Refinancing One Car Loan With Another

What if your current lender wont refinance your loan with better terms? In this case, youll need to approach alternative lenders to see if you can get a better deal.

You might do this with a car loan, especially if your credit has improved significantly since you took out the loan. When you open a brand new loan, it will have a few effects on your credit score.

For one thing, the new loan will show a new open date. Since part of your credit score is related to the average age of your accounts, this can pull your score down slightly. Opening a new account, though, typically will only have a large negative impact if youve opened a lot of other new accounts recently.

One thing to keep in mind here is that refinancing in this way could help you improve your credit score. For instance, if youre getting a lower monthly payment, you can use the money youre saving to pay down other debts more quickly. This could balance out the potential negative impact within a month or two.

Bottom Line: If refinancing to a new loan is a good move for other areas of your finances, dont worry too much about its effect on your credit score. Just do your rate shopping in a timely fashion, and use the money you save wisely.

What If I Refinance More Than Once

The number of times you refinance your mortgage shouldnt do any compounding damage to your credit if you space the refis out. Waiting at least one year before you refinance again will make it so that the new round of credit inquiries wont accumulate with the first time you refinanced, Opperman says.

Rather than a credit hit, where homeowners typically lose when doing multiple refinances in a short time frame is the money spent on closing costs and other fees.

Ultimately, the main reason not to refinance too often isnt your credit score its simply how expensive refinancing is, and how long it takes to recoup the savings you might get on your mortgage payment, Opperman says.

Its worth noting that if your was in good shape when you got your mortgage or after your last refinance, and its remained that way, you should be able to get a good rate again provided rates have gone down. If rates are on the rise, its usually not the best time for a refinance.

Juggling Multiple New Loans

Applying for several different types of loans can drive down your credit score faster than if you were focusing solely on doing a mortgage refinance, notes David Battany, executive vice president of Capital Markets for Guild Mortgage.

If the borrower is shopping for all sorts of debt mortgage, car loan, credit card then that pull would become a negative on their FICO score, Battany says.

Don’t Miss: How Much Should Your Mortgage Be In Relation To Income

What To Do After Refinancing

Whenever you refinance a loan, your credit score will decline temporarily, not only because of the hard inquiry on your credit report, but also because you are taking on a new loan and haven’t yet proven your ability to repay it. Be sure to make your payments on time, and after a few months, your credit score should go back to where it was. In fact, it may even improve as you show that you’re able to handle the new loan. To see how refinancing and your new loan payments are affecting your credit score, you can get a free credit score to check.

Refinancing a mortgage, auto loan, personal loan or other loan can help lower your interest rates, reduce your monthly payment and give you more wiggle room in your budget. But because refinancing can negatively affect your credit score, it’s important to carefully weigh the benefits versus the costs before you start shopping for a new loan.

Whats The Effect Of An Inquiry On Your Credit Score

While everyones credit report is different and it depends on your history, FICO® says that the impact of one additional inquiry on your credit score is fewer than 5 points for most people.

Moreover, not every inquiry is treated the same. Well go over why rate shopping with multiple lenders wont impact your score as much as you think below.

You can think of this temporary dip in your score as credit bureaus asking you to prove your financial stability. As long as you maintain good habits like paying your bills on time and keeping little to no balance on your credit cards referred to as low credit utilization your score should bounce back within a few months.

Finally, although credit inquiries stay on your report for 2 years, only inquiries in the last year impact your score. Its a very short-term downtick.

Also Check: How To Apply For Mortgage Assistance

Apply In A Short Period

As mentioned, the credit scoring models deduplicate hard inquiries from credit applications that you make within the same short window .

To protect your score in every model, submit all your applications within a 14-day period so that your credit score only suffers from the effects of one hard inquiry.

Does Refinancing A Home Hurt Your Credit Score

- Does Refinancing a Home Hurt Your Credit Score?

Many homeowners wonder if refinancing their homes will hurt their credit scores. The truth is that it depends on several elements such as the time frame for hard credit checks, multiple loan applications, closed accounts, debt-to-income ratio, and knowing how to maintain a solid credit score during the process. In the end, how refinancing your mortgage affects your credit is all in how you play your hand.

This article examines the home refinancing process, how it may affect your credit, and how to plan and determine if refinancing is the best solution for you. With a firm understanding of the process and a concrete strategy, it is possible to refinance your home without adversely affecting your credit score.

Recommended Reading: Can You Get A Mortgage With A Low Credit Score

Refinancing Your Auto Loan

Refinancing a car loan may be worthwhile if interest rates have dropped or your credit score has improved since you took out the loan. You might also want to refinance your car loan if you simply need to reduce your monthly expenses.

Refinancing for a longer-term auto loan will lower your monthly payments, but depending on how long you stretch out the loan, it could increase the total amount you pay for the car. Make sure that the new interest rate is low enough that it doesn’t drastically increase your total cost. To refinance, you’ll need a car that has held its value generally, the car must be worth more than what you still owe on it for lenders to consider refinancing.

What Financial Activity Doesnt Affect Your Credit Score

Activities that wont impact your credit score include:

- Debit card usage. Credit scores are generally only concerned with credit accounts and debt, not your savings and checking accounts.

- Checks and cash usage. Because this is money you have, not money youre borrowing, it wont affect your score.

- Receiving welfare. Getting assistance from state or federal governments is not usually considered a loan so it doesnt form part of your credit history.

- Installment and layaway purchase plans. Because you dont get the item until youve fully paid for it, its not considered a credit purchase so it wont affect your score.

- Rent and utilities. Paying on time wont improve your score. But multiple missed payments may hurt it if a company sends your bill to collections.

- Federal taxes. A small delay in payments wont hurt your score. But if youre very late, the IRS may report you and that is likely to harm your score

Checking your credit score wont have a negative impact as that is considered to be a soft check only. Youre entitled to know your credit score before you make financial decisions.

Don’t Miss: A& m Mortgage Merrillville Indiana

Make All Your Payments On The New Loan On Time

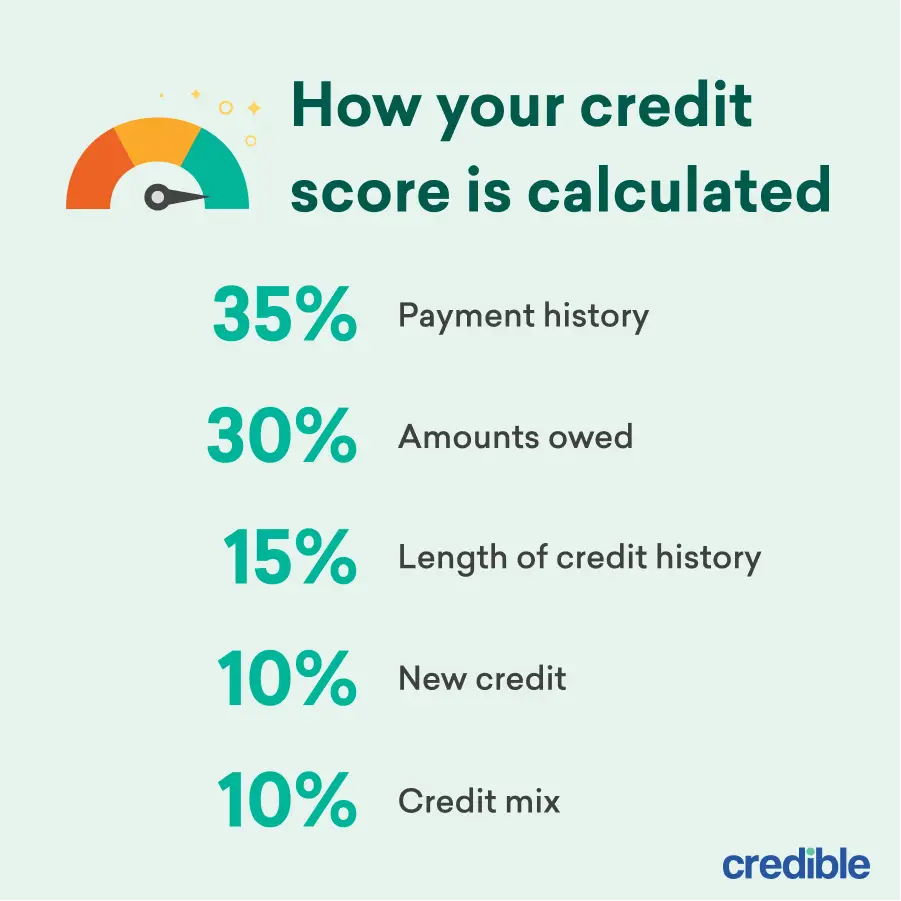

It might seem obvious, but be very careful to manage your refinanced loan responsibly. Your payment history on your credit accounts is the single most important factor contributing to your credit score.

Making on-time payments on a loan is a good way to gradually build your credit score, but making even one late payment can undo all your progress and seriously damage your credit.

Takeaway: Refinancing hurts your credit, but not enough that you shouldnt refinance your car if it will save you money.

- Refinancing incurs a hard inquiry, lowers your average credit age, and closes an old loan, all of which hurts your credit.

- The hit to your credit score will be modest, and it wont last for very long.

- The main consideration when you decide whether or not to refinance should be whether it will actually save you money.

- If you do choose to refinance your car, try to get prequalified and submit all your applications within a 14-day window.

Article Sources

FinanceJar Team

Your Score Could Drop But Will Rebound With Timely Payments

Kate_sept2004 / Getty Images

Becoming a homeowner is a huge milestone. It often takes years to build up your credit and finances enough to get approved for a mortgage. But how does a mortgage affect your credit score during and after the homebuying process? While you may see your score drop, dont panicits usually temporary. Heres what you should know.

Don’t Miss: Can I Get A Mortgage With A Fair Credit Score

Dont Refinance If Its Not Really A Better Deal

Sometimes a refinance only looks like a better deal. For instance, lets say you have a $500 credit card balance at 10% interest. You can pay it off in a couple of months, but you get a 0% APR introductory deal. Sure, you wont save much interest with the deal, but youll save some, right?

Not so fast! These deals often charge a balance transfer fee. Its often a percentage of the balance, with a $5 minimum. Youre paying about $4 per month in interest on that card now. If youre going to pay it off within a month or two, you may actually pay more in the balance transfer fee than youll pay in interest while waiting to pay it off!

The same goes for refinancing your home, although the break-even calculation gets a lot more complicated. Generally, home refinancing includes many of the same closing costs as buying a home. So you cant just get into a better interest rate for free. In fact, you could have to front a few grand to refinance.

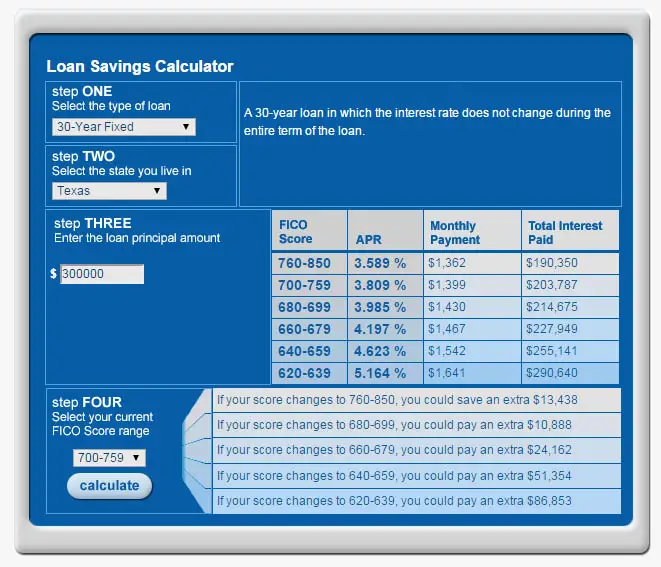

If youre planning to stay in your home for a while, the savings on interest will likely be worth it. Even a percentage point or two makes a big difference over the life of such a large loan.

But what if you plan to sell your home within the next five years? In this case, refinancing may not be worth the money or effort.

Need help doing the math to see whether a refinance is worthwhile? Check out this calculator to help you make the calculations:

How A Mortgage Affects Your Credit

Know the fundamentals. Your measures your ability to pay back debts. You only earn so much money so keeping your amount of debt in good proportion to your income is essential. This is called your debt-to-income ratio.

Keeping it no higher than 36% is considered optimum with no more than 28% going to your mortgage. If you know you will purchase a home in the near future, dont take on other debt obligations. Keep your debt-to-income ratio low.

However, do continue to build your . A little credit is better than no credit as far as your credit score is concerned. And of course, paying your mortgage on time is good for your credit history.

Also Check: Is It Good To Pay Off Mortgage

Negotiate Rates And Fees

Mortgage rates and fees change constantly. Homeowners dont often realize that fees are also negotiable in addition to interest rates in a lot of instances.

Make sure you have the most current and up-to-date information before you negotiate with lenders. It is the only way to go into a refinancing transaction.

Another part of a good strategy is to thoughtfully and logically examine the advantages and disadvantages of refinancing. It just makes good sense.

Next Steps: Consider Whether Refinancing Makes Sense For You

While its always smart to think twice and consider your credit when making financial decisions, if refinancing makes sense for your situation, go for it. In the typical case, you most likely wont see a tremendous difference in your credit health, but dont be surprised if your new loan results or has resulted in some minimal changes. As always, if any details related to your refinancing look incorrect when you view your full credit report, reach out to your creditor or file a dispute. Happy refinancing!

Also Check: How Much Net Income Should Go To Mortgage

When To Refinance A Mortgage

The best time to refinance a mortgage is when it saves you money or decreases your monthly payments. Under the right market conditions, refinancing can help you save interest over the long run, but it also can help you eliminate a Federal Housing Administration loan that comes with high mortgage insurance premiums. Likewise, if you need to tap into your home equity, refinancing your mortgage is a great way to do so.

Keep in mind, however, that refinancing a mortgage does come with closing costs, including an origination fee, appraisal costs, title insurance and credit reporting fees. These costs often add up to between 2% and 6% of the total loan amount.

Whats more, refinancing a mortgage typically involves extending payments out over a longer period of time. While this lowers the amount you pay each month, it means interest will accrue for longer. If youre considering a mortgage refinancing, use a mortgage refinance calculator to determine the break-even point.

If youre unsure of whether now is a good time to refinance your mortgage, work with some of the best mortgage refinance lenders to see how much you could save.

When You Apply: Hard Credit Inquiries

Whenever you apply for credit, including a mortgage, the lender conducts a hard credit inquiry to see if you qualify for the product. The inquiry is recorded on your credit reports and may temporarily affect your credit scores.

New credit accounts for 10% of your FICO score. The credit-scoring company says one inquiry may lower your credit scores by five points, but multiple hard inquiries may have a larger impact.

Recommended Reading: What Credit Card Can I Pay My Mortgage With

Potential Effects Of Refinancing On Credit Health

When you apply for new loans, including refinance loans, creditors will run your credit reports, which results in new hard inquiries. Hard inquiries typically lower your credit scores by a few points. In some cases, you may be able to avoid incurring several new inquiries by employing smart rate shopping tactics and getting all your applications in during a 14- to 45-day period. Depending on the scoring model and type of loan, inquiries made during this period may only count as one inquiry when your scores are calculated.

If you didnt follow this suggestion when you refinanced, dont worry. In general, the influence of an inquiry on your credit decreases over time. You can gauge the impact of hard inquiries on your credit score by monitoring your credit and tracking them as they fall off your reports.

You cant exactly do anything to speed up the aging of your loan or payment history, but these factors will improve over time. Your new loan will also be added to your number of total accounts, so thats a bonus.

When To Refinance A Personal Loan

As with other types of loans, its best to refinance a personal loan if your credit score has improved since the original loan was processed and youre likely to qualify for a better interest rate. Refinancing also may be an appropriate strategy if you need to lower your monthly debt service or want to consolidate several personal loans into one lower interest loan. These are a few scenarios where refinancing a personal loan may make sense:

- Your credit score has increased since the loan was originally issued

- You have a variable annual percentage rate and want to refinance into a fixed-rate loan

- Your income decreased and you need to lower your monthly debt service

- You want to avoid an upcoming balloon payment

- Youre comfortable paying the lenders application and origination fees

- You want to pay off your loan sooner by refinancing into a loan with a shorter term

If youre planning to refinance a personal loan or other debt in the near future, take steps to build your credit so youre more likely to qualify for a competitive interest rate.

Recommended Reading: Which Bank Is Best For Mortgage

Skipping Mortgage Payments During The Refinancing Process Can Damage Your Credit Scores

Refinancing your mortgage may take longer than you expect, so dont count on the process closing by a certain month. Some borrowers have gotten into trouble by skipping a mortgage payment when they assumed their refinance would go through. A missed or late payment can negatively impact your credit scores.

The best way to avoid delinquent payments is to stay in constant communication with your lenders and set reminders for yourself to avoid missing important due dates. Make payments toward your original mortgage as you usually would until your refinance is closed. Remember that payment history generally accounts for the largest portion of your credit scores, and missed payments can remain on your credit reports for seven years after the delinquency.

Even after your refinance is complete, it may take several months for the new account to appear on your credit reports. If you give it time and the loan still doesnt show up, make sure your lender is reporting your payments to the CRAs. The refinancing process has some impact on your credit scores, but how you handle the new loan will be more important in the long term.