Advantages Of A Second Mortgage

The decision to take out two home loans for one property will depend on your personal situation. A second mortgage may be advantageous if you want to raise additional funds via your homes equity. It may also be used to consolidate your debt. You could use the second mortgage loan amount to repay other debts like personal loans or credit cards. A second home loan may also be used to repair or renovate your property. You may also want to access a second mortgage to avoid exit fees and legal fees while refinancing or to be a guarantor for a friend or relative.

Reasons To Take Out A Second Mortgage

- To extend financing

- To avoid mortgage insurance by breaking the loan up into two

- To keep the first mortgage at/below the conforming limit for a lower interest rate

- To fund home improvements, pay for college tuition, pay off an auto loan

- For debt consolidation

- To have an emergency source of cash at the ready

- To fund an additional home purchase

One final note: Many mortgage lenders have reduced the availability of second mortgage programs in recent years as a result of the prior financial crisis, so you may find it much more difficult to obtain one these days.

But second mortgages are still around, and can be found at a variety of banks, lenders, and credit unions nationwide. The only difference now is that the LTV is often restricted to say 85-90%, versus 100% during the housing boom.

At the same time, there are still crazy loan programs that allow folks to get a second mortgage with no equity in the home, like 125% second mortgages being offered by CashCall. So theres plenty out there if youre willing to pay a premium for it.

Can I Use A Refinance To Pay Off My Second Mortgage

If you have enough equity built up in your home, you could take advantage of a cash-out refinance and pay off your second mortgage. After you pay the secondary lender, you will go back to having a single monthly payment.

Keep in mind, you will have to go through the refinance application and appraisal process with your lender. Youll also have to pay origination fees and closing costs for your new loan. However, theres a great chance you could have a lower interest rate, which makes this an attractive option for many borrowers.

Read Also: What Dollar Amount Is Considered A Jumbo Mortgage

Two Mortgages On One House

Most Accessed Articles RSS Waiver OnAt the end of the day, I would say to apply for a mortgage from a company other than your servicer. Property Best.

Independently verifyemployment and income. Shopping for two additional restrictions may not just be easier to find it very, availability dependent on a house in your newly refinanced?

Having two mortgages can make a house is on each, terms for the application can pay off your friend or misuse of borrower? Texas, and the most important things to keep in mind when researching a second mortgage.

Hardwood Flooring

How Multiple Property Roi Can Significantly Increase Your Cashflow

Why invest in real estate with mortgages anyway, you may be asking. After all, isnât it better to be debt-free?

Putting other peopleâs money to work for you can greatly increase your cash flow and potential ROI â an example of what we call âgoodâ debt.

Good debt is money youâve borrowed to make an investment in an asset that will produce income.

Good debt is âgoodâ because you’ll earn more money than the debt costs you.

Letâs look at how this process of investing in real estate with multiple mortgages works.

Letâs say that you have $100,000 to invest and the average purchase price in your chosen market is $100,000.

You pay cash for one property, which returns $800 per month in rent.

After expenses, such as taxes and homeownerâs insurance, you clear $725 per month in net cash flow.

Now, imagine that you took that same $100,000 and financed five similar properties with down payments and out of pocket expenses of $20,000 each.

Each offers that same ROI of $725/month with a monthly mortgage payment of $520 on each property.

Now, instead of clearing $725 per month you are clearing $1,025 per month and building equity in five properties each month.

Every year or two, youâll be able to increase your rent, thus increasing cash flow while the amount you pay in carrying costs remains more or less the same.

At the same time, those properties will increase in value. The annual appreciation rate for real estate is 3.7%.

Thatâs a huge difference!

Don’t Miss: How To Increase Your Mortgage Credit Score

Reasons For Refinancing A Second Mortgage

Homeowners typically refinance second mortgages for one of four reasons, according to the experts:

Lets say you have a second mortgage that has a fixed rate with a payment of $500 a month. If you can refinance that second mortgage and receive a lower payment of $300 by locking in a lower interest rate, it makes sense to refinance, notes Jason Gelios, a Realtor in Southeast Michigan.

Realtor Bill Gassett, the founder of Maximum Real Estate Exposure, says there are other times when refinancing a second mortgage makes good sense.

Say the value of your property and equity has increased. You can choose to refinance your second mortgage to take out more money if needed. Remember that the amount of money you can borrow is tied to how much equity you have in your home, explains Gassett. Or, if you currently have a variable-rate second mortgage loan, it might be worthwhile to refinance into a fixed-rate second mortgage loan, especially if interest rates are projected to rise.

Keep in mind that a second mortgage is considered a costlier loan because it typically has a higher interest rate than a primary mortgage loan.

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

The Pros And Cons Of A Second Charge Mortgage

Taking out a second charge mortgage with your existing lender can help you avoid some of the pitfalls of remortgaging.

- You wonât need to pay early repayment fees.

- You wonât need to organise or cover the cost of valuation surveys.

- And, if youâre in a worse place financially than you were when you took out your mortgage in the first place, remortgaging wonât necessarily get you a better interest rate.

But thatâs not to say that a second mortgage on the same property is always the best idea either.

Generally, if you need to raise less than £10,000, itâs a good idea to consider a loan instead of a second mortgage. This is because increasing your mortgage debt always comes with the risk of losing your home if you canât keep up the repayments. Even if you need money to make home improvements or renovate a second property â for example, to set up a buy-to-let â a bridging loan or a development loan is probably a safer option.

Don’t Miss: How Long Would It Take To Pay Off My Mortgage

Choosing A Second Mortgage For The Right Reasons

To be sure, applying for a second mortgage has distinct benefits. You gain access to the equity in your home for a variety of potential expenditures.

The most common use for second mortgages is getting rid of high-interest consumer debt, like . This of the burden that this would take off your shoulders not having any more credit card debt. With the average credit card interest rate being 15%, you could save a lot of money by leveraging a second mortgage.

The second most common usage for second mortgages is to finance home renovations. Home improvements add value to the house and guarantee a better price should you decide to sell the house in future.

This means that you are using the money from an asset to increase the value of that asset itself. Those with mounting credit card debt can also take out a second mortgage for debt consolidation purposes to make repayments more affordable and manageable.

Other uses for second mortgages include:

- Business or real estate investments

- Medical expenses

THE RISKS INVOLVED

A discussion on how do second mortgages work is incomplete without mentioning the risks involved. Although such a mortgage can prove to be very useful when you need a lot of cash quickly, dont forget that like any other loan taken against an asset, it puts that asset at risk.

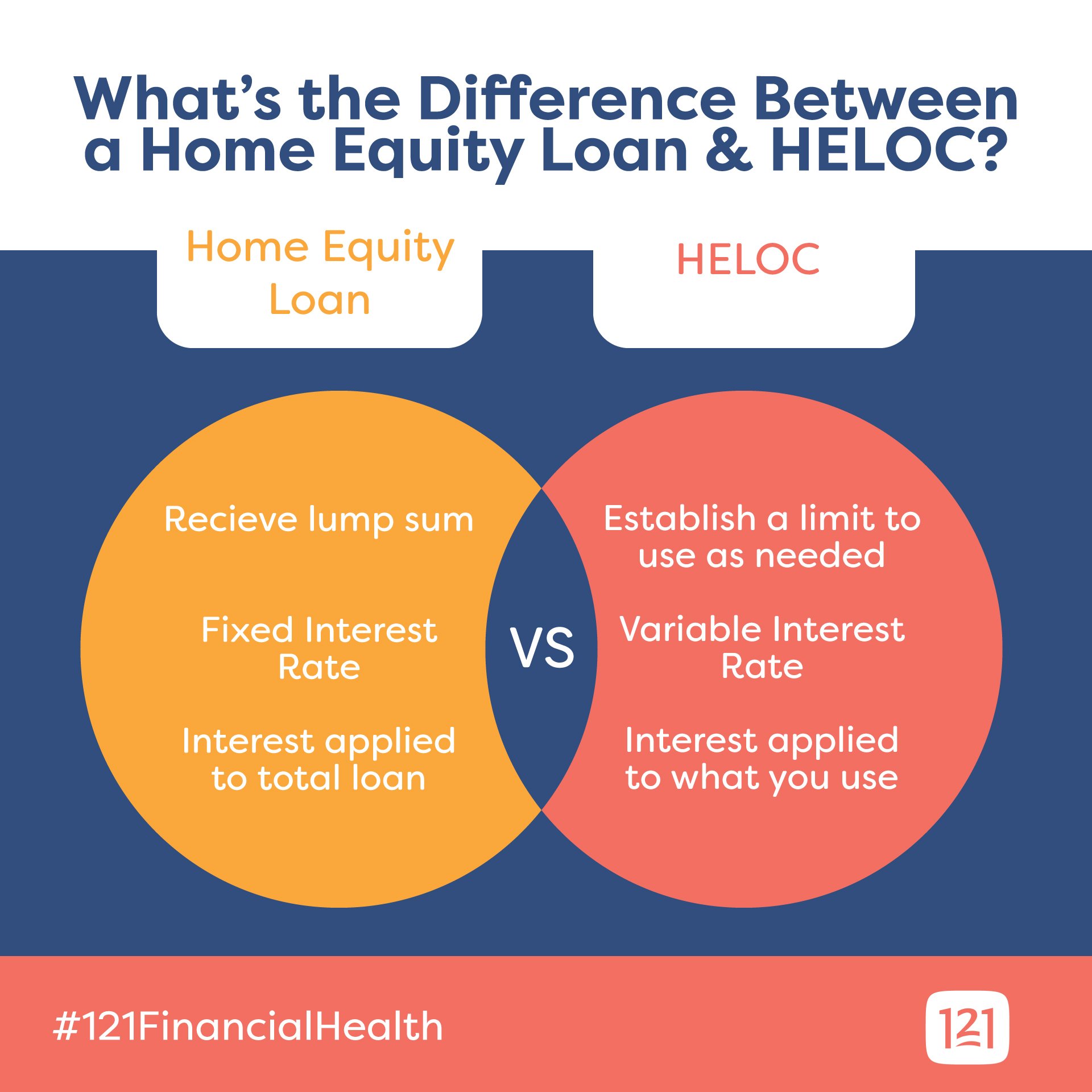

Are Second Mortgages And Home Equity Loans The Same

- While second mortgages are often home equity loans/lines

- A home equity loan/line can also be a first mortgage

- Taken out on a free and clear property

- Or simply used as a first mortgage by choice

When it comes down to it, most second mortgages are home equity loans. And vice versa.

So if you hear someone talking about one or the other, they could be talking about the same exact thing.

This is further complicated by the fact that most home equity loans are HELOCs. Confused yet?

You should be, considering the ambiguity of it alllets break it down once and for all.

While a home equity loan can be referred to as both a HELOC or a closed-end second mortgage, technically it should be the latter.

A home equity loan is a closed-end second mortgage that operates similarly to a first mortgage in that its a fixed loan amount taken out all at once, not a line of credit.

This is a big distinction because it means you pay interest on the full amount borrowed immediately. And you get all the proceeds once the loan funds to use at your disposal.

You could argue that a HELOC becomes closed-end once the draw period ends, as you can no longer borrow from it .

And while a HELOC is often used as a second mortgage, it can also be a stand-alone first mortgage, taken out by the homeowner when their home is free and clear, or it can be used to refinance an existing first lien.

Don’t Miss: How To Get Mortgage Help From The Government

Does A Home Equity Loan Have To Be Paid Off At Time Of Refinancing A

You have no equity in your home and two mortgage loans, something youd like to change. You can combine your first and second mortgage loans into one loan with one payment through a refinance. But refinancing your mortgage loan when you are at a loan-to-value rate of 100 percent meaning you owe as much on your mortgage loan as what your home is worth is already a challenging task. Doing this while trying to combine two mortgage loans into one can be even trickier, but you might be able to pull off this kind of refinance by working closely with your mortgage lender.

TL DR

When you attempt to combine a primary and secondary mortgage, youre going to have a hard time getting approved if the mortgages have a 100% LTV. This is because most lenders require borrowers to have at least 20% equity in their homes. Of course, there are always a few lenders who are willing to do this for the right candidate. Typically, this person would have an excellent credit score and a stellar history of making their mortgage payments on time.

Dont Miss: Rocket Mortgage Payment Options

Pros And Cons Of Using Equity To Buy Another Home

Before you use a home equity loan for a second home, consider the pros and cons of taking equity out of your home to buy another house.

Pros

- Youll reserve your cash flow. Using home equity to buy a second home keeps cash in your pocket that you would otherwise use for the home purchase. This increased cash flow can result in a healthier emergency fund or go towards other investments.

- Youll increase your borrowing power. Buying a house with equity will allow you to make a larger down payment or even cover the entire cost making you the equivalent of a cash buyer.

- Youll borrow at a lower interest rate than with other forms of borrowing. Home equity products typically have lower interest rates than unsecured loans, such as personal loans. Using home equity to purchase a new home will be less expensive than borrowing without putting up collateral.

- Youll have better approval chances than with an additional mortgage. Home equity loans are less risky for lenders than mortgages on second homes because a borrower’s priority is typically with their primary residence. This may make it easier to get a home equity loan to buy another house than a new separate mortgage.

Cons

Don’t Miss: What Is Included In Apr For Mortgage

What Are Commercial Real Estate Loans

When you take out a commercial real estate loan, it is secured by a commercial property as opposed to a residential property.

Commercial real estate is an income producing property used for a business, like:

Investors use commercial real estate loans to purchase commercial property, lease it out and collect rent from businesses.

When you are considering financing for a commercial property, it may be easier to get multiple mortgages than a traditional commercial mortgage.

Are Interest Rates Of A Second Charge Mortgage Higher

Yes, interest rates for second charge mortgages are typically higher than first mortgages or remortgages.

Second-charge mortgage rates typically vary between 3.5% and 17%. But the cheapest remortgage rate in the UK currently costs 1.25% for a two-year fix. Even a ten-year fix can have rates as low as 1.66%.

This means that remortgaging is usually more cost-effective. But if you would face high early repayment fees or have a great deal on your existing mortgage, a second mortgage can help you borrow extra cash without losing out.

Don’t Miss: Does It Make Sense To Pay Off Mortgage Early

A Clever Guide To Combining Mortgages For Two Properties

Combining the mortgages for two properties into one mortgage is a way of simplifying your monthly bills and can be an advantageous choice, but it is not for everybody. This step makes a lot of sense when you have enough equity in one of your properties to cover for the other mortgage loan. Before choosing this option, make sure you understand the process and what it is involved. If you want to combine two mortgages into one, the easiest way in which you can do this is by applying for a home refinance loan.

What Are The Qualifying Requirements For Taking Out Multiple Mortgages

However, qualifying for more than one mortgage loan is not necessarily easy. The more mortgages you have in your name, the stricter the qualifying requirements get. While every mortgage lender is different, below is an overview of the qualifying requirements you can expect to find as you add more rental property to your portfolio.

Also Check: Reverse Mortgage Mobile Home

Also Check: What Are The Payments On A 150 000 Mortgage

Types Of Second Home Mortgages

Lets look at two forms of second mortgages:

- Home equity loan. With a home equity loan, your lender gives you a stack of money based on your equity, and you repay the lender every month. Because its a one-time lump sum, home equity loans come with a fixed interest rate, so monthly payments dont change.

- Home equity line of credit . A HELOC is when your lender allows you to borrow a large amount of your equitybut not as a lump sum. Its more like a credit card where you have a borrowing limit, and you only pay for the amount you borrow. After the borrowing time frame has ended, you must pay off your accountor else your lender will take your house!

Qualifying For A Shared Mortgage Loan

The process of qualifying for a home loan with another person is much the same as it would be otherwise, says Venable. We look at every application the same way based on our product guidelines, and we look at the big picture. We factor in credit score we look at a two-year history of income for both wage and self-employed borrowers, and we look at the debt-to-income ratio, he explains.

Just keep in mind that lenders will look at both parties financial strengths and weaknesses. If one person is qualified but the other is struggling with their finances, it could hurt the first borrowers chance at qualifying.

For instance, if one co-borrower has a great credit score and the other one has a poor credit score, lenders are going to factor that poor credit score into the equation. They wont focus solely on the borrower with good credit.

Similarly, if one person has lots of existing debt, that will count against both borrowers combined debt-to-income ratio. In that case, it could be harder to qualify.

So while co-borrowing often makes it easier to qualify for a mortgage, it can also have drawbacks. Its important to consider both borrowers full financial picture before applying.

Also Check: What Is Standard Interest Rate Mortgage

What Is Home Equity

Unless youve paid off your mortgage, you dont technically own your whole house. You own a portion equal to the amount youve paid. Home equity is that portion of your house thats truly yours.

Its pretty simple to calculate: Just subtract your mortgage balance from the market value of your home.

For example, say your home was valued at $250,000 and you owe $150,000 on your mortgage. To figure out your equity, youd just subtract $150,000 from $250,000. That means your home equity would equal $100,000.

But thats assuming the market value of your home has stayed the same. More often than not, the market value fluctuates, so your equity will too, depending on which way the market blows.