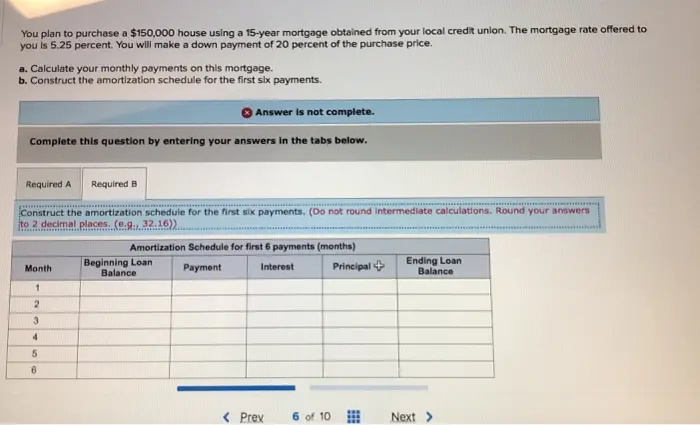

Amortization Schedule For A $150000 Mortgage

What is amortization?

Your amortization period is the total number of years you have to pay off your mortgage.

When you sign on for a mortgage, you agree to pay the principal amount and the interest over the life of the mortgage. Your interest rate is applied to your principal amount, and as you pay down your principal amount, the amount you pay in interest changes. Amortization means that at the beginning of your mortgage, a big percentage of your payment is applied to interest. With each subsequent payment, you pay more toward your principal amount and less toward interest.

Below, you can estimate your monthly mortgage repayments on a $150,000 mortgage at a 3% fixed interest rate with our amortization schedule over 10- and 25- years.

At a 3% fixed-rate over 10-years, youd pay approximately $1,448.41 monthly. Over the course of a year, thats a total of $17,380.92 in mortgage payments. In the table below, compare how much you would pay toward both interest and the principal amount each year.

| Year | |

|---|---|

| $17,102 | $0 |

At a 3% fixed-rate over 25-years, youd pay approximately $711.32 monthly. Over the course of a year, thats a total of $8,535.84 in mortgage payments. In the table below, compare how much you would pay toward both interest and the principal amount each year.

| Year |

|---|

Can I Get A 150000 Buy

Yes, of course, but the rules can be different for buy-to-let mortgages, so its important to know a few things before you start.

Some mortgage providers will expect you to put down a higher deposit of around 25%, although others will accept 15% subject to other criteria. You may also find that certain providers insist on minimum income requirements around £25k is standard although affordability come down to whether the forecast rental income will cover the mortgage repayments by 125-130%.

There are also lenders who will only offer you a buy to let deal if you have owned and lived in your own home from at least six months, but specialist providers may consider first-time buyers subject to other criteria being met.

The majority of buy to let mortgages are set up on an interest-only basis, so see the section below for examples of what the monthly payments on a £150,000 mortgage might be.

How Much Is A 150000 Mortgage A Month Final Thoughts

When considering what mortgage amount to apply for ask an expert to assist you. Affording the repayments each month comfortably should be a number one priority.

If youre ready to take the leap, were ready to help you with your first time buyer mortgage application.

As a first time buyer, its natural to have a lot of questions. Ask away, one of our friendly advisors would love to talk things through with you.

Call us today on 01925 906 210 or complete our quick and easy First Time Buyer Mortgage Application.

Consolidate Today!

Read Also: Rocket Mortgage Loan Requirements

Don’t Miss: Are Mortgage Rates Going To Rise

The Term For A 150 000 Mortgage

Typically you may get a term of between 5 to 30 years to repay a £150000 mortgage depending upon your circumstances. The term will have a massive effect on your monthly repayments as well as the total amount youll ultimately pay.

With a more extended period, youll have cheaper monthly payments. However, the total amount youll repay for the loan will be higher than a shorter period. You can save thousands by repaying your loan over a shorter period.

To give you an idea of how the term affects monthly and total payments of a £150 000 mortgage, check out the table below, which is based on a 3% interest rate.

How The Term Affects The Cost Of A 150000 Mortgage

The mortgage term significantly affects how much a £150,000 mortgage costs a month and what you ultimately pay in total. Most lenders in the UK offer between 5 to 30 years to repay a £150,000 mortgage.

How long youll need to pay off the mortgage will depend on how much you can realistically afford to pay each month. Youll get cheaper monthly repayments with extended periods, but the overall cost will be higher at the end of the loan term.

Youll have higher monthly repayments with a shorter mortgage term but a lower overall cost. A £150,000 mortgage with a term of 30 years will cost you thousands more than a mortgage for 20 years or less. However, the cost of the more extended period may be worth it if you need cheaper monthly repayments you can easily afford.

Its wise to choose a term based on how much you can afford each month without getting into financial hardship. Based on a 3% interest rate, the table below can give you a rough idea of how the term affects how much a £150,000 mortgage costs a month and in total.

| Term |

| £161,712 |

You May Like: What Is The Current Mortgage Loan Interest Rate

What Term Should I Choose

The most common term length in Canada is 5 years, and it generally works well for most borrowers. Lenders will have many different options for term lengths for you to choose from, withmortgage ratesvarying based on the term length. Longer terms commonly have a higher mortgage rate, while shorter terms have lower mortgage rates.

Read Also: Rocket Mortgage Loan Types

Does The Term Of The Mortgage Affect Repayments And The Total Amount Youll Repay

The short answer is, yes. Were often asked, how long does it take to pay off a £150,000 mortgage? This all depends on your circumstances and how much you can afford to pay each month.

Based on an average interest rate of 3%, the following is an indication of how reducing the term of your mortgage will affect your repayments and the total amount youll repay.

| Monthly Repayment | |

|---|---|

| £161,712 | £11,712 |

The above example is for demonstrative purposes only and you should consult your broker or lender for the most up-to-date information and rates.

As you can see, the term of the mortgage has a huge bearing on your monthly repayments and how much youll finally pay.

For instance, taking a mortgage over a 20-year term, as opposed to a 25-year term could save you over £13,700.

Talk to one of the expert mortgage advisors we work with for the right advice on which term may be the most beneficial for you. They will be able to get specific mortgage quotations based on your financial circumstances.

Read Also: How Are 30 Year Mortgage Rates Determined

Why Does Your Monthly Calculator Have Four Columns

We think its important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary amortization period as well as interest rates, so youll know how a variable vs. fixed mortgage rate changes your payment.

How Can I Calculate My Monthly Mortgage Payment

You can use our mortgage calculator to calculate your monthly payment , or you can do it yourself if youre up for a little math. Heres the standard formula to calculate your monthly mortgage payment by hand. To figure out your monthly mortgage payment , plug in the principal , monthly interest rate , and number of months from your loan and solve:

= Number of months required to repay the loan \begin & M = \frac \\ & \textbf \\ & P = \text \\ & i = \text \\ & n = \text \\ \end M=Pwhere:P=Principal loan amount i=Monthly interest raten=Number of months required to repay the loan

Lenders usually list interest rates as an annual amount. To determine the monthly rate, divide the annual amount by 12. So, if your rate is 6%, the monthly rate would be 0.06/12 = 0.005.

Read Also: Can You Get A Mortgage With No Job

Factors That Impact The Interest Rates Available To You For A 150000 Mortgage

The larger the deposit you provide, the lower the loan-to-value of your borrowing, which gives a larger pool of lenders the confidence to offer more competitive interest rates

If youre a PAYE earner, you may get slightly better rates on the high street than self-employed applicants, as lenders consider your income to be more stable. If youre self-employed, however, dont worry, as there are plenty of lenders that specialise in self-employed mortgages, who will offer you competitive rates.

Most lenders reserve their most competitive interest rates for applicants with a strong credit score. Its possible to get a bad credit mortgage, however, the interest rates are typically higher and the pool of lenders willing to consider your application will be lower.

As lending is all about risk, even certain property types can be considered riskier than others, meaning youre likely to be offered less competitive rates if you buy a property of non-standard construction or a second home, as they are both seen as riskier purchases.

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Read Also: What Credit Score Is Best For Mortgage

How Much Is A 150000 Mortgage A Month

Customers often ask us what are the average repayments on a £150K mortgage?, and the answer depends on a number of factors and your credit history will have a bearing on the interest youll pay, which of course will directly affect your monthly mortgage repayments.

A £150K mortgages monthly repayments will vary depending on the interest rate youre given as well as the length of the term.

The table below illustrates how £150k mortgage payments can differ based in these variables.

| Interest Rate | |

|---|---|

| £664 | £757 |

Which mortgage rate you qualify for will depend mostly on your level of deposit and your profile as a borrower.

If youre still unsure about the cost of a £150k mortgage, get in touch and the expert advisors we work with will get you mortgage quotations based on your specific circumstances and connect you with the lender most likely to offer favourable rates.

Estimating How Much House You Can Afford

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income ratio .

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldnt pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Keep in mind, however, that just because you can afford a house on paper doesnt mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money youll have on-hand after you make the down payment. Its best to have at least three months of payments in savings in case you experience financial hardship.

Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if youre planning to retire early, determine how much money you need to save or invest each month and then calculate how much youll have leftover to dedicate to a mortgage payment.

Ultimately, the house you can afford depends on what youre comfortable withjust because a bank pre-approves you for a mortgage doesnt mean you should maximize your borrowing power.

Recommended Reading: How Can I Make My Mortgage Payments Lower

Interest: The Difference 15 Years Can Make

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Say youve decided to buy a home thats appraised at $500,000, so you take out a $400,000 loan with an interest rate of 3.5%. First, lets take a look at a 30-year loan. For quick reference, again, the formula is: M = P /

Our P, or principal, is $400,000.

Remember, with i, we must take the annual interest rate given to us 3.5%, or 0.035 and divide by 12, the number of months in a year. This calculation leaves us with 0.002917, or i.

Our n, again, is the number of payments. And with one payment every month for 30 years, we multiply 30 by 12 to find n = 360.

When alls said and done, for a 30-year loan at 3.5% interest, well pay $1,796.18 each month.

For a 15-year loan, the math is nearly identical. All thats different is the value of n. Our loan is half the length, and so the value for n is 180. Each month well pay $2,859.53, over 60% more than with the 30-year loan.

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay $514,715 in total. With the 30-year, you pay $646,624 total over $100,000 more.

Your decision between these two, quite simply, hinges on whether or not you can float the significantly higher monthly payments for a 15-year loan.

A little math can go a long way in providing a how much house can I afford? reality check.

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.

Read Also: What Would The Mortgage Be On A 200 000 House

Monthly Payments On A $150000 Mortgage

At a 4.5% fixed interest rate, your monthly mortgage payment on a 25-year mortgage might total approximately $833.75 a month, while a 10-year mortgage might cost roughly $1,554.58 a month.

Note that your monthly mortgage payments may differ slightly depending on the type of interest rate , your mortgage term, payment frequency, taxes and possible other fees.

-

See your monthly payments by interest rate.

Interest $833.75

What Are 2 Cons For Paying Off Your Mortgage Early

Cons of Paying Your Mortgage Off Early

- You Lose Liquidity Paying Off Your Mortgage. Liquidity refers to how easy it is to access and spend the money you have. …

- You Lose Access to Tax Deductions on Interest Payments. …

- You Could Get a Small Knock on Your Credit Score. …

- You Cannot Put The Money Towards Other Investments.

Recommended Reading: Does Capital One Give Mortgage Loans

Term Monthly Repayment Interest Total Repaid

- 30 years £632 £77,621 £227,621

- 25 years £711 £63,358 £213,358

- 20 years £832 £49,627 £199,627

- 15 years £1,036 £36,437 £186,437

- 10 years £1,448 £23,796 £173,796

- 5 years £2,695 £11,712 £161,712

The less the loan term, the less the total amount youll pay, but the higher the monthly payments. Keep in mind that the period you get will depend on your circumstances, and its wise to base your decision on the amount you can realistically afford each month.

Recommended: Learn more about the different types of mortgages and the fees involved in buying a home.

A Sample Maximum Affordability Calculation

Lets look at an example where your gross annual income is $75,000. Youre buying a home with annual property taxes of $3,600, monthly heating costs are $200 and, since youre buying a house, there are no condo fees. In addition to your housing expenses, you have a monthly car loan at $300 and must make minimum monthly payments of $250 on your credit card debt. You have $20,000 saved up for a down payment.

Example Parameters

÷ 12 months in the year

= Max monthly mortgage payment: $1,450

Since both your GDS and TDS ratios must be less than or equal to the maximum, the largest mortgage payment you can afford is $1,450. Though your GDS suggests you can afford $1,500, at that monthly payment, your TDS will be over 40% and therefore $1,450 is the maximum payment that ensures both debt service ratios fall within the allowable range.

With a monthly mortgage payment of $1,450 per month, you can afford a $300,000 mortgage with a 5-year fixed interest rate of 3.28% and an amortization period of 25 years. Finally you must ensure you have the minimum down payment of 5%. Since $20,000 / $300,000 = 6.67% you can satisfy the minimum down payment requirement.

After calculating your GDS ratio, TDS ratio and down payment percent, you can determine your maximum affordability at $300,000. Since your TDS ratio is limiting your affordability, you could try paying off some of your credit card or car debt to increase your maximum affordability.

Dont Miss: Mortgage Rates Based On 10 Year Treasury

Recommended Reading: What Are Essential For Completing An Initial Mortgage Loan Application