Are Biweekly Mortgage Payments A Good Idea

A biweekly payment plan can be a good ideabut never pay extra fees to sign up for one. Remember, theres nothing magical about them. The real reason it helps pay off your mortgage faster is because your extra payments add up to 13 monthly payments per year instead of the standard 12. So if your lender only lets you pay biweekly by charging you a fee, dont sign up.

Benefits Of Paying Mortgage Off Early

Many people struggle when deciding whether to pay off their mortgage or build up savings, but in the long run, the benefits of getting free from that mortgage really shine through. For one, having one debt paid off means being able to handle any short-term debts such as credit cards. You also end up saving money if you pay off your mortgage earlier, avoiding additional interest that would have otherwise accrued. Your financial stability is bolstered by cutting out these future payments and also by your ability to better endure turbulent housing market conditions.1

Why Pay Off Your Mortgage Early

Few people keep a 30-year loan for its full term. In fact, homeowners stay put just 13 years on average and their loans might have an even shorter lifespan if they refinance at some point.

Homeowners who plan to sell their home or refinance soon usually arent concerned about paying off their mortgage early.

But what about homeowners who stay put for the long haul? Those 30 years of interest payments can start to feel like a burden, especially compared to the payments on todays lower-interest-rate loans.

You may find yourself wondering how to pay your mortgage off faster so you can live debt-free and have full ownership of your home.

Here are five strategies you can use to meet those goals.

Read Also: How To Get Approved For A Large Mortgage

Pretend You Refinanced Without Actually Refinancing

You may decide that doing a formal refinance is not appropriate for you. However, that doesnt mean that you cant ACT like you refinanced. Simply pretend that your monthly mortgage bill has increased and pay more toward the loans principal.

For example, suppose your monthly payment is $1000. Pretend that you refinanced and your payment is now $1400. Applying that extra $400 each month to principal reduction is equivalent to making several more mortgage payments each year.

Because this cash is applied directly to the principal, you are taking big chunks out of the amount that interest is based on.

Pro tip: Make sure that extra $400 goes towards principal and is not counted as an additional payment towards interest and principal.

Understanding Principal Balance

Before you start making extra principal payments, contact your lender and identify the terms of your loan. There are a few mortgage companies that will not allow you to pay extra towards the principal whenever you want.

Avoid Prepayment Penalties

Some contracts only allow you to make extra payments at a specific interval. If you make the extra payment outside of the allowed times, you may be charged a prepayment penalty. Be sure your lender will accept extra payments before you write that check.

Buy A Home You Can Afford

This is something to think about before you purchase your home. If you are still in the market and havent bought yet, buy a home you can afford.

However, what the lenders tell you and what youll want to pay for a house could be very different amounts. When shopping, look for a home that you like but also something that isnt too expensive.

A common rule is to stay around 28% of your before-tax income. However, if you go too far above this, it may be difficult to make payments at all, let alone pay off a mortgage in five years.

If youve already purchased your home and its more expensive than you wouldve liked, dont worry. You can still pay off a mortgage in five years!

You may have to work harder, especially if your house payment is substantial, but it will all be worth it when you no longer owe any money for your home.

Check out this free home buying guide and financial dashboard to learn about how buying a house will affect your money goals.

Recommended Reading: How To Become A Mortgage Loan Officer In Michigan

Benefits Of An Early Mortgage Payoff

There are two main benefits of paying a mortgage early less interest paid and more home equity faster.

But paying off the mortgage is not necessarily always the best choice if you have more expensive debt, like outstanding credit card balances. Or if you havent yet saved for retirement. You may also want that money to purchase additional real estate, as opposed to it being locked up in your home.

This calculator can at least do the math portion to illustrate the power of paying extra and paying off your mortgage ahead of schedule. Youll then need to weigh those savings against other options like paying your credit cards or ensuring youve saved for retirement.

In other words, make sure youre actually saving money by allocating a larger amount of money toward paying off the mortgage as opposed to putting it elsewhere.

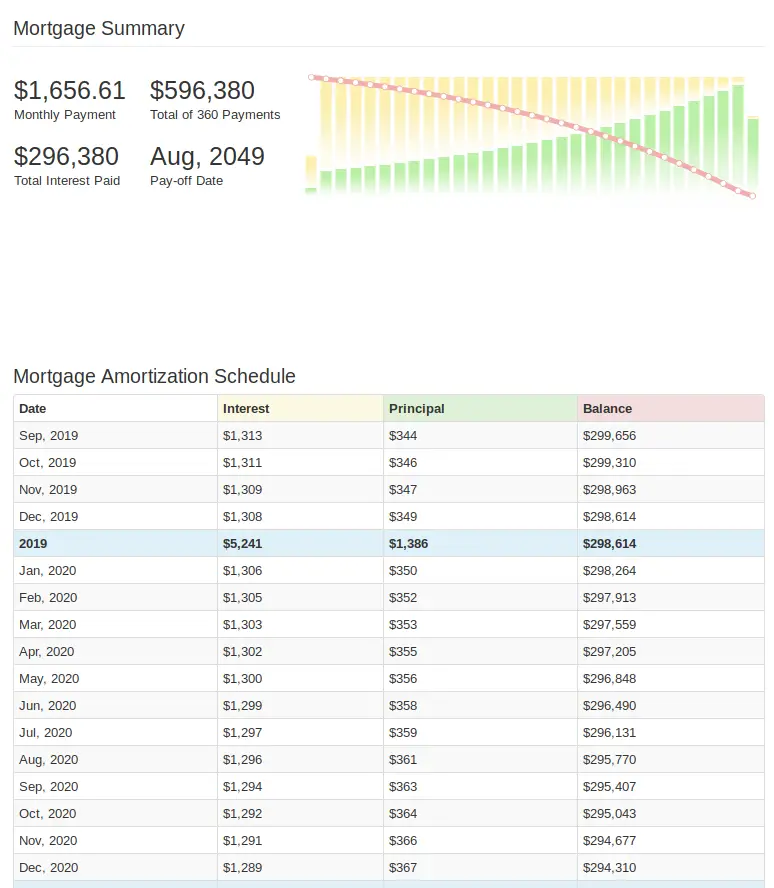

If you want to see the payment schedule, which details every monthly payment based on your inputs, simply tick the box. This will also show you your loan balance each month along with the home equity you are accruing at an ideally faster rate thanks to those additional payments.

To determine your home equity, simply take your current property value and subtract the outstanding loan balance. For example, if your home is worth $500,000 and your loan balance is $300,000, youve got a rather attractive $200,000 in home equity!

And thats all it takes to use this mortgage calculator with extra payments. Happy mortgage saving!

Do This Before You Pay Extra

After you have an emergency fund, begin by paying off your non-mortgage debts, so you will have your income freed up to apply to your mortgage.

Suppose you have paid all of your debts except your mortgage. Time to throw every dollar that way, right? Not so fast. You should also be investing money for retirement at a rate of 18% of your income. You do not want to get to retirement age years down the road and have a paid-off house but no nest egg on which to live.

So, after you begin investing at a rate of 18% of your income into retirement accounts, THEN start throwing every extra dollar at the mortgage.

The type of mortgage loan matters

If you are paying on an adjustable-rate mortgage, then it will adjust every year. The interest rates may go up or down depending on how well the economy does over time. So, even though you might think that you are getting a good deal now, there is always something else coming along later.

The best way to avoid this problem is with a fixed-rate mortgage. With a fixed-rate mortgage, you lock into a set amount each month.

Also Check: What Would The Mortgage Be On A 500 000 House

Refinance To A Shorter Term

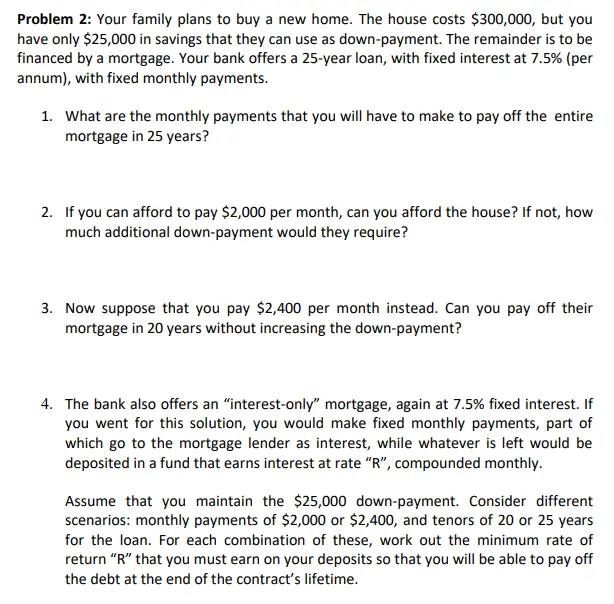

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

Pay Down Your Other Debts

âA crucial rule of debt repayments is: clear the most expensive debts first,â suggests Martin Lewis, founder of MoneySavingExpert.com. âDo so and the interest doesnt build up as quickly, saving you cash and giving you more chance of clearing debts earlier.â

As a rule of thumb, âClear high-interest credit cards and loans before overpaying your mortgage, as theyre usually more expensive.â

You May Like: How To Get Pre Approved For A Mortgage

Do You Have Any Other More Expensive Debts

Expensive debts are those that cost a lot to pay off over time.

Other expensive debts could include unsecured loans, where the interest rate is much higher than the cost of your mortgage borrowing.

Always pay off more expensive debts before thinking about reducing your mortgage but be careful not to rack them up again.

Make One Extra Mortgage Payment Each Year

Making an extra mortgage payment each year could reduce the term of your loan significantly.

The most budget-friendly way to do this is to pay 1/12 extra each month. For example, by paying $975 each month on a $900 mortgage payment, youll have paid the equivalent of an extra payment by the end of the year.

Recommended Reading: How Long Does A Mortgage Take

Bought A Row House In The City

We lived in an area where land was super expensive, so this was a much cheaper option and we were able to get a nice house with a small yard for way less than we would have otherwise.

It was sometimes been a bit challenging to live in that location with 3 young children, but it was definitely doable!

Understand And Utilize Mortgage Points

Whenever people are curious about how much their mortgages cost are going to cost them, lenders will provide them with quotes that include loan rates and points. Stephanie McElheny, the Assistant Director of Financial Planning at Hefren-Tillotson in Pittsburgh, says that âone point is equal to 1 percent of the loan amount .â

McElheny adds, âthere are two kinds of points, discount and origination fees:

- Discount: prepaid interest on the mortgage the more you pay, the lower the interest rate.

- Origination fee: charged by the lender to cover the costs of making the loan.â

If you plan on staying in your home for the foreseeable future, it may be worth paying for these points since youâll end-up saving money on the interest rate of your mortgage. You could save that extra cash each month and put it towards your overall mortgage payment.

You May Like: How Much Income To Qualify For 160 000 Mortgage

How Can I Pay Off My Mortgage In Five Years

Its a question thats only asked by the brave. Considering most houses take between 15 and 30 years to pay for, five years is an incredibly brief period.

It is possible to pay off a mortgage in five years, but it does require a lot of focused effort. You may find that your lifestyle changes quite a bit, but you definitely wont regret it.

Your mortgage can be paid off in many different ways. There are a lot of creative approaches, but Ive added some of the best ones here.

Youll learn what works, what doesnt, and how to pay off a mortgage in five years with confidence. Heres how to get started.

This post may contain affiliate links. That means if you purchase an item through these links, I may earn a commission at no additional cost to you. Please read the full disclosure policy for more info.

Use My Free Mortgage Payoff Calculator

Head over to my free mortgage payoff calculator and enter your current loan information. The mortgage calculator will show you how many years you have left to pay off your mortgage, and how it changes if you adjust your payment.

In addition to analyzing extra payments, my early payoff calculator will also allow you to adjust the different payment schedules between a 15-year and 30-year loan.

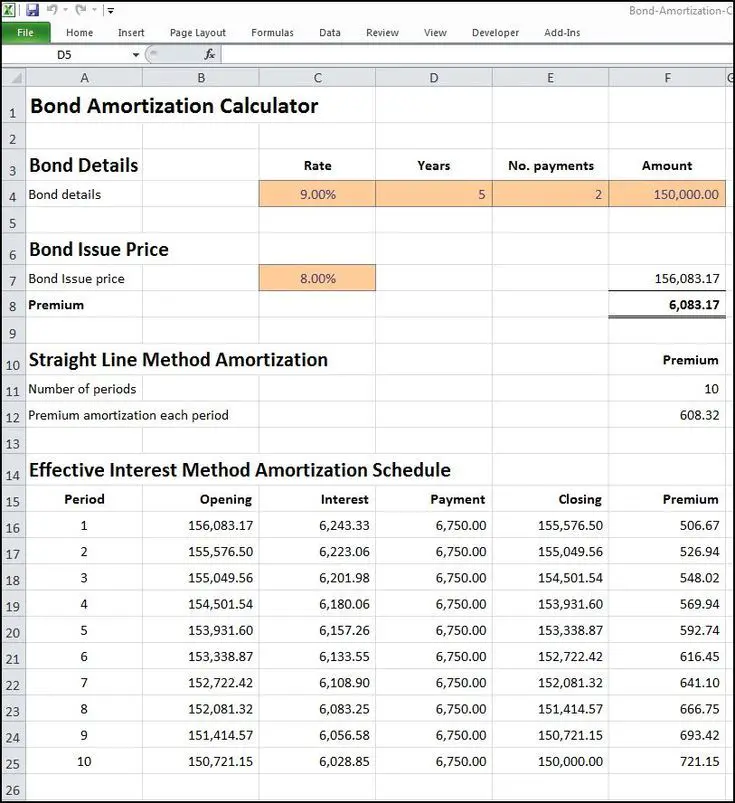

Understanding Your Amortization Schedule

An amortization schedule shows your payment schedule for your current loan. It will show how much money is going towards the principal and how much is going towards interest at each given payment.

You may be surprised to see how much of your hard-earned money goes towards interest at the beginning of your loan. My early mortgage payoff calculator will also break down your amortization schedule to make these payments painfully obvious.

You May Like: Does Spouse Have To Be On Mortgage

Consider Using A Cosigner When Refinancing

Youll typically need good to excellent credit to qualify for refinancing a good credit score is usually considered to be 700 or higher. There are also several lenders that offer refinancing for bad credit, but these loans usually come with higher interest rates compared to good credit loans.

If youre struggling to get approved, consider applying with a creditworthy cosigner. Even if you dont need a cosigner to qualify, having one could get you a lower interest rate than youd get on your own.

Tip:

Learn More: Best Student Refinance Companies: Reviewed and Rated

Ways To Pay Off Your Mortgage Quickly

But, how can you pay off your mortgage early? Fortunately, the vast majority of todays mortgages are free of prepayment penalties, meaning you can pay off your home as fast as you want.

So if youre wondering how to lower your mortgage payments or pay off your home faster, here are several tried and true strategies that can help. Just remember that the right strategy for you depends on how much extra cash you have lying around, as well as how much of a priority it is for you to become mortgage-free.

Don’t Miss: Can You Cancel A Reverse Mortgage

The Impact Of 2 Extra Mortgage Payments A Year

Again, if we just plug these numbers into the early mortgage payoff calculator

If you pay an extra $3,220 a year on your $300,000 mortgage, youll pay off your mortgage 8 years early AND save over $85,000 in interest payments!

Sounding pretty good right?

Now that I have your wheels turninglets start thinking about that 5 year mark again. Could you actually pay off your house in just 5 years??

What Does Paying Your Mortgage Biweekly Do

Some mortgage lenders allow you to sign up for biweekly mortgage payments. This means you can make half of your mortgage payment every two weeks. That results in 26 half-payments, which equals 13 full monthly payments each year. Based on our example above, that extra payment can knock four years off a 30-year mortgage and save you over $25,000 in interest.

You May Like: What Is A Mortgage Advisor

Is It Worth It To Pay Off A Mortgage Early

A: As long as you aren’t charged a prepayment penalty by your lender and saving money is your goal, then yes, it could be worth it for you to pay it off early. However, consider that everything depends on your financial goals and what is going on in the housing market. It’s always a great idea to talk to a mortgage consultant when in doubt. Find out more about makingextra mortgage payments.

Can I File For Bankruptcy To Eliminate My Student Loan Debt

Yes, you can file bankruptcy for student loan debt. But keep in mind that actually having your student loans discharged could be quite difficult. To have your loans discharged, youll have to prove to the court that repaying them would cause an undue hardship on you and your dependents.

If the court decides in your favor, your loans might be:

- Fully discharged

- Partially discharged with you responsible for the remainder of the balance

- Adjusted with different terms to make repayment easier

Tip:

If youre thinking about filing for bankruptcy, be sure to consult with a lawyer so you can make the best decision for your financial situation.

Read Also: How Much Is A Fixed Rate Mortgage

Make Extra House Payments

Lets say you have a $220,000, 30-year mortgage with a 4% interest rate. Our mortgage payoff calculator can show you how making an extra house payment every quarter will get your mortgage paid off 11 years early and save you more than $65,000 in interestcha-ching!

But before you start making extra payments, lets go over some ground rules:

- Check with your mortgage company first. Some companies only accept extra payments at specific times or may charge prepayment penalties.

- Include a note on your extra payment that you want it applied to the principal balancenot to the following months payment.

- Dont shell out your hard-earned cash for a fancy-schmancy mortgage accelerator program. You can accomplish the same goal all by yourself.

Do Children Inherit Student Debt

Typically no. Heres what you can typically expect:

- Federal students are discharged upon the death of the borrower. If you have Parent PLUS Loans, theyll be discharged upon the death of either the parent or the student who benefitted from the loan.

- Private student loans are often discharged like federal loans however, this is up to the discretion of the lender. If your lender doesnt offer a death discharge, then your loans will be considered part of your estate and will be paid off by your assets.

Read Also: Can You Borrow From Your Mortgage

How Can I Speed Up Paying Off My Mortgage

You can pay off your mortgage faster with one of a few strategies: