Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Can You Lose Your House With A Reverse Mortgage

As with any mortgage, there are conditions for keeping your reverse mortgage in good standing, and if you fail to meet them, you could lose your home. The ways you could violate the terms of a reverse mortgage include:

- The home is no longer your primary residence.As part of the reverse mortgage agreement, the home must be your primary residence. This means that you cannot leave the home for more than 12 consecutive months, explains Michael Micheletti, spokesperson for Unlock Technologies, a company that helps homeowners access their equity. This rule doesnt bar you from leaving your home to travel or to come and go as you please, but if you vacate the property for 12 consecutive months, the reverse mortgage loan becomes eligible to be called due and payable.

- You decided to move or sell your home.If you have to move and put your home up for sale as part of the move, youre still bound by the requirement to live in the house for 12 consecutive months. If selling your home becomes a challenge and you dont find a buyer within that 12-month window, the reverse mortgage can be called due, Micheletti says.

- You dont pay your property taxes or homeowners insurance. Even with a reverse mortgage, youre still responsible for paying property taxes, and failure to do so could violate the terms of your loan. In addition, you must maintain current homeowners insurance.

What Do Reverse Mortgages Have To Do With Anything

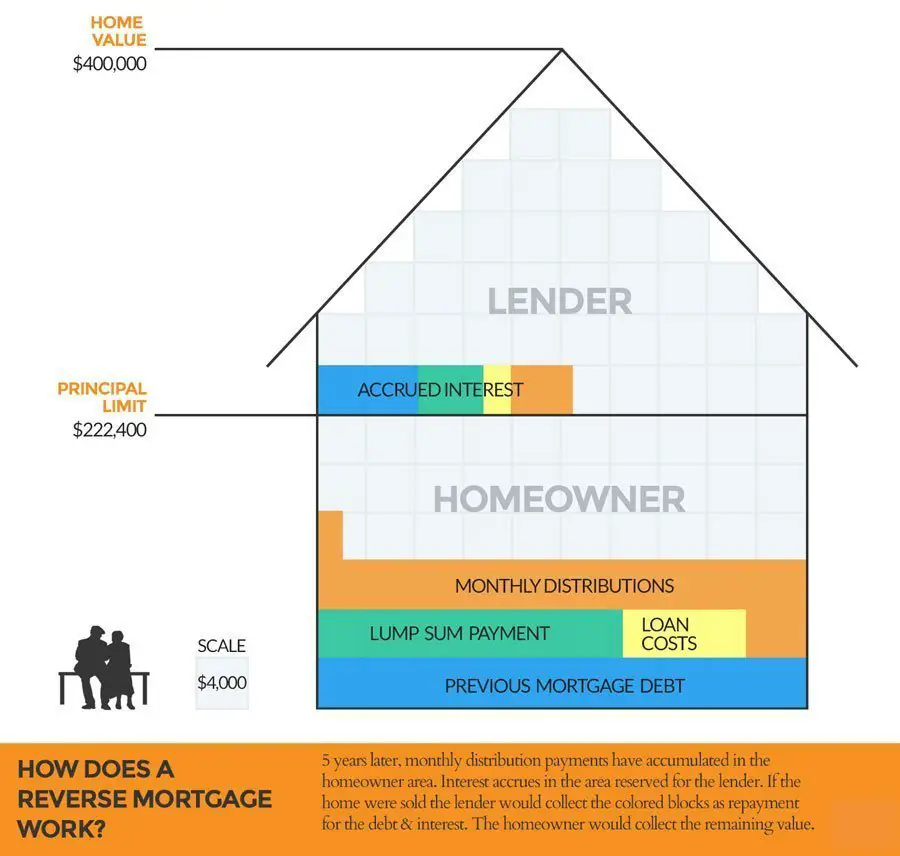

As you probably know, a reverse mortgage is a home loan designed to support borrowers who are 62 and older. In this type of home loan, the homeowner surrenders equity in their home in exchange for the monthly mortgage payment. Unlike traditional mortgages, which decrease as you pay down the loan, reverse mortgages rise over time as interest on the loan accumulates. This option can provide older borrowers with a supplemental retirement income option.

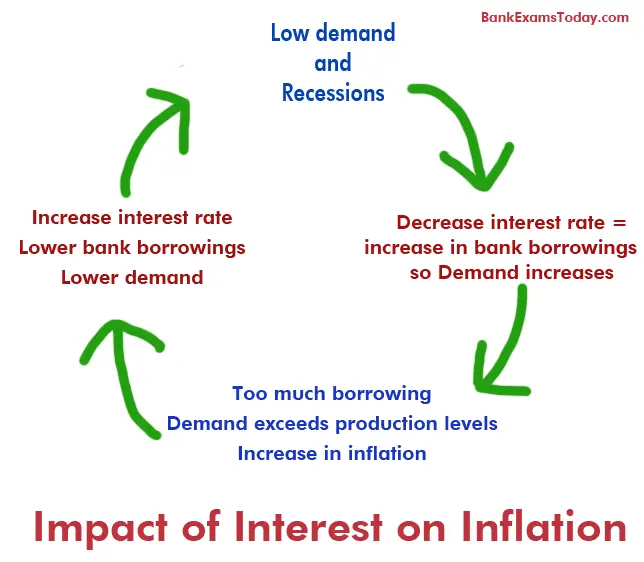

Since the Fed raised interest rates in an effort to reduce inflation, borrowers have been wondering if they may have missed the boat on benefiting from a reverse mortgage. Of course, each borrower has to make this decision for themselves, but with inflation hovering between 8.5-9% and interest rates continuing to rise, its a good idea to discuss reverse mortgages with your borrowers as an option to fight inflation.

Recommended Reading: How Much Of Your Mortgage Interest Is Tax Deductible

Use Rates To Your Benefit

Ive seen many people shoot themselves in the foot because they dont see the true power of interest rates. They procrastinate buying or refinancing their home because prices are high or rising. But by ignoring current low-interest rates they will cost themselves tens of thousands of dollars in the long run.

How Reverse Mortgage Interest Rates Affect Your Loan Options

Generally, when considering a loan of any kind, one of the first pieces of information considered is the interest rate as it affects the funds available to you and the amount you will repay. In this respect, a Home Equity Conversion Mortgage , commonly known as a reverse mortgage, is no different than other types of financing: although the borrower is not required to make any monthly mortgage payments1, reverse mortgage interest rates will impact the amount of equity the borrower can access and the interest that will accrue on the loan balance.

How Do Interest Rates Affect a Reverse Mortgage?

As with most financing options, the lower the interest rate, the more borrowing capacity you will have. Interest rates affect the reverse mortgage as follows:

When is Reverse Mortgage Interest Charged?

- The home is sold

- The last borrower no longer occupies the property as his/her principal residence or

- There is a default on property taxes or insurance.

You May Like: What Is A Future Advance Mortgage

Reverse Mortgage Fixed Rates

- Payment options: Single lump sum disbursement.

- Interest rate:Fixed rate for the life of the loan. The interest rate remains the same for the life of the loan but requires a single lump sum disbursement at the time of closing.

If you are using the reverse mortgage for a new home purchase or are already taking most of your available funds at closing to pay off another mortgage balance you might find this plan the most appealing.

How Are Reverse Mortgage Rates Calculated

As the leading provider of reverse mortgages in Canada, HomeEquity Bank works to ensure the rates we offer our customers are competitive and fair. Many customers ask why the interest rates associated with a reverse mortgage are slightly higher than a conventional mortgage or line of credit. While there are many myths out there, the truth is there are a few important reasons why reverse mortgage interest rates may be higher.

While our rates may be slightly higher than that of a conventional mortgage, the two products are very different and were created to provide a different solution for Canadians.

While a conventional mortgage is meant to help Canadians afford to buy a home, a reverse mortgage was primarily designed to help Canadians 55+ access cash they need while retaining ownership and title of their home. It helps them get the cash they need to live a comfortable and secure retirement, without having to worry about regular mortgage payments.

For a comparison, heres a snapshot of how our rates compare to other lending options you may be familiar with.

You May Like: Will Applying For A Mortgage Affect My Credit

A Valuable Source Of Retirement Income

The combination of receiving payments from home equity and not owing a monthly mortgage payment can be a game-changer for your clients in retirement. Since they’ll only need to pay taxes and insurance, plus any costs related to maintenance and upkeep, they can have more cash on hand for other expenses.

Even if your client is not retired yet, a reverse mortgage can significantly boost their retirement finances. Money received from a reverse mortgage does not count as taxable income, and they may be able to hold off on taking withdrawals from their investment accounts which do count as taxable income by relying on reverse funds instead.

Of course, everyones situation is unique, and you should talk with your clients to determine whether a reverse mortgage fits into their retirement financial plans.

Reverse Mortgage Interest Rate Faqs

What is the current interest rate on reverse mortgages?What is the downside of a reverse mortgage?

Monthly reverse mortgage payments are optional the full loan balance comes due when the last borrower dies or moves out of the home.Even though your client won’t have to make a monthly mortgage payment, they will need to continue paying property taxes and homeowners insurance premiums. They’ll also have to keep up with regular maintenance and repairs on the property.

What are the closing costs on a reverse mortgage?

Also Check: Does Canada Have 30 Year Mortgages

How The Home Equity Access Scheme Works

The loan is secured against real estate you, or your partner, own in Australia. You can choose how much you offer as security.

You can choose the amount you get paid fortnightly. Your combined pension and loan payments cannot exceed 1.5 times the maximum fortnightly pension rate.

From 1 July 2022, you can get an advance payment of your loan . This is in addition to, or instead of, your fortnightly loan payments. Taking up this option may reduce the fortnightly loan payment you get for the next year .

There is a maximum amount of loan you can borrow over time. This is based on your age and how much you offer as security for the loan.

How Much Money Can You Get From A Reverse Mortgage

The amount of money you can get from a reverse mortgage depends upon a number of factors, according to Boies, such as the current market value of your home, your age, current interest rates, the type of reverse mortgage, its associated costs and your financial assessment.

The amount you receive will also be impacted if the home has any other mortgages or liens. If theres a balance from a home equity loan or home equity line of credit , for example, or tax liens or judgments, those will have to be paid with the reverse mortgage proceeds first.

Regardless of the type of reverse mortgage, you shouldnt expect to receive the full value of your home, Boies says. Instead, youll get a percentage of that value.

Also Check: How To Become A Certified Mortgage Underwriter

What Fees Can My Lender Charge Me

With respect to reverse mortgages under New Yorks Real Property Law sections 280, or 280-a, lenders may only charge those fees authorized by the Department in Part 79.8. All costs and fees must be fully disclosed and reasonably related to the services provided to or performed on behalf of the consumer. Specifically, a lender may charge the following fees, among others, in association with a reverse mortgage loan:

- An application fee

Fixed Vs Variable Interest Rates

Reverse mortgages can have either fixed or variable interest rates. With a fixed interest rate, the rate is set at the time the loan is originated, and it doesnt change for the lifetime of the loan. Variable rates, on the other hand, can change over time. Additionally, there are other key differences between fixed and variable rates as it relates to reverse mortgages.

| Fixed Interest Rate | |

|---|---|

| No protection against rate increases | |

| No access to more funds in the future | Access to more funds in the future |

Read Also: How Can I Get Help Paying My Mortgage

What Are The Types Of Reverse Mortgages

There are different types of reverse mortgages, and each one fits a different financial need.

- Home Equity Conversion Mortgage The most popular type of reverse mortgage, these federally-insured mortgages usually have higher upfront costs, but the funds can be used for any purpose. In addition, you can choose how the money is withdrawn, such as fixed monthly payments or a line of credit . Although widely available, HECMs are only offered by Federal Housing Administration -approved lenders, and before closing, all borrowers must receive HUD-approved counseling.

- Proprietary reverse mortgage This is a private loan not backed by the government. You can typically receive a larger loan advance from this type of reverse mortgage, especially if you have a higher-valued home.

- Single-purpose reverse mortgage This mortgage is not as common as the other two, and is usually offered by nonprofit organizations and state and local government agencies. A single-purpose mortgage is generally the least expensive of the three options however, borrowers can only use the loan to cover one specific purpose, such as a handicap accessible remodel, explains Jackie Boies, a senior director of housing and bankruptcy services for Money Management International, a nonprofit debt counselor based in Sugar Land, Texas.

How Does The Market Affect Reverse Mortgage Payouts

When the Federal Reserve raised interest rates in 2015, it was the first time in nearly a decade. Since then, the rate has been raised twice more, most recently in March. If you expect this upward trajectory to be short-lived, youre in for a rude awakening. The Fed expects interest rates to continue rising as the economy improves, bucking a roughly 30-year downward progression.

Minimum age to qualify for a reverse mortgage

Most people know that these increases could affect the rates they get on their mortgages or refinance opportunities. But some are unclear about how this change affects reverse mortgages. For seniors looking to supplement their retirement with a reverse mortgage, heres a look at what this trend means and what steps they can take to lessen the effects on them.

Don’t Miss: What Are Government Mortgage Loans

How Do Rising Interest Rates Affect Reverse Mortgages

Last month the Federal Reserve raised the federal funds rate for the third time in just over a year. There is talk among some economists that they will raise it another two to three more times in 2017.

While the federal funds rate doesnt have a direct impact on reverse mortgage rates, they tend to follow suit. Reverse mortgages use the London Interbank Offered Rate as the index. What this means is that as the index increases or decreases, the rate you are charged on your reverse mortgage will go up or down.

If you had a reverse mortgage today, and kept some of the money in a line of credit , which is an option with this loan, the growth rate for these funds will also change along with any rate change. If you happen to have a lot of money in your reverse mortgage LOC, increasing interest rates can have a very positive impact on how quickly it grows.

Here is how it works: When you take out a reverse mortgage, the amount available is determined by the age of the youngest borrower, the value of the home and the interest rate. The lender has to make all of this money available to you, but you do NOT have to take it all.

If the lender tells you that you have $200,000 available, but you only need $80,000, that leaves $120,000 left over that you dont need and dont want to be charged interest on. You can choose to leave that extra money in the form of a line of credit. This LOC comes with a growth rate.

Please feel free to call me with any questions at 303-467-7821.

Bruce Simmons

Unlike A Traditional Line Of Credit Hecm Line Of Credit Cannot Be Frozen

Another thing to keep in mind with a reverse mortgage is that unlike a Home Equity Line of Credit , you have guaranteed access to the line of credit for as long as there are funds in your line.

You sustain the terms of the program. Unlike the HELOC, you do not have to worry about a bank freezing your line because they are afraid your property value has gone down, your income is not the same, or they just dont want to do those loans anymore.

And if you dont think that can happen, talk to anyone who had their line frozen or closed sometime between 2009 and 2012. If they are like me, it happened when they were never late on their loan, they may not have had any or much balance owed on the line and it might have happened just when they needed it most.

That cannot happen with a reverse mortgage.

As long as you live in the home, pay your taxes, insurance and any other property charges on time, maintain the home in a reasonable manner and adhere to the terms of the loan, you will always have access to your funds.

In fact, if the lender doesnt pay you on time under a reverse mortgage, you are entitled to a late charge from them and your loan is backed by HUD.

Recommended Reading: How To Get A Mortgage With A Foreclosure

I Currently Have A Mortgage On My Home Can I Still Get A Reverse Mortgage

Yes, although any reverse mortgage lender will require that the proceeds from a reverse mortgage will first go to pay off the balance of your existing mortgage. As such, an existing mortgage will limit the amount of the net loan proceeds you will receive under a reverse mortgage. When considering whether a reverse mortgage is right for you, it is important to discuss with a housing counselor whether the net loan proceeds will be enough to enable you to live in your house. A list of New York non-profit housing counseling agencies is available.

How To Pay Interest On Reverse Mortgages

A key feature of reverse mortgages is the borrower doesnt have to repay the loan as long as they remain in the home. This could occur if the borrower moves out, sells the home, or if they pass away. The amount that must be repaid is based on the principal balance, fees that were charged during the loan term, and the interest that accrued.

In some cases, borrowers may choose to pay interest on the loan even while they live in the home to reduce the amount theyll owe when they leave the home.

Don’t Miss: Does It Make Sense To Pay Points On A Mortgage

What Home Sale Proceeds Sharing Costs

It’s not a loan, so you don’t pay interest. You pay a fee for the transaction and to get your home valued . You may also have to pay other property transaction costs.

Home sale proceeds sharing costs you the difference between:

- what you get for the share of your home you sell now, and

- what it’s worth in the future

The more your home goes up in value, the more the provider will receive when you sell it.

Get the provider to go through projections with you, showing the impact over time. Get a copy of this to take away, and discuss it with your adviser. Ask questions if there’s anything you’re not sure about.