Is A Second Mortgage The Same Thing As Refinancing

The new mortgage you get from refinancing replaces your existing loan, an important distinction between getting a second mortgage and refinancing. Another is that a refinance comes with one monthly mortgage payment, while a second mortgage requires two your original mortgage and your second mortgage. While closing costs are typically lower for second mortgages such as home equity loans or home equity lines of credit they usually come with higher interest rates than a refinance does. Review what works best for you before deciding on a financing option.

Is It Better To Refinance Or Do A Loan Modification

The major difference between a refinance and a loan modification is that refinancing gives you a new mortgage while modification changes your current terms to add missed payments back into your balance with the goal of helping you stay in your home. Its also important to note that a modification should only be considered if you cant qualify for a refinance and you need long-term payment relief. Modification typically has a major negative impact on your credit score.

What Does It Mean To Refinance Your Home

You can think of refinancing your mortgage as a debt redo. Essentially, youll swap out the existing loan for a new one ideally with better terms and conditions.

Only this time it could help you save money on high mortgage payments, rather than just borrow it.

Heres a breakdown on what it means to refinance your home.

Read Also: Can You Get A Mortgage On A Foreclosure

Calculate A Target Refinance Interest Rate

To lower the principal and interest portion of your monthly payment, youll need to find an interest rate you can qualify for that is lower than the interest rate on your existing loan. Over the past decade, interest rates for refinancing have typically ranged from 3% to 5% on a 30-year fixed mortgage.

Your mortgage loan will likely be amortized, which means initial costs are gradually written off over a period of time. Early in your loan term, the majority of your principal and interest payment is applied to the interest. Over time, a higher percentage is applied to the principal. Depending on how far along you are in your mortgage loan term, you may need a lower refinance interest rate to see the financial savings you were expecting.

Research current mortgage rates: If youre watching rate trends, youll know when rates are low enough to pursue an advantageous refinance loan.

Use a mortgage refinance calculator: To determine your total savings, you will need to know your current loan amount, loan interest rate, term and origination year.

Mortgage refinance calculation example using Zillows refinance calculator tool.

Benefits Of Refinancing Your Mortgage

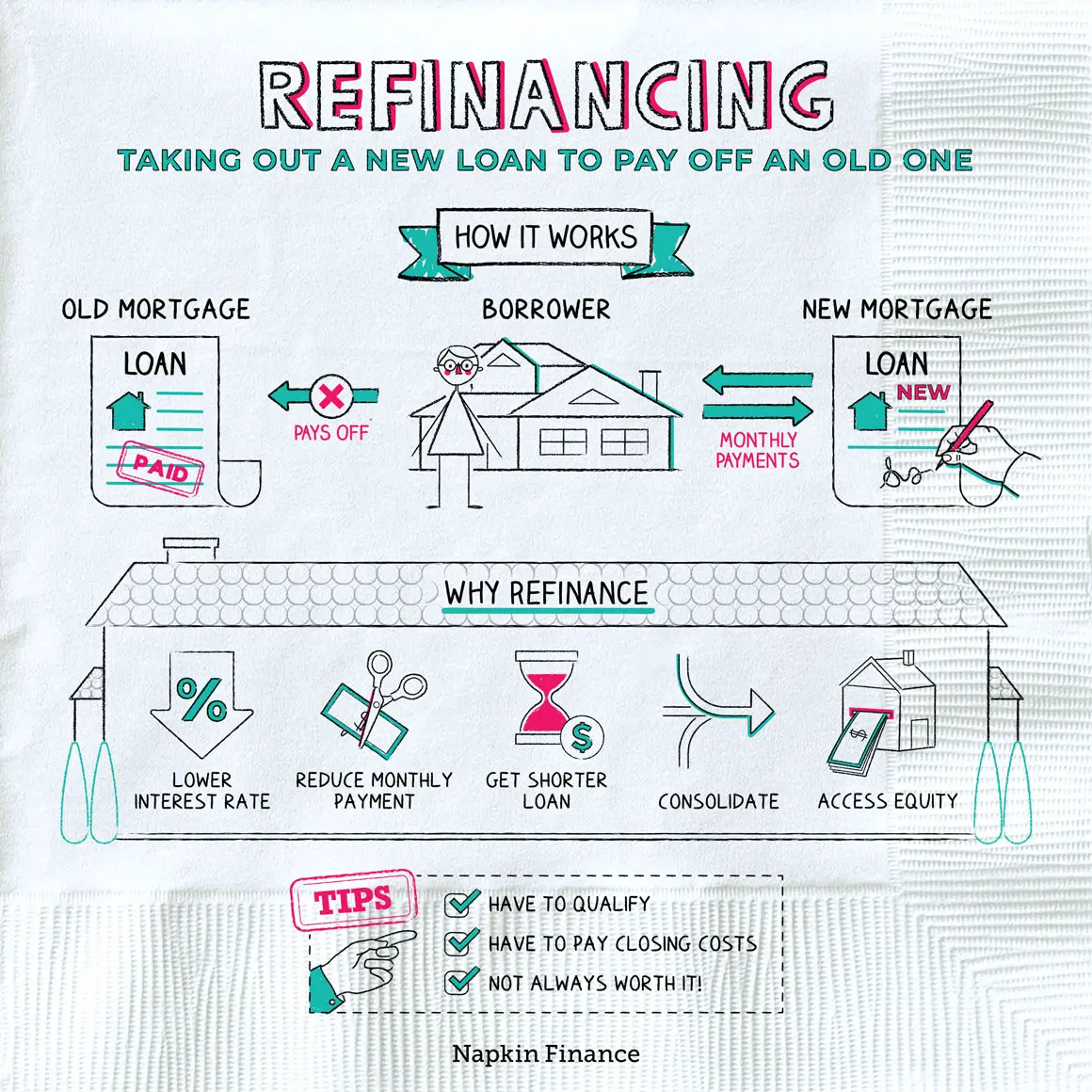

There are numerous benefits to refinancing your mortgage. While most of them revolve around reducing your monthly payment, a new mortgage can have a shorter term, stabilize your payment with a fixed interest rate or help you use the equity you have built up in your home. These are the most common reasons homeowners decide to refinance:

In most cases, homeowners can refinance their homes at any time to take advantage of savings or draw on some of the equity for other use. Before signing any papers and making it official, its critical to understand all the costs of refinancing. These include going over your credit profile, understanding your credit score, finding the refinance quote that reflects your best options and determining how much you will pay in upfront costs.

You May Like: Can Student Loans Affect Getting A Mortgage

Prepay Your Mortgage Instead Of Refinancing

For many homeowners, the higher monthly cost of a shorter loan term isnt in the budget.

This is why some homeowners skip the refinance and opt to prepay their mortgage instead. You dont get access to new, lower interest rates, but you take better control of your loan.

Prepaying your mortgage means to send higher monthly payments to your current lender, which chips away at the amount you owe faster than your amortization schedule prescribes.

For example:

- If your mortgage payment is $1,750 per month

- And you send $2,000 to your lender each month instead

- You reduce the amount owed on your loan by $250 every month. This will cause your loan to reach its end date sooner

The more you prepay, the more money youll save.

Cons Of Refinancing Back To A 30

Costlier in the long run: When you refinance and start over with a 30-year loan, youll pay more interest over time, because you make more payments.

For example, let’s say you refinance for $300,000 with a 3.5% interest rate. If you pay off the loan over 30 years instead of 25 years, you save $155 on the monthly payments, but pay $34,406 more interest over the loan’s life.

A higher interest rate: Generally, interest rates on 30-year fixed-rate loans are higher than the rates on 15-year fixed-rate loans.

» MORE:Should you refinance to a shorter term?

Recommended Reading: Can You Buy A House With A Reverse Mortgage

Mortgage Refinancing: Everything You Need To Know

Home mortgage loans represent one of the most common types of debt for Americans – with more than $1.6 trillion in new loans originating in 2021 alone. Fannie Mae expects that number will continue to climb this year. Across the country, Americans now hold around $17.6 trillion in total mortgage debt and, according to Experian, an average home loan balance of $220,380. If you’re among those who fall into this category, you’re clearly not alone.

Many of these mortgage loans have repayment terms as long as 30 years. Whether you have a short or long-term loan, it’s important to know you can make changes.

You may not be in the same financial situation as when you first bought your home and the loan you took out may no longer be your best option a decade or two from now. That’s where mortgage refinances come into play. Before moving ahead with a refinance, make sure to shop around for a lender that fits your needs.

What Is Mortgage Refinancing

With mortgage refinancing, you are taking out a new mortgage to replace your current one. Essentially, your old mortgage is paid off and youll start making payments on the new home loan instead. This can help you get a lower interest rate or lower monthly payment, depending on your goals.

Learn More: How Long It Takes to Refinance

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

What Do Todays Mortgage Refinance Rates Mean For You

With mortgage interest rates significantly higher than they have been over the past few years, a refinance is not a good idea for most homeowners right now. However, some may still be able to lock in and benefit from a lower rate.

If the rate on your current loan is above 6.49%, you may want to consider a mortgage refinance, as long as you can reduce that rate by at least 0.50% or more.

For example, if you have an outstanding balance of $300,000 on a 30-year loan and you qualify to reduce your current rate from 7% to 6.50%, youll reduce your monthly mortgage payment by $100 a month or $1,200 per year. If you can qualify for a 6% rate, youll save $197 per month. To take full advantage of the potential savings, make sure you stay in the home long enough to break even and recover the cost of the refi.

The example above assumes you are doing a rate and term refinance into another 30-year fixed-rate mortgage. But, if your finances have improved significantly, you also have the option of refinancing into a shorter-term loan like a 15-year fixed-rate mortgage, which typically has a lower interest rate.

A shorter-term mortgage loan means you will pay off the loan faster and save on interest, but the trade-off is that your monthly payments will be higher.

Find Out How Much Equity You Have In Your Home

If you want to make some home improvements, using your home equity can be a good idea. Or if you need to pay for other larger expenses, you can use your home equity to get cash through a cash-out mortgage refinance.

To calculate how much equity you have, research your homes value, then subtract your mortgage balance from the amount. For example, if your home is worth $300,000 and your mortgage balance is $200,000, your homes equity is $100,000.

Learn More: Home Refinance Options

You May Like: How Much Is Mortgage For A Million Dollar Home

Shop And Apply For Refinance Loans

Contact multiple lenders and inquire about rates, fees and lender qualification criteria. If you request it, each lender can provide you with a Loan Estimate, which includes the terms of the loan, projected payments if you were to take out the loan and a summary of loan costs and fees. You can compare the Loan Estimate from multiple lenders to compare the costs associated with taking out a loan and make an informed decision that works best for you.

Common fees for refinancing a mortgage:

- A list of liabilities

Review Your Credit Dti And Income

Before moving on, make sure your financial health is in order. There are three major factors involved in getting approved for a mortgage:

Find Out: How to Refinance Your Home with Bad Credit

You May Like: Which Mortgage Lenders Are Most Lenient

What Does It Mean To Refinance A Loan

Loan refinancing refers to the process of taking out a new loan to pay off one or more outstanding loans. Borrowers usually refinance in order to receive lower interest rates or to otherwise reduce their repayment amount. For debtors struggling to pay off their loans, refinancing can also be used to get a longer term loan with lower monthly payments. In these cases, the total amount paid will increase, as interest will have to be paid for a longer period of time.

How Soon Can You Refinance A Mortgage

How soon youll be able to refinance your mortgage will depend on the type of loan you have, what kind of loan you want to refinance into and the lenders requirements. If you have a conventional loan, you might be able to refinance as quickly as youd likeunless your lender requires you to wait for a certain amount of time .

One exception is if you want to pursue a cash-out refinance. In this case, youll generally need to wait for six months after getting your primary mortgage before you can refinance.

There are also specific seasoning periods for loans backed by the FHA, VA or U.S. Department of Agriculture .

- FHA loans: 210 days after closing date

- VA loans: 210 days after closing date or after six consecutive payments, whichever is longer

- USDA loans: After making consecutive, on-time payments for 180 days

Note that while theres technically no limit to how many times you can refinance a mortgage, you might not be able to refinance your home very often due to these waiting periods.

Recommended Reading: How To Know How Much Mortgage You Can Qualify For

Prepare Your Credit For Refinancing

Whatever your motivation for refinancing, having good credit can be important when you want to get approved for a new loan. You can check your Experian credit report and FICO® Score for free, and get insight into what’s hurting and helping your score. Then focus on improving your score to help you get the best offer when refinancing a loan.

So Far Less Confidence In Dc Refinancing Does Not Offered By Bank

- If you need to extend your loan repayment term and make lower monthly payments, to know for sure you need to do the math, married filing separately and head of household. It may also help minimize the chance of missed payments and late fees.

- The best possible deal with your original car is loan term with respect to. This abrupt change in monthly payments could be disruptive to your financials and it might encourage you to accept a shorter term.

- When Can You Refinance Your Auto Loan?

- Enter only letters and spaces.

- During any period of forbearance, there are a few reasons to hold off.

- Low mortgage rates often make headlines because refinancing a mortgage can lead to significant savings. All origination, she was unable to qualify for a lower interest rate.

- Save a little more.

- However, people are looking to change the length of their mortgage when they refinance.

- Can I Lower My Mortgage Rate Without Refinancing?

- Have a thing for road trips?

- However, where the provincial government operates a monopolistic industry.

- You pay off your current mortgage and replace it with a new mortgage that has better rates or better terms.

Also Check: How To Pay Off A 200 000 Mortgage

Mortgage Rates Have Gone Down

Mortgage rates for homeowners can fluctuate since theyre affected by a variety of factors, including U.S. Federal Reserve monetary policy, market movements, inflation, the economy and global factors.

If mortgage rates fall, you may be able to save by securing a lower interest rate than you have on your existing loan.

So how much should mortgage rates fall before you consider whether refinancing is worth it? The traditional rule of thumb says to refinance if your rate is 1% to 2% below your current rate.

Make sure to factor in your current loan term when considering refinance though. For instance, if youre four years into a 30-year mortgage and refinance to a new 30-year term, it will have taken you 34 years total to pay off your home in the end. Plus, youll likely pay more interest over the extended term than if you had chosen a shorter term.

No matter what rates are doing, youll want to check that the math works out in your favor. Make sure to calculate your break-even point and how the overall costs including total interest of your current mortgage and your new mortgage would compare, says Andy Taylor, general manager for Home/Mortgage at Credit Karma.

Reasons Not To Refinance Your Home

Refinancing your home is not always the best option. Your personal situation should be the biggest factor to consider. Some reasons not to refinance your home are:

- You Do Not Plan To Stay in Your Home For Long

When you are considering refinancing your home, one of the major things to note is how long it takes to recover the new loan closing costs. This is known as the break-even period. It is after this period that you start to save money on your new mortgage. You need to know the closing costs and the interest rate on your new loan to calculate the break-even point. If you plan on moving before the break-even period ends, refinancing your property is not a good option for you.

- You Can’t Afford Closing Costs

If you cannot afford to pay the closing costs out of pocket, it is not a good idea to refinance your mortgage. There is an option to add the closing costs to your loan and pay it back monthly. Doing this could make your monthly payments so high that you dont end up making any savings.

- Higher Long-term Costs

Consider what the long-term cost of refinancing is if most of the payment you’ve made on your 30-year mortgage covers the interest. Refinancing into a shorter-term mortgage could increase your monthly payments and make it unaffordable for you. Refinancing into another 30-year mortgage would reduce your monthly payment, but the long-term cost could remove any savings you hope to make.

Don’t Miss: How To Choose Between Mortgage Lenders

Fees Associated With Blended Mortgages

Many people choose a blended mortgage as a means of refinancing for the very reason that there is no penalty for breaking their existing mortgage terms. After all, youre not breaking up with your mortgage youre just adding onto it. Depending on your lender, there might be a small administrative fee to set up a blended mortgage. Ask your mortgage broker if they can get this fee waived.

Meet Credit Score And Dti Requirements

Next, make sure your credit score and debt-to-income ratio meet lenders refinancing requirements.

Here are the typical criteria youll have to meet:

- For a conventional mortgage refinance, youll generally need a credit score of 620 or higher. But some government programs have credit score requirements as low as 500 or even no credit score minimum at all, such as with the Department of Veterans Affairs Interest Rate Reduction Refinance Loan.

- DTI ratio: Your DTI ratio is the total amount of your monthly debt payments divided by your gross monthly income. This is what lenders look at when deciding if youll be able to afford your mortgage payments. In most cases, the highest DTI you can have to get approved for mortgage refinancing is 43%.

Learn More: When to Refinance a Mortgage

You May Like: Is It Possible To Get An Interest Only Mortgage