A Calculator Can Show Expenses Vs Savings

If youve already submitted a loan application, the Loan Estimate from your lender should show your new loans long-term costs. Likewise, the Closing Disclosure, which you should receive at least three business days before closing, will detail closing costs.

But how can you compare these costs before making a new mortgage application?

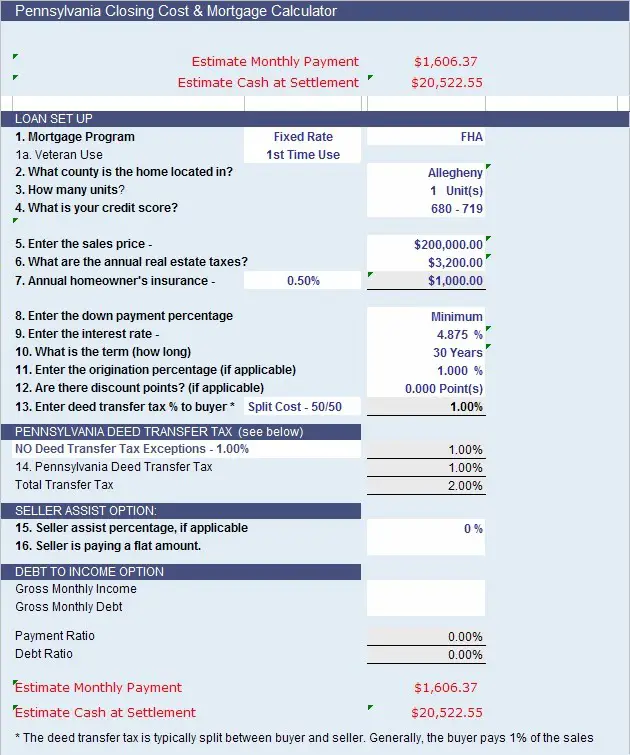

A refinance calculator can help show the savings youll see by refinancing. You can compare those savings with and without the extra closing costs added to your new loans principal.

A calculator can help you see the difference between mortgage rates before you submit a loan application.

How To Minimize The Cost Of Prepaid Interest

The most direct way to minimize the cost of prepaid interest is to delay your closing date until the end of the month, but this also means youll need to make your first monthly mortgage payment not long after youve paid your closing costs.

What are the different types of prepaid mortgages?

When it comes to mortgage loans, there are several different types of prepaid items, the most common are: 1 Homeowners insurance premium paid up front as well as into an escrow account 2 Real estate property taxes paid into an escrow account 3 Mortgage interest that accrues between the closing date and month-end

How are closing costs prepaid in real estate?

Homeowners insurance premium paid up front as well as into an escrow account Real estate property taxes paid into an escrow account Mortgage interest that accrues between the closing date and month-end Typically, one full year of homeowners insurance is collected and prepaid to your insurance company at closing.

Are Closing Costs Tax Deductible

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is no. The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

Don’t Miss: Are There 50 Year Mortgages

Why Do Sellers Seem To Decline Offers With Fha Mortgage Preapproval Letters

When you use a government-insured loan to purchase a home, the home must meet the governments livability standards. That means the FHA appraisal process can create problems and delays. For this reason, given a choice of offers, many sellers will go with a conventional mortgage or better still an all-cash offer.

An Example Of How Seller Concessions Work

Heres one example of how a seller concession might look:

- Original home purchase price: $200,000

- Closing costs: $5,000

- Seller concessions for closing costs: $5,000

- Your out-of-pocket closing costs: $0

Keep in mind that, in a buyers market, the seller may offer concessions even without a home price hike. Its always good to ask for that option first.

Also, keep in mind that the new loan amount with seller concessions added in cant exceed the market value of the home as determined by the home appraisal.

Whether you roll your closing costs back into your mortgage or not, theres almost always closing costs associated with obtaining a home loan.

But rolling closing costs into a mortgage can be a great way to save on out-of-pocket cash.

Also Check: What Does Arm Mean In Mortgages

Average Closing Costs On A Home Loan

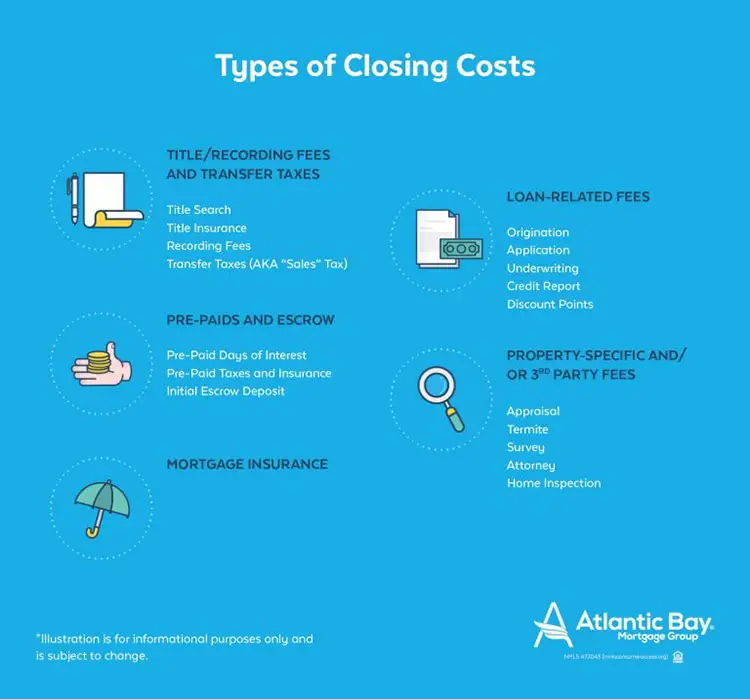

Each closing cost falls into one of three categories: lender fees, third-party fees and prepaid funds for taxes or mortgage interest. Although we looked at each closing cost individually, it’s helpful to group your upfront mortgage expenses into one of these broader groups.

| Bank of America | |

|---|---|

| $6,832 | $7,227 |

To determine an average figure for each closing cost, we collected home loan estimates from the four largest banks in the US. Our scenario assumes a loan at the median US home price of $198,000, with a down payment of 10% and a credit score of 740. Other assumptions for property tax and escrow requirements were plugged into the estimate of prepaid costs, which are explained below.

While there are several factors that can significantly raise or lower your closing costs, we found that mortgage discount points are the one area that offers you the most control as a borrower. While lenders didn’t show much variation in third-party costs or prepaid expenses, their quoted interest rates relied on very different amounts of points.

What Are Closing Costs In A Mortgage

Closing costs are expenses that a homebuyer or refinancer must pay to finalize their loan transaction. Closing costs can include a loan origination fee, discount fee, processing fee, underwriting fee, wire transfer, credit report, tax service, flood certification, lenders title insurance, title search, escrow, courier fee, appraisal, local government recording fees, and more.

Other closing costs can be added based on your preferences. For example, you will likely decide to purchase a home inspection. So, there will be an inspection fee added to your costs. Or you may choose to enlist the help of a real estate attorney, which will come at a cost.

Read Also: What Is A Pre Qualified Mortgage

Are Closing Costs Included In A Mortgage Loan

Depending on the loan program you choose, you may have the option of including your closing costs in your mortgage loan if you are refinancing. By rolling closing costs into a refinance, you can include these expenses into the total loan amount. While this may help you lower the cash needed at closing, paying closing costs upfront can save money in the long run.

Can You Negotiate Closing Costs

You may wonder how you can afford all of these fees on top of the down payment, moving expenses, and repairs to your new home. Fortunately, some of them may be negotiable.

For example, if you suspect a lender is adding on unnecessary fees, known as “junk fees,” speak up. Ask the lender to remove or reduce fees if you notice duplication. Be especially wary of excessive processing and documentation fees.

Your attorney, if you’re working with one, should be able to point out any fees that are unnecessary or unusually high.

Read Also: How Do You Get Your Name Off A Mortgage

How Do I Know What My Monthly Mortgage Payments Will Be

Finding the loan thats right for you is a lot easier when you know all the closing costs involved.

On the first page of your LE or CD, in the section titled Projected Payments, youll see your estimated total monthly payment. This calculation covers your principal and interest, private mortgage insurance , homeowners insurance, and estimated escrow fees.

In the estimated taxes, insurance, and assessments section, it will show you the amount youll need to pay each month on taxes, insurance, and assessments . If youre buying a home in a building or community with no homeowners association or if youre refinancing, then the amount listed on your CD under estimated total monthly payment is what your monthly mortgage payment will be.

Generally speaking, HOA fees are not included in the escrow portion of your monthly mortgage payment. So, if youre planning to buy into a community with an HOA, add the HOA fees to your estimated total monthly payment for an accurate total monthly mortgage payment.

Can Your Closing Costs Be Included In The Loan Balance

Youve probably heard the saying, Life isnt fair. Thats especially true when youre buying a home.

While the seller usually pays the real estate commission and a few other fees, the bulk of the costs of buying a home are the responsibility of the buyer and those fees can easily add up to thousands of dollars or more.

In this article, well discuss how investors can keep more cash on hand by including closing costs in the total loan amount.

Also Check: Will My Mortgage Payment Go Down

What Do I Need To Know About Origination Fees

An origination fee can encompass a variety of different fees added together, says Mark Ventrone, owner and broker with ABLEnding, based in California and Arizona. It can include underwriting fees, administrative fees, processing fees, discount fees , and any other fee charged by the lender and/or broker to the borrower.

Refinancing: When Are Closing Costs Due

If youre refinancing an existing mortgage, your closing costs are due at least one day before the loan is funded. This gives the lender enough time to disburse all the proceeds when the mortgage is funded. As your closing date approaches, your lender will tell you how and when to pay your closing costs.

You don’t need to pay a down payment because you made your down payment when you initially purchased the home. Other differences include the cost of title feesthese are lower when you refinance because the owner of the property isnt changing.

Read Also: What Is The Federal Interest Rate For Mortgage

J Total Closing Costs

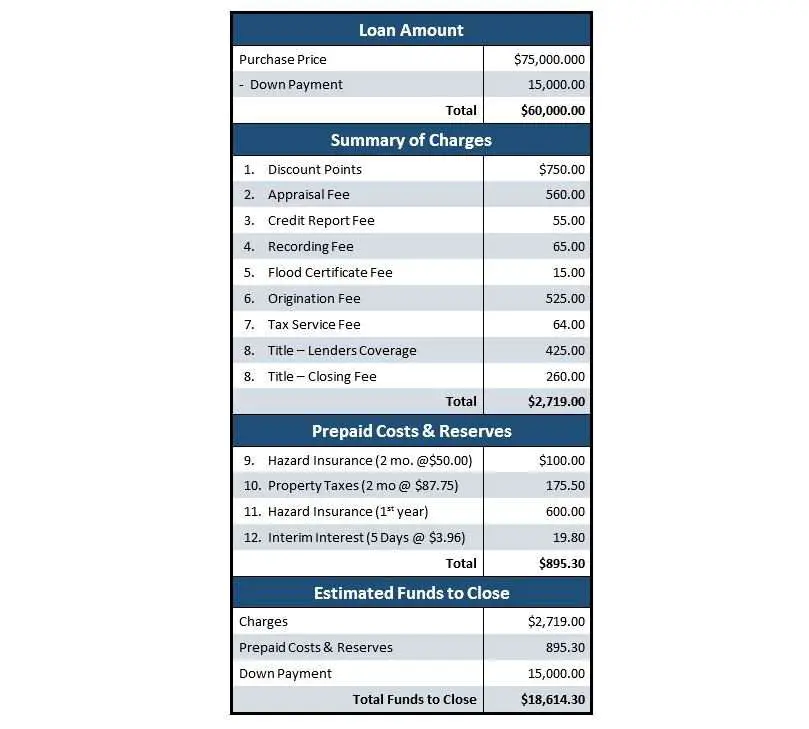

D + I = J. This is the total of all your closing costs. It represents the sum of all your loan costs and all your non-loan costs. This is roughly the amount you should budget for, since it represents the lenders estimate of what you will owe at closing time.

Weve gone through some of the most common fees that make up your total closing costs. You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment.

What Are Fha Closing Costs

When you buy a home with a home loan, youll need two piles of cash ready to go at the closing table. One for your down payment and one for closing costs.

No matter the type of home loan you choose, all mortgages come with closing costs. The general rule of thumb is to plan on having between 3% 6% of your total loan amount on hand for closing costs.

The closing costs that come along with an FHA loan are generally the same as conventional ones, although the mix of costs and fees might look a little different.

Don’t Miss: What’s The Mortgage On 500k

What Is Included In Buyer Closing Costs

Closing costs refer to the charges and fees that are paid when a house purchase is finalized. Typically, the buyers costs include mortgage insurance, homeowners insurance, appraisal fees and property taxes, while the seller covers ownership transfer fees and pays a commission to their real estate agent.

Who pays for the origination fee?

lenderThese fees are charged by the lender for preparing your mortgage loan. Home buyers typically pay about 0.5% of the amount they are borrowing in origination fees.

Can loan origination fee be waived?

You can always simply ask your lender to waive origination fees without changing your interest rate.

So What Are All Of These Itemized Closing Costs

Excellent question. After all, Loan Estimates and Closing Disclosures are 35 pages long and theyre an alphabet soup of fees, taxes, and jargon thats only familiar to people in the real estate industry. Whats more, there are different tax and insurance regulations from state to state, and some use different terms for the same types of charges. The kind and number of itemized fees you could see on a LE or CD can also vary dramatically. For this reason, its challenging to find a detailed list that explains what each and every one of these fees mean.

Page 2 of your LE or CD divides all your closing fees into two categories: Loan Costs, and Other Costs. Loan Costs are charges for services provided to the lender so that they can accurately process the loan. Other Costs include taxes, prepaid costs, initial escrow payments, and other itemized costs.

At the end of this article we explain the most common closing fees and charges. Theyre broken down into the same sections as your LE or CD so you can easily follow along.

- If theres a fee on your loan estimate thats not listed below, your loan consultant or processing expert will be able to explain it for you.

- If you need more information about the itemized fees on your Closing Disclosure, your closing expert can help you.

Better Mortgage is committed to eliminating unnecessary fees wherever possible and not passing on costs to our customers. Youll see how our Loan Estimates compare when you start the process.

Read Also: What Is The Monthly Payment On A 500 000 Mortgage

What Does It Mean To Roll Closing Costs Into Your Loan

Including closing costs in your loan or rolling them in means you are adding the closing costs to your new mortgage balance.

This is also known as financing your closing costs. Lenders may refer to it as a no-cost refinance.

Financing your closing costs does not mean you avoid paying them. It simply means you dont have to pay them on closing day.

If you dont want to empty your savings account at the closing table and if your new mortgage rate is low enough that youll still save money financing your closing costs over the term of your mortgage might be a good strategy.

But the big downside is that you end up paying interest on your closing costs, which makes them more expensive in the long run.

So if youre able to pay closing costs in cash, thats typically the best move.

How Much Youll Pay In Closing Costs

The total closing costs paid in a real estate transaction vary widely, depending on the homeâs purchase price, loan type and the lender you use. In some cases, closing costs can be as low as 1% or 2% of the purchase price of a property. In other casesâwhen loan brokers and real estate agents are involved, for exampleâtotal closing costs can exceed 15% of a propertyâs purchase price.

In total, buyers should expect to pay between 2% and 5% of purchase price in closing costs. Their portion of the costs typically includes:

- One or two origination pointsâlender feesâthat equates to 1% to 2% of the loan amount, and usually includes loan origination fees of $750 to $1,200)

- $1,000 or more in loan underwriting fees for things such as an inspection, appraisal, survey and title work

- One or more mortgage discount points if you choose to lower your interest rate by prepaying interest

- Up to 2% of the loan amount as an initial mortgage insurance premium if you decide to use insurance or a government-issued loan that requires it

The specific closing costs of a real estate transactionâand whether costs are the responsibility of buyers or sellersâare all outlined in the disclosure sections of a purchase agreement and determined by the lender and loan type that the buyer selects.

Don’t Miss: How Much Does One Percent Make On A Mortgage

Pros And Cons Of Rolling Closing Costs Into Your Mortgage

Borrowers who roll closing costs into a mortgage spend less money out of pocket and keep more cash in hand. Thats a big argument in favor of rolling in closing costs.

However, you are also paying interest on those costs over the life of the loan.

For example, lets assume:

- The closing costs on your new mortgage total $5,000

- You have an interest rate of 3.5% on a 30-year term

If you roll the closing costs into your loan balance:

- Your monthly mortgage payment would increase by $22.50 per month

- And you would pay an extra $3,000 over the 30-year loan term, meaning your $5,000 in closing costs would actually cost $8,000

Heres another con: By adding the closing costs to your new mortgage balance you are increasing the loan-to-value ratio. Increasing the LTV lowers the amount of equity in your home.

Less equity means less profit when you sell your home because youd have a bigger lien to pay off after the sale. You would also have less equity if you wanted to take a home equity loan.

The cons losing equity and paying more interest may be OK with you if youre still saving more from your lower refinance rate than youre losing by financing the costs.

Appeal To The Seller For Help

You might be able to get a seller to either lower the purchase price or cover a portion of your closing costs. This is more likely if the seller is motivated and the home has been on the market for a long time with few offers. In many hot housing markets, though, conditions favor sellers, so you might get pushback or a flat-out no if you ask for a sellers help. But it doesnt hurt to ask.

Don’t Miss: Can You Use Mortgage Loan For Renovations

How Do You Reduce Closing Costs

Although closing costs can be significant, there are some things you can do to lower them. First, its important to understand that different lenders will have different closing costs. Some will be higher than others, and some lenders will charge more fees than other lenders.

Also, if you are a first-time home buyer, you may qualify for a grant to help you with this expense. Its worth your time to research your options to see whats available before you apply for a mortgage.

Finally, as previously mentioned, you may be able to negotiate the closing costs with the seller. This may not always work, of course, especially if there is a strong real estate market where you are buying a home. If a seller has multiple offers, for example, he or she will most likely go with the highest offer and probably wont be interested in helping out with the closing costs.

Read Also: What Kind Of Mortgage Loans Are There