What Is The Average Mortgage Payment

From down payments to mortgage payments, private mortgage insurance and homeowners insurance, theres a lot to consider when youre buying a home. Upfront costs are easy enough to calculate, but one important factor to consider is whether youll realistically be able to afford your mortgage payment and if youre even ready to buy a house given your monthly income.

Of course, the specific amount of your mortgage payment will depend on many things, including the size of your down payment, your mortgage rate and the size and duration of the loan. But examining the averages in these areas can help prospective home buyers examine their budget to avoid financial headaches down the road.

Good News: Pmi Can Go Away Once You Reach 20% Equity

The good news is, homeowners arent stuck with PMI forever.

If you have a conventional loan, your lender should stop charging PMI when one of the following happens:

- You reach 78% loan-to-value ratio based on your original loan value

- You reach 80% loan-to-value and you request PMI cancelation from your servicer.

If you have an FHA loan, mortgage insurance cannot be canceled. But, once you reach 20% equity, you can likely refinance into a conventional loan with no PMI.

Also note that VA loans do not charge ongoing PMI, even with zero down. The Department of Veterans Affairs charges an upfront funding fee instead of PMI, but that can typically be rolled up in your mortgage loan amount.

The Caveat: Average Mortgage Payments Don’t Really Matter

Its important to keep in mind that statistics are just broad, overall trends. The truth is, every mortgage payment is unique. Two homebuyers with identical properties can have very different payments, whether theyre across the country from each other or just down the street.

Thats because mortgage payments are based on a whole slew of factors that vary from one buyer to another. Here are just a few of the things that can make one homeowners mortgage payment different than the next:

- Down payment size

| $1,100 | $1,450 |

In this scenario, Buyer A has a stellar credit score of 760. She qualifies for a 3.75% interest rate as a result. And she makes a 20% down payment of $60,000. Not including property taxes and home insurance, shed see a monthly mortgage payment of $1,111.

On the other hand, Buyer B has notsogreat credit . He qualifies for a 4.25% interest rate and puts down just 10% . His mortgage payment would come out to $1,443 .

Thats a difference of $332 per month or $3,984 per year. Buyer B would also see significantly more paid in interest over the life of the loan.

Read Also: Recast Mortgage Chase

Factors In Your Florida Mortgage Payment

When youre calculating the costs of buying a home, youll need to think about property taxes in addition to your monthly mortgage payments. Luckily, Floridians dont have it bad, with tax rates near or below the national average. The effective property tax rate in Florida is 0.83%, which equals about $2,035 in annual tax payments for the typical homeowner.

Your property tax bill starts with an appraisal by a county official. Your actual tax rate is based on the assessed value, not just the appraised value of the home. This means that account exemptions are taken into consideration. Your assessed value can decrease if you claim the homestead exemption , or the Save Our Homes assessment increase limitation. Wondering what your property taxes pay for? In Florida, counties, municipalities, school districts and special districts can all levy taxes to pay for services, improvement projects and ongoing operating costs. Your total bill will depend on where your property is located and what taxes apply to that exact area.

Another cost youll need to consider is homeowners insurance. This is where youll be hit hardest with prices in Florida, as the state has some of the highest homeowners insurance costs in the nation. Insurance.com data shows that the average annual insurance premium in the Sunshine State is $3,643, good for the third-highest rate in the country.

How Much Monthly Mortgage Payment Can You Afford

Weve looked at the median monthly mortgage payments, and youve even learned how one is calculated. But now the big question remains: How much mortgage can you afford?

Once youve set a ballpark housing budget, give Churchill Mortgage a call. Not only will they help you get a mortgage the smart way , but theyll also pay close attention to your budget and make sure you can actually afford it. Theyre real friendly folks. Get started with one of their loan specialists today! If youre wondering how much you can afford, dont sit around twiddling your thumbs. Get answers from a trustworthy lender now!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Read Also: Reverse Mortgage For Condominiums

Florida Jumbo Loan Rates

Across the U.S., the conforming loan limit is generally $548,250. Home loans in excess of the countys limit are considered non-conforming or more commonly, jumbo loans. They cant be sold by your lender to government mortgage corporations Fannie Mae and Freddie Mac. That, plus the fact that theyre larger loans, means jumbo loans are more risky for lenders to take on and therefore come with higher interest rates.

Certain areas are more expensive than average, however. In those places, the conforming loan limit is higher than $548,250, which means you can get a bigger loan without being bumped into the jumbo loan category. As of 2021, only one Florida county has a conforming loan limit above $548,250: Monroe County, with a limit of $608,350.

The average Florida 30-year fixed jumbo loan rate is 2.66% .

Living In The Sunshine State

Between the Gulf of Mexico and the Atlantic Ocean, Florida is known for its hundreds of miles of beaches. But thats not all it has to offer. From Miamis nightlife, culture and art scene to Jacksonvilles coastal cuisine, world-class fishing and historic neighborhoods, theres something for everyone to enjoy in Florida.

Also Check: Rocket Mortgage Loan Types

South Florida Rents Mortgages Both On The Rise And Breaking Records

Spurred by rising mortgage costs, Decembers average monthly rent grew to $1,877, a 14.1% increase from the previous year and the largest annual jump since February 2019, according to a new Redfin report.

Mortgage payments also saw double-digit percentage growth last month. Nationally, monthly mortgage payments grew 21.6% from the previous year, another record increase.

Redfin chief economist Daryl Fairweather said the growth in mortgage payments has been driven up by rising prices and rising mortgage rates.

And those rising mortgage costs push more potential homebuyers into renting instead, which pushes up demand and prices for rentals, he said in a press release. Mortgage rate increases are accelerating, which will cause both mortgage payments and rent to grow throughout 2022.

The average Miami rent rose 34% in December year over year to $3,020, while the average mortgage payment grew 29% to $1,785.

The report found rents rose in more than 30% of major metros. And except in Austin, Texas, and Seattle, the top 10 areas with the fastest-growing rent year over year were all on the East Coast. Only Kansas City, Missouri, saw rents decline year over year, down just 0.8%.

Monthly Mortgage Payments Average In Florida Finds Lending Tree

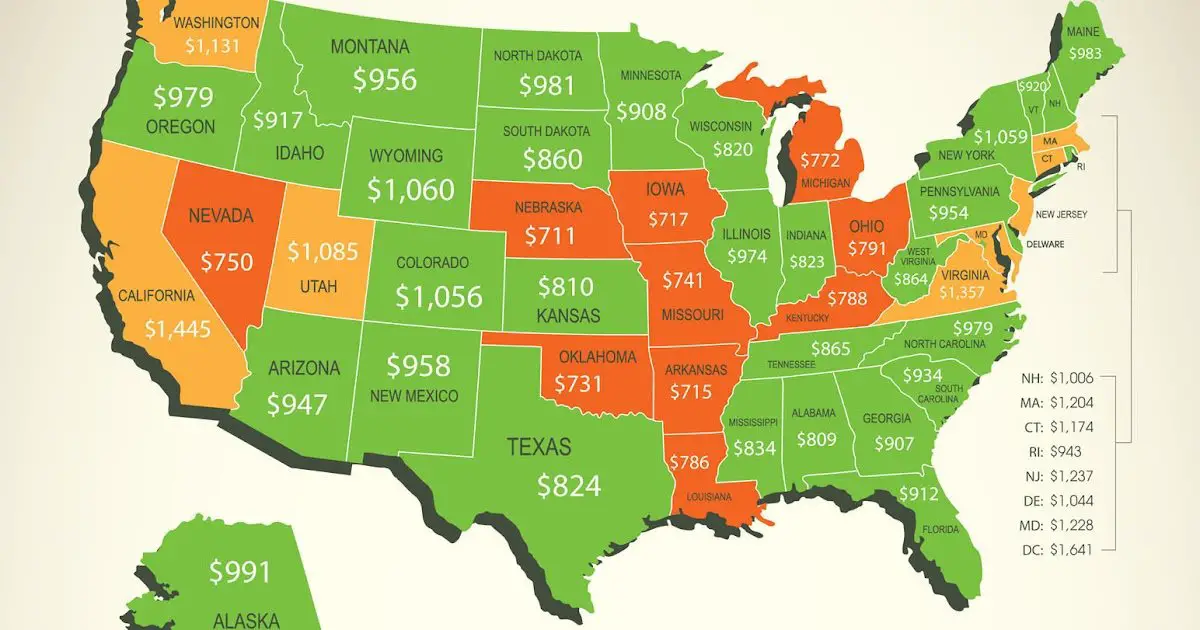

A massive study by Lending Tree has found the average monthly mortgage payments for all 50 states where does your state lie compared to others?

Monthly mortgage payments in the Sunshine State are pretty average, according to an expansive study by Lending Tree of the various states mortgage payments in the last 12 months.

As Lending Tree found, monthly mortgage payments in Florida average out at $974, which is pretty much what most other states pay. The most expensive, unsurprisingly, was the District of Columbia at $1,641, and the least expensive was Nebraska at $711.

You May Like: Mortgage Rates Based On 10 Year Treasury

What Happens After You Get Preapproved For A Home Mortgage Loan

Getting preapproved for a mortgage is just the beginning. Once the financial pieces are in place, its time to find your perfect home! While its one of the most exciting stages of the process, it can also be the most stressful. Thats why its important to partner with a buyers agent.

A buyers agent can guide you through the process of finding a home, negotiating the contract, and closing on your new place. The best part? Working with a buyers agent doesnt cost you a thing! Thats because, in most cases, the seller pays the agents commission. Through our Endorsed Local Providers program, our team can match you with the top real estate agents we recommend in your area.

Rate Over X% Assumptions

- Rates shown assume a refinance transaction.

- Annual Percentage Rate calculations assume a purchase transaction of a single-family, detached, owner-occupied primary residence a loan-to-value of 75% a minimum FICO score of 740 a Loan Term of 360 months and a loan amount of $300,000 for conforming loans.

- Rates may be higher for loan amounts under $275,000. Please call for details.

- Rates are subject to change without notice.

- Closing Costs assume that borrower will escrow monthly property tax and insurance payments.

- Subject to underwriter approval not all applicants will be approved.

- Fees and charges apply.

- Payments do not include taxes and insurance.

- Rates based on information gathered from OptimalBlue.

- Mortgage insurance is not included in the payment quoted. Mortgage insurance will be required for all FHA and USDA loans as well as conventional loans where the loan to value is greater than 80%.

- Restrictions may apply.

- Moreira Team | MortgageRight is an Equal Opportunity Lender

How much should you expect to pay on your Florida private mortgage insurance? Generally, costs range between 0.5 and 1% of the total loan amount per month. So for a $150,000 loan, you may have to pay as much as $1,500 per annum or $125 per month. It might seem a lot, but there are actual benefits of paying PMI.

Read Also: Does Rocket Mortgage Sell Their Loans

Florida Private Mortgage Insurance

If you take out a conventional mortgage loan in Florida, you may be required to pay private mortgage insurance. Known as PMI for short, this insurance protects the lender from making a loss in case you fail to make your mortgage payments. Typically, Florida private mortgage insurance is usually required if you put less than 20% down payment for the home of if you are refinancing and your equity is less than 20% of the homes value.

Try Our Down Payment Calculator to See Which Loan Programs Might Work for You!

More often than not your Florida lender will add the PMI premium to your monthly mortgage payment. But you can opt to pay it as an upfront lump sum or a combination of both. While an upfront payment will ease the burden, in case you refinance or move you may not be entitled to a refund. If you want to know more about strategies for paying PMI in Florida talk to us and our experts here at Moreira Team will guide you.

What Affects Mortgage Payments

Before even worrying about your average monthly mortgage payments, you should understand what affects this amount. Multiple factors are at play here. Some affect the mortgage rates you get and hence indirectly impact the payment size. Others, in contrast, are standard expenses that are typically calculated in the average monthly house payments.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

Average Mortgage Payments In The Us

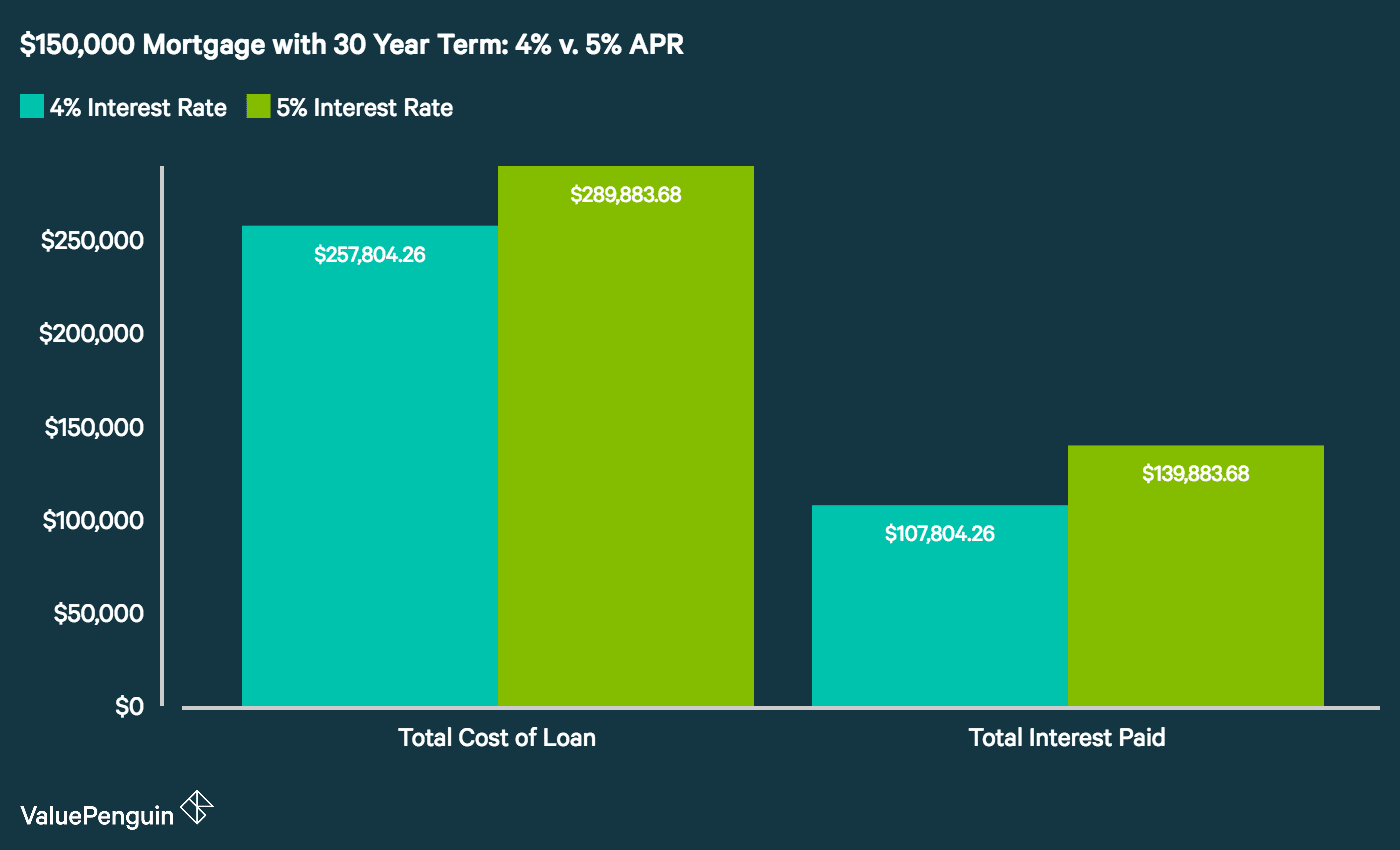

Monthly mortgage payments are largely determined by the size of a loan. In general, high-income consumers who take out bigger mortgages will pay more in lifetime interest than lower-income consumers. Still, smaller loans generally have the higher interest rates, as do loans drawn by borrowers with poor credit scores. As expected, higher interest rates also lead to larger monthly payments as a whole.

Mortgage Legal Issues In Florida

Florida used to be known as a caveat emptor state, meaning buyer beware. However, over the last 20 years, more and more lawsuits have sided in favor of the homebuyer rather than the seller. That makes this state quite homebuyer-friendly.

Sellers are required to disclose facts materially affecting the value of the property which are not readily observable and are not known to the buyer, according to Johnson vs. Davis, a Florida Supreme Court case quoted by the Florida Realtors association. In addition to court precedents, Florida law requires coastal erosion disclosures, radon gas, mandatory membership in a homeowners association and condo disclosures. While there isnt a specific disclosure form set by law, many Florida realtors will use this five-page Florida Realtors sellers disclosure. As always, its essential to arrange a home inspection yourself to get the best picture you can for a property. While Florida does have laws in place, youll have to go through a lawsuit to collect any damages if you do, in fact, find issues with a property after purchase.

Worried about foreclosures in Florida? The state had the fourth-highest foreclosure rate as of June 2019, but in past years it ranked closer to the top of these lists. Florida also has a large number of zombie homes, which are abandoned, unsold foreclosed homes. This generally drives down the overall property value in neighborhoods with high concentrations of these empty homes.

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

Hows That Average Calculated

The first thing to keep in mind is that the U.S. Census Bureau reports the median monthly mortgage, which technically isnt the same as the average monthly mortgage payment .

To find the median, you order the numbers you have from least to greatest and take the number in the middle:

$1,450, $1,500, $1,600, $1,700, $4,600

Now, if you average these numbers, you get $2,170. Is that a fair representation? Definitely notnearly every number in that line is below $2,025 by a lot.

But if you look at the median, which is $1,600, you can see its more accurate, isnt it?

Oh yeah, it is. Thats why we take the medianso homeowners with multimillion-dollar mansions or cheaper-than-cheap houses cant skew the final average.

With that in mind, lets take a quick look at the Census Bureaus data.

First Mortgage Direct Best No

First Mortgage Direct has been in business since 2008 and is based in Kansas City. The lender is a subsidiary of First Mortgage Solutions, which has an A+ rating from the Better Business Bureau. The lender prides itself on three key components honesty, integrity and experience and borrowers will appreciate it for a fourth reason: It doesnt charge any lender fees.

Strengths: Aims for personal touch by assigning an individual loan officer to each application preapprovals within 48 hours

Weaknesses: Doesnt advertise average rates online refinances take around 60 days

Read Bankrate’s First Mortgage Direct review

You May Like: How Much Is Mortgage On A 1 Million Dollar House

How To Get A Better Mortgage Interest Rate

A common question you may ask as a mortgage beneficiary is, do I have control over the interest rate?

Well, market conditions greatly determine the interest rate youll get. But you still have some influence over the actual rate you get for your mortgage. Certainly, your financial profile comes into great play here.

Heres how you can get a better mortgage rate:

National Average Monthly Mortgage Payment

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Housing is one of Americans biggest expenses. In fact, Americans now owe $14 trillion in mortgage debt. That sounds like a mountain of debt, but what does that figure really mean for average families?

LendingTree analyzed data from the 2016 U.S. Census Bureaus American Community Survey to figure out the average monthly mortgage payment on a national and state-by-state level. We also analyzed the affordability of these payments based on mortgage costs relative to homeowners incomes.

Read Also: Bofa Home Loan Navigator

How To Get A Low Interest Rate On Your Mortgage

Here are some tips for landing a good interest rate on your mortgage:

- Save for a down payment. With a conventional loan, you may be able to put down as little as 3%. But the higher your down payment, the lower your rate will likely be. Rates should stay low for a while, so you probably have time to save more.

- Increase your credit score. Many lenders require a minimum credit score of 620 to receive a mortgage. But the higher your score, the better your rate will be. To improve your credit score, be sure to pay all your bills on time. You can also pay down debts or let your credit age.

- Lower your debt-to-income ratio. Your DTI is the amount you pay toward debts each month, divided by your gross monthly income. Most lenders want to see a DTI of 36% or less, but an even lower DTI can result in a better rate. To improve your DTI, pay down debts or consider opportunities to increase your income.

- Choose a federally backed mortgage. If you’re qualified, you might think about a USDA loan , a VA loan , or an FHA loan . These loans typically come with lower interest rates than conventional mortgages. As a bonus, you won’t need a down payment for USDA or VA loans.

Improving your financial situation and choosing the right type of mortgage for your needs can help you get the best interest rate possible.