choose to pay. Learn more about discount points

Of course, if you believe that interest rates will decrease in the near future, waiting to lock your rate may make sense to you. In the end, its a personal choice when to lock your rate. The rate must be locked prior to the lender preparing your closing documents. Talk to your lender about the choice that best suits your needs and your preferences.

List Of Documents Required For Nri Applicants

- Document establishing KYC.

- Salary Certificate from employer stating in English the name , designation, passport number, date of joining, latest salary.

- Last 3 to 6 months salary slips reflecting variable components like incentives, overtime, etc.

- Latest IT Returns .

- For Self Employed NRIs, business documents like Trade License, Sponsor Agreement, Power of Attorney, etc.

- Copy of Passport showing the page of residence visa.

- Proof of employment by the Government of the residing country like work permit, labour contract, etc.

- Documents related to the Property with cost estimates from an Indian Architect or Engineer.

- For Salaried NRIs, income documents attested by embassy official required if theres no documented evidence for salary credit or fund remittance to India is available.

- Bank statements copies from overseas of the past 6 months.

- Last 6 months NRO/NRE bank statement.

- If applicant is unavailable in the country at the time of signing documents, Power of Attorney needs to be produced by the person acting on their behalf.

Also Check: What Is The Best Mortgage Loan Company

How To Get A Mortgage: A Step

You probably already know that a mortgage is a type of loan that you use to buy a home. Its a good idea to learn as much as you can about getting a mortgage before you start shopping for a home.

The best way to avoid wasting time is to know the players and the process. That means working with a lender to get the best possible loan.

In this article, well get you ready to go mortgage shopping by going over what lenders are looking for, the paperwork involved and the five steps it takes to complete the mortgage process.

Time: 1 Hour To Several Hours

You

Applying to more than one lender has given you options. Now use your Loan Estimate forms to compare terms and costs.

At the upper right corner of the first page youll see expiration dates for the interest rate find out if it’s locked and closing costs. Ask the lender to explain anything you dont understand.

If the numbers seem dizzying, Dont focus too much on rate, Burrage says. Instead, look at the four numbers in the Estimates Comparisons section, on page 3. These will allow you to easily compare offers:

-

Total cost in five years. This is all charges including interest, principal and mortgage insurance that you’ll incur within the mortgage’s first five years.

-

Principal paid in five years. This is the amount of principal youll have paid off in the first five years.

-

APR. Also known as its annual percentage rate.

-

Percent paid in interest. This is the percentage of the loan paid in interest over the entire life of the mortgage. It’s not the same as the interest rate.

The lender

The lenders job is to answer all your questions. If you cant get good answers, keep shopping.

Recommended Reading: How Much Interest Do I Pay On A Mortgage

Checklist Of Documents Youll Need For A Mortgage

Through December 31, 2023, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you’re applying for a home loan, your mortgage lender will want to take a deep dive into your financial life. This is to ensure that you meet all of their underwriting guidelines and are in the position to easily afford your new mortgage payment. Throughout the approval process, you can expect to be asked for documents that substantiate different aspects of your income, work status, expenses and more. It’s little wonder that it can take up to 60 days to complete.

Getting your paperwork organized in advance is a great way to streamline the process and improve your odds of getting approved. Here we take a closer look at the supporting documents you’ll need if completing the uniform residential loan application . It’s the form most lenders use to determine a borrower’s mortgage eligibility.

How The Application Process Works

When you’ve laid the groundwork for your mortgage application, you can begin the process in earnest. Remember that by entering the housing market, you may be competing against other buyers for the same property while at the same time negotiating your best price with the seller. In a seller’s market, that often means higher price tags and concessions, while a buyer’s market will usually result in lower costs and greater negotiation power for the new homeowner.

With the current housing market in mind and your preparations complete, use the following steps to secure a mortgage and land your next home.

Also Check: What Mortgage Companies Finance Mobile Homes

Spending Expenses And Debts

On top of your income, your lender will also want to understand your financial liabilities. After all your bills are paid, how much is left over each month to put toward a new mortgage payment? You’ll be asked to list out all of your debts, as well as expenses like child support and alimony you may provide.

Find A Property And Make An Offer

Now comes the best part finding the home thats right for you. To help you with your search, try connecting with a real estate agent in your area when you start viewing properties, especially if youre buying your first home. A real estate agent can help you narrow your search and show you properties that fit both your budget and needs.

Once you find the right home, your real estate agent will also help you submit an offer, and potentially begin negotiating with the seller. Once the seller accepts your offer, its time to move to the final stages of the home buying process.

You May Like: How To Lower My Mortgage Interest Rate Without Refinancing

How Do Lenders Check I Can Afford A Mortgage

Lenders will work out your household income including your basic salary and any other income you receive from a second job, freelancing, benefits, commission or bonuses.

Checking affordability is a much more detailed process. Lenders take all your regular household bills and spending into account, along with any debts such as loans and credit cards, to make sure you have enough left to cover the monthly mortgage repayments.

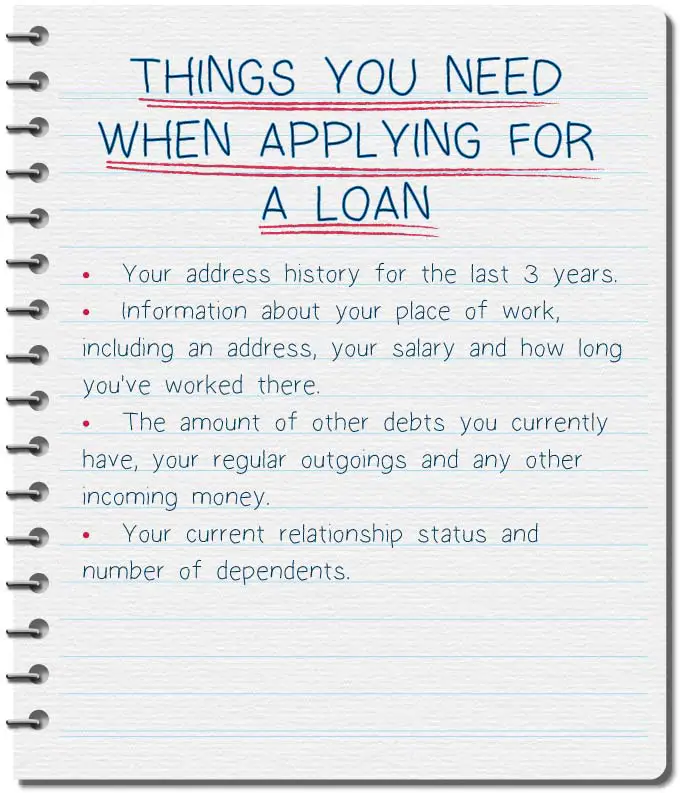

Loan Application Information Required

The first thing youll do when applying for a mortgage is complete a federally required mortgage application. Regardless of whether the application is in the paper format linked here, an online form, or done verbally with your loan officer, this linked document contains the application with the information youll need to provide, including:

- Full name, birth date, Social Security number, and phone number

- Residence history for at least two years. If youre a renter, your rent payment is needed. If youre an owner, all mortgage, insurance and tax figures are needed for your primary residence and all other properties owned.

- Employment history for at least two years, including company name, address, phone number, and your title.

- Income history for at least two years. If you receive commissions, bonuses, or are self-employed, you must provide two years of bonus, commission, or self-employed income received. Most lenders average variable and self-employed income over two years.

- Asset account balances including all checking, savings, investment, and retirement accounts.

- Debt payments and balances for credit cards, mortgages, student loans, car loans, alimony, child support, or any other fixed debt obligations.

- Confirmation whether youve had bankruptcies or foreclosures within the past seven years, whether youre party to any lawsuits, or you co-sign on any loans.

- Confirmation if any part of your down payment will be borrowed.

Read Also: What Would The Payment Be On A 100 000 Mortgage

Make A Formal Mortgage Application

Once you’ve had your offer on a property accepted, you should formally apply for a mortgage.

If you’re using a mortgage broker, they will arrange this for you.

The mortgage lender will then conduct a valuation on the property you intend to buy. This confirms to them that the property is worth roughly what you intend to pay for it.

The lender will also do a thorough check of the paperwork you’ve provided and your credit record. This search will appear on your credit file.

If a lender turns you down at this stage, it’s worth trying to find out why, and potentially waiting a while before applying to another lender. Making several mortgage applications very close together could significantly damage your credit score.

Check Your Credit Scores And Reports

Most cliché advice ever. Yes, but theres a reason. Its very, very important, if not the most important aspect of home loan approval.

It also happens to take a lot of time to fix credit-related issues, so its not a last-minute activity if you want to be successful.

These days its also super easy to check your credit scores and reports for free, thanks to services like Credit Karma or Credit Sesame.

Simply taking the time to sign up and monitor your credit could make or break you when it comes time to apply for a mortgage.

It may also save you a ton of money as higher credit scores are typically rewarded with lower mortgage rates, which equates to lower monthly payments and lots of interest saved.

If your scores arent all good, tackle the issue immediately so youre in excellent standing when it comes time to apply.

Read Also: Is Quicken Loans A Mortgage Broker Or Lender

Think How Long Youll Be In The Home

Along those same lines, try to determine your expected tenure ahead of time.

If you know or have a good idea how long youll keep the property, it can be instrumental in loan choice.

For example, if you know youre just buying a starter home, and have pretty strong plans to move in five years or less, a 5/1 adjustable-rate mortgage might be a better choice than a 30-year fixed.

It could save you a ton of money, some of which could be put toward the down payment on your move-up property.

Conversely, if youre thinking forever home, it could make sense to get forever financing via a fixed-rate product.

And also pay mortgage points to get an even lower rate youll enjoy for decades to come.

Test Your Mortgage Fitness

When it comes to determining if you’re fit for the loan you want, lenders assess four main factors: income, credit score, assets and collateral.

Often, Hammond says, clients omit information or claim earnings that don’t match their tax return.

“When a client can’t produce the correct return, we must qualify with what the IRS presented,” she explains. If the IRS’ records cite a lower income, it can make the applicant appear less fitand can disqualify them from getting the loan rate they want.

Your credit score can also impact your loan fitness. To build up your score, ensure you pay things on time. Also, to avoid unpleasant surprises, be sure to request a free report through a credit bureau before you apply for your loan.

Your assets can also affect your down payment. Lenders will want to know where the money comes from. Is it inherited money? A 401K? Other collateral? Will you live in the home or rent it out?

Hammond recommends thoroughness. She’s found that, when a client forgets to mention something vitallike co-signing a lease on an apartment for a friendthe omission can reduce the amount the bank will approve for their mortgage.

Recommended Reading: How Many Years Can I Knock Off My Mortgage Calculator

Time: 24 Hours Or Less

In this final step, the lender must act before the borrower can move forward.

The lender

With time to spare before your closing date, you hear from the lender with happy news: You’re cleared to close!

The lender must send you another federally required form, the Closing Disclosure, three business days before your scheduled closing date. It shows the detailed and final costs of your mortgage.

Examine the Closing Disclosure carefully to compare it against the Loan Estimate form to see if any of the quoted fees or numbers have changed. If they have, ask the lender to explain.

You

Compare the Closing Disclosure with your Loan Estimate to see if any of the quoted fees or numbers have changed. If they have, ask the lender to explain.

Complete These Five Simple Steps To Get To The Closing

Okay. Youve found your dream home and the seller has accepted your offer. Heres what you can expect during the mortgage process, from application to closing.

Also Check: How Long It Takes To Get Mortgage Approved