What To Do Next

The ability to remortgage and/or fix your mortgage has become more difficult over recent years as the rules surrounding the affordability tests when applying for a mortgage were tightened leaving some borrowers stranded on their existing deals. It’s important to calculate the impact of an interest rate rise and seek advice from a mortgage expert ahead of time by following the steps below.

Whether you are on a tracker mortgage, variable rate mortgage or looking to remortgage your existing fixed rate deal that is coming to an end the steps below will take you a few seconds, but could prevent your mortgage repayments crippling your finances in the future and help you secure a low rate while they are still available.

What Is The Ocr What Effect Does It Have On Interest Rates

The OCR is the Reserve Banks interest rate, which influences other interest rates.

A change in OCR has a large impact on short-term interest rates and less impact on longer-term interest rates .

Looking back over the last 10 years, the average difference between the OCR and the 1-year fixed rate is about 2.5%. The pair follow broadly the same trend over time.

So, if the OCR is 3.5% , then the 1-year fixed interest rate would be about 6% .

What Affects Mortgage Rates

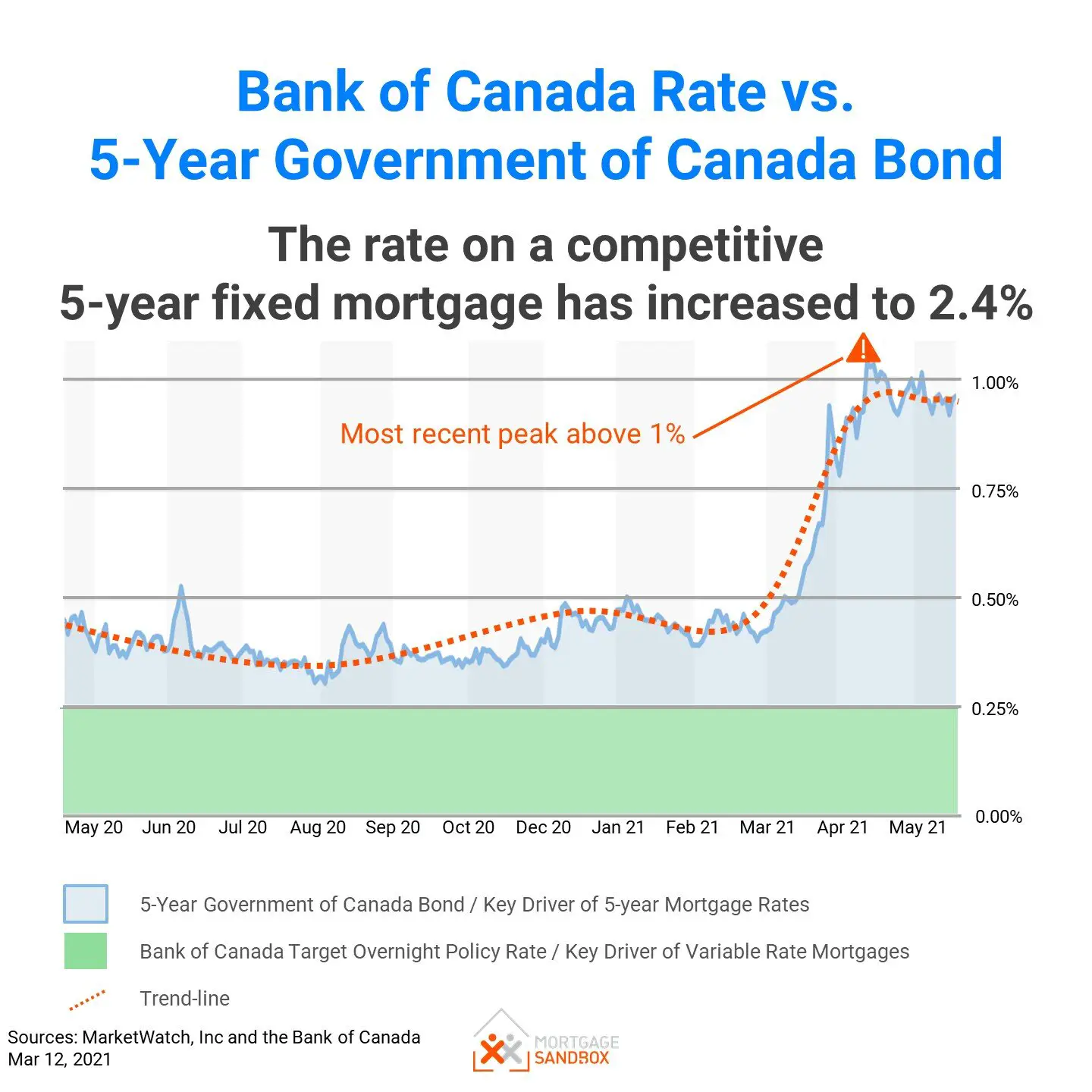

There are a complex set of factors that impact mortgage interest rates, including broader economic conditions, the monetary actions of the Federal Reserve and inflation. However, long-term mortgage rates are directly impacted by the bond market. The rate youre offered on a mortgage will also depend on the lender you work with, its business costs and your financial profile.

Demand for mortgages can also affect rates, pushing it higher as available capital for lending tightens. Conversely, when theres less borrower demandas were seeing now due to average interest rates hovering in the 7% rangelenders might consider offering more competitive rates or other incentives to attract borrowers.

Recommended Reading: What Does A Mortgage Include

Never Take The First Offer

Since interest rates can vary drastically from day to day and from lender to lender, failing to shop around likely leads to money lost.

Lenders typically have different rates they reserve for different levels of credit scores. And while there are ways to negotiate a lower mortgage rate, the easiest is to get multiple quotes from multiple lenders and leverage them against each other.

Research has shown that many borrowers only get rate quotes from a single lender, said Len Kiefer, deputy chief economist at Freddie Mac. Given the recent volatility in markets, rates can shift substantially day by day. A savvy customer would be informed about market conditions and consider multiple options before opting for a lender and loan product that best meets their needs.

As the mortgage market slows due to lessened demand, lenders will be more eager for business. While missing out on the rock-bottom rates of 2020 and 2021 may sting, theres always a way to use the market to your advantage.

Will Mortgage Rates Keep Increasing

Many people have been asking this question and the answer is that the RBNZ will continue lifting interest rates until they have seen a clear turn in inflation. I know the volatility in interest rates in recent years has been dramatic, but we expect interest rates to peak in the first half of 2023 as the economy cools and inflation eases.

Recommended Reading: What Will Mortgage Rates Do Next Week

Uk Interest Rates: What Next

Interest rates in the UK and elsewhere are forecast to continue rising as central banks battle inflation. We keep track of what these changes mean for markets and economies.

THURSDAY 3 NOVEMBER where could interest rates go from 14-year high?

The Bank of England has raised its main policy interest rate, or the Bank Rate, by 0.75% to 3.0%. After increasing the rate by the most at a single meeting since 1989, the BoE signalled it will not hike it as high as markets are pricing in.

Azad Zangana, Senior European Economist and Strategist, said: Looking ahead, we expect further rate rises in coming months, though the pace of hikes may ease from here. The Schroders forecast is for a peak of 4% in the Bank Rate, but the BoE may even undershoot this below-consensus estimate from us.

Read Azad’s full response here: UK interest rates rise to a 14-year high

Scroll down for “Five key questions about interest rates answered”

MONDAY 31 October rates for new mortgage lending 89% higher than in November 2021, latest Bank of England data show

The monthly average effective interest rate the actual interest rate paid on newly drawn mortgages rose by 0.29 percentage points to 2.84% in September, according to Bank of England data.

This was the largest monthly increase since the BoE started increasing its main policy interest rate in December, and compares with an monthly average effective rate of 1.5% for November 2021.

Continues below…

WEDNESDAY 22 June

TUESDAY 7 June

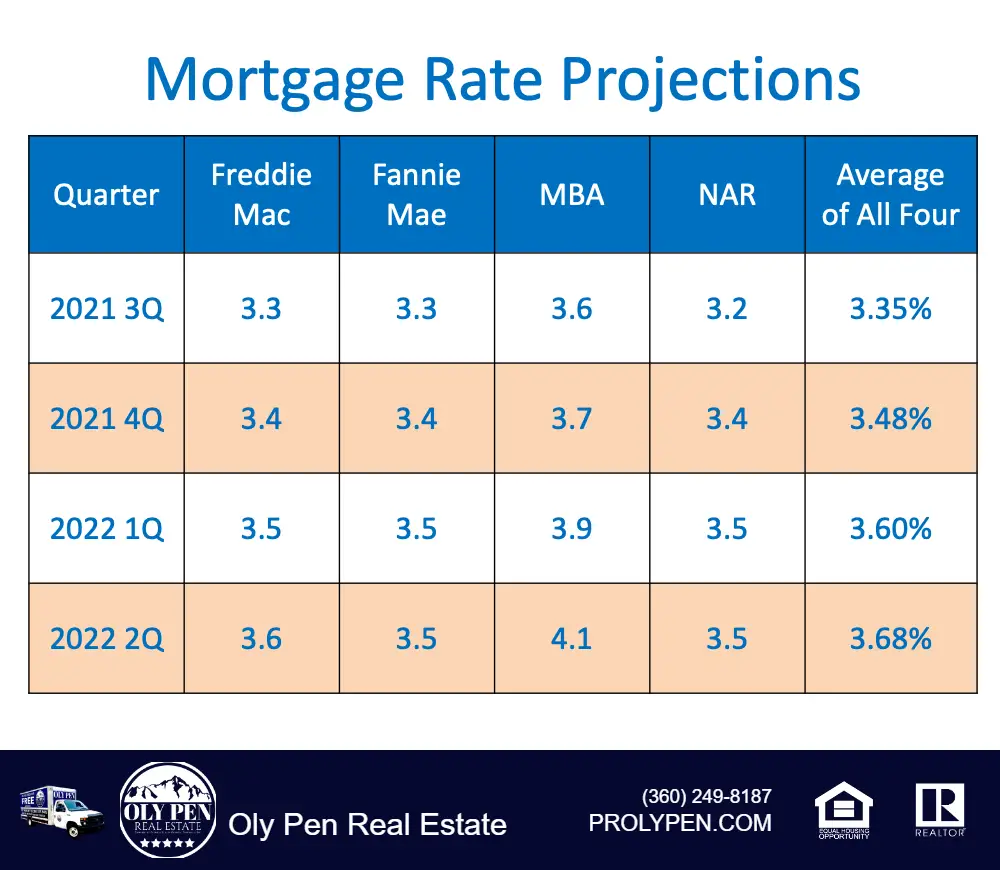

Mortgage Rate Forecast: Housing Authorities Weigh In

Mortgage rate forecasts give an idea of what might be ahead for the year. Here’s a preview of how things may shape up in 2022.

The year is just a quarter of the way through, and itâs already been an eventful one for mortgage rates. Many are looking ahead to try and predict what mortgage interest rates will average this year.

The question is no longer when mortgage rates will rise — it’s how much they will rise and for how long. The following round-up reveals what leading housing authorities believe 2022 will hold.

What’s in this Article?

What do the mortgage rate forecasts mean for homebuyers?

2022 mortgage rate forecast chart

National Association of Realtorsâ forecast

RealtyTracâs forecast

Fannie Maeâs forecast

Freddie Macâs forecast

Mortgage Bankers Associationâs forecast

Kiplingerâs forecast

Recommended Reading: Should You Get Mortgage Insurance

If Interest Rates Are Rising Is There A Risk Of Panic Selling

Its unlikely rising interest rates are going to result in panic selling or people realising they can no longer afford their mortgage with current interest rates, and sell up.

Why? Because banks test at a higher rate than what the current interest rate is.

Banks have already modelled out and tested whether you can financially afford your mortgage, should interest rates rise.

Said another way, you arent going to start seeing fire sales because the banks have already got that covered.

At Augusts press conference, Reserve Bank Governor Adrian Orr said: I will remind people banks have stress tested their customers’ financial capabilities to manage interest rates well within the range we are talking about at present, but there will be belt tightening.

These test rates differ by bank and are not heavily publicised. Here are the test conditions a bank will typically run your mortgage through:

The last point is particularly important for property investors.

Generally, property investors will use an interest-only mortgage to decrease their expenses and maintain an acceptable cashflow for their properties.

What Term Should I Fix?

How Is The Bank Of England Base Rate Set

The Banks monetary policy committee meets to discuss and set UK interest rates eight times a year. This happens roughly once every six weeks, with announcements being made on a Thursday.

In these meetings, the nine members of the MPC, including governor Andrew Bailey, vote on what monetary policy action to take in the current climate.

You May Like: What Is An Investment Mortgage

Mortgage Rate Predictions For Late 2022

The 30-year fixed-rate mortgage averaged 6.58% near the end of November, according to Freddie Mac. Only one of the six major housing authorities we looked at projects the fourth quarter average to finish below that.

The National Association of Home Builders and the National Association of Realtors sit at the low end of the group, estimating the average 30-year fixed interest rate will settle at 5.39% and 6.6% for Q4. Meanwhile, Freddie Mac, Wells Fargo, and Fannie Mae had the highest predictions, with forecasts of 6.8%, 6.95%, and 7%, respectively, by the end of 2022.

| Housing Authority |

| 6.90% |

Mortgage rates moved on from the record-low territory seen in 2020 and 2021 but are still below average from a historical perspective.

Dating back to April 1971, the fixed 30-year interest rate averaged around 7.8%, according to Freddie Mac. So if you havent locked a rate yet, dont lose too much sleep over it. You can still get a good deal, historically speaking especially if youre a borrower with strong credit.

Just make sure you shop around to find the best lender and lowest rate for your unique situation.

Will Mortgage Rates Go Down In December

Mortgage rates fluctuated greatly in the third quarter of 2022. The average 30-year fixed rate dipped as low as 4.99% on Aug. 4 then reached a high-water mark of 7.08% on Nov. 10, according to Freddie Mac.

This followed 248 basis points of growth in the years first half. Rates varied from one week to the next as the Fed wrestled with inflation. Mortgage rates experienced the largest weekly jump since 1987, surging 55 basis points the day after the Federal Reserves June hike.

With the pandemics declining economic impact, decades-high inflation, and the Fed planning several more aggressive hikes, interest rates could continue trending upward this year and next. However, concerns about an impending recession and waning buyer demand have caused brief rate drops and could cause more on any given week.

Experts from Attom Data Solutions, the Mortgage Bankers Association, the National Association of Realtors, and others weigh in on whether 30-year mortgage rates will climb, fall or level off in December.

If inflation continues to decelerate over the next several months, mortgage rates will likely stabilize below 7%.

Nadia Evangelou, senior economist & director of forecasting at the National Association of Realtors

Also Check: How Much Will Mortgage Be A Month

Why Do Mortgage Rates Follow The Yield On The 10

Even though 30-year mortgages can be held for three decades, most people sell their house or refinance within a decade, which means the investor who is receiving the mortgage payments is effectively investing in a 10-year bond.

As a result, the average 30-year fixed rate mortgage interest rate is normally 1 to 2 percentage points higher than the yield on the 10-year Treasury bond.

However, when the economy has more uncertainty than usual, like earlier this year, this spread can get as large as 3 percentage points. This uncertainty can be the result of a potential economic downturn, the possibility of the Fed raising rates more than expected, inflation, Fed balance sheet changes or all of the above as happened in 2022.

National Association Of Realtors Forecast

The leading organization for real estate professionals predicts the 30-year fixed-rate mortgage will climb throughout 2022 and average 5.4% by the fourth quarter.

Nadia Evangelou, senior economist and director of forecasting for the NAR, wrote in a report mortgage rates have increased enough to cooled demand and allow inventory to recover during the busy spring season. However, they’re still quite low, historically speaking.

“While May and July are generally the two busiest listing months, more homes are expected to be available in the market in upcoming months,” Evangelou said. “Thus, these additional homes may help potential buyers to find a home while mortgage rates are still historically low.”

30-year fixed mortgage rates since 1970 with a red line indicating 5%.

Read Also: How Much Money Do Mortgage Brokers Make

Should You Fix Your Mortgage For 2 3 5 10 Years Or Longer

If you have a low loan-to-value then you will almost certainly benefit from fixing, as you will be able to secure a low fixed-interest rate.

Now, of course, the longer your fixed term, the longer you are locked into a lower interest rate. And although there is no limit to how many times you can remortgage, if you decide on a long fixed-term period, there will likely be exit penalties and early redemption fees if you want to repay your mortgage or move.

These factors need to be traded off against the cost of exiting your current deal and the certainty that a fixed-term mortgage provides.

Longer-term fixed-rate mortgage deals are a recent development in the mortgage market, with some providers even offering up to a 40-year fixed-rate mortgage.

These have a higher rate but offer certainty and stability over the amount you will pay long-term. And these longer mortgages also remove the effort and cost of needing to remortgage every few years.

Mortgage Interest Rate Faq

What are current mortgage rates?

Current mortgage rates are averaging 6.49% for a 30-year fixed-rate loan and 5.76% for a 15-year fixed-rate loan, according to Freddie Macs latest weekly rate survey. Your individual rate could be higher or lower than the average depending on your credit score, down payment, and the lender you choose to work with, among other factors.

Will mortgage rates go down next week?

Mortgage rates could decrease next week if the mortgage market takes a cautious approach to a possible recession. However, rates could rise if lenders account for the Federal Reserve continuing to take aggressive measures to counteract the high inflation of 2022.

Will mortgage interest rates go down in 2022?

Its unlikely mortgage rates will go down in 2022, although their current growth should moderate at some point. Inflation has been climbing at a record rate over the last few months. And the Fed is planning to raise interest rates after each of its scheduled FOMC meetings. Both these factors should keep mortgage rates elevated in 2022.

Will mortgage interest rates go up in 2023?

Mortgage rates may continue to rise in 2023. High inflation, a strong housing market, and policy changes by the Federal Reserve have all pushed rates higher this year. However, if a serious recession comes on, we could potentially see a dip in mortgage rates.

What is the lowest mortgage rate right now? Will there be a housing crash? What is the lowest mortgage rate ever?

Read Also: How Much Do You Need For A Mortgage

What If Your Interest Rate Forecast Is Wrong I Cant Bank On This Forecast Being Accurate

Forecasts are just forecasts.

They are subject to change, depending on what happens in the world. And these things cannot be predicted with 100% accuracy.

More importantly, economists expect to be wrong. It comes with the territory.

So, if youre a conservative investor, either run the numbers on your portfoliofactoring in higher percentages in your forecasts, or lock in for a longer interest rate. Itll likely cost you more over time, but you are paying for certainty.

The other thing to remember is that the bank will stress test your mortgage application at a much higher interest rate, so if you can get a mortgage they have the confidence that youll be able to afford it.

You can also stress test your lending at higher interest rates. You can do this using our ROI Spreadsheet to model the cashflow of your investment properties.

This is a good tool to aid investors when running the numbers on an investment property.

Who are Opes Partners?

Experts Advice For Homebuyers And Sellers

Although borrowing costs are climbing, there remain two bright spots in the real estate market: inventory and price cuts. There were more homes for sale this October than the same month in 2021 and 2020, Ratiu says. Additionally, 21% of homes on realtor.com had price cuts.

With fewer buyers on the market in the fall and winter, you might have a better chance at getting a bid accepted. So it could be a good time to buy if you find a house that works for your family and you can afford it.

Heres some advice on what to do if youre buying a home in this rate environment.

Also Check: How Do Mortgage Loan Officers Make Money