Stay In Touch With Your Lender

During the underwriting process, there may be questions or the need for more information. Responding promptly to these requests will keep your application moving forward. Our online loan application makes it easier for you to gather the information they need while staying connected with a trusted mortgage loan officer throughout the process.

What Does The Mortgage Application Process Look Like

In our last video, we talked to Evelyn about the beginning of the application process. This time, were here with Crystal Harris to dig into the process a little further.

Crystal has been with us for a little over a year, and this is her first job in the mortgage industry. After Evelyn gets applications sent out to clients, Crystal is responsible for helping you through the application process, answering any and every question you have.

After the application is in, she is the one who will follow up with you and request a whole lot of paperwork. Be prepared for us to ask for a lot of information. Its not going to be an easy thing to do to track down everything we need, but it will be worth it. The process is vastly different and more complex than it used to be, but its worth it in the end.

Shop Around For A Great Pre

Just as youâll see several homes before settling on âthe oneâ, you should shop around for the best mortgage rate. Donât just go to your local bank branch and expect to receive a great deal. Do your research and compare mortgage rates, or use a mortgage broker who will negotiate on your behalf.

Even half a percentage point can make a huge difference in your regular payments and the amount of interest youâll pay over time. To see what we mean, plug your numbers into our mortgage payment calculator, then change the interest rate in small steps. Youâll very quickly see the difference!

What happens after your mortgage pre-approval? Generally, youâll have a 90 to 120 day period where your offered rate will be held for you. This is when you should begin house-hunting!

Also Check: How Much Would A Million Dollar Mortgage Cost

Apply For A Mortgage Pre

Most Canadians think the first step in the homebuying process is to contact a realtor and start looking at homes. This isnât correct. The first thing you should do is apply for a mortgage pre-approval. After all, if you find a home you like, youâll want to move quickly. Being pre-approved for a mortgage removes an extra step in the process.

Being pre-approved also helps you know how much you can afford to spend. You can get a good estimate of how much you can afford with our mortgage affordability calculator. However, the hard limit will always be how much the bank will approve you for â a mortgage pre-approval gives you that.

How long does it take to get a mortgage pre-approval? It can be done within an hour if you have your documentation together. Get in touch with a mortgage broker near you to get started.

The Mortgage Application Process

In order to help give you an understanding of how the mortgage process works, below is a basic timeline of the things youll need to apply for a mortgage:

You May Like: Do Multiple Mortgage Pre Approvals Affect Credit Score

Mortgage Loan Process Faq

How long does the loan process take for a mortgage?

For most lenders, the mortgage loan process takes about six to eight weeks. But times to close can vary quite a bit from one lender and loan type to the next. Banks and credit unions tend to take a bit longer than mortgage companies. Also, high volume can alter turn times. It may take more than 60 days to close a mortgage during busy months.

What does it mean when your mortgage loan is in processing?

Mortgage processing is when your personal financial information is collected and verified. It is the loan processors job to organize your loan documents for the underwriter. Theyll ensure all needed documentation is in place before the loan file is sent to underwriting.

What do loan officers look for when applying for a mortgage?

Your loan officer will scrutinize your credit report closely, looking at your credit scores, payment history, credit inquiries, credit utilization, and disputed accounts. Lenders want to see a strong borrowing history where youve consistently paid back loans on time. Loan officers will also look very closely at your income and asset documentation to make sure you have enough cash flow to make monthly mortgage payments.

How long does underwriting take?

Underwriting turn times vary greatly depending on the institution. Many lenders will render an underwriting decision in as little as two or three days. But for some banks and credit unions, underwriting decisions can take a week or even longer.

What Is The Truth

When lenders look through bank statements they are doing it for a couple of reasons.

The first reason is to check that your income is as you have said.

The second is to check the general conduct of your account. By that they are looking for bounced direct debits, any commitments not mentioned, living in an overdraft or going over your overdraft. You can probable guess why this is the case. Someone who has been constantly overdrawn for a year of more can be regarded as more of a credit risk.

The last reason is where the very small element of truth may come in to play. Most lenders assess your expenditure using Office of National Statistic figures which are generic figures for things like Utility bills and food. However, some lenders will look at your latest 3 or 6 months bank statements and average out how much you spend on Utility bills, meals and food etc.

Going off the last paragraph, you can probably see that a single take away on a Saturday night is very unlikely to be the deal breaker on your Mortgage application, even if you ordered a take away every Saturday night. It is unlikely to be the end of the world with your Mortgage application.

Worst case scenario would be the lender reduces the mortgage amount. However, as most lenders do not assess affordability in this way, the chances of it actually being an issue are very very slim.

Don’t Miss: What Is Needed For Mortgage Approval

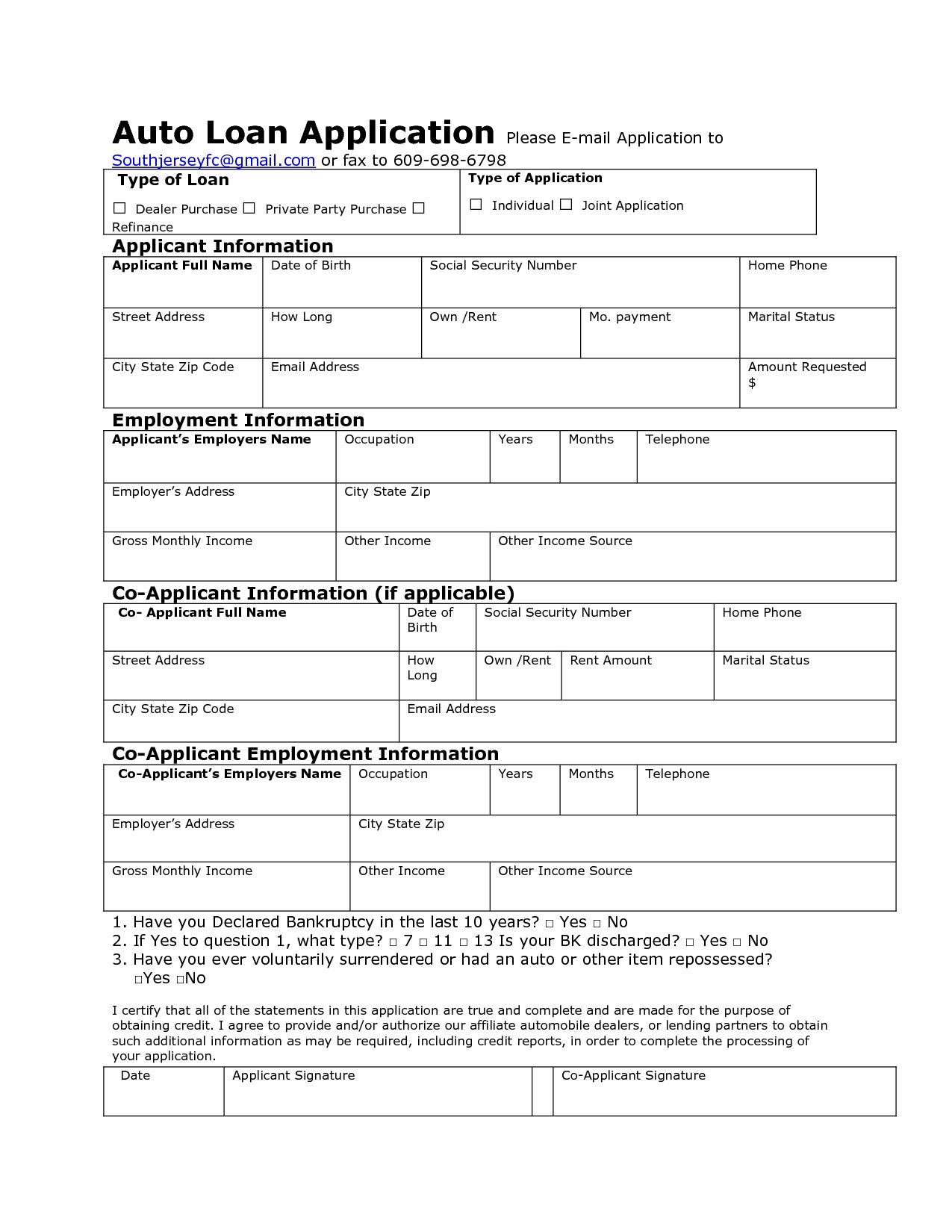

If Youre Applying For A Mortgage Its A Good Idea To Start Prepping Your Financial Documents

Lenders will request paperwork for your mortgage application that proves things like how much money you make and your debts. The exact forms you need for a home loan depend on your situation. For example, someone who is self-employed will likely have to provide different forms than someone who is employed by a company.

Although the exact forms might vary, Todd Huettner, owner of Huettner Capital, a residential and commercial real estate lender, says a lender can get a good sense of your likelihood of being approved by checking out your recent pay stubs, bank statements, W-2 forms and tax returns.

Huettner says that with these documents, hes able to make a good assessment of the borrower. These documents allow me to tell what they can and cannot do with a very high level of certainty, he says.

Depending on your unique financial situation, here are seven mortgage documents you might need when applying for a home loan.

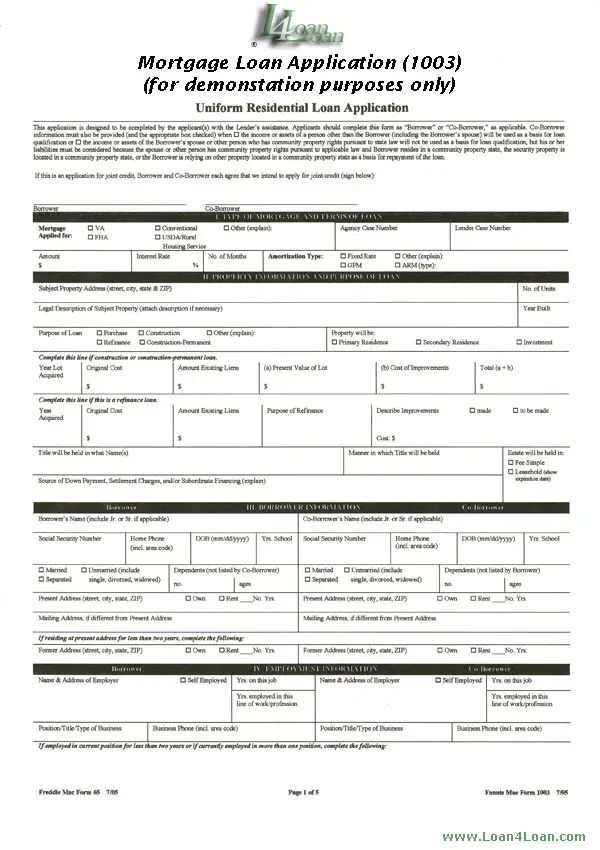

Understanding A Mortgage Application

Once you are under contract to buy a specific property, your lender will initiate the mortgage application. The mortgage application asks for a significant amount of information, so its best to gather all of your financial details prior to applying.

Although there are several versions of mortgage applications that are used by lenders, one of the most common is the 1003 mortgage application form, also known as the Uniform Residential Loan Application, which is a standardized form used by the majority of lenders in the U.S. The 1003 form includes all the information that a mortgage lender needs to determine whether a potential borrower is worth the risk of the loan.

The 1003 loan application is a form from the Federal National Mortgage Association, or Fannie Mae. Fannie Mae and Freddie Mac are lending enterprises created by Congress that purchase and guarantee mortgages. As both require the use of Form 1003or its Freddie Mac equivalent, Form 65for any mortgage that they consider for purchase, it is simpler for lenders to use the appropriate form at the outset than try to transfer information from a proprietary form to a 1003 form when the time comes to sell the mortgage.

Don’t Miss: What Is The Recommended Percentage Of Income For Mortgage

What Do Lenders Look For In Mortgage Applications

Mortgage lenders receive applications from borrowers who are seeking funds for a home loan. Applications may be submitted for purchase or refinance transactions. Lenders will scrutinize mortgage applications to determine whether borrowers meet specific qualifications. Your banker might offer financing for home-improvement projects, such as a home equity line of credit or a second mortgage loan.

Concerned About Eligibility When You Apply For A Mortgage

Are your circumstances a little more complex than usual? The mortgage brokers we work with pride themselves on their in-depth knowledge of the market. If anybody can find a mortgage for you, its them.

Whether you have bad credit, are self-employed, have just started a new job or are not sure how much you can borrow, youre in the right hands.

Recommended Reading: Can You Get A Mortgage On A Foreclosed Property

What Affects My Eligibility For A Mortgage

Bad credit scores, bad personal finances, low available credit, more debt than income, late payments on rent, and other monthly commitments, can all affect your eligibility. The mortgage broker needs to see a good credit history and positive bank statements to know that you can handle monthly mortgage payments.

They will check your bank accounts to see that you can pay your mortgage repayments without hassle.

Bank Statements And Other Assets

When assessing your risk profile, lenders may want to look at your bank statements and other assets. This can include your investment assets as well as your insurance, such as life insurance.

Lenders typically request these documents to make sure you have several months worth of reserve mortgage payments in your account in case of an emergency. They also check to see that your down payment has been in your account for at least a few months and did not just show up overnight.

Recommended Reading: How To Get A Pre Qualification For Mortgage

Tips For Applying For A Mortgage

Preparation is key when applying for a mortgage. In addition to having all of your paperwork in order, there are a few things you can do to help ensure a successful application:

- Document the source of the down payment. If a family member is helping you make a down payment, for example, have them sign a gift letter confirming where the funds came from and what they will be used for.

- Keep your job the same. If you can help it, avoid quitting your job or starting a new one while your application is being processed. The lender can deny your loan if your employment situation changes.

- Refrain from large purchases. Big-ticket charges can be a red flag to lenders, who may become concerned about your capacity to afford the mortgage. Ditto to opening a new line of credit or missing a debt payment, which can impact your credit history. Be especially careful if youre already close to your maximum affordability.

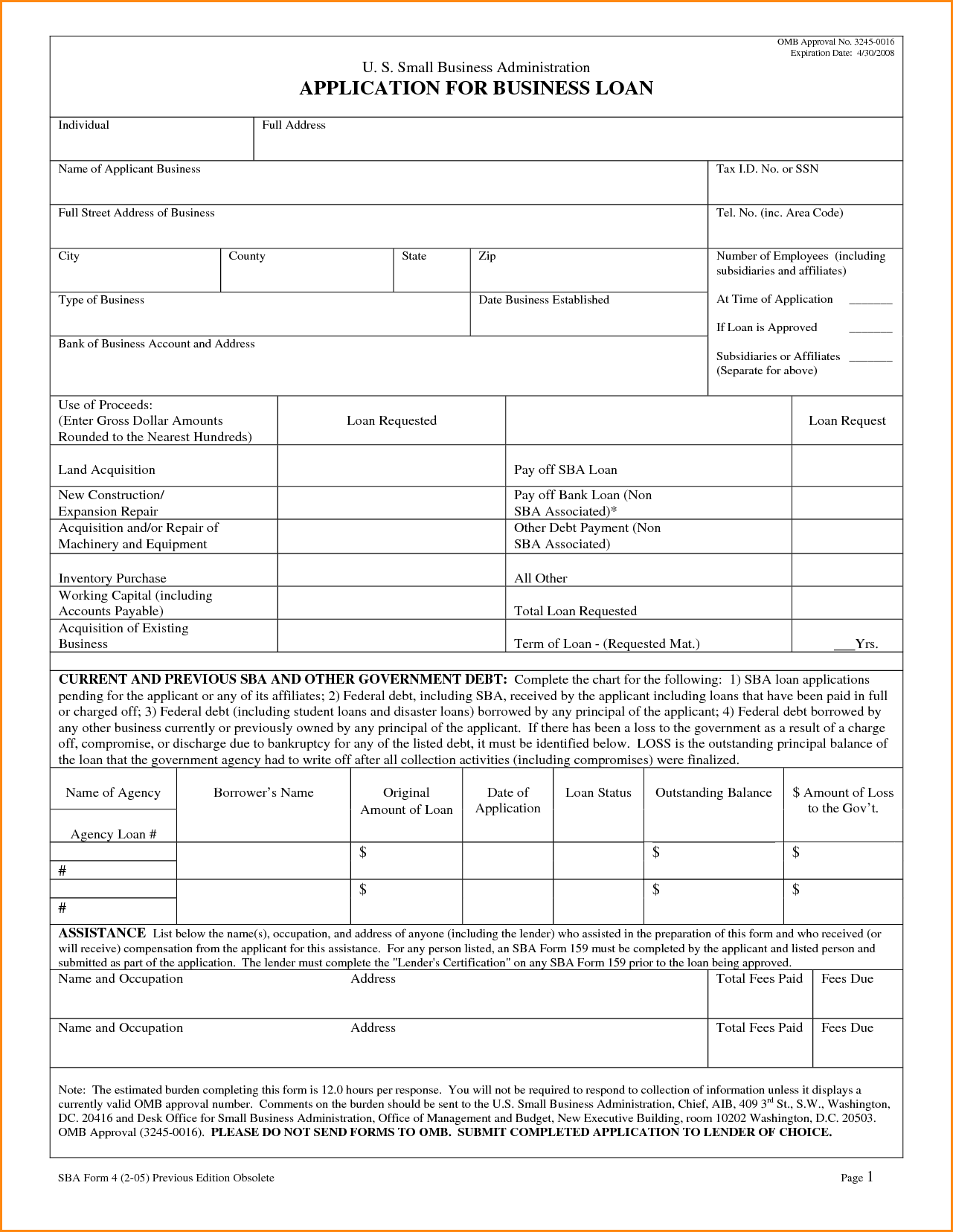

Complete Your Mortgage Application

The first step is to fill out a loan application. The information you provide will help determine if youre eligible for a loan. Since every situation is unique, the exact documents youll need may vary. Youll likely need to provide:

- ID and Social Security number

- Pay stubs from the last 30 days

- W-2s or I-9s from the past two years

- Proof of any other sources of income

- Federal tax returns

- Recent bank statements or proof of other assets

- Details on long-term debts such as car or student loans

- Real estate property information/Accepted Offer to Purchase

Our online application process is a safe and secure way to get started on your mortgage application from your smartphone or computer. After you sign up, youll answer simple questions along a guided path and easily import or upload documents. You can start your application on your own, or with the help of a mortgage loan officer. Within three business days of submitting your complete application, your lender will deliver a Loan Estimate showing your estimated closing costs.

Start your application if youve found a home you love.

Well confirm your personal and financial information, pull your credit, and then a mortgage loan officer will connect with you about the results.

Also Check: What Is The Middle Score For Mortgage

A Note About Technology

The detailed list above is only partial. As mortgage industry technology improves, more lenders will be able to obtain many of the documents above from their sources rather than getting paper, emails, or uploads from you.

Improved technology may help with convenience, but it wont reduce the documentation needed, so this list provides the proper perspective of what goes into a loan approval.

What Do Mortgage Lenders Look For On Your Credit Report

Your is an important factor that lenders will consider when looking at your mortgage application. Theyll be checking for a positive credit history to see how well you handle your finances.

The main factors mortgage companies will consider when checking your credit:

-

Your credit history how much youve borrowed, how much you still owe, and your repayments

-

Whether youve had any county court judgements or ever been declared bankrupt

-

How much credit youre using out of whats available to you

-

Whether youve ever missed any payments

Read Also: What Is The Monthly Mortgage On A 350 000 Home

What Is A Mortgage Application

A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate. The application is extensive and contains information about the property being considered for purchase, the borrowers financial situation and employment history, and more. Lenders use the information in a mortgage application to decide whether or not to approve the loan.

Do Mortgage Lenders Contact Your Employer

It depends on the lender, but most mortgage companies will want to verify your employment. Usually if youve provided your payslips this will be enough, but some lenders may want to call your employer to check the salary information youve provided is correct. However, this would be quite rare. A mortgage provider would probably only ever do this if theyre not sure about your income or application.

Read Also: Should You Shop Around For Mortgage Lenders

Commit To A Lender And Wait For Approval

Time estimate: Up to a few weeks

Choose the best offer, and let your loan officer know youre ready to move forward with the process. They may request additional documentation along the way, so make sure you respond quickly to prevent your loan from getting delayed.

Your loan will soon move into underwriting, when all your financial information is double-checked and verified. The underwriter will look to assess your overall risk as a borrower.

Specifically, your loans underwriter will be looking at:

- Your credit history

- Your propertys value and condition

- Your debts and assets

- Your financial reserves

Using this information, theyll work to verify that you 1) meet the requirements for the loan youre applying for and 2) can afford the mortgage payment that comes with it.

What Information Is Needed On The 1003 Form

The 1003 form is intended to collect all the information that a mortgage lender needs to determine whether a potential borrower is worth the risk. Though some lenders do not require employment information to consider a new mortgage, the 1003 form calls for at least two years of employment history, including monthly income.

The 1003 form also requires the borrower to note any other household income, as well as provide an itemized list of their assets and liabilities.

A borrowers assets include anything that could help cover or liquidate loan payments:

- Stocks, bonds, mutual funds, or other investments

- IRA, 401, or similar retirement accounts

The borrower also needs to make lenders aware of any other debts for which the borrower may be liable , such as car loans, credit card debt, student loans, or open collection accounts.

If the borrower owns any other property, as either an investment or a second home, the 1003 form requires the disclosure of these assets and any mortgages tied to them. In addition, the 1003 form requests information about the property that the borrower wishes to buy with the new mortgage.

Also Check: How To Get Approved For A Second Home Mortgage