Refinance With A Shorter

Refinancing a mortgage refers to getting a new loan to replace your current mortgage. The new loan can help cut monthly costs or pay off the loan quicker with a new loan term. A shorter term on the mortgage means it goes away sooner but at the cost of a much higher monthly payment and perhaps some out-of-pocket closing costs. Ask yourself: Can you afford the higher monthly payment of a 15-year loan? Or, are you better off contributing extra each month to a 30-year payment?

Youll Pay Off Your House In Half The Time

Guess what? If you get a 15-year mortgage, itll be paid off in 15 years. Why would you choose to be in debt for 30 years if you could knock it out in only 15 years?

Just imagine what you could do with that extra money every month when your mortgage is paid off. Thats when the real fun begins! With no debt standing in your way, you can live and give like no one else.

How Old Will You Be When You Finish The Mortgage

The longer the mortgage term, the older youll be when you make the final repayment. That might not be a problem as some mortgage providers have increased its limit to 80 years old, but you are less likely to be working and therefore bringing in as much money every month.

Of course, its not just long term mortgages you need to plan for. Any mortgage loan you apply for is going to be subject to some affordability tests to make sure you really can make the monthly repayments, even if circumstances change.

Don’t Miss: How Much Is An Application Fee For A Mortgage

How Mortgage Terms Impact Cost

A mortgage is simply a particular type of term loanone secured by real property. For a term loan, the borrower pays interest calculated on an annual basis against the outstanding balance of the loan. Both the interest rate and monthly payment are fixed.

Because the monthly payment is fixed, the portion going to pay interest and the portion going to pay principal change over time. In the beginning, because the loan balance is so high, most of the payment is interest. But as the balance gets smaller, the interest share of the payment declines, and the share going to principal increases.

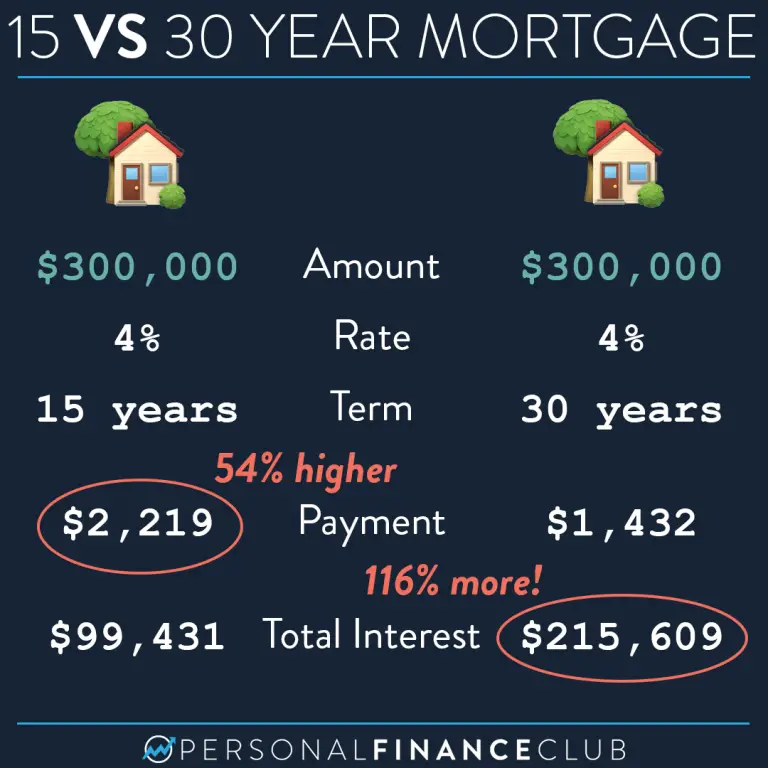

A shorter-term loan means a higher monthly payment, which makes the 15-year mortgage seem less affordable. But the shorter term makes the loan cheaper on several fronts. In fact, over the full life of a loan, a 30-year mortgage will end up costing more than double the 15-year option.

Because 15-year loans are less risky for banks than 30-year loansand because it costs banks less to make shorter-term loans than longer-term loansa 30-year mortgage typically comes with a higher interest rate.

The Main Downsides Of A 30

The most obvious disadvantage of a 30-year mortgage is that itll take twice as long for you to own your home outright, which means a longer duration until you have financial freedom from your housing payment.

But Nicole Rueth, producing branch manager at Fairway Mortgage in Englewood, Colorado, also points out that the lower monthly payment of a 30-year mortgage comes at an additional cost, with 30-year mortgages carrying higher interest rates. Combined with the longer term, that results in paying much more in total interest over the life of your mortgage.

According to a recent Bankrate mortgage survey, average interest rates on a 30-year fixed-rate mortgage are currently 3.75% as of mid-January, which is significantly higher than the historic lows we saw in 2020. But in the same survey, the average rate on 15-year mortgages was just 2.92%.

That means youre paying over 0.8% more for a 30-year mortgage, which may not sound like a lot. But on a $200,000 home with a 20% down payment, youll pay a total of $37,781 in interest over the entire length of a 15-year mortgage at 2.92%, while the same home with a 30-year mortgage at 3.75% ends up costing a whopping $106,754 in total interest.

Recommended Reading: How To Pay Off Mortgage In 15 Years Calculator

When Does A 30

Despite the higher interest rate on a 30-year mortgage, the longer loan term will mean a much lower monthly mortgage bill, which can free up a significant amount of your money in your budget. That means more you can put into savings, investments and future family expansions. The simple math of having more cash on hand every month can be appealing to many borrowers, despite the increased overall cost of the loan.

One of the best opportunities of the 30-year option is the financial flexibility it can afford. While you won’t be locked into a higher monthly payment, it’s still possible for you to treat your 30-year mortgage like a 15-year mortgage. If you can afford it and choose to do so, you can make higher monthly payments on your 30-year mortgage and expedite the repayment timeline. Since you’re making a higher monthly payment by choice, you can always go back to making the required monthly payment if your financial situation changes.

Opting for the 30-year mortgage can also mean you’re able to afford to make investments. You could invest the difference you save on monthly payments and potentially come out ahead over the long term. The return on your investments would have to be higher than your mortgage rate for you to at least break even, however, which could be possible depending on your investment strategy and market factors.

Why Do Banks Push 15

You may hear banks and lenders push 15-year loans on the radio and social media all the time! I always wonder if the 15-year loan is so much better for consumers and worse for banks, why are the banks trying to convince people to get 15-year loans? There are a couple of reasons.

- The banks want people to refinance their loans because they make more money every time someone gets a new loan. You pay 2 to 5% in closing costs on a new loan and the bank or lender gets most of that money.

- Most banks do not want their money locked up for 30 years. There is a reason they offer a lower interest rate on 15-year loans because they want more people to get 15-year loans. 30 years ago interest rates were more than 10%! Now they are less than 5%. The banks know that the lower the rate is, the shorter-term loan they want. They dont want their money tied up in long-term loans.

The banks and lenders push 15-year loans because they make more money with short-term loans.

Recommended Reading: How To Get A Mortgage Loan

Is A 15 Or 30 Year Loan Better For Rental Properties

When considering either a 15 or 30 year loan for investing, most people choose the 15 year loan. 15-year loans may appear to save money over 30-year loans because they have a lower interest rate, but I would much rather have the flexibility of a 30-year loan. Buying rental properties is a great investment, especially when you are able to use a mortgage to buy the properties and still get great cash flow. Many investors will get a 15-year mortgage because the rates are a little lower and they can pay off the properties quicker. I use a 30-year loan when I buy my rental properties because I get more cash flow and I can make much more money buying more properties than I can be paying off loans.

When Should You Consider A 15

A 15-year fixed-rate mortgage can be attractive because it has a lower interest rate and a shorter lifespan. The fixed rate allows you to set a budget without surprises from rising interest rates. But to take advantage of these perks, you have to be able to afford the higher monthly payment that comes with them. Plus, because the payments are higher, its more difficult to qualify for this type of loan. In short, if you can qualify and afford the higher monthly outlay, the 15-year fixed mortgage can be a great way to save money when you buy a home.

Recommended Reading: How To Buy A Reverse Mortgage Foreclosure

Which Loan Term Should You Choose

The right mortgage term for you depends on your monthly budget as well as your age, earnings, savings, and financial goals.

Jake Maier, a senior mortgage banker with American Bank of Missouri, says that good candidates for a 15-year mortgage are those who:

- Can comfortably afford the higher monthly payments

- Want to pay off their home sooner

- Want to build equity more quickly

- And have the cash flow to support the debt load and the additional costs of homeownership

John Li, co-founder and CTO of Fig Loans, adds that older adults closer to retirement may want to choose a 15-year mortgage and make aggressive payments so that their home is paid off or closer to paid off at retirement.

That said, Johnson cautions against picking a 15-year mortgage unless you are in a strong financial position to fund other life goals such as retirement accounts and childrens educational funds.

If committing to a shorter mortgage would not allow you to fund these other life goals, then a 30-year mortgage is likely the better choice, Johnson says.

Younger adults with plenty of working life ahead are also probably wise to select a 30-year mortgage, especially if theyre just beginning their career and earning entry-level salaries, adds Li.

One final thought to consider: You can always take out a 30-year mortgage loan and, at any time you choose, either refinance to a 15-year term or make extra payments toward principal balance .

How Much Do You Save With A Lower Interest Rate

If you get a 15 year, $100,000 loan on a rental property at a 4 percent interest rate, the payments will be $740 a month . Over the 15 years of that loan, you will pay $33,143 in interest. With a 30 year loan at 4.5 percent interest, the total amount paid in interest over the life of the loan will be $82,406.

On the surface, it looks like you are saving almost $50,000 by getting a 15-year loan. However, you are paying interest over 30 years on one loan and over 15 years on the other, which is deceiving. The payment on a 30-year loan is only $507 a month, which is $233 less a month than the 15-year loan. If you were to take that $233 a month and put it back into the 30-year loan each month, the 30-year loan would cost $39,754 in interest and be paid off in less than 17 years. It definitely costs a little more to have a higher interest rate, but over 15 years that is only $550 more each year. As time goes by that money is worth less and less due to inflation.

I go over specific numbers on 15 versus 30-year loans in the video below:

You May Like: How To Get A Mortgage On A Foreclosure

The Effects Of Amortization

Amortization is the accounting term for paying off a debt over time with fixed monthly payments. It determines the mix of interest and principal in every monthly payment. At first, a big chunk of your fixed monthly payment will go to interest. But, over time, the principal portion will get bigger until nearly all of your payment goes to principal rather than interest.

For a 15-year mortgage, your bank will use a 15-year mortgage rates calculator to figure out your monthly payments. It divides your interest rate by 12 to get your monthly rate and then multiplies it by your remaining principal each month to calculate how much interest you owe. It also calculates how much principal you need to pay down each month to get your balance to zero in 15 years. As your balance goes down, so will your interest payments, allowing even more of your fixed monthly payment to go to the principal.

The calculations for 30-year loans work the same way. The difference is, though, that with 30-year loans, a calculator will show that youll be paying interest for longer before you start knocking down your principal. This means it takes longer to build equity in a 30-year mortgage.

Tip: A mortgage calculator will show you the amortization schedule for each loan you calculate so you can see how the principal and interest change over time.

How Do I Pay Off A 30

There are a few ways to pay down a 30-year mortgage in 15 years. First, you could consider refinancing your current mortgage into a 15-year fixed mortgage. Another way is to make extra payments towards the principal amount or make biweekly payments equally one additional mortgage payment per year. This might not get you to the 15-year mark, but the amount of principal would most certainly go down.

Also Check: How Much Is A 600000 Mortgage

Dont Forget About Retirement

Hows your retirement fund? Check on this and see if youre currently contributing enough. Instead of refinancing to a 15-year mortgage, you may be better off putting more money toward a 401 plan or an IRA account.

You also want to make sure youre maximizing your tax benefits in these and other types of programs, like health savings accounts and 529 college savings accounts. Compared to these plans, paying down a low-rate, potentially tax-deductible debt like a mortgage is a low financial priority.

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

You May Like: What Is The Monthly Mortgage On A 400 000 Home

To Help You Make The Best Decision For Your Situation Ask Yourself:

Youll Build Equity In Your Home Faster

One way to build equity is to pay back the principal balance of your loan, rather than just the interest.

Since youre making bigger monthly payments on a 15-year mortgage, youll pay down the interest a lot faster, which means more of your payment will go to the principal every month.

On the flip side, the smaller monthly payments of a 30-year mortgage will have you paying down the interest a lot slower. So less of your monthly payment will go to the principal.

Recommended Reading: What Is The Current Rate For A 30 Year Mortgage

Job And Income Stability

Just because your job and income is stable today does not mean it will continue to be so.

- The economy is booming and the housing market is skyrocketing

- However, just because we are in a bull market does not mean the economy will slow down

- This holds true for workers who are on commission such as car salespeople, realtors, loan officers, and insurance agents

- Even workers with solid salaried jobs can get laid off and/or fired

- Nobody has a crystal ball to predict the future

- You cannot bank that your income will be solid for the next 15 or more years

- One of the main factors borrowers should consider when considering a 15-year versus 30-year mortgage is the potential instability of income and employment

- Gap of employment means a halt to income

- This may affect your ability to pay all of your monthly bills on time

- A large monthly mortgage payment on a 15-year mortgage may add undue stress

- A larger mortgage payment may mean you cannot pay other monthly debt

- If you cannot meet your other debt obligations, you may tap into your high interest credit cards to cover the shortage

- If your flow of income remains halted for a longer period, you may face potential foreclosure proceedings and could lose your home

In todays changing economy, keeping all costs, especially your mortgage, as low as possible is a wise idea.

It’s About More Than The Loan Term

The Balance / Miguel Co

Fixed-rate mortgages are the simplest and most popular home loans. They prevent the surprises that can come with adjustable-rate mortgages when your interest rate is subject to increase down the road. But you still have a choice to make: Should you take out that fixed-rate mortgage for 15 years or for 30 years?

A 15-year mortgage minimizes your total borrowing costs and lets you pay off your mortgage in half the time. However, a 30-year loan has lower monthly payments, and that can free up some of your money to save for other goals or to pay for unanticipated expenses.

You May Like: Is It A Good Idea To Pay Off Your Mortgage