How Income Multiples Affect What You Could Borrow

This table demonstrates how much the income multiple used by your lender in their calculation can affect the amount you can borrow.

| Income | |

| £200,000 | £240,000 |

As you can see, an applicant earning £30,000 would be unable to afford £100,000 if the lender used a multiple of 3 x their income, as the maximum they could borrow would be £90,000. On the other hand, if you find a lender willing to offer a multiple of 4 x your income, you would only need to be earning £25,000 to achieve a £100,000 mortgage.

The absolute minimum amount that you could be earning to achieve a mortgage of £100,000 would be £16,700, however, this would require a lender to offer you a multiple of 6 x your income, which can be difficult to qualify for, especially given that this type of offer is generally reserved for professionals, who are likely to have a much larger income.

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

How Many Years Does Biweekly Payments Save On 20 Year Mortgage

Anything over that amount must be directed toward reducing your remaining principal balance. The bi-weekly scheme actually provides a 13th monthly payment each year, and that extra must be aplied to lowering your balance. At today’s mortgage rates, bi-weekly payments shorten your loan term by four years.

Don’t Miss: How Often Do Fico Mortgage Scores Update

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

Realize That Other Expenses May Come Up

Even if your mortgage doesn’t stretch your budget, an unexpected job loss or other event could cause you to struggle to make your mortgage payments. The more affordable a home is in the first place, the better chance youll have of recovering.

Building up an emergency fund is easier if you limit your mortgage payment to 25 percent of your take-home pay. The more cash you have on hand, and the lower your monthly obligations, the better chance youll have of staying afloat if difficult times strike.

Also Check: How To Get First Mortgage

Where To Get A $450000 Mortgage

Since interest on a $450,000 home loan can be significant, youll want to shop around before taking out your mortgage. This can allow you to get the lowest interest rate possible and reduce your costs.

Credible offers a streamlined way to shop for a mortgage. With Credible, you can compare all of our partner lenders in just a few minutes saving you a whole lot of time and effort. Once youve found the best rate, you can proceed with your loan application to finalize the process.

Do Extra Payments Automatically Go To Principal

The interest is what you pay to borrow that money. If you make an extra payment, it may go toward any fees and interest first. But if you designate an additional payment toward the loan as a principal-only payment, that money goes directly toward your principal assuming the lender accepts principal-only payments.

Read Also: What Is Llpa In Mortgage

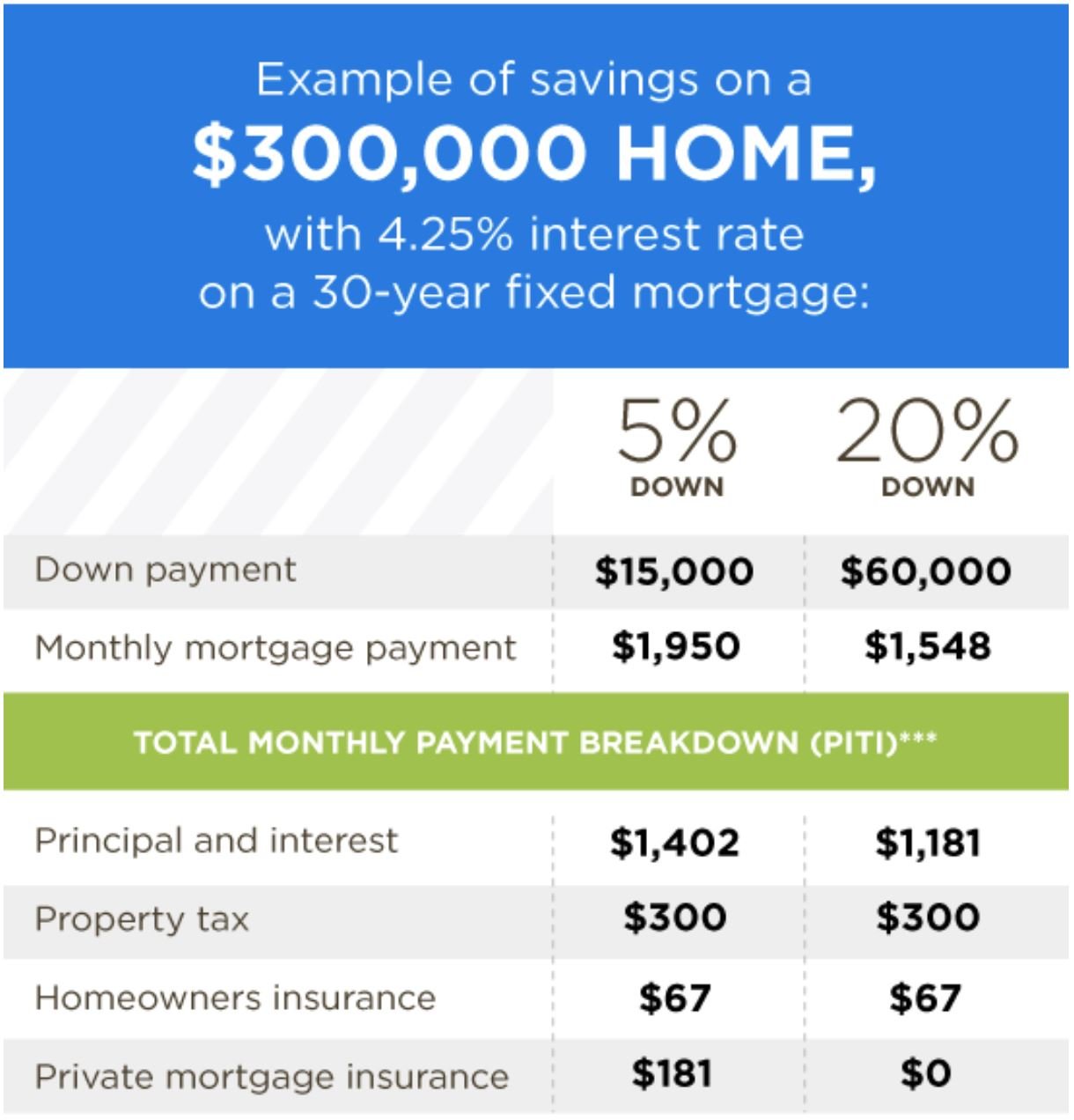

Consider The Cost Of Property Taxes

A monthly mortgage payment will often include property taxes, which are collected by the lender and then put into a specific account, commonly called an escrow or impound account. At the end of the year, the taxes are paid to the government on the homeowners’ behalf.

How much you owe in property taxes will depend on local tax rates and the value of the home. Just like income taxes, the amount the lender estimates the homeowner will need to pay could be more or less than the actual amount owed. If the amount you pay into escrow isn’t enough to cover your taxes when they come due, you’ll have to pay the difference, and your mortgage payment will likely increase going forward.

You can typically find your property tax rate on your local government’s website.

More Than The Monthly Payment

If youre trying to figure out how much to spend on a home, remember that theres more to your home purchase than the monthly mortgage payment.

Taxes and insurance are often added to your monthly payment automatically. Your lender collects funds from you, places the money in escrow, and pays required expenses on your behalf.

Homeowners Association dues might also be a significant monthly expense. Those costs cover a variety of services in your community or building, and skipping those payments can lead to liens on your property, and potentially even foreclosure.

Other costs of homeownership can be surprisingly high. You might not pay those expenses monthly, but its helpful for some people to budget for a monthly savings amount for those costs. You need to maintain your property, replace appliances periodically, and more.

Some people suggest a budget of 1% of your property value each year for maintenance, but its easy to go higher than that, especially with older properties. If you need to buy furniture or make upgrades before moving in, you face additional up-front costs.

Read Also: Should I Take Out A Mortgage

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Mortgage Monthly Repayments Table

The repayments have been calculated using our online mortgage calculator which you can use yourself or look at the tables below for the repayments on a £100,000 loan. Its divided up into the length of the loan and the interest rate you will pay. These rates are applicable for new mortgages or remortgages and are on a repayment basis for a loan of £100,000 to repaid in the number of years shown.

| Rate | |

|---|---|

| £716 | £644 |

Please note these rates are for illustrative purposes only and you should not rely on these rates but get a professional financial quote for your £100,000 mortgage offer.

All the values are in pounds sterling for the years provided and this is the monthly repayment for each month of your £100,000 mortgage. Please see our mortgage calculator to see different rates, the total repayments youll make over the life of the loan and the total interest paid. You can also enter different interest rates and time and loan periods. See our mortgage calculator here for full information.

Whatever your reasons for needing a £100,000 mortgage be sure to seek professional advice either from a mortgage broker or an independent financial adviser who can help your find the right product whether on fixed rate, tracker rates or offset mortgages to fit your exact circumstances.

Most Popular

Also Check: Can You Transfer A Mortgage To Another Person

You May Like: Why Is My Credit Score Different For A Mortgage

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

How Much Do I Need To Make To Buy A 500k House

The Income Needed To Qualify for A $500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 2.5 to 3 times your total annual income. This means that if you wanted to purchase a $500K home or qualify for a $500K mortgage, your minimum salary should fall between $165K and $200K.

Recommended Reading: What’s Considered A Good Mortgage Interest Rate

What Do These Look Like Altogether

Lets say you buy a gorgeous $200,000 house on a 20% down payment . In this scenario, youd have to borrow $160,000. On a 15-year mortgage with a fixed interest rate of 4%, youd pay around $1,184 a monththats principal and interest.

But wait. Theres still tax and insurance. So lets say one of our ELP insurance agents hooked you up with a sweet deal and got you homeowners insurance for $75 a month. Then lets say your local government charges you $1,400 a year for property taxes or $117 per month. Add all these numbers together, and you have your monthly mortgage.

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

You May Like: Should I Add My Spouse To My Mortgage

Amortization Schedule On A $450000 Mortgage

You can use an amortization schedule to understand the principal and interest costs for each year of your loan, as well as the mortgages costs over the long haul.

As you can see in the examples below, your monthly payments largely go toward interest in the first few years of your loan. As you get closer to the end of your loans term, youll pay more toward the actual balance.

Heres what an amortization schedule for a 30-year, $450,000 loan with 3% APR looks like:

| Year |

|---|

| $0.00 |

How Much Of A Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford .

Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Recommended Reading: How To Figure Out Mortgage Budget

Put The Numbers Into A Mortgage Calculator

Now, take the amount you have from Step 2 and use an online mortgage calculator to find the home price and possible loan type that will fit your ideal monthly payment. Wells Fargo has a free calculator that automatically estimates potential costs based on where you plan to buy a house and your credit strength.

You can change the home price you enter in the calculator to raise or lower the payment range.

There Are A Number Of Factors To Consider

A Tea Reader: Living Life One Cup at a Time

Purchasing real estate with a mortgage is often the most extensive personal investment most people make. How much you can afford to borrow depends on several factors, not just what a bank is willing to lend you. You need to evaluate not only your finances but also your preferences and priorities.

Here is everything you need to consider to determine how much you can afford.

Read Also: How Much Should My Mortgage Be Dave Ramsey

Don’t Be Fooled By The 5

Kaplan says homeowners usually need to stay put for at least five years to make the closing costs of buying a home worthwhile. That’s a useful rule of thumb, but if you’re thinking of staying that long, you may be tempted to opt for a mortgage that’s higher than you can comfortably afford now. Be careful. Predicting future income isnt as easy as it may seem. Kaplan cautions that stretching your budget can backfire if you become unemployed for an extended period.

When they’re planning for the long term, many homebuyers may also see their home as an investment for the future, which can be an excuse for spending more today than they can easily afford. But real estate can be volatile, as we saw in the 2008 housing crash. Having too much of your net worth tied up in your home can be risky.

Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

“In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.” – Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to “help” people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

Don’t Miss: How Many Pay Stubs For Mortgage

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that play a role in determining your mortgage rate and, therefore, your payments over time.

How Do You Compare Loan Offers

In any loan scenario, you have to make underlying assumptions such as:

- If you are likely to remortgage the loan again.

- When you are likely to remortgage.

- Where you think interest rates are headed.

- If you think you will sell the home soon.

- If rates head higher and your rate resets well above the initial offer, will your wages be enough to cover payments?

Look Beyond the Monthly Payment

Its important to consider the overall mortgage costs, not just the monthly payment amount. Borrowers will find interest-only payments affordable. However, compared to a full repayment mortgage, you immediately build equity in your home. This bring you closer to home ownership, stability, and grants you further life flexibility. In contrast, interest-only payments do not build equity. It does not provide financial cushion which helps protect you against shifting market conditions.

If one loan amortises and the other does not, then you have to look at how much equity you build in a home. This is a key factor in determining value. Most people also do not want to pay mortgages for the entire lifetime, or until they hit a tough patch and risk foreclosure.

Example Loan Comparison from a Reader

The key to being able to accurately compare mortgage offers is to only adjust a single variable at a time. This way you can easily see the differences between offers, instead of trying to compare apples to oranges.

The example below is based on a question from one of our users named Dan.

| Year |

|---|

Read Also: How To File A Complaint Against A Mortgage Lender