What Are The Benefits Of A No

A no-closing-cost refinance can allow you to keep your refinance plans on track. If you’re planning to refinance and you need money to cover a sudden bill, a no-closing-cost refinance can actually save you money.

Interest rates on mortgages are usually lower than home equity loans, which means that even if you take a slightly higher rate, you may end up paying less compared to another type of loan.

Shop For Lenders With Low Fees

Before you decide on a lender, shop around for the best deal. Many of the fees lenders charge are negotiable. Ask each lender for a breakdown of how much they charge in origination fees. You may even want to ask them to break out their bundled origination fees into individual line items. Then compare lenders and negotiate to see which items can be omitted or reduced. A good place to start is with document prep or courier fees.

What Are Origination Points

Origination points, also called mortgage points, are a type of prepaid interest. Many lenders offer the option to pay for points to reduce the interest rate of your mortgage. If you stay in the home long enough, that helps reduce the overall cost of your loan and your monthly mortgage payment.

Typically, one point costs 1% of the total loan amount and reduces the loans interest rate by 0.25%.

For example, on a $250,000, 30-year mortgage, one point costs $2,500. If you reduce your interest rate from 6% to 5.75% by buying a point, you reduce your payment from $1,499 to $1,459, saving you $14,400 over the life of the loan.

Also Check: What Does A Mortgage Application Look Like

Can You Roll Your Closing Costs Into Your Mortgage

Buying a home is an expensive prospect. You have to come up with a down payment, pay for movers, and buy furniture for your new home. But there’s another expense many home buyers forget to account for: closing costs on a mortgage.

Closing costs aren’t universal. Each mortgage lender sets its own fees that are then passed on to borrowers when they finalize their home loans. Typically, closing costs range from 2% to 5% of a borrower’s loan amount. Your loan estimate should include your closing costs so you know what fees to expect. In fact, your lender should break down each fee for you in your closing disclosure so you know everything you’re paying for.

The good news is that as a borrower, you usually don’t need to come up with a check for your closing costs when you sign your mortgage. You could go that route, but you often get the option to roll those fees into your mortgage and pay them off with the rest of your loan. This applies to new home purchases and refinances. The question is: Which is the better choice?

Jump To

How Much Are Closing Costs

Buyer closing costs are usually between 2% to 5% of the homes purchase price. For example, if the home costs $300,000, you might pay between $6,000 and $15,000 in closing costs.

Seller closing costs are typically higher. On average, sellers pay roughly 8% to 10% of the sale price of the home in closing costs the majority of this cost is made up by agent commissions. On a $300,000 home, thats between $24,000 and $30,000.

A lot of factors impact how much youll pay in closing costs. For buyers, it depends on your loan program, size of loan and individual lender practices. For sellers, it comes down to what youve negotiated in terms of concessions and agent commission.

Recommended Reading: What Is The Difference Between A Bank And Mortgage Broker

Closing Costs Can Be Regained

While closing costs may seem like a high price at the time, you can regain your losses in a reasonable amount of time by locking in a great refinancing rate. First Bank can help you find the best refinancing rate for your mortgage*, so you can save money in the long term and build equity in your home. Contact us today to discuss your mortgage refinance options.

*Loans subject to credit approval.

When It Makes Sense To Finance Closing Costs

Financing your closing costs doesnt mean that you avoid paying them entirely. It simply means that you dont have to bring thousands of dollars to the closing table. If youve already spent a large portion of your savings on your down payment, financing your closing costs over the term of your mortgage might be a good idea.

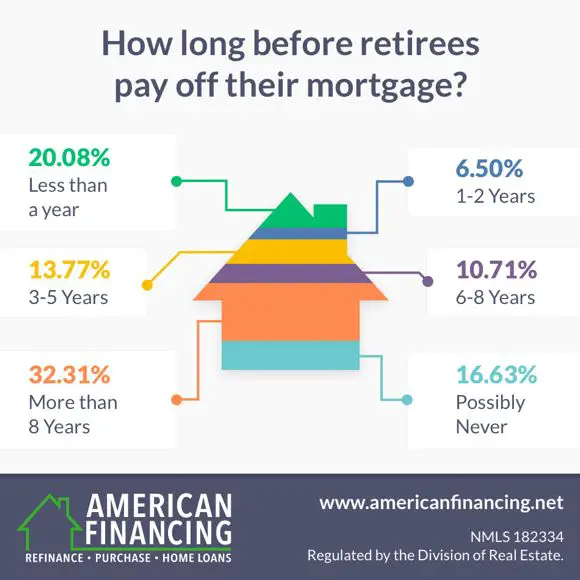

It might also be worth considering if youre refinancing your home or youre applying for a home equity loan. You might not end up paying too much extra interest, especially if you pay off your loans relatively quickly.

Don’t Miss: Can You Have Two Mortgages On One House

Escrow And Title Fees

The escrow and title fees will include both the lender and the owner policy of title insurance, as well as the escrow fee itself. The title insurance will protect not only the owner, but also the lender by insuring a clear title, and also that the people with a legal right to convey title to the property are the people who will actually do so. In some cases, the policy also protects against an occurrence of forgery or fraud.

Most homeowners who refinance have already paid for a policy of title insurance during the initial property purchase, and do not want to pay for it a second time. Also keep in mind that lenders as well as owners are insured. The new mortgage created during the refinancing process brings about the need for a new policy. Many title companies can offer a substantial reduction in both the escrow fees and title policies to borrowers needing to refinance.

Escrow fees are service fees that are charged by the title company for assuming the role of an independent third party, insuring that those involved in the transaction perform as agreed, as well as facilitating the transaction itself.

Other title costs include the miscellaneous drawing, express mail, and courier fees, as well as the recording fee, the county recorder office’s fee to record the deed of trust, mortgage document notarization fees, and the notary’s fee.

Mortgage Refinance Closing Costs To Watch Out For

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Don’t Miss: Can I Get A Mortgage With Credit Card Debt

Whats Included In Refinance Closing Costs

The closing costs of a refinance can be different for different homeowners. Closing costs vary because of factors such as property location, loan type, and loan amount. Some of the closing costs you may need to pay when you refinance a mortgage include:

- Lender fees. These are the fees lenders may charge to process your refinance application . These fees can vary from lender to lender.

- Mortgage Discount Points. These are fees some lenders may charge you to get a lower interest rate. For example, a lender may offer you a 2.75% interest rate but charge you discount points to get it. One mortgage discount point is equal to 1% of the loan amount. You can often choose to pay discount points to get a lower interest rate too.

- Mortgage Insurance. When you refinance with a conventional loan, you will most likely need to pay for private mortgage insurance if your home equity is less than 20%. You will mostly likely need to pay an upfront mortgage insurance premium when you refinance an FHA loan.

- Funding and Guarantee Fees. VA and USDA refinances dont have mortgage insurance but they do have funding or guarantee fees you will most likely need to pay.

- Homeowners Insurance and Property Taxes. You may need to pay hazard insurance premiums and property taxes as part of your closing costs.

Closing Costs On A Conventional Loan

Conventional loan closing costs range between 2% and 5% of the purchase price. If you make a down payment of less than 20%, youll pay private mortgage insurance until you reach a loan-to-value ratio of 78%, when you can request discontinuation of the payment.

Similar to an FHA loan, there are limits to how much of the buyers closing costs the seller can cover. If you make a down payment of 25% of the purchase price or more, the seller can pay for closing costs up to 9% of the total loan amount. If your down payment is between 10% and 24%, they can cover up to 6%. For down payments of less than 10%, the seller can assist with closing costs up to a total of 3% of the loan amount.

Recommended Reading: Can Three People Be On A Mortgage

Costs You Have To Pay But That Are Deducted From The Amount Borrowed

These costs rather than being upfront costs that you have to pay out of your own pocket can be deducted from the amount that you receive.

So lets say you arrange a reverse mortgage for $150,000 and these costs are $2,000. Then you will receive $148,000 instead.

You can choose to pay them if you like but almost every single person chooses to have them deducted from the amount borrowed instead.

These are split between two different sets of legal costs:

You May Like: How Much Would Payments Be On A 45000 Mortgage

How To Negotiate Mortgage Origination Fees

As with everything else in the world of business, mortgage loan origination fees are negotiable. And there are a few tactics you can use to reduce the fees you pay.

The simplest is to ask your loan officer or lender to waive or reduce them. Theres no harm in asking, and the worst that can happen is theyll say no. One way to strengthen your position is to show your lender a preapproval from another lender thats charging lower fees.

You could also ask your lender about a no-closing-cost or no-origination-fee mortgage. These loans let you skip the upfront fee but usually have higher interest rates. That can be a good choice for people who want to buy a home despite limited savings. But the higher interest costs mean youll lose out if you stay in the home for a long time.

If youre in a buyers market, you can also ask for seller concessions to cover a portion of the fee. You can negotiate with the current homeowner to determine how much theyre willing to pay for the loan application fee and other origination costs.

You May Like: Where To Find Lowest Mortgage Rates

Ways To Reduce Your Refinance Closing Costs

There are a number of factors that affect the costs a lender charges for the refinance rate they offer, and knowing how they impact your refinance expenses can help you reduce your refinance closing costs.

Here are nine refinance cost-cutting tips:

What Are The Closing Costs For Cash Buyers

Cash buyers are still required to pay for things like notary fees, property taxes, recording fees, and other local, county and state fees. Unlike a buyer who is using financing, cash buyers wont have to pay any mortgage-related fees. But most cash buyers still opt to pay for things like appraisals, inspections, and owners title insurance.

Also Check: Is Quicken Loans Same As Rocket Mortgage

Do You Pay Closing Costs When Refinancing

Here’s what you should know about closing costs when refinancing a loan.

Recently, a regular listener/watcher of ours, Michael Duree, asked if you pay closing fees each time you refinance your home, and today we’re answering that question in full. The answer is yes, there are closing costs every time you get a loan, so the fees that will always be there are escrow, title insurance, and recording fees.

We do many of our loans at no cost, so people assume it’s a ‘free loan.’ However, it’s not necessarily free you’ll take a slightly higher interest rate and get a credit from the lender to cover those fees. The reason we do a majority of our refinances that way is that we’ve been in a 40-year bull market for interest rates since 1982. Rates have decreased over and over since then.

Rates are trending downward, and we haven’t broken that trend in 40 years.

So essentially, we’re saying you should do a ‘free’ loan today so you have no sunk costs that you won’t get back. That way, in a few years, if rates go even lower, we can refinance you again at no cost and you protect your ability to keep reducing your rate. You may be leaving % on the table, but over time it’ll save you quite a bit.

If you have any questions about this or a question you’d like us to answer in a future blog post, feel free to reach out to us. We would love to help you.

What Is Refinancing And How Does It Work

Refinancing replaces your existing mortgage loan with a new one. It works like this: You apply for a new mortgage, submit your documentation, and once approved, that loan is used to pay off your old one.

Because refinancing gives you a new loan with a new interest rate, term and monthly payment, many people refinance their mortgages to save money.

Do you think you’d benefit from a refinance? First, you should look into current interest rates and what you could qualify for.

There are also cash-out refinances, which allow you to turn your home equity into cash. With these, you take out a new loan larger than your current one. That loan pays off your existing balance, and you receive the difference between those two numbers in cash. You can then use those funds for anything you’d like .

Also Check: Does It Matter What Mortgage Lender You Use

Closing Costs Vs Down Payment

People often assume that their down payment covers closing costs. Though you may make your down payment at closing, these are two completely different payments.

Your down payment is paid to the seller of the house closing costs are paid to the lender, real estate attorney, title company, and other third parties involved in your real estate transaction.

What you put down on the house goes towards the overall purchase price. For example, if you put $60,000 down on a $300,000 home, youâll only need to finance $240,000. Closing costs, on the other hand, are not included in the purchase price of the home. They are an additional amount that must be paid in full upfront.

Rate Adjustment On No

One way the closing costs get re-allocated is with a rate adjustment. If you dont pay closing costs, your rate will be higher.

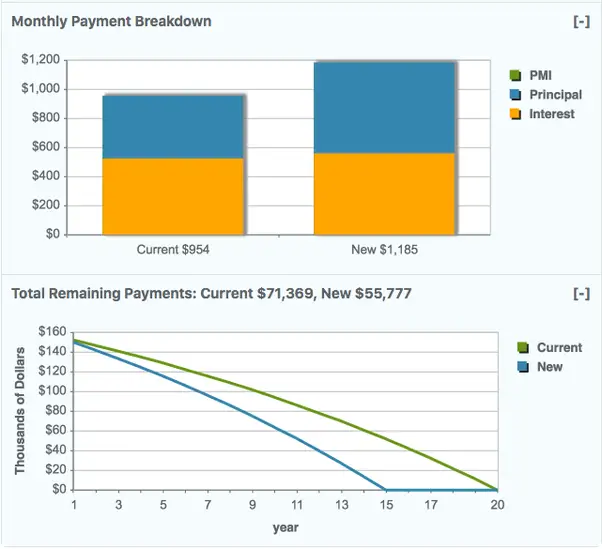

How much higher depends on your loan amount. The lower your loan amount, the higher the rate adjustment will be to cover your closing costs. In general, you can expect your rate to be between .25 percent and .5 percent higher if you go with a zero-closing cost mortgage.

For example, if you were refinancing a $200,000 loan with a zero-closing cost mortgage, you might pay a rate thats .375 percent higher than if you paid the closing costs. This means your monthly payment would be $42 per month higher for the life of the loan but youd conserve about $3,000 in costs at closing.

Don’t Miss: How Are 30 Year Mortgage Rates Determined

Prorated Real Estate Taxes

When someone sells a property, theyâre usually required to pay the real estate taxes for the portion of the year for which theyâve held the property. This is because the buyer will pay the real estate taxes for the full year when they get their property tax bill at the next billing cycle. The seller is simply crediting back the real estate taxes due for the portion of the year they owned the property.

Average Mortgage Refinance Closing Costs

As of last year, the average closing costs to refinance a mortgage was 1.5%. This figure varies depending on your type of loan and FICO score. If you have a $200,000 mortgage, the typical closing costs for a refinance will amount to 1.5% or $3000. If you want to refinance your loan into a 30 year note, this means you need to see a drop of about $90 per month in your payment to make it worth it.

On the up side, most lenders allow you to roll your closing costs into your new loan. So you need not pay cash up front.

You May Like: Is Rocket Mortgage And Quicken Loans The Same

Also Check: How To Calculate Mortgage Approval