How Long Does Pre

Although there is no definite duration for the validity of a pre-approval letter, the custom within the real estate industry is that pre-approval is good for between 90 to 180 days, says Reischer. But many may consider it too old after three months.

The reason? In three months, your financial life can change drastically. You could lose your job, buy a car, or do plenty of things that might affect your home-buying prospects. So, lenders and sellers alike will just have a hard time trusting a pre-approval letter thats more than a few months old.

Want to know how long your pre-approval is good for? The actual time frame will be on your letter. If you want a longer time frame, ask for that upfront.

What Are The Benefits Of Pre

If you’re looking to purchase a house but you’re not sure how much you can spend, it’s difficult to know where to begin. You might find a property that seems perfect, but have no idea whether it’s a realistic option for your budget.

If a lender pre-approves you for a loan, they will do so for a specific amount, so you can focus your house hunting on the properties you can afford. Which might mean that you have to forget about that beachside mansion with tennis court and pool, but the whole process will be a lot easier. It also means that, if you’re bidding at an auction, you’ll have a maximum bid in mind.

For example, you may be looking at two different properties: one valued at $550,000 and one valued at $700,000. If you’re pre-approved for a home loan of $550,000, the more expensive house may be outside your budget, unless you contribute more of your own funds.

Pre-approval can also make you a more attractive buyer to a potential seller, as it indicates that you’re serious about purchasing the property and that your offer is less likely to be withdrawn due to a lack of financing.

How Many Preapproval Letters Should You Get

While you can get multiple preapproval letters, it can be harmful to your credit score. Since lenders run a credit check to make a letter, it creates a hard inquiry on your credit report. A hard inquiry can decrease your credit score by several points, and too many inquiries can be a red flag to future lenders.

There is a grace period, however. If you apply for preapproval with multiple mortgage lenders in 14 days or less, it will show up only as one hard credit pull on your credit report. So, when youre shopping around, dont wait several weeks between applications. Do them all at once to lessen the impact on your credit score.

You May Like: Will Mortgage Pre Approval Hurt Credit Score

When Should I Get Pre

For many buyers, the ideal time to get pre-approved is right before they want to start shopping for a home, with the aim of finding, bidding, and closing on a home within that window. If you arent able to find a home in that timeframe, you can technically get pre-approved more than once by connecting with your lender, updating your paperwork, and reapplying for a new letter. However, if there have been any major changes in your financial situation, your updated pre-approval limit might also change.

Getting pre-approved even earlier in the home buying process also has benefits. For example, if there are any issues that might prevent you from qualifying for financing youll have more time to sort that out before you dive into shopping. In most cases, getting a pre-approval takes 1 to 3 days, but with a Better Mortgage online pre-approval you can start the process in as little as 3 minutes. While youll still need to provide additional documentation to understand which loans you can qualify for, well help you begin buying or refinancing a home in just a few clicks.

How Do I Get Preapproved For A Mortgage

Itâs a good idea for first-time home buyers to have an idea of how much they can afford, so they don’t get taken advantage of by lenders. The lender will quote you a loan amount as well as an interest rate. Keep in mind that you may get preapproved for a higher amount than you can afford, but donât let it get to your head and try to stay within your budget.

Get essential money news & money moves with the Easy Money newsletter.

Free in your inbox each Friday.

Sign up now

You can check out how much house you can afford with our mortgage calculator, which shows your projected monthly mortgage payments.

Also Check: Reverse Mortgage On Condo

What Is The Difference Between Pre

Both pre-qualification and pre-approval involve a review of an applicant’s credit report. The difference is the degree of credit review. Pre-qualification involves a quick review of one’s credit and only provides a potential borrower with a general idea of how much mortgage they could qualify for and under what terms. Pre-approval involves a full credit review, while only offered for a limited time window, provides the potential borrower with a solid offer of credit from a lender with which they can use to make good faith offers on homes for sale.

What Is The Quickest You Can Close On A House

Typically, you can expect closing to take 30 45 days. The average time to close does vary among loan types, but the variation is relatively small. A 30-day closing process means that few complexities have arisen in evaluating the buyers financial readiness and in appraising and inspecting the sellers home.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

Better Real Estate Agents At A Better Rate

Enter your zip code to see if Clever has a partner agent in your area.

If you don’t love your Clever partner agent, you can request to meet with another, or shake hands and go a different direction. We offer this because we’re confident you’re going to love working with a Clever Partner Agent.

Contact Us

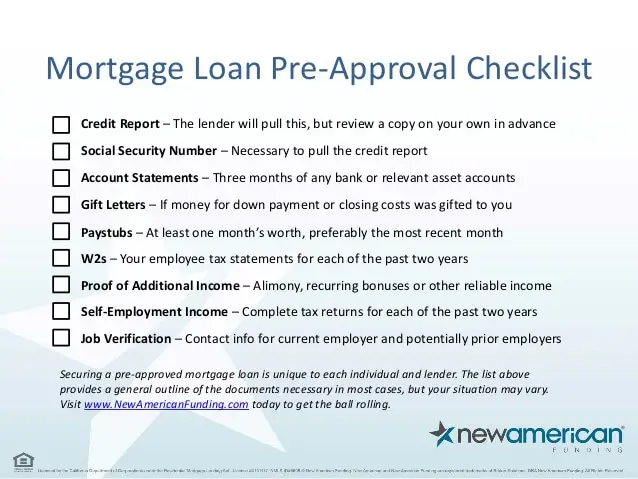

Employment And Income History

When you apply for a mortgage, lenders go to great lengths to ensure that you earn a solid income and have stable employment. Thats why lenders request two years worth of W-2 tax forms and contact information for your employer. Essentially, lenders want to ensure that you can handle the added financial burden of a new mortgage.

Youll also be asked to provide salary information, so a lender has evidence that you earn enough money to afford a mortgage payment and related monthly housing expenses. Youll also have to provide 60 days of bank statements to show that you have enough cash in hand for a down payment and closing costs.

Also Check: Reverse Mortgage Manufactured Home

How Long Does A Preapproval Last

The time a mortgage preapproval is valid before expiring can vary depending on your lender. In most cases, it lasts for around 60 to 90 days. Your financial situation can change substantially within a few months and many lenders arent willing to take the risk of their agreement with a prospective borrower falling through beyond the 90-day mark.

It can be a good thing for a borrowers financial situation to change. For example, upon their first preapproval, they may have learned that they have a low credit score. If they lower their debt-to-income ratio and take other steps toward increasing their score, the borrower could receive a lower rate on their next mortgage preapproval.

Alternatively, credit scores could go down, debt could increase or some other impact on their ability to make mortgage payments, affecting their likelihood of moving forward in the loan process. In that case, they may receive a higher interest rate or smaller loan amount for their preapproval. Or, possibly not qualify at all if the negative changes are impactful.

Some peoples financial situations dont change, but they havent purchased a house, so their mortgage preapproval expires. They will still need to get a new preapproval letter. If your letter has expired, youll have to find a new lender or reapply to the same one.

What Is Mortgage Prequalification

Prequalification is an early step in your homebuying journey. When you prequalify for a home loan, youre getting an estimate of what you might be able to borrow, based on information you provide about your finances, as well as a credit check.

Prequalification is also an opportunity to learn about different mortgage options and work with your lender to identify the right fit for your needs and goals.

Don’t Miss: Chase Recast Mortgage

Everything That A Homebuyer Needs To Get Pre

Bottom Line PersonalConsumer ReportsPrevention

As you search for a home, getting pre-approved for a mortgage can be an important step to take. Consulting with a lender and obtaining a pre-approval letter provides you with the opportunity to discuss loan options and budgeting with the lender this step can serve to clarify your total house-hunting budget and the monthly mortgage payment that you can afford.

As a borrower, its important to know what a mortgage pre-approval does , and how to boost your chances of getting one.

How Do You Use Pre

Real estate agents will submit a pre-approval letter to solidify your offer on a home to the seller, says Mumoli. Thats because most sellers simply wont accept an offer unless the buyers can prove they can obtain a mortgage. Sellers see a pre-approval letter as evidence that a buyer is not only serious but also has the means to buy the home.

As such, pre-approval is something you need at the very beginning of your home-buying search. It doesnt make sense to look for properties without first having a pre-approval letter in hand.

Don’t Miss: Who Is Rocket Mortgage Owned By

Use A Mortgage Calculator

Before going through the hassle of calling a loan officer, its good to make sure you can first afford a mortgage payment. There are many costs associated with a mortgage besides just the monthly payment, such as PMI, home insurance, and HOA fees.

You can easily see if you can afford a mortgage based on your income with our home affordability calculator.

Can I Put In An Offer If Im Buying Privately

Yes you can. So long as the seller allow.

You can set some purchase conditions. For instance, you might make your offer ‘subject to finance’, or ‘subject to pest and building inspections’. Itâs a good idea to get your solicitor or conveyancer to advise you on this.

Note: when you make a âsubject to conditionsâ offer, itâll have an expiry date. Youâll want to factor in how long itâll take to get final approval. Best check the timeframe out first with your banker.

Recommended Reading: Who Is Rocket Mortgage Owned By

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

Questions To Ask Your Lender Or Broker When Getting Preapproved

When getting preapproved, ask your broker or lender the following:

- how long they guarantee the preapproved rate

- if you will automatically get the lowest rate if interest rates go down while youre preapproved

- if the pre-approval can be extended

Ask your lender or broker about anything you dont understand.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Can I Get A Car Loan With A Mortgage

My wife and I just bought a house and took out a mortgage. Can I get a car loan if we already have a mortgage to pay every month?

Answer

you can still get an auto loan if you have a mortgagedebt-to-income ratio is the amount of debt you take on with car loans, home mortgages, utility bills, or credit card debt compared to your gross monthly income used to satisfy these debts

When To Get Preapproved For A Mortgage

In most cases, its best to get preapproved right when youre ready to start your home search. That way, you can take full advantage of the shopping window your lender allows.

Dont ask for preapproval too long before youre ready to start shopping. Theres no point in falling in love with a home if your preapproval letters out of date.

Luckily, the process for getting preapproved doesnt usually take long.

You May Like: Chase Recast

What Is Mortgage Pre

If you want to purchase a home, your first step should be to prove that you have the financial means to do so. This is where pre-approval comes in.

Pre-approval is the process by which a mortgage professional such as a broker or bank account executive examines a loan application to determine whether a potential home buyer will qualify for a mortgage, says Matthew Reischer, an attorney and real estate agent at New Yorks Flushing Real Estate.

Pre-approval is also key to understanding what your home-buying budget is, adds Michelle Mumoli, CEO of the Mumoli Group at Keller Williams City Life in Jersey City. Since a lender will let you borrow only up to a certain amount, thats the price range you should stick to when shopping for a house.

Your Mortgage: How Long Does It Take To Get Preapproved

Everyone knows they are supposed to get preapproved for a home loan before they go house shopping. Its one of those annoying pieces of advice you cant escape, like wear sunscreen.

Groan. You have to do it. But how long will it take to get preapproved for your home loan so you can get to the fun part?

Fortunately, the approval process isnt as tedious as most new home buyers think its going to be.

Online application and computerized analysis have made everything faster and easier.

Ready to get approved? Start now.

In this article:

You may think it will take a long time to get preapproved. The process is actually easier than you think:

You May Like: Rocket Mortgage Conventional Loan

When To Get A Preapproval

The best time to get a mortgage preapproval is before you start looking for a home. If you dont, and you find a home you love, itll likely be too late to start the preapproval process if you want a chance to make an offer. As soon as you know youre serious about buying a home that includes getting your finances in home-buying shape you should apply for a preapproval.

If youre following mortgage rates, you can to determine the right time to strike on your mortgage with our daily rate trends.

Go Through Underwriting Process

The next stage is for your application to be assessed by underwriters.

Though you are unlikely to deal with them directly, mortgage underwriters are actually the key decision-makers in the mortgage approval process and are the people who will give final approval for your mortgage.

Underwriters will check every aspect of your mortgage application and carry out a number of other steps. For instance, borrowers are required to have an appraisal conducted on any property they take out a mortgage against. The underwriter orders this appraisal and uses it to determine if the funds from the sale of the property are enough to cover the amount you will be lent in your mortgage.

Once underwriters have assessed your application, they will give you their decision. This will either be to accept the loan as it is proposed, reject it, or approve it with conditions. Your mortgage might be approved, for instance, on the condition that you supply more information about your credit history.

If your application is approved, you will then lock in your interest rate with your lender. This is the final interest rate you will pay for the remainder of your mortgage term.

Read Also: Reverse Mortgage On Mobile Home

Is Mortgage Preapproval Worth It

Mortgage preapproval comes with several benefits. First, it gives you an idea of how much you can borrow, which will help narrow down your search to houses in your price range. But remember that just because youve been preapproved for an amount doesnt mean you have to borrow the maximum. In many cases, its probably a good idea that you dont. Thats because many mortgage lenders use your gross monthly income as a factor in determining how much you qualify for.

Your lender generally doesnt consider your daily living expenses things like groceries, utilities, childcare, healthcare or entertainment or monthly debts in its calculations. Its up to you to review your budget to make sure youre comfortable with the loan amount. Dont rely on your lender to tell you what you can afford.

The preapproval process could also uncover potential issues that would prevent you from getting a mortgage, so you can work them out before setting your heart on a house.

Lastly, a mortgage preapproval lets sellers know you have the borrowing power to back up an offer you make to buy their home, which could make your offer more competitive. It tells real estate agents, who typically work on commission, that spending time on you could well pay off with a transaction. And it alerts lenders that youre a savvy borrower who may soon be taking out a mortgage loan.

In short, getting preapproved for a mortgage signals that youre a serious buyer.