Is A Commercial Mortgage More Expensive Than A Residential

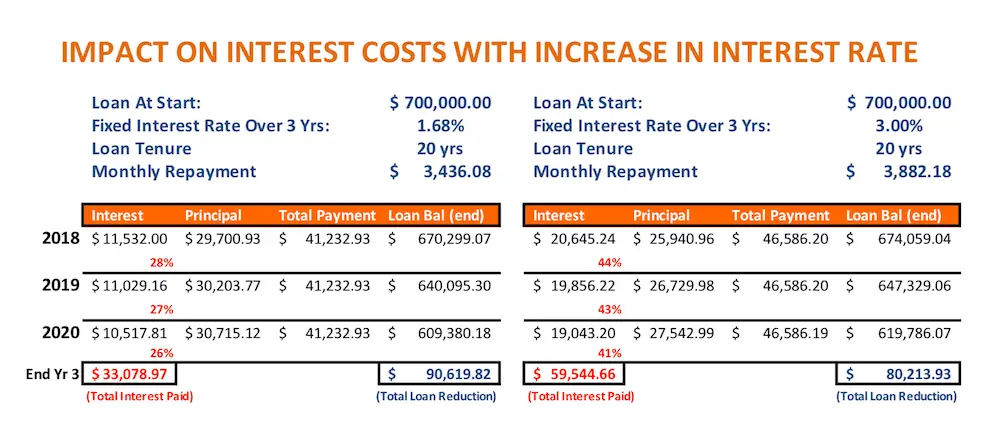

While its true that some commercial mortgages agreements can come with higher interest rates, that doesnt necessarily mean that it would be more expensive than a residential mortgage.

To truly understand exactly how much interest you would pay, it can help to compare all of the costs associated with a commercial mortgage vs a residential mortgage.

A mortgage broker can use their access to the UK market to source the most lucrative and financially viable options based on your unique circumstances.

It is only when you have all of the information needed to calculate your affordability that you can make an informed decision.

Can I Get A Commercial Mortgage With Bad Credit

Its theoretically possible, but dont expect it to be easy. You must be prepared for higher interest rates and lending from a high-street bank may prove impossible. It really depends on your circumstances.

There are lenders that specifically deal with customers with a bad credit history, but comparing their rates and finding a good deal can be difficult. It may be worth seeking the help of a mortgage broker.

If you have a bad credit history, some of the things that can counterbalance it and help you close an acceptable commercial mortgage deal are: a strong credit score and turnover other properties that you can use to secure the mortgage or a considerable debt owed to your business in the form of invoices.

In any case, borrowing money with a bad credit history can be really expensive, so you may want to consider the alternatives carefully before taking this step.

How Much Interest Will I Be Charged For A Owner

The rates you may be offered by any given lender will be determined based on an assessment of you and your business, so its important to position and present yourself as a low risk borrower.

On applying for a commercial mortgage for a business premises, its vital that your business plan projects profit and suggests a clear path to future financial success. Lenders want to feel reassured that their loans will be repaid and a profitable and well organised business plan can demonstrate this.

Your business plan may include:

- A history of your accounts which have been preferably overseen by a chartered accountant

- A forecast of future financial projections

- A SWOT analysis displaying your business strengths, weaknesses, opportunities and threats

Don’t Miss: Can I Get A Mortgage With A Fair Credit Score

How Are Commercial Mortgage Rates Used

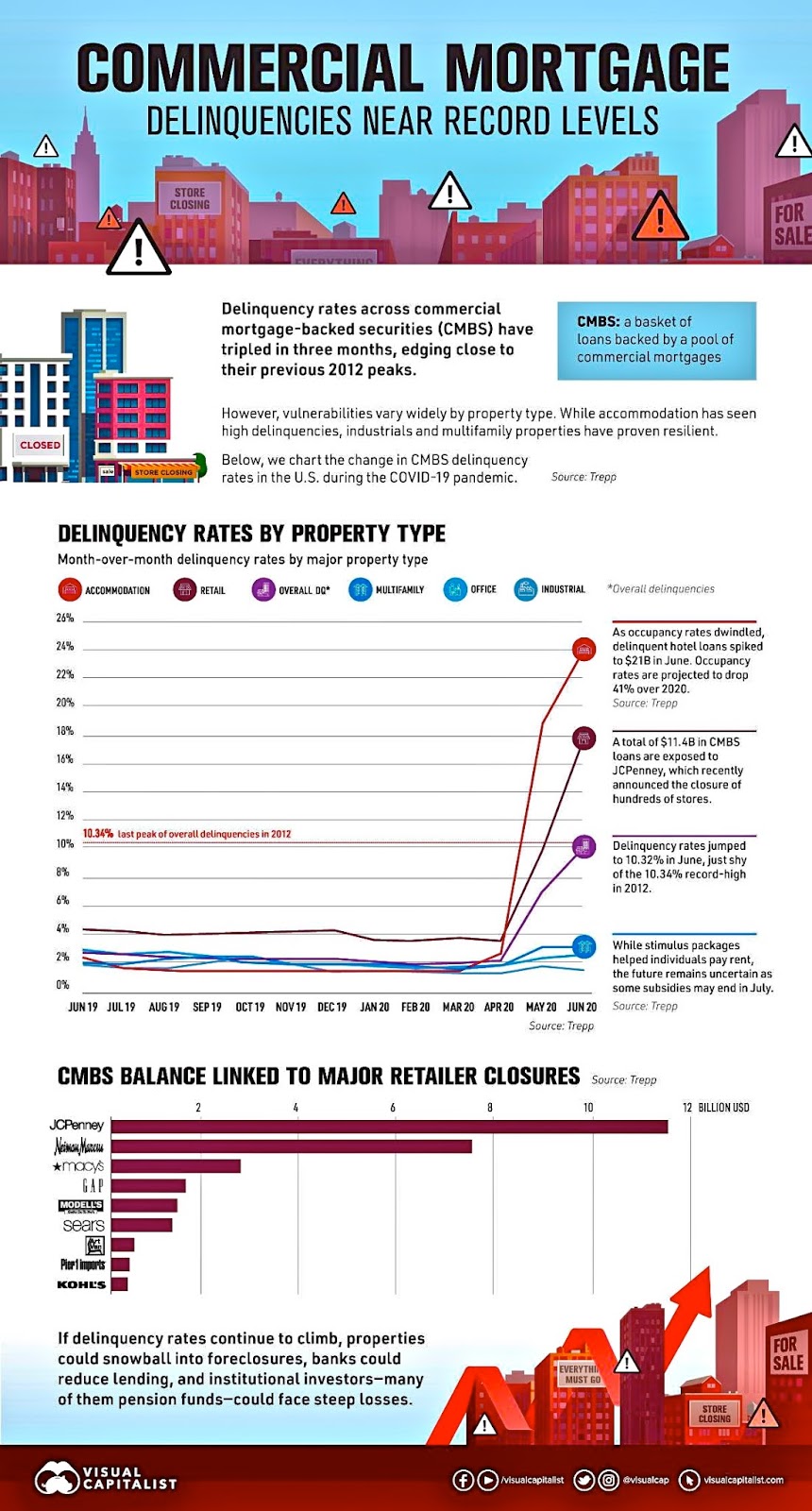

Commercial banks charge higher commercial mortgage rates and fees than they do for residential properties because there’s more inherent risk involved when it comes down to lending out large sums of money for investment purposes. The greater loan amount at stake may also require additional security measures from borrowers who need these loans, resulting in a more complex loan structure and potentially recourse against the borrowerâs personal assets along with the property.

There are 8 major types of commercial loan programs and each has a different range of rates. Commercial real estate investors use current commercial mortgage rates to determine their cost of capital for a particular investment in order to see if it’s even worth investing in at all.

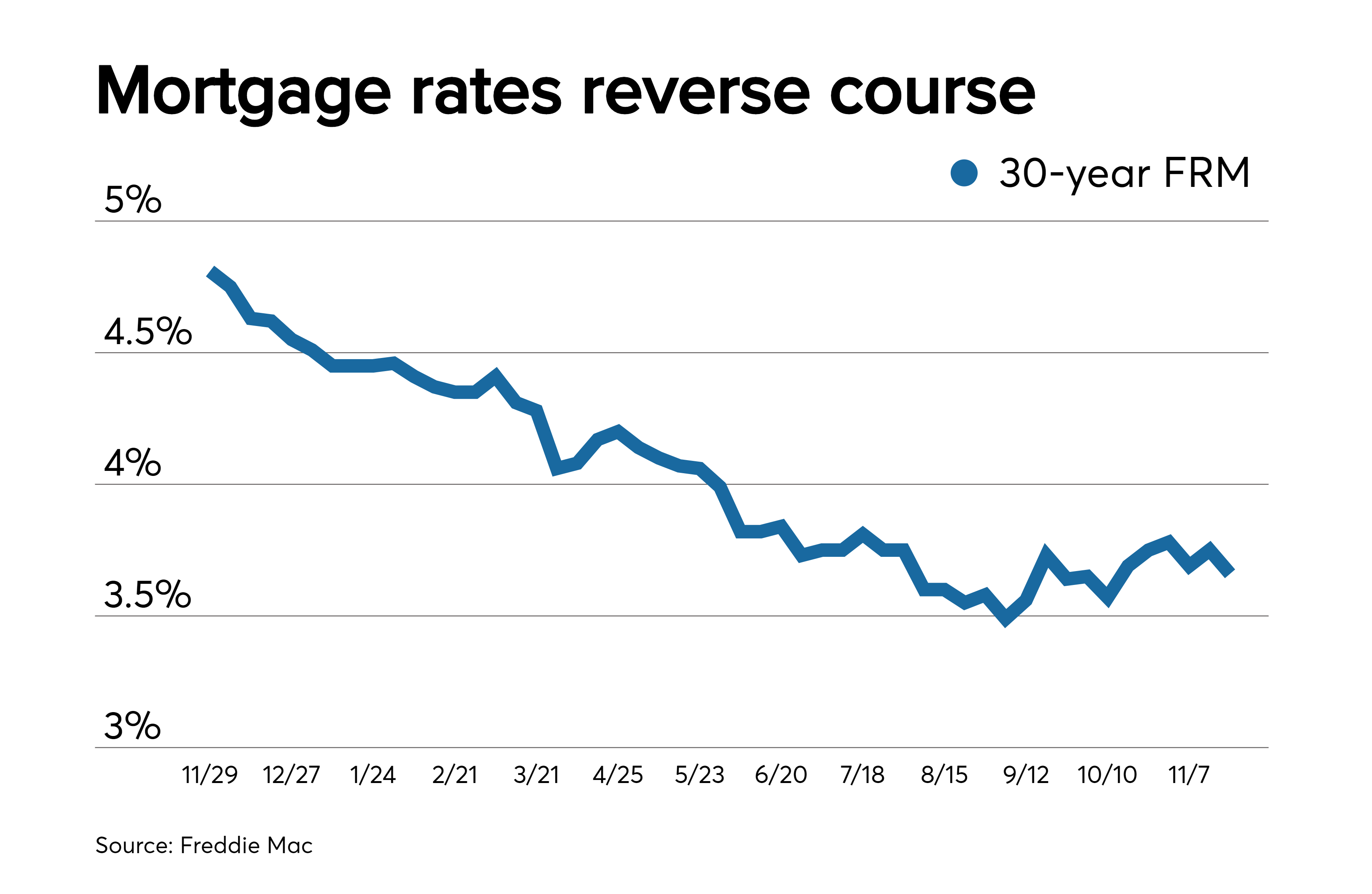

Commercial loan rates are determined by the current market conditions but there is a lot of back and forth with lenders to negotiate terms.

Commercial mortgages can be hard to obtain, especially for borrowers who don’t have perfect credit, a high net worth, or a long track record in real estate investment, so sometimes it’s helpful to work with an experienced Capital Advisory team like StackSource to help with the process.

Commercial mortgage rates change all the time because they’re affected by several factors such as:

– The current economic outlook, which affects consumer confidence . This also determines if banks need more liquidity.

How Commercial Real Estate Loan Rates Work

Commercial real estate loans can help you finance the purchase, improvement, or upgrade of almost any type of commercial propertyâfrom a retail shop to an office to a warehouse and everything in between. There are a few things that you should be aware of about commercial mortgage rates to make sure youre getting the best deal. Heres what you need to know.

Don’t Miss: Is A Heloc Considered A 2nd Mortgage

How Much Cash Down Is Needed To Finance Commercial Properties

The majority of commercial property loans will require a down payment, but how much that down payment amounts to will vary. Generally, conventional commercial loans and SBA 7 loans will require borrowers to make a down payment for 15% to 25%. In this case, a $200,000 commercial real estate loan will require a down payment between $30,000 and $50,000.

However, some lending options, specifically SBA 504 loans, borrowers can take advantage of a 10% down payment requirement. In this case, that same $200,000 loan would only require a down payment of $20,000.

What Determines Commercial Leveraging Finality

The posted mortgage loan rates are very important guidelines. However, one should not interpret these rates as an offer to loan.

Why? The simple answer to this question is that fixed rates and variable rates are hugely deviating items. In other words: they depend on several factors.

Here are some of the several factors that determine the commercial mortgage rates:

- Bank or credit union

- repayment option

- loan term option.

Further, an underlying assumption of all rates as provided is application to a commercial mortgage at 75% LTV. Naturally, lower LTV generally demands lower commercial mortgage rates.

Bottom line: The index rates are dynamic and rely on several factors. You need a professional broker to guide you for commercial real estate loans.

Once again: Our tables reflecting current index rates and spreads apply for today as we see them and they should be regarded strictly as a guideline.We will cover more about why you need a professional broker as a guide for commercial real estate loans in the rest of this article.

Read Also: How Much Should My Mortgage Be Dave Ramsey

Special Benefit For Veterans:

- Take advantage of a 25% discount on loan administration or origination fees.

- Offer valid for veterans of the U.S. Armed Forces on new credit facility applications submitted in Small Business.

Small Business Administration collateral and documentation requirements are subject to SBA guidelines.

You must be 18 years old or otherwise have the ability to legally contract for automotive financing in your state of residence, and either a U.S. citizen or resident alien .

Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation.

Commercial Real Estate products are subject to product availability and subject to change. Actual loan terms, loan to value requirements, and documentation requirements are subject to product criteria and credit approval. For Owner-Occupied Commercial Real Estate loans , owner occupancy of 51% or more is required. Small Business Administration financing is subject to approval through the SBA 504 and SBA 7 programs. Subject to credit approval. Some restrictions may apply.

Small Business Administration financing is subject to approval through the SBA 504 and SBA 7 programs. Loan terms, collateral and documentation requirements apply. Actual amortization, rate and extension of credit are subject to necessary credit approval. Bank of America credit standards and documentation requirements apply. Some restrictions may apply.

Investment and insurance products:

How Long Can You Finance Commercial Real Estate

The amount of time you have to finance a commercial real estate purchase depends on the loan you choose. However, many of the most popular commercial real estate loans allow for 10 to 20 years of financing, with some even extending terms as long as 25 years.

In other cases, particularly when it comes to bridging loans or hard money loans, financing terms or the amortization period may be limited to a few months or 3 to 5 years.

Don’t Miss: Who Can Get A Va Mortgage Loan

How Can I Calculate How Much My Ontario Mortgage Payments Would Be

Our Ontario Mortgage Payment Calculator will help you figure out how much youll pay with any rate you find on the site. It only takes a few minutes to use, so give it a try. You can modify the mortgage amount, mortgage term and type, amortization and payment type to see how your mortgage options and payment amount are impacted.

The Complete Guide To Understanding Commercial Mortgages

Running a new or old business? Coming up with strategic plans to achieve your goals is a must. But besides all the careful planning, you need enough working capital to jumpstart your operations. This is important whether youre a establishing a new company or getting ready for expansion.

As your business grows, its crucial to find the appropriate commercial property that can accommodate your needs. This is where securing commercial mortgage can help. It saves money on rising rental expenses and reduces your overall cost structure. In the long run, this provides financial leeway for your business, especially during unfavorable economic periods.

In this guide, well detail how commercial real estate loans work and how to qualify for this type of mortgage. Youll learn about commercial loan terms, its payment structure, and rates. Well also discuss various sources of commercial real estate loans, as well as different options available in the market.

What is a Commercial Mortgage?

A loan secured by business property is called a commercial mortgage. It is used to purchase commercial property, develop land, or a building. This type of mortgage is also used to renovate offices and refinance existing commercial loans. Examples of property that use commercial mortgages include apartment complexes, restaurants, office buildings, industrial facilities, and shopping centers.

In summary, companies use commercial mortgages to accomplish the following goals:

Recommended Reading: What’s A Good Ltv For Mortgage

Commercial Property Interest Rates

The average interest rate for commercial properties fluctuate based on current economic factors. The rates will also vary between various commercial property types. A few examples of commercial property types include:

- Office Buildings

- Religious centers

Loans for property types with strong economic tailwinds will typically command more favorable financing rates and terms. Multi-family and industrial properties are currently in high demand on the capital markets, and will see some of the lowest interest rates. Hotels, office buildings, and certain retail properties may be seen by lenders as more risky financial bets, so financing rates and terms may be less favorable.

How Is Interest Charged On A Commercial Mortgage

Commercial mortgages can have interest rates that are fixed or variable, though the majority of commercial mortgages in the UK are more commonly offered with a variable rate.

A fixed commercial mortgage has terms that allow the borrower to repay a lower rate of interest for a set period of time . One this period is over, the borrower will begin to pay a higher rate of interest on the lenders standard variable rate.

Of course borrowers seeking to save money can opt to remortgage if they qualify for the new lenders criteria.

Commercial mortgages with a variable rate have interest rates that are set in line with the Bank of Englands base rate.

Read Also: Can You Add To Your Mortgage For Renovations

How Much Is The Typical Down Payment For A Commercial Mortgage

Down payments for commercial real estate loans are typically between 20% and 50%, and will vary based on the loan scenario. Down payments, also known as an investmentâs Equity Requirement, will be determined by location, type of asset, experience of the borrower, and risk profile of the investment.

Commercial Real Estate Loan

|

|

|

|

|

|

You May Like: Do Mortgage Lenders Look At Medical Collections

Commercial Loan Terms And Payment Structure

Commercial mortgages come in short terms of 3, 5, and 10 years. Others stretch as long as 25 years. But in general, commercial mortgage terms are not as long as most residential loans, which is usually 30 years.

When it comes to the payment structure, expect commercial loans to vary from the traditional amortizing schedule. A lender asks a borrower to pay the full loan after several years with a lump sum payment. This is called a balloon payment, where you pay the total remaining balance by the end of the agreed term.

For instance, a commercial loan has a balloon payment due in 10 years. The payment is based on a traditional amortization schedule such as a 30-year loan. Basically, you pay the first 10 years of principal and interest payments based on the full amortization table. Once the term ends, you make the balloon payment, which pays off the remaining balance in the mortgage.

Furthermore, you have the option make interest-only payments in a commercial loan. This means you do not have to worry about making principal payments for the entire term. Likewise, once the loan term is through, you must settle any remaining balance with a balloon payment.

In some cases, commercial lenders offer fully amortized loans as long as 20 or 25 years. This is how certain Small Business Administration loans are structured. And depending on the commercial loan and lender, some large commercial mortgages may be given a term of 40 years.

What Is Commercial Mortgage Debt Service Coverage Ratio

The debt service coverage ratio determines how much net income commercial real estate properties generate compared with their loan payment. Commercial mortgage debt service coverage ratios vary depending on property use, location and other factors, but most lenders want at least a minimum of 1.2 times monthly loan payments from total income.

This means that if your property generates income of $120,000 per month, net of expenses, then a lender may provide a loan that costs up to $100,000 per month in principal and interest payments.

Recommended Reading: Why Do You Need Mortgage Insurance

How Much Can I Borrow

This will depend on the type of commercial property finance you’re looking for. If it’s for owner-occupied property, you’ll generally be able to find a mortgage at up to 70-75% loan-to-value , provided you can supply the necessary deposit. You’ll be subject to a rigorous affordability assessment, too, which means the amount you can borrow will be dictated by the amount you’re able to provide upfront and related affordability criteria.

It’s a little different when it comes to a commercial investment mortgage. Here, the amount you’ll be able to borrow will depend on the expected rental income generated by the investment, but even so, the mortgage typically won’t be able to exceed 65% of the initial purchase price. In some cases, you may be able to find a deal with lower deposit requirements, but you’ll be required to provide significant collateral instead.

The Complexities Of Commercial Mortgages

While calculating your eligibility for a commercial mortgage, lenders will consider the complexity of managing the property youre buying.

The least complex properties tend to be semi-commercial properties, such as a shop or restaurant with a flat above it. You may find it simple to get a mortgage on these properties, even with only a couple of years of buy-to-let management under your belt.

More complex properties, such as large shopping centres, hotels, theme parks or tourist attractions, will be much harder for new investors to be approved for.

Also Check: How To Prequalify For A Home Mortgage

Key Features Of A Commercial Mortgage

Here is a brief list of things you should think of before starting to compare commercial mortgage options:

- Deposit and LTV. The deposit will be much higher than for a residential mortgage. In most cases, 9095% LTV isnt going to be an option. Be realistic and plan at least a 25% deposit.

- Interest rate. How much are you expecting to pay? Is it fixed or variable?

- Duration of the mortgage. A mortgage is always a long-term commitment, so make sure that your business can sustain it in the long run. Also, think carefully about whether youd rather get rid of the debt earlier and temporarily have less money to invest in the rest of your activities or take more time to repay your property and have more cash every month at your immediate disposal .

- Additional fees. Once again, be aware that fees will be higher than for a residential mortgage. If a lender offers you a particularly cheap interest rate, double-checking the fees to make sure theres no trick cant hurt.

- Flexibility. What happens if your circumstances change? How much is it going to cost you if you want to repay the mortgage early?

Commercial Real Estate Loan Interest Rates And Fees

Interest rates on commercial loans are generally higher than on residential loans. Also, commercial real estate loans usually involve fees that add to the overall cost of the loan, including appraisal, legal, loan application, loan origination and/or survey fees.

Some costs must be paid up front before the loan is approved , while others apply annually. For example, a loan may have a one-time loan origination fee of 1%, due at the time of closing, and an annual fee of one-quarter of one percent until the loan is fully paid. A $1 million loan, for example, might require a 1% loan origination fee equal to $10,000 to be paid up front, with a 0.25% fee of $2,500 paid annually .

You May Like: Are Mortgage Rates Going To Rise