How Does A Mortgage Rate Lock Work

When you lock in your interest rate, it will stay the same for an agreed-upon amount of time, usually between 30 and 90 days. This means you wont need to worry about rates going up before your loan closes. This could save you a substantial amount of money if interest rates hike during the mortgage approval process.

What Are The Costs To Buy Down Points For A Mortgage Loan

Home buyers sometimes get a lower mortgage rate by “buying down” the rate. A mortgage lender will offer loans at different rates, along with a corresponding cost in “points” to get a loan at the lower quoted rates. Home buyers or refinancing homeowners may be willing to pay these points in order to get a specific rate so that they can save on interest or have a specific monthly payment. The extra cost for the lower rate is paid at the closing of the new loan.

Are There Limits To Mortgage Buydowns

Technically, there are no limits to the number of mortgage points you can buy down. However, the lender and the type of mortgage you have may put limits on your ability to buy points. If you have the cash to spare, you may benefit more from applying the money toward your down payment or simply setting the money aside for emergencies.

Recommended Reading: How To Take A Mortgage Loan

Does Buying Points Pay Off

The Should I buy mortgage points calculator determines if buying points pays off by calculating your break-even point. Thats the point when youve paid off the cost of buying the points. From then on, youll enjoy the savings from your lower interest rate.

To find the break-even point, the calculator determines your monthly savings from buying points and divides that amount into the total cost of the points. For example:

On a $200,000 loan, purchasing one point brings the mortgage rate from 4.1% to 3.85%, dropping the monthly payment from $957 to $938 a monthly saving of $19. The cost: $2,000. The calculator divides the cost by the monthly savings amount to find the break-even point.

$2,000/$19 = 105 months

Back to the question: Is buying points worth it? The answer depends on how long youll keep the mortgage.

» MORE:Calculate your closing costs

Are There Limits On Buydowns

If youre interested in a mortgage buydown, you should consult a lender, as some restrictions apply. Buydowns are only eligible when purchasing or refinancing primary residences and second homes. Typically, buyers must qualify for the standard interest rate of the zero-point loan to be able to buy down a home loan.

Read Also: How Much Is A Mortgage On A Mobile Home

What Is The Breakeven Point

To calculate the breakeven point at which this borrower will recover what was spent on prepaid interest, divide the cost of the mortgage points by the amount the reduced rate saves each month:

$4,000 / $56 = 71 months

This shows that the borrower would have to stay in the home 71 months, or almost six years, to recover the cost of the discount points.

The added cost of mortgage points to lower your interest rate makes sense if you plan to keep the home for a long period of time, says Jackie Boies, a senior director of Partner Relations for Money Management International, a nonprofit debt counseling organization based in Sugar Land, Texas. If not, the likelihood of recouping this cost is slim.

You can use Bankrates mortgage points calculator and amortization calculator to figure out whether buying mortgage points will save you money.

/1 Buy Down Video For Mortgage Interest Rates

HomeMortgage Resource Library2/1 Buy Down Video for Mortgage Interest Rates

A 2/1 buy down is a feature for residential mortgages where the monthly payments for the first two years are based on temporary reductions in the mortgage interest rate.

This feature is often used when a purchasing a newly constructed home from a home builder and is available on various mortgage programs. Home builders often provide financial incentives that cover the costs of the 2/1 temporary buydown and other new construction closing costs.

Also Check: How To Pay Off 300 000 Mortgage In 5 Years

Calculating Points On Arm Loans

While a point typically lowers the rate on FRMs by 0.25% it typically lowers the rate on ARMs by 0.375%, however the rate discount on ARMs is only applied to the introductory period of the loan.

ARM loans eventually shift from charging the initial teaser rate to a referenced indexed rate at some margin above it. When that shift happens, points are no longer applied for the duration of the loan.

When using the above calculator for ARM loans, keep in mind that if the break even point on your points purchase exceeds the initial duration of the fixed-period of the loan then you will lose money buying points.

| Loan Type |

|---|

| 120 months, or whenever you think you would likely refinance |

How To Buy Down A Mortgage Rate

Buying down the interest rate on your mortgage can save you tens of thousands of dollars over the life of the loan. Weighing the monthly savings against the increased closing cost is critical when determining if the cost of the lower rate is worth the money to buy it down. Lenders use discount points to buy down interest rates. Each discount point is equal to 1 percent of the loan amount. One discount point does not necessarily mean the interest rate will be lowered by 1 percent, however. On a fixed-rate loan one discount point can lower your interest rate by .25 percent to .50 percent.

1.

Determine how many discount points you are willing to spend to buy down your rate. Discount points will increase the amount of money needed to close. Sometimes, the purchase contract will include seller-paid closing costs. Use these funds to pay for the discount points. If the loan is a refinance loan with the financed closing costs, the new loan amount will be higher.

2.

Request quotes from multiple lenders specifying how many discount points you wish to spend. Since each lenders rates are different, the quotes may come back with varying interest rates. Compare each lenders interest rates against each other. Ensure each loan is of the same type. If you want a fixed-rate loan and one lender quotes you an adjustable-rate loan, reject the quote, or require that lender provide you with a fixed-rate quote.

References

Recommended Reading: How Can I Remove Pmi From My Fha Mortgage

Is Buying Down The Rate In California Required

Buying down the rate is not required even if your Loan Officer says it is .

The fact is there are some mortgage lenders who will say all their loan options come with at least one point and then after that, you can buy down the rate with additional discount points. They are overcharging their clients.

So if are working with a company like this and you wanted to buy down the rate with two points, that could mean $9,000 in points . One point for the Loan Origination fee and two Discount points to buy down the rate . Thats a significant amount of money.

Many reputable lenders do not require you to pay a Loan Origination fee on every loan option and they usually offer an option without a Loan Origination fee. I suggest you avoid lenders that dont offer an interest rate option without Loan Origination fees.

How To Buy Down Your Mortgage Interest Rate

Buy down interest rate is the only way to bring down your financial burden in mortgage borrowing. Interest rates concern any borrower when they wish to get real-estate property, finance and as a future investment in buying and selling properties. Initially, a borrower in a needy condition never bothers with interest rates on any loan, including mortgage loans. When it comes to mortgages, the borrowers are least bothered as the mortgaging process backs it. It will help in times of financial down position of that individual. Yet, your credit score is least considered in mortgage loan. Thus, they go for pre-closure when they arrange some finance to clear the mortgage debt. I have detailed here the ways you are benefited from the lenders.

Recommended Reading: What Is Wells Fargo Current Mortgage Rates

Future Reduction Of Expenses

The temporary 2/1 buy down payments can be welcomed when there are other financial obligations that will soon be paid off and eliminated.

For example, if Joe Buyer has a student loan with a $500 per month obligation that will be paid off in two years, the buy down allows the flexibility for Joe to focus on that debt and eliminate it during the first couple of years during homeownership.

Another reason why the lower 2/1 buy down payments may be welcomed is because of the short-term financial obligations that come with a new home. The cost of moving, new furniture, and home décor can certainly impact the monthly budget during the first year of homeownership. The 2/1 buy downs monthly payments provide some relief.

Purchase And Refinance Loans

Buydown options are available on both purchase and refinance loan options. Its less common to see someone paying a one-point buy down on a purchase loan because with a purchase loan you have to come out of pocket for all your fees.

So in addition to all the general lender, title, and escrow fees youll also have to come up with thousands more for the interest rate buydown.

One way to avoid having come out of pocket on a purchase loan is by requesting the seller to cover some of your closing costs by providing a seller credit back to you.

With our refinancing loan programs, you can simply roll the buydown into the total loan amount.

Also Check: What Is Wrong With Reverse Mortgages

Who Usually Pays For A Buy

Cox: The escrow or buy-down account can be funded by the seller, the buyer, the lender or a third party, such as a Realtor. Getting the seller to accept a concession to fund the account is usually the most beneficial scenario for the buyer.

Melgar: A buy-down can be paid by the buyer, seller, mortgage lender or builder. In my experience, buy-downs are most often used in new home construction and the builder typically pays for it.

If Youre Ready To Buy A Home Take What You Can Afford

A home is often described as an asset or an investment, but for most people, its not merely or even primarily a financial tool. Its a place to live. And you need one of those.

This decision, for most people, isnt dictated by the financial environment. Those who are interested in buying a home, theyre still going to do that, says Nicole Carson, a CFP and lead financial planner at Brunch & Budget.

Despite the highest mortgage rates in 20 years and home prices still near record highs, you may be able to find a home you love and can afford. Experts say you shouldnt wait in hopes rates or prices will drop, because the future is unpredictable.

I dont recommend waiting for the sake of waiting, Rihl says.

Read Also: What It Takes To Be A Mortgage Broker

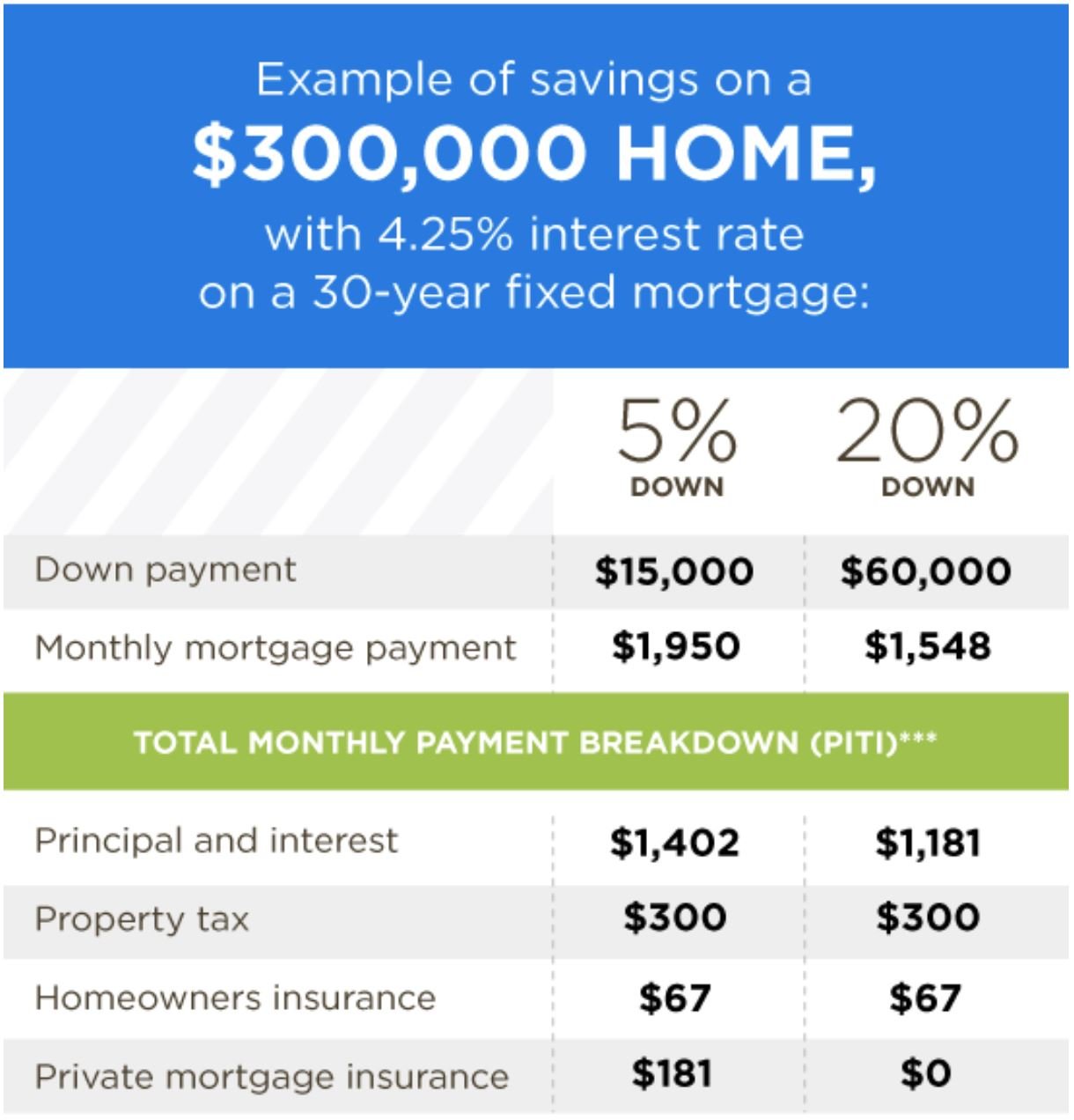

What Are The Disadvantages Of Doing A Buy

Idziak: Buyers who plan to own the home for a significant length of time may benefit more from a lower monthly payment over the life of the loan, as opposed to a temporary reduction in payments over the first few years of the loan. For such buyers, using those funds to buy points to permanently reduce the interest rate or toward a larger down payment may result in greater savings over the life of the loan. Additionally, borrowers putting less than 20 percent down on a conventional purchase are normally required to purchase mortgage insurance. The cost of such insurance over the life of the loan could outweigh any benefit a borrower would receive from using their funds to fund a temporary buy-down.

Cox: A disadvantage of the buy-down is the homeowners payment will increase after the first and second year before stabilizing in the third year going forward, so eventually they will have to adjust their monthly budget for those larger payments.

Tips For Buying A Home

- Buying a home is no small feat, so it can be helpful to work with a financial advisor to figure out your finances beforehand. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Before you fall in love with your dream home, figure out what prices are actually within your budget. To help you out, check out SmartAssets how much home can I afford calculator. All you need to know is where youre looking for homes, your marital status, your annual income, your current debt and your credit score.

- SmartAssets no-cost closing cost calculator will help you understand your total closing costs and amount needed at settlement.

Recommended Reading: What Is The Difference Between Hazard Insurance And Mortgage Insurance

Buying Down Interest Rates Explained

Buying down your mortgage rate will allow you to secure a lower interest rate for either the entire length of the mortgage or a predetermined amount of time. This process is often referred to as a mortgage buydown.

When you apply for a mortgage, your lender will let you know the interest rate you will be expected to pay. This rate is determined by several factors, including the current state of the mortgage market and your credit score.

However, they might be willing to offer a lower interest rate if you are willing to make an initial lump sum payment. In other words, you might be able to buy a lower interest rate.

What Are Mortgage Points

There are two kinds of mortgage points:

-

Discount points. When you hear points, that usually means discount points the fees you pay a lender to lower your home loans interest rate. You can buy points either when buying a home or refinancing your home loan. Its sometimes called buying down your rate. Lowering your interest rate reduces the size of your monthly payments.

-

Rebate points. Another kind of points are negative points or rebate points. In this scenario, the closing costs on your mortgage are added to the cost of your loan in the form of a higher interest rate. You may have heard of a no-closing costs mortgage. This is it you dont need cash for closing. But the higher rate means a higher monthly payment. The trade-off can be useful if you dont have cash for closing costs.

Recommended Reading: How Much Is A 260 000 Mortgage

Mortgage Discount Points Vs Apr

Buying discount points on your mortgage is effectively a way of prepaying some of your interest, and looking at the annual percentage rate can help you compare loans with different rate and point combinations. The APR incorporates not just the interest rate, but also the points you pay and any fees the lender will charge. Check out a quick explanation from Greg McBride, CFA, Bankrate chief financial analyst:

How To Find The Best Mortgage Lender

The best mortgage lender for you will be the one the can give you the lowest rate and the terms you want. Your local bank or credit union probably writes mortgage loans with rates close to the current national average. A loan officer in your local branch could guide you through the process.

Online lenders have expanded their market share over the past decade. You could get pre-approved within minutes. Your loan amount combined with current mortgage rates could define your price range for home prices in your area. Many online lenders also assign a dedicated loan officer to offer continuity as you shop.

Shop around to compare rates and terms, and make sure your lender has the loan option you need. Not all lenders write USDA-backed mortgages or VA loans, for example. If youre not sure about a lenders veracity, ask for its NMLS number and search for online reviews.

Recommended Reading: How Long Can You Be Pre Approved For A Mortgage

Future Income Is Expected To Increase

The 2/1 buy down allows homeowner the flexibility to grow in to their mortgage payments. Often times this can be for young professionals with upward income growth, or for new employment positions that offer future incentives.

For example, Joe Buyer recently started a new sales job. He has a base income and will receive commission when he sells widgets. Joe Buyers expects his commission to increase as he builds his pipeline of customers in the coming years.

A 2/1 buy down makes great sense for Joe Buyer because the temporarily lower payments alleviate undue stress while his income grows.

Weekly Mortgage Demand Falls 6% As Rates Climb

by Maurie Backman | Published on Oct. 22, 2021

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Mortgage demand is down. Should you put your buying or refinancing plans on hold?

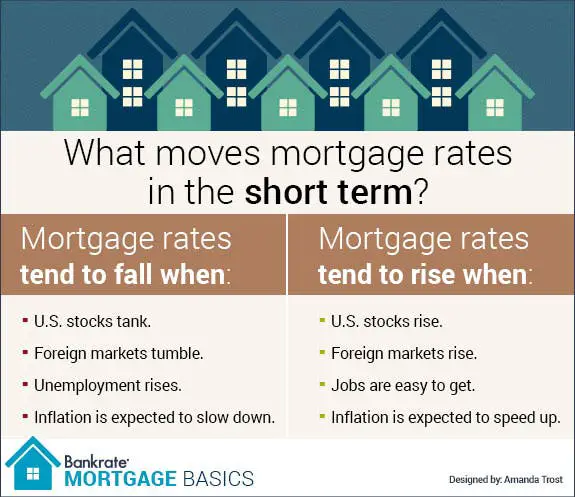

Although mortgage rates are still sitting at competitive levels, historically speaking, they have risen over the past few weeks. Thats had an impact on mortgage loan originations.

Total mortgage application volume fell 6.3% last week compared to the week before, as per the Mortgage Bankers Associations seasonally adjusted index. And much of that decline stemmed from a dip in refinance activity.

If youre thinking of buying a home or refinancing a mortgage, you may be wondering if nows not the best time to move forward with those plans. Heres what you need to know.

You May Like: Are Mortgage Rates Going Down Again