A $100k Salary Puts You In A Good Position To Buy A Home

One of the first questions you ask when you want to buy a home is how much house can I afford?

With a $100,000 salary, you have a shot at a great homebuying budget.

But to qualify for the lowest mortgage rates and therefore the biggest loan amount you also need a strong credit score, low debts, and a decent down payment.

With all these factors and $100K of income per year, most doors in the mortgage world will be open to you.

In this article

What Proportion Of Net Income Should I Spend On My Mortgage

Q I’m interested to know what the recommendations are regarding what proportion of our net monthly income should be going on mortgage payments. We’re currently on a very low rate , but we are looking to move to the south east and increase the mortgage.

Based on the amount we’re looking to borrow I’ve calculated monthly repayments at 5% to make sure they’re still affordable, as interest rates can really only go in one direction now, but not sure if I’m still being over-cautious. SH

A There’s nothing wrong with being over-cautious. Making sure that you’ll be able to afford your mortgage if interest rates rise is precisely what the Financial Services Authority would like lenders to do when assessing mortgage affordability. The FSA is worried that current low mortgage rates are disguising the full impact of unaffordable lending and the true extent of consumers’ vulnerability to a rise in interest rates.

As to what proportion of your income should go on mortgage payments, there seems to be a general view that if you spend more than half your income on servicing debt of all types not just mortgage you are heading for trouble. Some experts suggest that the total amount you pay towards your mortgage should not exceed 28% of your gross income. And you should make sure that you don’t go over 36% of gross income for the total amount you spend on all borrowing, including mortgage.

Aim To Put 20 Percent Down

The amount of mortgage you can afford also depends on the down payment you make when buying a home. In a perfect world, we recommend a 20 percent down payment to avoid paying mortgage insurance, Neeley says.

When your down payment is less than 20 percent, your costs rise. You typically have to pay private mortgage insurance, which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your home. On a $240,000 mortgage, thats $200 per month.

Keep in mind that you will have other ongoing costs related to homeownership as well, including taxes, insurance, and utilities. All of these expenses need to be estimated before you settle on a monthly mortgage payment.

Also Check: How To Get A 2nd Mortgage

A Simple Formulathe 28/36 Rule

Here’s a simple industry rule of thumb:

- Housing expenses should not exceed 28 percent of your pre-tax household income. That includes your monthly principal and interest payments plus all the such as property taxes and insurance.

- Total debt payments should not exceed 36 percent of your pre-tax incomecredit cards, car loans, home debt, etc.

Tips To Maximize Your Budget

Knowing where you spend money every month is key when planning to purchase that first home, so you want to get a handle on your budget. Increasing your gross monthly income is one way to improve your DTI. But if thats not possible, reducing your monthly debt will help. Here are some tips:

- Pay down debt: Make an extra payment one month and consider adding it to your principal Youd be surprised how quickly you can decrease your overall debt. But dont forget to check if there are any prepayment penalties.

- Consolidate debt: Consolidate all those high-interest debts into a consolidation loan with a lower interest rate. Keep in mind, this may cause a temporary dip in your credit score.

- Cut out bad habits: Whether it is impulse buying or paying for streaming services you rarely watch, reducing those monthly credit card charges ultimately means less debt.

At Wyndham Capital Mortgage, we want our borrowers to feel comfortable purchasing that first home. Understanding how you could reduce monthly debt payments and the guidelines mortgage lenders use to determine the percentage of income that should go toward a mortgage could help you buy that dream home. If you have any questions, reach out to your loan officer today.

You May Like: What Type Of Mortgage Loan Do I Have

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

How Much Of Your Income Should You Spend On A Mortgage In The Uk

TL DR: You should try to spend no more than 35% of your gross income on your mortgage. A more conservative recommendation is no more than 25% of your gross income.

If you are currently in the market for a house you will first need to figure out exactly how much you can afford.

There are a lot of costs that go into buying a house and even a scrupulous planner can get overwhelmed by costs if they dont plan properly.

Inorder to figure out how much you can afford to spend on a house, youwill need to figure out:

- Your gross income

- How long of a mortgage you want

All of these factors go into determining how much you should be paying each month on your mortgage.

Before we go into specific recommendations for mortgage payments, were going to cover the major types of mortgages and how monthly mortgage payments are calculated.

Don’t Miss: Why Do Mortgage Loans Get Transferred

Take Advantage Of Lower Interest Rates

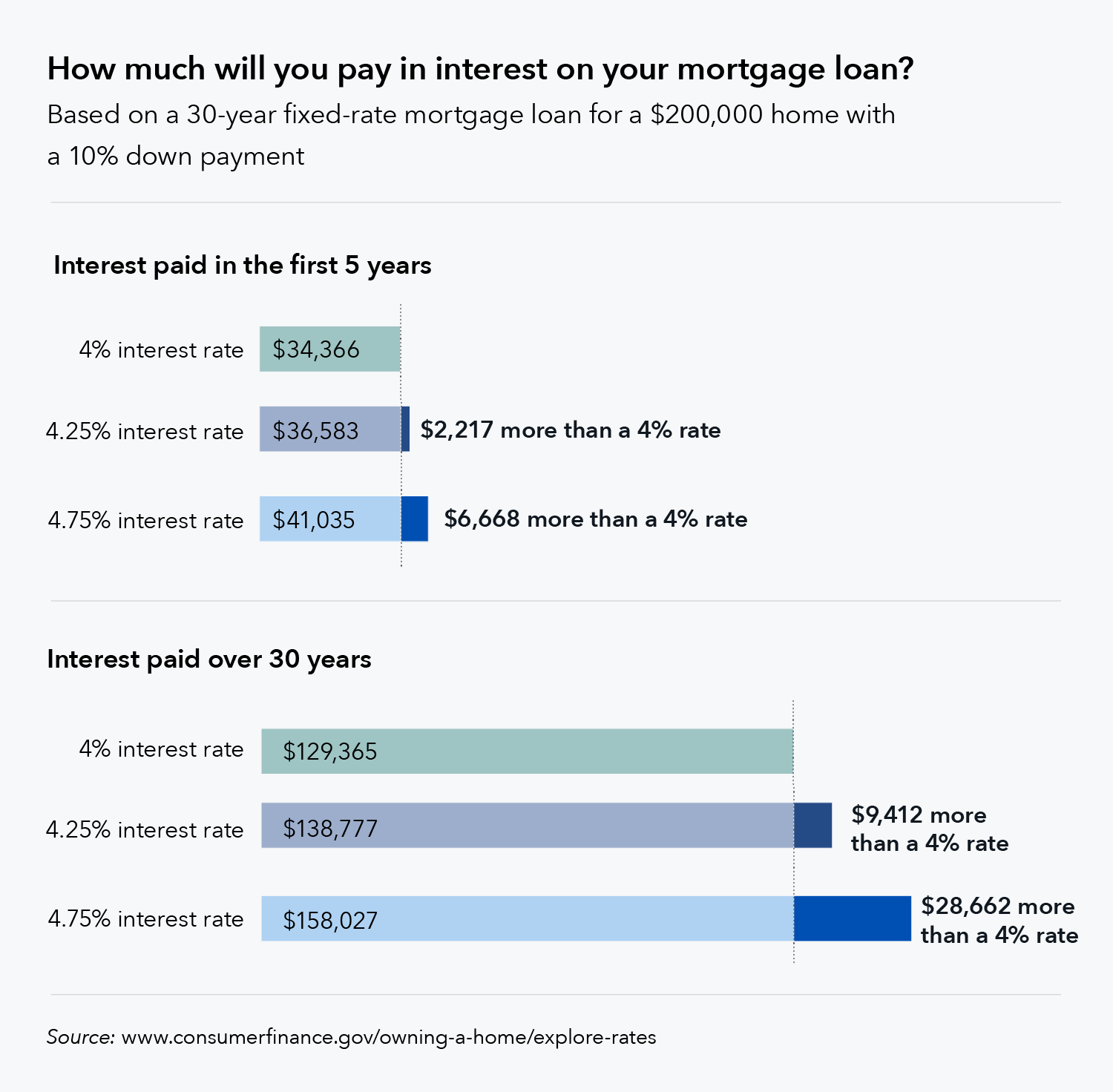

Besides buying a smaller home that has no wasted rooms, the next best thing is to get a mortgage with as low of an interest rate as possible.

Mortgage rates came down since the late 1980s and reached all-time lows in 2021 as the economy became more productive thanks to technology. Interest rates are closely coordinated around the world now and the Federal Reserve is more efficient in controlling inflation.

Although rates started to rise in 2022 along with inflation, you may still be able to save money by refinancing if you have a higher interest rate.

The best way to get a low mortgage rate is to shop around. Check out the latest highly competitive mortgage rates online today. You can get free, real refinance quotes in one place from multiple qualified private lenders competing for your business. Thanks to technology, its so easy to compare mortgage rates today.

All youve got to do is input your information and you should get real quotes to compare within three minutes.

How To Reduce Your Monthly Payment

There are a few things you can do to try and reduce your monthly payment, to make sure your mortgage is affordable. This is especially important if you have a lot of other debt, as you need to keep your DTI below 40%.

You can reduce your monthly payments by taking a longer mortgage term. This means spreading your payments out over a larger number of months. You will pay more interest in the long run, but it will keep your monthly payment lower.

If you have a lot of debt, you may need to focus on improving your credit score. A poor credit rating is a red flag to mortgage lenders. So you should concentrate on paying other debt down first, then you will qualify for better mortgage rates.

Finally, you should make sure you shop around for the best deals and get some expert mortgage advice. There are a lot of products on the market and things move quickly, so its a good idea to seek professional help.

Also Check: When To Refinance Your Mortgage Rule Of Thumb

Our Recommended Percentage Of Income For Mortgage

At Rocket Mortgage®, the percentage of income-to-mortgage ratio we recommend is 28% of your pretax income. This percentage strikes a good balance between buying the home you want and keeping money in your budget for emergencies and other expenses. However, its important to remember that you dont need to spend up to your monthly limit. Think of 28% as the ideal amount you should spend monthly on your total mortgage payment. Remember to include your principal, interest, taxes, insurance and homeowners association dues in your total before you sign on a loan.

What Does A Mortgage Payment Include

To understand how much of your income should go toward a mortgage loan, you first must understand the components that make up a mortgage payment. Each month, a portion of your payment will go toward the following:

- Principal: The principal balance of a mortgage refers to the original sum borrowed to purchase the house.

- Interest: Alongside the principal, the largest component of your monthly mortgage payment is interest, which is the cost you pay the lender in exchange for borrowing money.

- Property taxes: The exact cost of property taxes depends on the location and assessed value of the home.

- Homeowners insurance: This type of insurance protects your home against things like accidents and natural disasters.

- Mortgage insurance: If you make a smaller down payment, your lender will also require this type of insurance, which protects their investment in the event that you default on the loan. This could be paid in the form of private mortgage insurance or a mortgage insurance premium , depending on the loan type.

Find out what you can afford.

Use Rocket Mortgage® to see your maximum home price and get an online approval decision.

Also Check: What Banks Look For When Applying For A Mortgage

How Much Of A Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford .

Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

The Traditional Model: 35% Or 45% Of Pretax Income

In an article on how the mortgage crash of the late 2000s changed the rules for first-time homebuyers, the New York Times reported:

If youre determined to be truly conservative, dont spend more than about 35% of your pretax income on mortgage, property tax, and home insurance payments. Bank of America, which adheres to the guidelines that Fannie Mae and Freddie Mac set, will let your total debt hit 45% of your pretax income, but no more.

I would hardly call 35% of your pretax income conservative, let alone truly conservative.

Lets remember that even in the post-crisis lending world, mortgage lenders want to approve creditworthy borrowers for the largest mortgage possible. So when you obtain mortgage pre-approval, lenders will likely approve you for a loan amount with payments of up to 35% of your pretax income. That may tempt you to take on more home than you should. But dont just assume that because the bank approved it, you can afford it. They are two very different things.

Remember: The more you spend on your home, the less you have available to save for everything else. You may be able to afford a housing payment that is 35% of your pretax income today, but what about when you have kids, buy a new car, or lose your job?

December 22, 2017 by Barron Rothenbuescher

Also Check: How Much Is Mortgage On A 130k House

How Much House Can I Afford

12 Min Read | Sep 2, 2022

Buying a house. Its a huge life milestone and comes with a lot of emotions. But dont worry. I want to show you how our home affordability calculator can help you figure out how much you should spend on a house.

I want you to feel confident about how much house you can afford before you hit the ground running and start shopping. And our How Much House Can I Afford? calculator can do just that. All you have to do is enter your monthly income into our home-buying calculator to instantly get a home price that fits your budget.

Did you give it a whirl? As you can see from the results, how much house you can afford really depends on the relationship between your income and the mortgage.

To figure out how much mortgage you can afford with your income, housing lenders use different guidelinesbut most lenders dish out mortgages that are way more than people can afford . . . and keep them in debt for decades longer than they have to be!

I want you to buy a home thats a blessing, not a burden. And the only way to do that is to understand your home-buying budget and stick to it!

Thats where our home purchase calculator comes in. How does it work? Lets do a little math and see.

How Do Lenders Determine What I Can Afford

These are the major factors mortgage lenders weigh to determine how much mortgage a borrower can reasonably afford:

- Gross income Your gross income is your total earnings before taxes and other deductions are factored in. Other sources of income, such as spousal support, a pension or rental income, are also included in gross income.

- DTI ratio Your DTI ratio is your total monthly debt obligations divided by your total gross income.

- Your credit score is a major factor lenders look at when evaluating how much you can afford. In general, the higher your credit score, the lower your interest rate, which impacts how much you can feasibly spend on a home.

- Work history Lenders look for a stable source of income to ensure you can repay your mortgage. When you apply for a loan, youll be asked to provide evidence of employment from at least the past two years. If you work for yourself, youll be asked to provide tax returns and other business records.

Don’t Miss: What Score Does Mortgage Companies Use

What Is Your Gross Monthly Income

Before we dig into the details of the guidelines mortgage lenders use, lets get a handle on gross monthly income. Gross income is the money you earn whether it be from sources such as salary, profits, tips, alimony or freelance work before taxes and deductions for benefits such as health insurance are taken out.

For an employee who is paid a salary, calculating your gross monthly income takes one simple step:

Annual Salary Before Taxes / 12 = Gross Monthly Income

If you are paid hourly, there are a few extra steps required to calculate gross monthly income:

Step 1: Hourly Rate x Number of Hours Worked Per Week = Weekly SalaryStep 2: Weekly Salary x 52 = Annual SalaryStep 3: Annual Salary / 12 = Gross Monthly Income

Learn About Your Mortgage Options

Home buyers can typically choose from two main types of mortgages:

- A conventional loan that is guaranteed by a private lender or banking institution

- A government-backed loan

When choosing a loan, youll want to explore the types of rates and the terms for each option. There may also be a mortgage option based on your personal circumstances, like if youre a veteran or first-time home buyer.

Conventional loans

A conventional loan is a mortgage offered by private lenders. Many lenders require a FICO score of 620 or above to approve a conventional loan. You can choose from terms that include 10, 15, 20 or 30 years. Conventional loans require larger down payments than government-backed loans, ranging from 5 percent to 20 percent, depending on the lender and the borrowers credit history.

If you can make a large down payment and have a credit score that represents a lower debt-to-income ratio, a conventional loan may be a great choice because it eliminates some of the extra fees that can come with a government-backed loan.

Government-backed loans

Buyers can also apply for three types of government-backed mortgages. FHA loans were established to make home buying more affordable, especially for first-time buyers.

Rate types

First-time homebuyers

Read Also: What Is Mortgage Payment On 350 000

Using Your Dti As An Indicator

Now that you know your DTI, you can get a good idea of how much you can afford to pay monthly for your mortgage with a few simple calculations. In the example above, we saw that your DTI was 40%. If your ratio is approaching 50% , youll want to keep your housing expenses close to what youre paying now.

Keep in mind that your rent doesnt include other costs associated with owning a home, like insurance and taxes. This means youll likely end up taking a payment thats below what youre currently paying in rent to stay at the same DTI.

If you have less debt, you can be more flexible. For example, lets say your monthly debts equal $2,000 but your income is $8,000 gross. This puts you at a 25% DTI, which is great. In this instance, you can afford to take on more debt.

Lets say you want to keep your DTI at or below 35%. To consider how much you can afford in a mortgage payment, multiply your comfortable DTI by your gross monthly income. For example:

$8,000 × .35 = $2,800

Ideally, youll want to spend a total of around $2,800 per month on your mortgage payment. This will keep you around your ideal DTI.