Covering Up Bad Spending Habits

If youre taking out a home equity loan because you dont have the cash to pay for something, stop and ask yourself why. Is it because you have poor budgeting or spending habits?

Borrowing more money, in that case, likely wont help your financial situation. Youre not dealing with the underlying issue that got you here, Arrigo says.

I Own A Home With No Mortgage Balance And Want To Buy Another House

Mortgaging your current home isnt always necessary when buying a second home, vacation home, or investment property. You may already have enough savings for a down payment without tapping into your equity, says Jon Meyer, The Mortgage Reports loan expert and licensed MLO.

Before getting a mortgage on a house you already own, look into mortgage loans that allow low down payments. Home buyers should consider the following types of loans.

How To Get A Home Equity Loan With Low Income

Home equity loans can be essential if you are going through a period of financial hardship or if you need to fund a project youre working on. If you dont currently have a source of income, though, you might be concerned that it will be difficult to get subprime home equity loans.

As stated above, traditional lenders typically require that you have stable employment in order to take out a home equity loan. However, if you work with a more flexible lender, you can certainly access the equity in your property when you need it most.

Since home equity lenders focus on how much equity you have in your home, your income doesnt necessarily have to factor into the decision of whether or not they loan you money. Since this is a secured loan, the lender knows that they can take possession of your house if you fail to pay back the loan. This means that they are more willing to take the risk of lending you money.

Turned Away wants to help people access their home equity when they need it most. Without any income requirements for home equity loans in Canada, we make it easy to tap into the savings account that is your property.

One reason that Canadians often take out a home equity loan is to consolidate their debt. If you are trying to consolidate your debt to lower your interest rate, simplify your payments, and be free of debt once and for all, check out this guide for homeowner debt consolidation.

You May Like: How Long After Car Repossession Can I Get A Mortgage

How To Pay Off Your Mortgage Early Without Touching Your 401

If youre thinking of using your 401 to pay off a mortgage, youre probably looking for an instant hit: this month a mortgage, next month debt-free.

Thats understandable. But with a little strategy and patience, you could free yourself from your mortgage several years early without taking money from your golden years.

Here are five ideas:

I Own My Home Outright And Need A Loan

If you own your home outright with no current mortgage its value is all equity. You can tap that equity by taking out a loan against the homes value.

There are several mortgage loan options available when you already own your home, including a cash-out refinance, home equity loan, or HELOC. So do your research and choose the best one based on your goals.

In this article

Recommended Reading: How To Calculate Mortgage Debt Ratio

Home Equity Loan Vs A Cash

Also known as a second mortgage, a home equity loan gives you a lump sum of money, secured by the equity in your home and repaid on a fixed schedule. That means that every month, youll make your existing mortgage payment and a second, separate payment for the home equity loan. In comparison, a cash-out refinance originates a new, single mortgage.

How To Borrow Smartly Against Your Home

- Always compare the rates from more than one lender before taking a loan against your home. Knowledge of different offers will also help you better negotiate terms with your preferred lender.

- If you have a good credit score, you will also have a better negotiating position. The risk for the lender is low in such kinds of loan and they are usually more than happy to lend against home equity. You can try and get various kinds of fees, like application or appraisal fees, waived off because of your strong negotiating position.

- Ideally, its best to keep some home equity, say 15-20% with you. Lending against your complete home equity is not advisable and can be risky. It is always a good idea to have some headroom and back up in case of an emergency.

Its important to remember that knowing how to borrow money using your home is not enough you should also know how to do it smartly and with minimum risk.

Read Also: How To Remove A Co Borrower From A Mortgage

The Pros And Cons Of Remortgaging To Release Equity

The big positive of releasing equity like this is that you unlock some money which you can put to use, whether its to consolidate other debts, pay for home improvements or to gift to a family member.

But remember – you are increasing the size of your loan. This is not something you should do lightly. Depending on the mortgage you go for, this may mean that your monthly payments actually go up.

You also need to remember that house prices can go down as well as up. If house prices fall sharply, that equity you have built up could quickly be eroded away, potentially even leaving you in negative equity. This is where the size of your outstanding loan is larger than the value of the property.

Being in negative equity can make it extremely difficult to remortgage or move home in the future.

Should I Get A Second Mortgage If I Have Bad Credit

Although second mortgages are often difficult to qualify for with bad credit, its not impossible. Obtaining a second mortgage with a low credit score likely means that youll be paying higher interest rates or using a co-signer on your loan.

You can also consider looking into alternative financing options to help pay for your home improvements or debt consolidation. Both personal loans and cash-out refinances are good options to use if you have trouble qualifying for a second mortgage.

Also Check: What’s The Payment On A $250 000 Mortgage

Other Options Besides A Cash

What if you cant qualify for a conventional loan cash-out refinance? You may have other options including:

- Personal loan If you need cash to fix up the home, an unsecured personal loan may offer the cash you need. You dont have to put your home up as collateral and you can use the funds as you need without getting approval from the bank.

- Home equity loan You can take out a home equity loan or line of credit on your owner-occupied property. You can usually take out up to 80% of your homes value, using the funds as needed. This could include using the funds to fix up your investment property to increase your profits.

Recommended Reading: How To Qualify For A Higher Mortgage

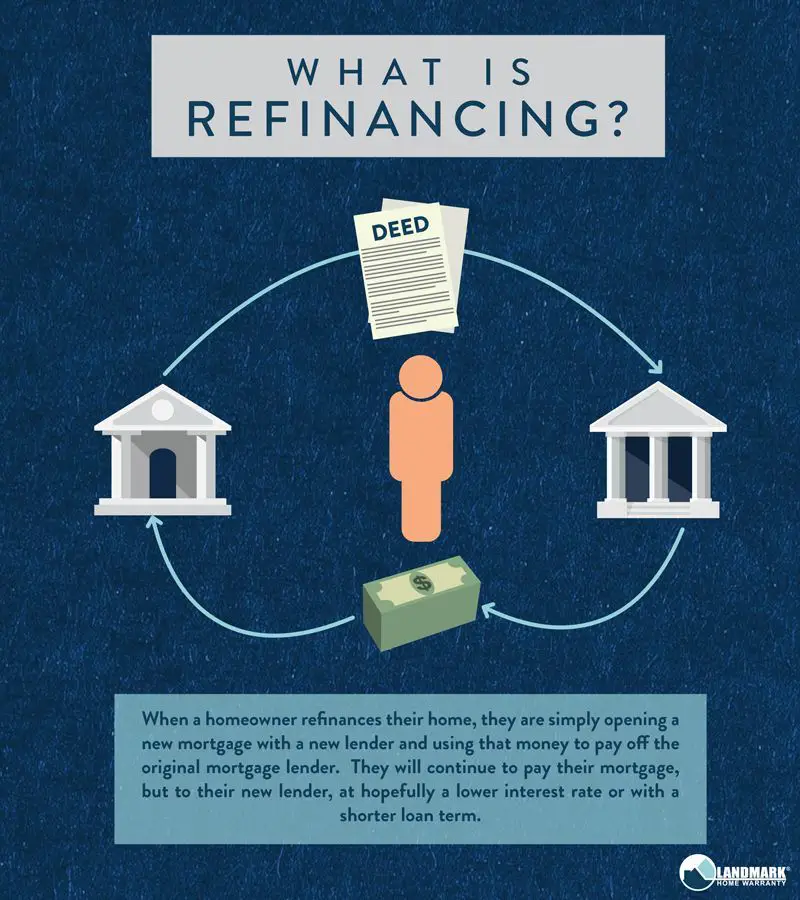

What Is Mortgage Refinancing

Mortgage refinancing allows you to borrow money against the equity in your home. Equity, or net value, is the difference between your homes current value and the balance remaining on your mortgage.

Good to know : You may hear people talking about remortgaging or refinancing. Both of these expressions mean the same thing.

Heres an example: Lets say that your home is worth $300,000, and you still have $150,000 left to pay on your mortgage. By remortgaging, you could borrow $90,000: $150,000 = $90,000

Important: As this example shows, you can refinance up to 80% of the value of your home, minus the balance of your existing mortgage. You would then owe $240,000, which is the balance of your current mortgage plus the new amount borrowed .

Recommended Reading: How To Hire A Mortgage Broker

Do I Need Financial Statements Prepared By An Accountant To Apply For A Business Loan

Accountant-preparedyear-end financial statements are usually needed to apply for larger business loans. A bank may also ask for interim statements prepared internally to understand the more recent financial situation. If statements arent available, tax returns may suffice in the case of a smaller loan.

When Should I Get A Second Mortgage

Second mortgages arent for everyone, but they can make perfect sense in the right scenario. Here are some of the situations in which it makes sense to take out a second mortgage:

- You need to pay off credit card debt. Second mortgages have lower interest rates than credit cards. If you have many credit card balances spread across multiple accounts, a second mortgage can help you consolidate your debt.

- You need help covering revolving expenses. Do you need revolving credit without refinancing? Unlike a refinance, HELOCs can give you access to revolving credit, as long as you keep up with your payments. This option can be more manageable if youre covering a home repair bill or tuition on a periodic basis.

- You cant get a cash-out refinance. Cash-out refinances, compared to home equity loans, usually have lower interest rates. But if your lender rejects you for a refinance, you may still be able to get a second mortgage. Consider all of your options before you get a second mortgage.

You May Like: How Do I Calculate Points On A Mortgage

Should I Refinance My Mortgage

If interest rates have dropped since you signed your mortgage, you might think about refinancingOpens a popup.. But before you take the leap, there are a few things to consider.

When you refinance your mortgage, you replace your existing mortgage with a new one on different terms. To find out if you qualify, your lender calculates your loan-to-value ratio by dividing the balance owing on your mortgage and any other debts secured by your property into the current value of your property. If your loan-to-value ratio is lower than 80%, you can refinance.

The lender also looks at your monthly income and debt payments. You may need to provide a copy of your T4 slip, notice of assessment or a recent pay stub your mortgage statement a recent property tax bill and recent asset statements for your investments, RRSPs and savings accounts.

How To Keep Your Investments Safe

One of the most important things to remember when investing in the stock market is that you dont lose any money until you sell your stocks. The market could plummet tomorrow, but as long as you dont sell, you havent lost any money.

Holding your investments despite market volatility, then, is a smart way to keep your money safer. The market may dip and your stocks may decrease in value, but as long as youre buying the right investments, theres a very good chance theyll recover. When that happens, your portfolio will bounce back stronger than ever.

Also Check: Does Shopping For A Mortgage Hurt Your Credit Score

You May Like: How Much Mortgage Can I Afford With 100k Salary

Should You Mortgage The House You Own

Owning your home outright provides a valuable equity cushion, and its exciting when you no longer shoulder the burden of monthly mortgage payments. The good news, though, is that you dont have to sell your home to access your equity.

Using a cash-out refinance, home equity loan, or home equity line of credit, homeowners can pull cash from their equity and use the money for many different purposes.

Make sure you understand the pros and cons of each type of financing and choose the best one for you based on your specific goals.

How Will You Use Your Home Equity In 2022

In the end, the way you decide to access and use your home equity is up to you. Whatever path you choose should be based on your financial situation, so dont make that choice until youve got all the advice you can and weigh all your options equally. If youre having trouble figuring out which solution will suit your needs best, Loans Canada can help match you with the right home equity loan product and licensed specialist.

Note: Loans Canada does not arrange, underwrite or broker mortgages. We are a simple referral service.

Rating of 5/5 based on 24 votes.

Read Also: How Is A Mortgage Payoff Calculated

Is It More Important To Pay Off Debt Or Build My Savings

The answer to this question is specific to you, but there are a few guidelines that can help in making this choice.

How Much Can I Borrow With A Cash

The maximum LTV ratio for a cash-out refinance is 80%. Depending on your credit and income, you might not be able to qualify for a 80% LTV. If you have bad credit, the maximum allowed LTV by your lender might be lower.

For example, lets say that your home is valued at $500,000, and you currently have a $300,000 mortgage. This means that your current LTV is 60% . With a maximum LTV of 80%, you can borrow up to an additional 20% of your homes value, or $100,000. You can refinance your mortgage for $400,000, pay off your existing mortgage of $300,000, and withdraw $100,000 in cash.

To calculate how much you can borrow, use ourmortgage refinance calculatorto see how much home equity you can access and how a change in mortgage rates can affect your mortgage payments.

Also Check: How To Get Into Mortgage Processing

Using Your 401 Funds To Buy A Home Has Pros And Cons

Marcus Reeves is a writer, publisher, and journalist whose business and pop culture writings have appeared in several prominent publications, including The New York Times, The Washington Post, Rolling Stone, and the San Francisco Chronicle. He is an adjunct instructor of writing at New York University.

If you need cash for a down payment for a home, and you have a 401 retirement plan, you might be wondering if you can use these funds.

Typically when you withdraw funds from a 401 before age 59½, you incur a 10% penalty. You can use your 401 toward buying a house and avoid this fee. However, a 401 withdrawal for a home purchase may not be best for some buyers because of the opportunity cost.

Learn how to tap your 401 to buy a home and more about some alternatives for funding a home purchase, such as using a mortgage program or saving up cash.

The Best Way To Use Your Ira To Buy A House

Using our IRA to buy our house wasnt in our thought process when we bought our house three years before. We could have maximized the $10,000 tax credit and paid even less in mortgage interest.

The right way to make early IRA withdrawals to buy a house is following these steps:

- Withdraw from a Roth IRA account thats at least five years old

- Make the withdrawal within 120 days of your house acquisition date or during the construction process

- Only withdraw up to $10,000 from your Roth IRA and your spouses Roth IRA

Following these three steps means you can make an early IRA withdrawal thats tax-free and penalty-free.

If you only own a Traditional IRA, your first $10,000 in withdrawals can also be penalty-free, but you still need to set money aside to pay distribution taxes.

Don’t Miss: What Are Mortgage Underwriters Looking For

What Loan Terms And Conditions Are Best For My Business

Loan terms and conditions vary greatly depending on the financial institution and type of loan.

Its common to focus on the interest rate, but other elements can be just as important, Mittra says. You should shop around for the right terms and conditions.

Look into these terms and conditions.

You can also ask your business contacts about their experiences with different banks. Find out about the banks:

- quality of service

- ability to offer access to networks and procurement opportunities

- specialization with your industry or the type of loan youre seeking

- diversity financing record