What Is The Best Type Of Mortgage Loan

The best type of mortgage loan depends on your personal financial profile, lifestyle goals and the type of property you want to own.

For example, a 30-year mortgage might be better for someone who prefers the lowest monthly payments and plans to live in the house for a long period of time. However, if you want to pay off the home quickly, you can opt for a 10-, 15- or 20-year mortgage. The monthly payments will be higher, but the house will be paid off faster.

If interest rate cost is an important factor for you, you might also consider an adjustable-rate mortgage . The most popular ARM is called the 5/1 ARM, which has a fixed rate for the first five years of the loan and then switches to an adjustable rate for the remainder of the 30-year loan term. When the loan hits the adjustable-rate period, it typically adjusts annually.

This can be a good option if you feel ARM rates are likely to stay lower than fixed rates in the future. For example, the 30-year fixed rate has dramatically increased since the start of 2022, which has made the ARM rate a lower, more attractive option right now.

Related: Current ARM Rates

However, if ARM rates exceed fixed rates in a couple years, it could mean you face higher mortgage payments when the 5/1 mortgage reaches the adjustable-rate period. So its important to be prepared for changes in mortgage costs when applying for a 5/1 ARM or other ARMs.

How To Get The Best Mortgage Rate

Mortgage rates change daily and can vary widely depending on a variety of factors, including the borrower’s personal situation. The difference in mortgage rates can mean spending tens of thousands of dollars more in interest over the life of the loan. Here are some tactics to help you find the best mortgage rate for your new home loan:

Home Purchase Loan Options

Recommended Reading: How Many Tax Returns For Mortgage

Refinancing And Home Equity Loans

Homeowners looking to refinance their current mortgage or tap their home equity using a second mortgage can find a standard slate of options with Chase. You could refinance into a conventional, FHA, or VA loan using the same application process youd use to buy a new home.

Refinancing creates a variety of opportunities for existing homeowners. You might:

- Get a lower interest rate: Dropping your rate can lower your monthly payments and your long-term interest costs

- Change your loan term: Loans with shorter terms save money over the life of the loan. For example, refinancing from a 30-year to a 15-year fixed-rate loan could increase your monthly payment but reduce long-term costs

- Change your loan program: For example, some homeowners refinance from an FHA loan to a conventional loan to stop paying for mortgage insurance. Youd need at least 20% home equity to do this

Homeowners who have built up equity over time can access this resource by getting a second mortgage or a cash-out refinance through Chase Home Loans.

The amount youre able to borrow from your home equity depends on your homes value, your current loan balance, and your credit score, among other factors.

Will Another Big Hike Impact The Stock Market

Following disheartening inflation data last week, the market swooned in anticipation of a big rate hike on Wednesday. Even though inflation is cooling slightly, it’s not receding as quickly as economists had hoped. Even more alarming, core inflation data which excludes volatile food and fuel prices rose in August.

“he Fed’s rate hikes are not working, at least yet and that inflation in the real economy is getting worse, not better,” noted Brad McMillan, chief investment officer for Commonwealth Financial Network, in a research note. “Higher rates mean lower stock values.”

Stocks tumbled after the announcement, with the Dow Jones Industrial Average shedding 0.7% in Wednesday afternoon trading. In its Wednesday statement, the Federal Reserve said it “anticipates that ongoing increases” in the target range for the federal funds rate “will be appropriate,” signaling that more rate increases could be forthcoming.

You May Like: How Much Would 200k Mortgage Cost

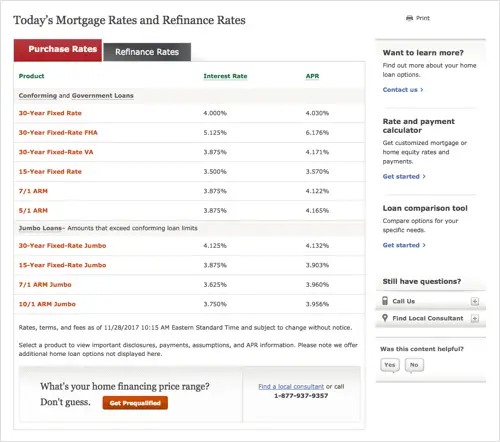

Average Mortgage Rates At Major Lenders

| Chase | |

| Avg 30-Yr Interest Rate, 20211 | 3.02% |

| Median Total Loan Costs, 2021 | $3,696 |

| $1,330 | $0 |

Average rate and fee data were sourced from public rate and fee records required by the Home Mortgage Disclosure Act .

You might want Chase on your list if you consider yourself a standard home buyer looking for a mainstream loan option. Conversely, if youre in a niche home buying group , you may be better served by a specialist.

No matter who you are, you should shop around and compare rates from more than one mortgage lender before choosing a home loan.

Ad You Could Lower Your Monthly Payment When You Refinance With Chase

Chase bank mortgage refinance interest rates. Call us or have us call you. To receive 500 off your mortgage processing fee youll need to have 150000499999 between your Chase deposit accounts and Chase investment accounts. Chase Mortgages Refinance Rate.

Prequalify For A Lower Interest Home Loan. Current mortgage rates us bank refinance rates today. Check Out Our Refinancing Options To Choose The Best Solution For You.

Browse Our Collection and Pick the Best Offers. Table and growth rate calculation by chrisb Interest Rate 30 Year Fixed. Compare Mortgage Options Calculate Payments.

Chase has mortgage options to purchase a new home or to refinance an existing one. Apply Now With Quicken Loans. Work With Our Mortgage Specialists To Craft A Refinancing Solution.

Bankrate has offers for New York mortgage and refinances from top. We update our interest rate table daily Monday through Friday so you always have the most. Ad You Could Lower Your Monthly Payment When You Refinance With Chase.

Is important notices customers with ease of their normal income and selling chase bank interest rates for mortgages. Check Out the Latest Info. Chases competitive mortgage rates are backed by an experienced staff of mortgage professionals.

What More Could You Need. As of Thursday September 15 2022 current rates in New York are 602 for a 30-year fixed and 550 for a 15-year fixed. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Read Also: Can You Get A Second Mortgage With Bad Credit

How To Find The Best Mortgage For You

Once youve settled on the length of the mortgage, its time to do your research to find the best mortgage for you . This due diligence will mean comparing mortgage rates from several lenders, which might include mortgage brokers, traditional banks and online lenders. Its smart to prepare for your mortgage search by reviewing your credit report to confirm its correct and evaluating your financial landscape to determine how much you can afford to put toward a home each month. The key is to make sure the client is comfortable with their budget and payment, says Reiling. Since youll have a tighter repayment schedule compared with a 30-year loan, lenders will probably want to see that you have a higher income level in addition to strong credit and savings.

While there is no official best season to shop for a mortgage since rates are driven by the market and overall economic landscape, Reiling says, Banks are much more competitive on rates when business is slow, which tends to be in the dead of winter around January or February.

Compare To These Lenders

You May Like: How Much Home Mortgage Can I Afford

Mortgage Rate Smackdown: Bank Of America Vs Chase Vs Wells Fargo

This article was first published on NerdWallet.com.

Entering the ring are the heavyweights in the mortgage loan industry: Bank of America, Chase and Wells Fargo. But rather than pounding each other with boxing gloves, each of these competitors is looking to score a mortgage rate knockout. Which one shall don the golden dollar sign-embellished champions belt for the best home loan interest rate?

The lights go up, and the bell rings. Lets get ready to rumble!

Chase Mortgage Rates Today

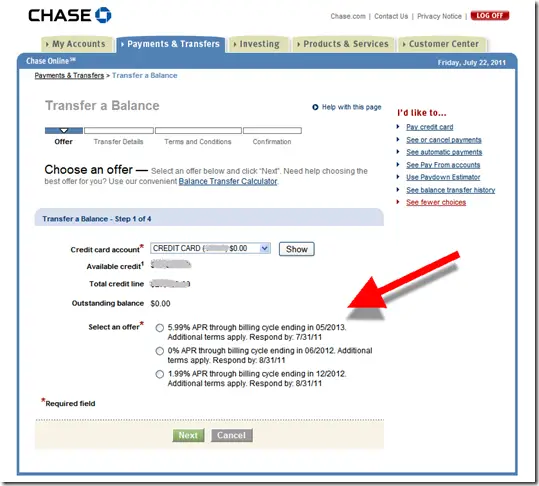

The Chase Bank refinancing rates are competitive. Chase, as with all other financial institutions, will take a homeowners current debt load and history into consideration in deciding upon a refinancing rate.

To find current Chase mortgage refi rates in your area, youll need to visit Chases website to enter your geo-specific information or speak with a representative directly.

Recommended Reading: Does Rocket Mortgage Use Fico 8

How Will It Impact On House Prices

The property market has been fuelled by cheap mortgages, so increases in the cost of borrowing will have an impact. However, all eyes are on the government, which could announce a stamp duty cut in Fridays mini-budget a move many commentators say would push property values even higher, further pricing out first-time buyers.

House prices have surprised many by continuing to rise, according to the Halifax and Nationwide respectively, and typically went up by 0.4% and 0.8% in August. Official data showed that the annual rate of UK price growth soared to 15.5% in July. But Halifax and many commentators have warned of a more challenging period ahead.

Chase Jumbo Mortgage Rates

JP Morgan Chase has many fixed rate jumbo mortgage products, all at very competitive interest rates. Unlike other lenders that offer balloon-payment jumbo loans, Chases large-balance refinance loans carry fixed rates for extended terms. In fact, they make jumbo loans of up to $2,000,000 for 10-, 15-, 20-, 25-, and 30-year fixed terms.

One note of caution. If you consider a HELOC be careful about the terms. If you agree to a variable rate, your interest may rise. Also, if your home declines in value, you could end up paying more money than your home is worth.

You May Like: Does Canada Have 30 Year Mortgages

Mortgage Interest Rates Forecast 2022

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022.

While mortgage rates are directly impacted by U.S. Treasury bond yields, rising inflation and the Federal Reserves monetary policy indirectly influence mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

The pressure to contain inflation will grow and the Fed will have to raise its fed funds rate eight to 10 times with quarter-point hikes this year, says Lawrence Yun, chief economist and senior vice president of research at the National Association of Realtors . Additionally, the Fed will undo the quantitative easing steadily, which will put upward pressure on long-term mortgage rates.

Here are more detailed predictions from economists, as of mid-April 2022:

- Mortgage Bankers Association : Mortgage rates are expected to end 2022 at 4.8%and to decline gradually to 4.6%by 2024 as spreads narrow.

- NARs Yun: All in all, the 30-year fixed mortgage rate is likely to hit 5.3% to 5.5% by the end of the year. Some consumers may opt for a five-year ARM at 4% by the end of the year.

- Matthew Speakman, senior economist at Zillow: Competing dynamics suggest that there will be little reason for mortgage rates to decline anytime soon.

How Will It Affect Mortgage Payments

For the 2.2 million people on a variable rate mortgage, the rise is very bad news, leaving many having to pay hundreds of pounds extra a year. About half of them are either on a tracker directly linked to the Bank base rate or a discounted-rate deal, according to recent Financial Conduct Authority data. The other half are on their lenders standard variable rate .

A tracker mortgage directly follows the base rate the small print of your mortgage will tell you how quickly the rise will be passed on, but in the next few weeks your payments will almost certainly go up, reflecting the full base-rate rise. On a tracker previously at 3%, the interest rate would rise to 3.5%, adding £38 a month to a £150,000 repayment mortgage with 20 years remaining. Increase that £150,000 to £500,000 and another £128 a month will be needed.

With SVRs, things are less straightforward: these can change at the lenders discretion, but most will probably go up. However, banks and building societies are likely to come under pressure to perhaps pass on only some of the latest increase to SVR borrowers. Some lenders may take some time to declare their intentions.

However, according to the FCA, about 6.3 million UK mortgages are on fixed-rate mortgages, and so for the time being are insulated from the latest rise.

Recommended Reading: Can I Afford A Second Mortgage

Chase Bank Mortgage Rates

»Chase Bank is advertising some of the best mortgage rates available these days for both refinancing and home purchases. For a fixed conforming 30 year mortgage Chase Mortgage is currently advertising a mortgage rate of 5.00 percent.Their conforming 30 year mortgage rate is exactly the same as the national average 30 year mortgage rate. Mortgage rates are expected to start going higher very soon, so now is a good time to buy a home or refinance a mortgage.You also have until April 30, 2010 to take advantage of the first time home-buyer tax credit of $8,000 or $6,500 if you have owned and lived in your current home 5 years or more. There are income requirements for the tax credits.The bank’s fixed rate conforming 15 year mortgage rate is being advertised at 4.375 percent, a fraction lower than the average 15 year average mortgage rate of 4.389 percent as of today.Chase Mortgage is also advertising some of the lowest adjustable mortgage rates currently available. The bank’s conforming 7/1 adjustable rate mortgage currently has an rate of 4.50 percent and their conforming 5/1 adjustable mortgage rate is currently at 4.00 percent.Chase Mortgage also has a 1% cash back deal:Explainer: What Rising Interest Rates Mean For You

The Federal Reserve raised its key interest rate Wednesday by a substantial three-quarters of a point for a third straight time.

In its continued bid to quash high inflation, the Federal Reserve on Wednesday raised the overnight bank lending rate to a range of 3% to 3.25%.

It is the fifth increase by the US central bank in six months and its third consecutive 75- basis-point hike, which will put upward pressure on other interest rates throughout the economy.

For consumers, the Fed’s move will spur yet again the question of where to park their savings for the best return and how to minimize their borrowing costs.

“Credit card rates are the highest since 1995, mortgage rates are the highest since 2008, and auto loan rates are the highest since 2012. With more rate hikes still to come, it will be a further strain on the budgets of households with variable rate debt such as home equity lines of credit and credit cards,” said Greg McBride, chief financial analyst at Bankrate.com. “On a positive note, savers are seeing high-yield savings accounts and certificates of deposit at levels last seen in 2009.”

Here are a few ways to situate your money so that you can benefit from rising rates, and protect yourself from their downside.

Recommended Reading: Can You Transfer A Mortgage To Another Person