Interest: The Difference 15 Years Can Make

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Say youve decided to buy a home thats appraised at $500,000, so you take out a $400,000 loan with an interest rate of 3.5%. First, lets take a look at a 30-year loan. For quick reference, again, the formula is: M = P /

Our P, or principal, is $400,000.

Remember, with i, we must take the annual interest rate given to us 3.5%, or 0.035 and divide by 12, the number of months in a year. This calculation leaves us with 0.002917, or i.

Our n, again, is the number of payments. And with one payment every month for 30 years, we multiply 30 by 12 to find n = 360.

When alls said and done, for a 30-year loan at 3.5% interest, well pay $1,796.18 each month.

For a 15-year loan, the math is nearly identical. All thats different is the value of n. Our loan is half the length, and so the value for n is 180. Each month well pay $2,859.53, over 60% more than with the 30-year loan.

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay $514,715 in total. With the 30-year, you pay $646,624 total over $100,000 more.

Your decision between these two, quite simply, hinges on whether or not you can float the significantly higher monthly payments for a 15-year loan.

A little math can go a long way in providing a how much house can I afford? reality check.

How Big Is The Uk Mortgage Market

Historically across the United Kingdom, around 65 thousand to 70 thousand mortgages are approved each month. This is from a low of around 30 thousand after the 2008 to 2009 global financial crisis. Prior to the recession, the monthly rate was closer to 80 thousand to 130 thousand mortgages completed each month.

The UK Mortgage Market is Over £1.5 Trillion

In the fourth quarter of 2020, there were £76.5 billion new mortgage originations in the UK, according to the Financial Conduct Authority . At the end of the fourth quarter of 2020, there were £1,438.4 billion in unsecuritised home loans outstanding, with £102.956 billion in securitised home loans. Total residential mortgages to individuals summed of £1.541 trillion across 13,404,487 loans in the fourth quarter of 2020.

Overall mortgage debt tends to grow around 3% to 6% per annum, though there can be significant fluctuations in that rate of growth due to factors like BREXIT, the global economic crisis which happened in 2008, COVID-19 lockdowns, etc. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to foreign property ownership, the localised balance between immigration and construction, etc.

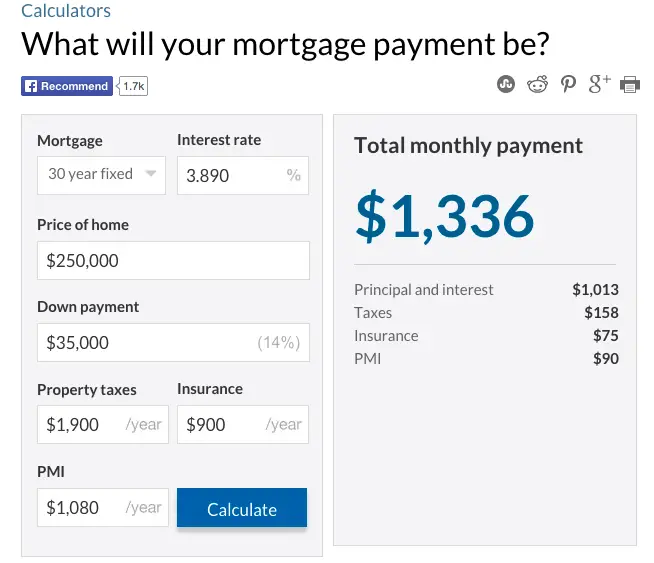

How To Use This Mortgage Payment Calculator

Regardless of where you are in the homebuying process, estimating your monthly mortgage cost is a crucial step in determining what you can truly afford and what you’re comfortable paying. This tool can help you evaluate different scenarios and figure out the type of loan, term and down payment that’s right for your financial situation.

Recommended Reading: Can You Put Renovation Costs Into Your Mortgage

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Determine What Your Ideal Down Payment Amount Should Be

A down payment is a portion of the cost of a home that you pay up front. It demonstrates your commitment to investing in your new home. Generally, the more you put down, the lower your interest rate and monthly payment. There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers. Use this down payment calculator to help you answer the question how much should my down payment be?.

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down-payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate of 3.946%.1

Also Check: How To Get A Cheap Mortgage Rate

How Much Should My Mortgage Be In The Real World

All this math can come across as a bit theoretical. And your goal when deciding on your mortgage amount should be more practical. You want a home loan that will fit neatly within your lifestyle, needs, and ambitions.

Try running a few numbers through a home affordability calculator to begin getting a sense of how much your mortgage should be.

The fact that a lender will give you $x amount because of your DTI, credit score, down payment, and personal finances doesnt necessarily mean you should borrow $x amount.

Yes, most of us borrow up to the maximum were allowed. But that doesnt mean you should.

How Much Will I Pay Monthly

The information provided by these calculators is for illustrative purposes only. The default figures shown are hypothetical and may not be applicable to your individual situation. Rates provided are for a 30-year fixed mortgage only and are a national average provided by a third party and may not be reflective of actual First Financial Bank rates. Be sure to consult a financial professional prior to relying on the results. The calculated results are intended for illustrative purposes only and accuracy is not guaranteed. This material is provided for general and educational purposes only it is not intended to provide legal, tax, or investment advice. Rates are subject to change without notice. All loans are subject to credit review and approval. NMLS #619717. First Financial Bank. Member FDIC.

Read Also: How To Calculate Mortgage Insurance On A Conventional Loan

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward paying interest.

Use Our Calculator To Estimate Your Monthly Payment

Most people need a mortgage to finance a home purchase. Use our mortgage calculator to estimate your monthly house payment, including principal and interest, property taxes, and insurance. Try out different inputs for the home price, down payment, loan terms, and interest rate to see how your monthly payment would change.

Read Also: How Much Do I Need To Earn For A Mortgage

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Consider The Cost Of Property Taxes

A monthly mortgage payment will often include property taxes, which are collected by the lender and then put into a specific account, commonly called an escrow or impound account. At the end of the year, the taxes are paid to the government on the homeowners’ behalf.

How much you owe in property taxes will depend on local tax rates and the value of the home. Just like income taxes, the amount the lender estimates the homeowner will need to pay could be more or less than the actual amount owed. If the amount you pay into escrow isn’t enough to cover your taxes when they come due, you’ll have to pay the difference, and your mortgage payment will likely increase going forward.

You can typically find your property tax rate on your local government’s website.

Recommended Reading: What Is A Non Qm Mortgage

What Are Mortgage Points And How Do They Work

Mortgage points are the fees a borrower pays a mortgage lender in order to trim the interest rate on the loan. This is sometimes called buying down the rate. Each point the borrower buys costs 1 percent of the mortgage amount. So, one point on a $300,000 mortgage would cost $3,000.

Each point typically lowers the rate by 0.25 percent, so one point would lower a mortgage rate of 4 percent to 3.75 percent for the life of the loan. How much each point lowers the rate varies among lenders, however. The rate-reducing power of mortgage points also depends on the type of mortgage loan and the overall interest rate environment.

Borrowers can buy more than one point, and even fractions of a point. A half-point on a $300,000 mortgage, for example, would cost $1,500 and lower the mortgage rate by about 0.125 percent.

The points are paid at closing and listed on the loan estimate document, which borrowers receive after they apply for a mortgage, and the closing disclosure, which borrowers receive before the closing of the loan.

Find Out Whether You Need Private Mortgage Insurance

Private mortgage insurance is required if you put down less than 20% of the purchase price when you get a conventional mortgage, or what you probably think of as a “regular mortgage.” Most commonly, your PMI premium will be added to your monthly mortgage payments by the lender.

The exact cost will be detailed in your loan estimate, but PMI typically costs between 0.2% and 2% of your mortgage principal.

Oftentimes, PMI can be waived once the homeowner reaches 20% equity in the home. You also may pay a different type of mortgage insurance if you have another mortgage, such as an FHA mortgage.

You May Like: How Much Net Income Should Go To Mortgage

How Does Your Credit Score Impact Affordability

Your credit score is the foundation of your finances, and it plays a critical role in determining your mortgage rate. For example, lets say you have a credit score of 740, putting you in the running for a rate of 4.375 percent on a loan for a $400,000 property with a 20 percent down payment. If your credit score is lower 640, for example your rate could be higher than 6 percent. In that scenario, the monthly payment to cover the principal and interest could be $300 cheaper for the higher credit score.

To find out your score, check your credit report at one of the big three agencies: Equifax, Experian and TransUnion.

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

Recommended Reading: How To Get A Pre Qualification For Mortgage

Learn What You Can Afford

How To Calculate Your Monthly Mortgage Payment

You can calculate your monthly mortgage payments using the following formula:

M = P /

In order to find your monthly payment amount “M,” you need to plug in the following three numbers from your loan:

- P = Principal amount

- I = Interest rate on the mortgage

- N = Number of periods

A good way to remember the inputs for this formula is the acronym PIN, which you need to “unlock” your monthly payment amount. If you know your principal, interest rate and number of periods, you can calculate both the monthly mortgage payment and the total cost of the loan. Note that the formula only gives you the monthly costs of principal and interest, so you’ll need to add other expenses like taxes and insurance afterward.

Also keep in mind that most lender quotes provide rates and term information in annual terms. Since the goal of this formula is to calculate the monthly payment amount, the interest rate “I” and the number of periods “N” must be converted into a monthly format. This means that you must convert your variables through the following steps:

Example

N = 30 years X 12 months = 360

Read Also: How Is Mortgage Amount Determined

How To Calculate Your Dti

We talked a lot about debt-to-income ratios in this article. Knowing yours is key to learning how much house you can afford.

So, in case you were wondering, heres how you can calculate your own DTI ratio for mortgage qualifying.

- First, add up all the monthly expenses included in your DTI:

- Estimated monthly housing expenses

- Minimum credit card payments

- Obligations like alimony and child support

Next, you need to know your gross monthly income.

Remember, thats the highest figure on your pay stub, before deductions for tax and so on. If your income varies considerably perhaps seasonally use an average over the last year or two.

Now, divide the first figure by the second .

Federal regulator the Consumer Financial Protection Bureau gives an example:

If you pay $1,500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000.

If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent.

If you use a calculator, youll need to multiply the result by 100 to get a percentage. So your display says 0.3333 but your DTI is 33.33% .