Make Your Mortgage Work For You

If youre ready to buy a home or are looking for a change in your current mortgage, start thinking about which type of mortgage rate works best with your life and budget. Then get in touch with one of our mortgage specialists to learn more about the interest rates we have available, or to start your application.

What Is A Mortgage

A mortgage is a type of secured loan that is used to purchase a home. The word mortgage actually has roots in Old French and Latin.. It literally means death pledge. Thankfully, it was never meant to be a loan you paid for until you died , but rather a commitment to pay until the pledge itself died .

You can also get a mortgage to replace your existing home loan, known as a refinance.

How Does My Amortization Period Affect My Mortgage

When deciding between a short amortization or a long amortization, you will need to take into account your financial situation. A long amortization means that your individual mortgage payments will be smaller, which might allow you to qualify for a larger mortgage amount based on your futuredebt service ratios. Likewise, higher mortgage payments from a shorter amortization may reduce themortgage amount that you can afford.

You wont be able to get a CMHC-insured mortgage if your amortization is more than 25 years. While your monthly mortgage payment might be higher with an amortization that is 25 years or less, youll be able to make a smaller down payment that can be as low as 5%. Otherwise, youll need to make a down payment of at least 20% for an uninsured mortgage with an amortization greater than 25 years.

You can use ourmortgage amortization calculatorto see how changing your amortization period can affect the cost of your mortgage. For example, the table below compares the cost of a mortgage and the amount of each monthly mortgage payment for different amortization periods.

Read Also: How Long Does It Take To Do A Reverse Mortgage

Fixed Rate Mortgage Penalty Interest Rate

For fixed-rate mortgages, lenders usually use the greater of three months of interest or an interest rate differential . Each lender has their own IRD calculation. The interest rate that they use for their IRD is usually based on either their current advertised mortgage rates or their posted rates, which can often be much higher.

| Advertised Rate IRD |

|---|

How Much House Can I Afford

Income is the most obvious factor in how much house you can buy: The more you make, the more house you can afford.

However, it also depends on how much of your income is already spoken for through debt payments as well as your credit score and history. The more debt you have, the less likely you will be approved for a mortgage or one at a lower interest rate. Your credit score also plays a role in that the higher your score, the better loan rate and terms you will receive.

And of course, if you have a larger down payment, it will help you in all these factors for affording a home.

You May Like: What Is The Mortgage On 800k

Hybrid Or Combination Mortgages

You could choose to opt for a hybrid or combination mortgage. In these mortgages, part of your interest rate is fixed and the other is variable.

The fixed portion gives you partial protection in case interest rates go up. The variable portion provides partial benefits if rates fall.

Each portion may have different terms. This means hybrid mortgages may be harder to transfer to another lender.

Summary Of Current Mortgage Rates

Mortgage rates moved lower this week

- The current rate for a 30-year fixed-rate mortgage is 6.49%, a of 0.09 percentage points from a week ago. The 30-year rate averaged 3.11% this week last year.

- The current rate for a 15-year fixed-rate mortgage is 5.76%, down 0.14 percentage points week-over-week. The 15-year rate averaged 2.39% a year ago this week.

Don’t Miss: What Kind Of Life Policy Typically Offers Mortgage Protection

Is The Lowest Ontario Mortgage Rate The Best Rate

Not always. The lowest rates usually come with more limitations. These restrictions can cost you much more than the small rate savings. Such terms are common with low frills mortgages and typically kick in when you try to port, break or increase the mortgage after closing. When comparing mortgage rates, dont be afraid to ask potential lenders questions to ensure you understand the terms and conditions of your mortgage.

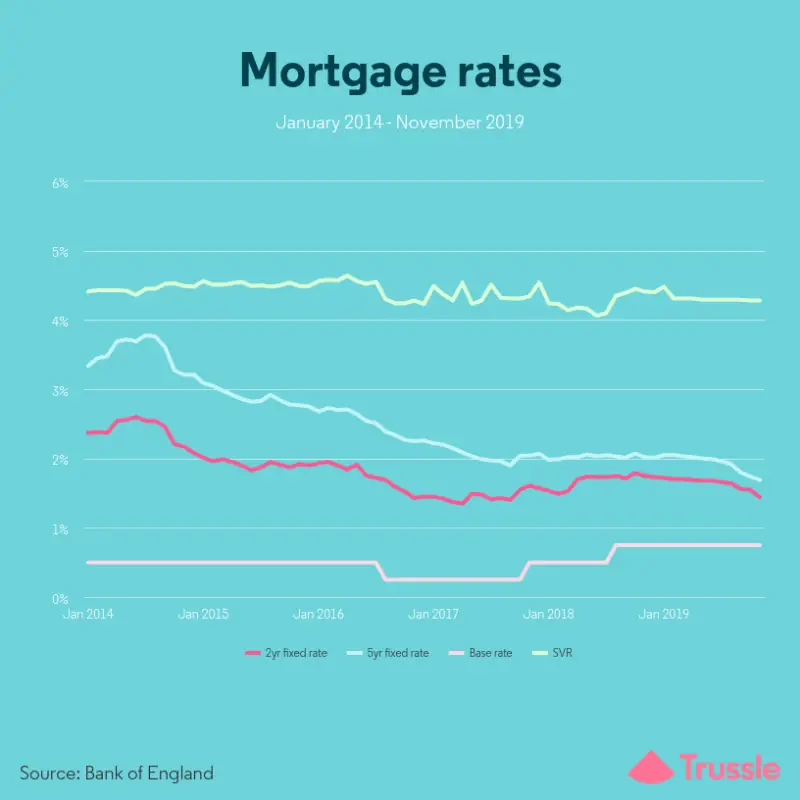

Why Are Fixed Rates Going Up So Much In 2022

5-year bond yields directly affect 5-year fixed mortgage rates. When bond yields go up, the cost to lend money to borrowers increases and consequently, lenders raise their mortgage rates to compensate.

Given the Bank of Canadaâs current economic outlook, bond markets have been increasing bond yields to price in rising inflation expectations. Since bond yields have steadily been going up in 2022, so have fixed mortgage rates.

You May Like: How Much Should You Budget For Mortgage

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed-upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

What Happens At The End Of A Term

At the end of each term, you have the option to renew or refinance your mortgage.

- Renewing your mortgageinvolves signing for another term with your existing lender. Your monthly payment and mortgage interest rate may change.

- Refinancing your mortgageinvolves signing a new term agreement, possibly with a different rate or lender. Refinancing allows you to take advantage of lower mortgage rates or better options not offered by your current lender. You can also borrow more money by using your home equity and receiving it in cash.

Your mortgage lender might not reassess your credit score or debt service ratios if youre renewing at the same lender. If youre switching to a new lender, youll need to be reassessed and you may need to pass the mortgage stress test.

Recommended Reading: How Are Mortgage Rates Determined

How Do Lenders Calculate My Dti

At a minimum, lenders will total up all the monthly debt payments youâll be making for at least the next 10 months Sometimes they will even include debts youâre only paying for a few more months if those payments significantly affect how much monthly mortgage payment you can afford.

Lenders primarily look at your DTI ratio. There are two types of DTI: front-end and back-end.

Front end only includes your housing payment. Lenders usually donât want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance. For example, if your total monthly income is $7,000, then your housing payment shouldnât be more than $2,170 to $2,520.

Back-end DTI adds your existing debts to your proposed mortgage payment. Lenders want this DTI to be no higher than 41% to 50%. Letâs say your car payment, credit card payment and student loan payment add up to $1,050 per month. Thatâs 15% of your income. Your proposed housing payment, then, could be somewhere between 26% and 35% of your income, or $1,820 to $2,450.

How Interest Rates Affect Your Available Loan

You may have heard of recent changes to the Federal Housing Administration-insured reverse mortgage program, the Home Equity Conversion Mortgage program.

The agency announced in late august that it would be making several changes to HECM loans that will impact borrowers- both in terms of how much they will pay to get a reverse mortgage, and how much theyll be able to borrow.

One of the big changes is that the amount you will be able to borrow with a HECM loan depends largely on current interest rates. The amount of home equity you can borrow is tied directly to the interest rate available at the time you get your reverse mortgage.

Just like in the forward mortgage market, your interest rate determines the amount of interest youll pay. But in the reverse mortgage market, the current interest rate also determines the amount you can borrow.

All HECM reverse mortgages use a specific table provided by the Department of Housing and Urban Development to determine loan amounts for borrowers. This amount is called the principal limit.

The principal limit depends mainly on three factors: the borrowers age, the home value, and current interest rates.

From home to home and borrower to borrower, every loan amount will be different. The percentage of home equity that borrowers can access will range from 50-60%. Older borrowers can access a greater percentage of home equity than their younger counterparts.

| 63.1% | $1,089,300 |

Recommended Reading: How To Reduce Your Mortgage

Mortgage Disability Insurance Plus

In the event that you are completely unable to work due to an unexpected disability or you involuntarily lose your job through no fault of your own, help protect your family’s home with CIBC Mortgage Disability Insurance Plus+ provided by The Canada Life Assurance Company .

How Are Mortgage Rates Impacting Home Sales

High mortgage rates continue to impact the housing market. The number of existing homes sold declined for the ninth straight month in October the longest decline on record, according to the National Association of Realtors.

“More potential homebuyers were squeezed out from qualifying for a mortgage in October as mortgage rates climbed higher,” said Lawrence Yun, chief economist at NAR, in a statement.

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

What Is A Good Mortgage Rate

Rates have been on the rise since the beginning of 2022, but are still in the favorable range. If youre considering a refinance, a good mortgage rate is considered 0.75% to 1% lower than your current rate. New homebuyers can also benefit from the latest mortgage rates as they are comparable to rates prepandemic rates.

Even if youre getting a low interest rate, you need to pay attention to the fees. Hidden inside a good mortgage rate can be excessive fees or discount points that can offset the savings youre getting with a low rate.

Current Mortgage Rates For Nov 25 202: Rates Fall

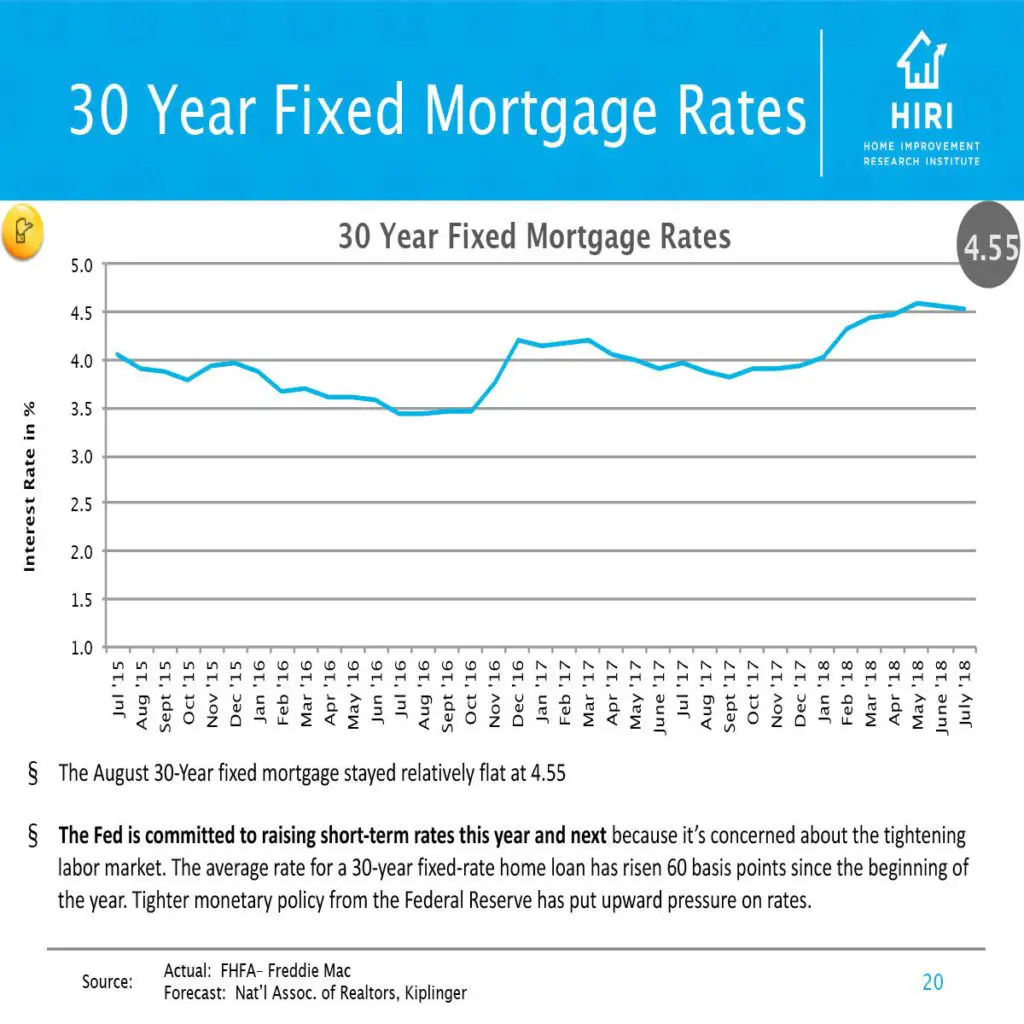

Some notable mortgage rates moved down this week, though rates are generally expected to rise this year. See how the Fed’s interest rate hikes could affect your mortgage payments.

Some closely followed mortgage rates trended lower over the last seven days. Fifteen-year fixed and 30-year fixed mortgage rates both trailed off. The average rate of the most common type of variable-rate mortgage, the 5/1 adjustable-rate mortgage, moved ever so slightly higher, however.

Mortgage rates have been increasing consistently since the start of 2022, following in the wake of a series of interest rate hikes by the Federal Reserve. Interest rates are dynamic and unpredictable — at least on a daily or weekly basis — and they respond to a wide variety of economic factors. But the Fed’s actions, designed to mitigate the high rate of inflation, are having an unmistakable impact on mortgage rates.

If you’re looking to buy a home, trying to time the market may not play to your favor. If inflation continues to increase and rates continue to climb, it will likely translate to higher interest rates — and steeper monthly mortgage payments. As such, you may have better luck locking in a lower mortgage interest rate sooner rather than later. No matter when you decide to shop for a home, it’s always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific situation.

Read Also: Can You Get A Mortgage On A Foreclosed Property

How Are Interest Rates Calculated

Interest rates are partially determined by factors that are completely out of your control, such as inflation, the ups and downs of the broader economy and the lender you choose to work with. Because of these factors, mortgages rates are constantly changing. You might see a rate of 4.98 percent today, only to see 5.25 percent tomorrow. This is why mortgage rate locks can be a valuable tool.

However, you have a big say over your interest rate because lenders take a close look at your financial picture your credit history, your debt-to-income ratio, your plans for a down payment and other pieces of your life to set your rate. There is a simple rule with mortgage rates: The higher your credit score, the lower your interest rate will be.

When Should You Lock In Your Mortgage Rate

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires.

If you donât lock in right away, a mortgage lender might give you a period of timeâsuch as 30 daysâto request a lock, or you might be able to wait until just before closing on the home.

Once you find a rate that is an ideal fit for your budget, itâs best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While itâs not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

If you donât lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs.

Read Also: How Long Do You Need To Pay Mortgage Insurance

Consider Different Types Of Home Loans

The 30-year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficialdepending on your situation.For example, if you require a lower interest rate, adjustable-rate mortgages offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time . Given that ARM loans are variable, the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. A 15-year fixed rate mortgage, on the other hand, may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed rate mortgage. Consider all your options and choose the home loan that is most comfortable for you.

How Can I Calculate How Much My Ontario Mortgage Payments Would Be

Our Ontario Mortgage Payment Calculator will help you figure out how much youll pay with any rate you find on the site. It only takes a few minutes to use, so give it a try. You can modify the mortgage amount, mortgage term and type, amortization and payment type to see how your mortgage options and payment amount are impacted.

You May Like: What Is Current Mortgage Refinance Rate

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan and is built into your monthly payment. Mortgage fees are usually paid upfront and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

Increase Your Down Payment

Did you know that your down payment amount can have an impact on your mortgage rate? That’s because mortgage rates are generally tiered, and typically lower rates are available for those with a down payment of 20% or more. If possible, check with your lender to see if increasing your down payment will lower your mortgage interest rate.

Don’t Miss: How To Calculate House Mortgage Payment

Mortgage Critical Illness Insurance

Mortgage critical illness insurance provides a benefit if you suffer a life-threatening issue, such as cancer, heart attack, or stroke. Critical illness insurance usually has a smaller coverage benefit, and it has slightly higher premiums. Some policies might not cover pre-existing conditions up to 24 months before the start of your coverage. You might also need to complete a health interview.

Your Fixed Mortgage Rate Source

There are many things to consider when buying a home in Canada, not the least of which is the loan term and type that you will need to pay for your home. The fixed-rate mortgage may indeed be the best choice for you, but there are many other mortgage options. We want to help you make the right mortgage choice, so choose the best rate on this page or fill out the online mortgage application form for more information on Canadian mortgage rates and all of the possibilities for home loan financing in Canada.

Read Also: What Makes A Jumbo Mortgage