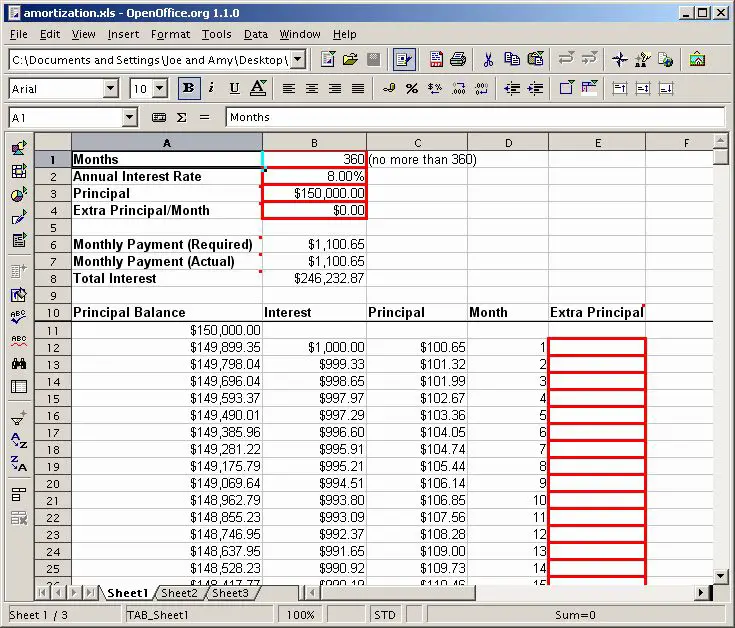

Set Up A Mortgage In Quickbooks Desktop

You can set up a mortgage in QuickBooks Desktop and show principal, interest, and escrow payments as described in this article. Note that the accounts used here are for illustration purposes only. Please consult your accounting professional for the accounts you need to use.

To track escrow activity, create three accounts.

To make a mortgage payment:

Was this helpful?

Soft Skills You Need To Succeed As A Mortgage Broker

Its not enough to be licensed and have a clear understanding of the industry. You also need to have the right entrepreneurial skills to successfully manage your mortgage business. Some of these skills include:

-

Attention to detail Youre dealing with peoples money here so strong attention is a must-have skill. The stakes are high and silly errors are not acceptable.

-

Interpersonal skills Its important to have a friendly and outgoing personality as a business owner. This would help you communicate more effectively with your clients, staff, and the lenders that you would represent.

-

Negotiation As a mortgage broker, your job primarily entails brokering strong lender-borrower relationships. This means your negotiation skills must be on point to ensure both parties reach a satisfactory agreement.

-

Organization Having strong organizational skills is important to help you stay on top of the day-to-day running of your business.

-

Patience The loan application and approval processes can be time-consuming and as the mortgage broker, youre firmly at the center of them all. Youll also need to be able to accommodate various client demands and expectations, many of which may not always be as straightforward as youd like. You must learn to be patient if you want to be able to handle all of these potential issues in your business.

How To Get A Mortgage: A Step

You probably already know that a mortgage is a type of loan that you use to buy a home. Its a good idea to learn as much as you can about getting a mortgage before you start shopping for a home.

The best way to avoid wasting time is to know the players and the process. That means working with a lender to get the best possible loan.

In this article, well get you ready to go mortgage shopping by going over what lenders are looking for, the paperwork involved and the five steps it takes to complete the mortgage process.

Don’t Miss: Why Do I Need A Lawyer To Refinance My Mortgage

Rocket Mortgage Loan Types

Rocket Mortgage offers a loan lineup thats fairly typical of nonbank lenders. Conventional loans, FHA loans and VA loans are available with fixed or adjustable rates. A customizable fixed-rate conventional loan with a term from eight to 29 years is also available, in addition to the standard 15- or 30-year mortgage.

Even though FHA loans made up only 7% of its total business, Quicken was the second-largest FHA lender in the nation in 2020, boasting more than twice the FHA loan volume of the next lender.

Home equity loans and home equity lines of credit, or HELOCs, arent available. Those seeking to put their home equity to work with Rocket will need to look to a cash-out refinance.

Get Your Approval Letter

Once you find the best mortgage solution for your needs, you can see if youre approved online. If you are, well send you a Prequalified Approval Letter that you can use to begin house hunting. If you want an even stronger approval, you may want to consider contacting a Home Loan Expert and applying for a Verified Approval.

Don’t Miss: How To Estimate Mortgage Loan Approval

Paying Your Mortgage In

If your mortgage lender is local, the company may allow you to submit payments by check or money order in person. If youre unfamiliar with money orders, they are considered secure payments since they dont include personal information. The downside is money orders have a limit between $700 $1000. According to the U.S. Census Bureau, the average mortgage payment is $1,595. So, money orders may not be the best option for most homeowners.

Other in-person options include a certified check or a cashiers check, which has no limit.

A check is a dependable method, but its not immune to fraud. Keep in mind, checks contain information such as your name, address, account number and routing number, all of which would be valuable to a scammer.

Additionally, checks take time to be delivered, so theyre not the most reliable option to send a mortgage payment. Especially during the holiday season or bad weather, since theres a high chance mail can be delayed.

How Does An Escrow Account Work

To set up your mortgage escrow account, the lender will calculate your annual tax and insurance payments, divide the amount by 12 and add the result to your monthly mortgage statement. Each month, the lender deposits the escrow portion of your mortgage payment into the account and pays your insurance premiums and real estate taxes when they are due. Your lender may require an escrow cushion, as allowed by state law, to cover unanticipated costs, such as a tax increase. If the estimated amounts are higher than actually needed, the overage balances will be refunded or credited to you.

Also Check: What Does Apr Mean For Mortgage

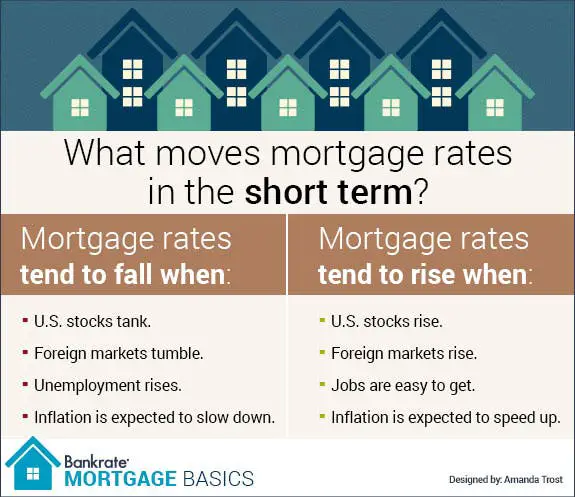

How Can You Get A Lower Interest Rate On A Mortgage

There are several strategies that could help you get a good interest rate on a mortgage, such as:

- Comparing lenders. Be sure to shop around and compare your options from as many mortgage lenders as possible. This will help you find a good deal more easily.

- Improving your credit score. In general, the higher your credit score, the better your rate will be. If you have less-than-stellar credit, consider working to build your credit score to qualify for more optimal rates in the future. There are many ways to do this, such as paying all of your bills on time or paying down debts.

- Picking a shorter term. Itâs usually a good idea to choose the shortest repayment term you can afford to keep your interest costs as low as possible. Additionally, many lenders offer better rates on shorter terms.

- Putting more money down. The more money you put down on a property, the less of a risk you look like to the lenderâwhich can translate to a lower interest rate. On top of this, if you put at least 20% down on a conventional loan, you can avoid getting stuck with PMI.

Tip : Put Everything In Writing

Its in your best interest to formalize your mortgage loan, even if its an intra-family affair. Youll want to document your mortgage agreement in the form of a promissory note , and register the mortgage loan and deed with the IRS and local authorities. You might need the help of a lawyer and chartered public accountant to get everything documented correctly.

You want to make sure you have a mortgage deed that secures the loan. This will entitle the lender to take ownership of the property if the borrower defaults or passes away. Without this, the property could revert to the borrowers other creditors, leaving the lender high and dry.

Also Check: How Long Does A Mortgage Refinance Take

What Does Fixed Vs Variable Mean On A Mortgage

Many mortgages carry a fixed interest rate. This means that the rate will not change for the entire term of the mortgagetypically 15 or 30 yearseven if interest rates rise or fall in the future. A variable or adjustable-rate mortgage has an interest rate that fluctuates over the loans life based on what interest rates are doing.

If I Make An Additional Principal Payment To My Loan How Will The Funds Be Applied To My Mortgage

Once your regular payment has been satisfied, any additional funds left over will be applied to your mortgage as a “Principal Only” payment. Note, we can only process the principal payment if your current months payment has been received, your loan is not delinquent and you have no outstanding fees.

Don’t Miss: Can A Locked Mortgage Rate Be Changed

Open The New Bank Account

Opening a new bank account can take as little as a few minutes. Youll need your contact information including your name and address, a government ID, and your Social Security number. Some banks may ask for proof of your address or multiple forms of identification.

When opening the new account, you may also be required to make an initial deposit to fund your account. This often requires and ACH transfer from an existing account, using the other banks account number and routing number.

Your Handy Guide To Starting A Mortgage Company

Learn the setup process and the most important considerations for starting your own mortgage company.

Thinking of setting up shop in the mortgage industry? Owning a mortgage company can be a rewarding experience. Youd be helping families, business owners, and renters close deals on their dream real estate properties.

The pay can be great, too. On average, mortgage brokers earn upwards of $80,000 per year, according to data from Indeed. This figure could even be higher in certain states like New York and Florida, where the average mortgage broker wage is well above the $100,000 mark.

So how do you launch your startup mortgage broker business?

Keep reading to learn the setup process and the most important considerations for starting your own mortgage company.

Recommended Reading: How Much Is The Average Monthly Mortgage

What If Im Late Making A Payment

If you know youll be late making a mortgage payment, reach out to your mortgage servicer as soon as possible. Explain your situation and see if the servicer might be able to work with you and waive any late fees. Communicating proactively can go a long way.

Note that there is typically a grace period for late payments, too usually 15 days.

If know youll be unable to make a mortgage payment for several months, ask your servicer for forbearance. With forbearance, your mortgage payment can be reduced or paused entirely for a period of time. If the problem is permanent in nature, ask your servicer for other relief options such as a loan modification. Most servicers are willing to work with borrowers to ensure they continue to make payments on time.

I Was Setup For Auto Drafting With My Previous Servicer Will This Service Automatically Continue With Pnc

No, your automated payments are not transferrable and you will receive a monthly billing statement in the mail. If you would like to set up automated payments with PNC, download the Automated Payment Authorization Form then complete, sign and return this form by mail, fax, or to a branch using the instructions provided on the form.

Read Also: When Does A Reverse Mortgage Make Sense

Things To Know About Homeowners Insurance

Can I Get A Rocket Loans Personal Loan With Bad Credit

Youre less likely to get approved for a loan with Rocket Loans when you have bad credit, but it may still be possible, depending on your exact credit score. Be aware, however, that even if you are approved for a loan with bad credit, you may end up with a higher interest rate. We recommend pre-qualifying with multiple lenders on our best personal loans for bad credit list to see which lender one gives you the best rate before accepting any loan offer.

You May Like: Is A Hecm The Same As A Reverse Mortgage

Finance For Buying Land And Building A House

Buying the land to build your house is likely to be one of the most expensive items in the overall construction cost. However, securing a construction loan is already quite complex, and, if you can, it makes sense to buy land separately from your construction loan.

The best way to do that is to buy the land up front. However, its also possible to arrange a separate loan to finance a land purchase. If you buy land rather than an existing house, because you want to build from scratch, then youll probably need a land loan. And that raises more problems than getting a normal mortgage. For one thing, theres no home to act as collateral for the land loan.

The terms of a land loansuch as down payment and interest ratewill depend on the intended use of the land, since this is directly linked to the banks risk exposure. In this way, getting land loans is always trickier than buying an existing house, since an existing house gives the bank immediate, tangible collateral, whereas new construction has more moving parts that can go awry.

For most people looking to buy land and build a house, the best way to arrange a loan is to use it to purchase a build-ready lot with the intention to start construction of a primary dwelling right away. There are things that could go wrong, cause delays, or increase costs along the way, but the timetable is still manageable in the banks eyes. The required down payment will typically be in the 15% to 25% range.

I Have A Rocket Loans Dashboard But Not A Rocket Account

If youve never created an account with Rocket Mortgage or Rocket Homes you will need to upgrade your Rocket Loans dashboard to a Rocket Account. We have customized, easy-to-follow prompts to connect your Rocket Loans dashboard to Rocket Account. Just start by signing in to your Rocket Loans dashboard as usual and well meet you there with guidance.

Also Check: Rocket Mortgage Qualifications

Read Also: What Is A Mortgage Advisor

Choose The Right Mortgage

Once your credit score and savings are in an adequate place, start searching for the right kind of mortgage for your situation. Youll also want to have an idea of how mortgages work before moving forward.

The main types of mortgages include:

- Conventional loans These are best for homebuyers with solid credit and a decent down payment saved up. Theyre available at most banks and through many independent mortgage lenders.

- Government-insured loans These can be great options for borrowers who do not qualify for a conventional loan or meet specific criteria, such as being a member of the military for a VA loan.

- Jumbo loans These loans are for more expensive properties. Conforming loans have a maximum allowable value, and if you need to finance more than that , youll need to get a jumbo loan.

A first-time homebuyer, for instance, might consider an FHA loan, which requires a minimum credit score of 500 with a 10 percent down payment or a minimum score of 580 with as little as 3.5 percent down. A conventional loan could be a better fit for a homebuyer with a higher credit score and more down payment savings.

Mortgages can have a fixed or adjustable rate, meaning the interest rate stays the same for the duration of the loan term or changes over time, respectively. Most home loans have 15- or 30-year terms, although there are 10-year, 20-year, 25-year and even 40-year mortgages available.

Update Your Automated Payments

This is one of the most important steps of opening a new bank account.

Automated payments are one of the biggest banking conveniences, and can help you stay on top of monthly payments. But when you switch bank accounts, its important to make sure you update your bank account information for any regular payments that may be affected from credit card payments to gym memberships to your workplace direct deposit, and more.

The biggest thing and the most difficult is making sure that everything has changed , says Ashley Coake, a certified financial planner at Cultivate Financial Planning in Radford, VA.

Carefully review past bank statements to find any automated transactions that come directly from your account. In fact, its best to review at least one year of your bank statements to account for transactions that may only happen once a year, says Coake.

You May Like: How To Become Mortgage Loan Underwriter