Whats A Typical Bad Credit Mortgage Term Length

Bad credit mortgages are only meant to be used as a temporary stopgap measure while you get your finances in order. You wouldnt want to stay with a bad credit mortgage lender for long either. Thats why youll usually see bad credit mortgages with term lengths from 6 months to 2 years. Youll need to have an exit plan when applying for a bad credit mortgage so that you can transition back to aB lenderor A lender.

Have The Down Payment Ready

Cooper says some lenders will work with clients who have a credit score of less than 680, as long as certain criteria are met, like having a 20% down payment. Some lenders are OK with a credit score of 620 or 640, he says. If youre taking an insured mortgage, which is less than 20% down, then lenders seem to be OK with a lower credit score.

In this situation, the mortgage will be fully insured by the Canadian Mortgage and Housing Corporation , Canada Guaranty Mortgage Insurance Company or Sagen. This costs from 2.8% to 4% of the total mortgage amount, and will be added to your mortgage principal.

Choose A Fha Refinance Option

The FHA provides multiple mortgage refinancing programs for homeowners with lower credit scores. One big requirement: your mortgage must already be a FHA loan to qualify. They include:

- FHA streamline refinance: To qualify for this loan, you must have an existing FHA mortgage and be current on the payments. There are two types of FHA streamline refinance loans credit-qualifying and non-credit-qualifying. The latter of the two doesnt require a home appraisal, a full credit check, or take your debt-to-income ratio into consideration. But you might have to pay a slightly higher interest than if you were to refinance with a credit-qualifying loan.

- FHA rate-and-term refinance: You might benefit from this type of FHA loan if you have a high interest rate. Its designed to help borrowers refinance their prime residences and reduce monthly housing costs. Unlike the FHA streamline refinance, a credit check and a new appraisal is required. And to qualify, you have to show you have paid six consecutive mortgage payments on time and in full.

Read Also: How To Find Out The Mortgage On A House

When Can You Refinance A Mortgage

Refinancing at the end of the mortgage term is best because you will avoid paying heavy penalty fees for breaking the contract. Still, many Canadians choose a mid-term mortgage to refinance, which can work under the correct conditions. Youll need to ensure that the savings you make outweigh the fees and costs associated with breaking the mortgage mid-term.

How To Refinance Your Home Mortgage Loan

If you are asking yourself How do I refinance my home? the process is actually easier than you think. Your first step is to break your mortgage contract early.

This is when you end your existing mortgage and take a new one with a different lender, the process of refinancing.

The next step can change depending on the new lender and conditions you choose. In a home refinance, a new mortgage gets created and pays the balance of the old one.

Some people may choose a similar method in which they go for a home equity loan or HELOC.

Don’t Miss: Is A Balloon Mortgage A Good Idea

Home Refinance In Canada

Refinancing a house using traditional lenders is becoming tougher. There are now strict qualifying criteria put in place by banks that look at income, credit history, and job stability.

Even if you do qualify, you are usually restricted to lending 65% of the equity.

Luckily there are other options for a mortgage refinance, such as alternate lenders.

They often have more relaxed criteria, meaning you can leverage the value in your property even when turned away from these institutions.

Good Vs Bad Credit: What Is A Good Credit Score

Your credit score is calculated based on the length of your credit history, your payment history and the amount of debt that youre carrying. It is represented with a number between 300 and 900. The higher the number, the better your credit score, meaning you may be offered a lower interest rate on loans and credit cards. The general breakdown of credit score looks like this:

| Category | |

|---|---|

| Excellent | 760 to 900 |

When it comes to your credit history, the longer youve had a record of paying off debt, the better. But aim for at least a year of good credit payment history before you apply for a mortgage. You can check your credit score and history at Equifax, TransUnion and Borrowell for free.

Recommended Reading: What Banks Use Experian For Mortgages

Can You Refinance Your Mortgage If Your Have Bad Credit

Mortgage refinancing can help lower your payments and save you money. But is it possible to refinance your mortgage if you have poor credit? The short answer is yes, you can. However, there are a few things you can do to help smooth the process:

Make Sure Your Application Is Attractive

It is very important to understand that refinancing your mortgage with lower than average credit can make it difficult to qualify. To help improve your candidacy as an applicant, be sure to include all the necessary documents like pay stubs, the prior years tax documents, and any other supporting information you can.

For example, if you are due for a large raise or promotion, request a letter documenting the change in your pay to show. Job history demonstrates security so asking for a letter from your human resources department documenting the tenure of your employment can also improve your application.

Build The Equity In Your Property

No matter how beautiful your home is, few banks will be willing to refinance your mortgage if you owe more on it than it is worth. Banks issue loans based on the market value of your property and without your own money invested, the investment for a third party is risky. Different banks require different amounts of equity so be sure to do your research. For example, more conservative banks may want you to have 25% of the homes value invested, while more aggressive lenders may be okay with 5% to 10%.

Learn how to build equity in your home.

Know What to Expect

Ask About Portfolio Loans

A portfolio loan is an exclusive deal between a borrower and lender that doesnt necessarily follow the same structure as a traditional mortgage. Instead, these loans are modified to address a specific financial situation, such as a borrower with a credit score below 620. Portfolio loans can be beneficial in certain situations, though youll likely be asked to pay a higher interest rate.

Also Check: How Much Will We Get Approved For A Mortgage

Can I Refinance My Home With A 580 Credit Score

It is possible to refinance your home with a 580 credit score or even lower depending on the equity you have in your home. The lower your score, the higher the fees and interest will be.

Lenders may restrict how much they will offer if your score is very low. That is you may only access 80% or 75% of your home’s value with a very low credit score.

There are always options and it’s best to speak with a broker to determine what options and lenders that you have access to.

How Does Mortgage Refinancing Work

In Canada, the process of refinancing a mortgage is simple and you can choose this option once some equity has been built on your property. Importantly, your current mortgage does not need to be up for renewal before you can refinance the loan. Reasons to consider a remortgage include:

- Borrow more money against your home.

- To get a better mortgage rate.

- Change the mortgage term length.

Refinancing a mortgage is a popular borrowing method for millions of Canadians. You can get a large loan lump sum against the equity of your home and often get better interest rates than other types of debt.

If you embark on the refinancing mortgage process, choosing the best rate and terms is important. Shopping around online for the top remortgage rates is the most efficient way to get the best refinancing conditions that meet your needs.

Don’t Miss: Why Are Condo Mortgage Rates Higher

Get More Cash Out With A Va Loan

Military homeowners can borrow up to 90% of their homes value with a VA cash-out refinance thats 10% more than FHA or conventional cash-out refinance guidelines allow. However, while the VA doesnt set a minimum credit score, lenders will often require at least a 620 score. Like other VA refinance loan options, no mortgage insurance is required, though you may pay a VA funding fee.

Will Refinancing Hurt My Credit

Any refinancing action will have an impact on your credit, both negative and positive.

On the negative side, the inquiry will show up on your credit report and be factored into your scores, albeit minimally. The new loan will reduce the average age of your accounts, so it will shorten your credit history. Still, these negatives are only temporary, and your scores will rebound when you handle this and other accounts responsibly.

Each of these credit score factors will be affected by refinancing.

Keep in mind that there is no limit to the number of times you can refinance a loan, but doing it too often can take a toll on your scores, since it will further erode your credit history.

On the positive side, refinancing your loans can help put positive data on your credit reports, which, in turn, will increase your credit scores. A lower interest rate will make it easier for you to get out of debt quickly and efficiently. If it puts more money in your pocket, you can use it to pay other financial obligations down.

And, if the new loan lowers your payments so they are more affordable, you may be less likely to go delinquent when cash is tight.

Read Also: What Is A Mortgage Deed

How Can I Improve My Credit Score With A Mortgage Refinance

The most important thing, in my opinion, to consider when you have bad credit and are applying for a mortgage refinance is your goal. And, your goal should be to get into a better financial situation.

Depending on your credit and the accuracy of what’s reporting, you might need some help fixing your credit. Loans Canada has a service that can help fix reporting issues on your credit report. In the drop down menu below, choose “fix errors on credit report” to get more details.

If you want to look at a solution where someone can help you to settle out some of your debt then choose “Debt Consolidation” from the drop down menu above. Then you will be directed to a company who could help you settle your debt.

Every situation is unique and if you have questions about what might be best for you, then connect with us. Visit the About Us page and complete the form under my character or phone me directly.

See If Youre Eligible For A Va Streamline Refinance

Homeowners who already have a loan backed by the U.S. Department of Veterans Affairs can use a streamline refinance program known as the VA interest rate reduction refinance loan . Theres no mortgage insurance, income verification or appraisal required for an IRRRL, and as long as theres a money-saving benefit and youve paid your VA loan on time, the approval process is fairly simple. Still, you may have to pay a VA funding fee unless youre exempt.

Recommended Reading: How Much Income To Qualify For 400 000 Mortgage

Review Your Credit Report And Check Your Credit Score

To figure out your best option, youll need to check your credit report. Your credit score will be based on the information contained in this report.

You can request a report from any one of the three credit reporting agencies Experian, Equifax and Transunion. Typically you would be able to obtain one free credit report from each of the agencies per year, but as part of the measures put in place to protect consumers during the pandemic, you can request a free credit report on a weekly basis until April 2022.

After reviewing your report, youll want to check your credit score. Sites like Credit Karma will provide your score for free. Many credit card providers now offer access to your score as well.

Basic Factors In Fico Score Calculation

FICO scores are weighted. Different elements of your credit history carry varying degrees of importance. FICO determines your score based on:

Overall, the higher your credit score, the greater likelihood that a lender will refinance your mortgage. Even better, you will earn a lower interest rate and pay less money over the term of your refinanced mortgage.

A lower score means that even if you are able to secure a loan or credit, you’ll likely pay for your past financial missteps with a higher interest rate. Fair Isaac Corp., the FICO score creator, estimates bad credit will add 1.5 percentage points to your rate as compared to otherwise identical customers with high credit scores. Is refinancing with bad credit impossible? No. Difficult? Yes. As you might expect, a successful outcome for a bad credit refinance requires a clear set of goals, some work and a little luck.

You May Like: Can I Get A Mortgage Loan After Chapter 7

Rebuild Your Credit To Refinance

If you can’t refinance now because of a bad credit score, focus on rebuilding your credit. Here’s the bright spot: It’s possible to elevate a low score fairly quickly. Small actions, such as paying bills on time and using a smaller percentage of your credit limit on credit cards, can make a big impact. Get your free credit score and monitor the changes.

» MORE:8 ways to build credit fast

How Does A Second Mortgage Work

The equity of your home can increase if you make lump sum principal payments on your mortgage, make upgrades to your home that increase its value or if valuations in your location go up. Higher equity means you can receive a higher amount from lenders for your second mortgage to meet your financial needs.

Although each lender has a unique combination of requirements for a second mortgage, some standard rules include a maximum of 90% of the appraised market value of your home for both mortgages. Aside from equity, lenders will also consider how much you still need to repay on your primary mortgage. Once you determine the second mortgage amount, you can use MoneyGeeks mortgage calculator to estimate how much you will pay per month.

The mortgage amount will not be the same as your home’s value since lenders spare a percentage to ensure you have some equity left.

Recommended Reading: What Factors Affect Mortgage Interest Rates

Find A Different Lender

If your lender is unwilling to work directly with you to help you refinance your loan, you may need to research other lenders. Every lender will have different loan approval standards. You may find your unique financial profile, combined with lower interest rates, could result in a lender willing to buy your current mortgage with a lower interest rate.Additionally, by searching around, you could find a lender more willing to help individuals with poor or bad credit looking to refinance their mortgage.

Read Also: What Are The Risks Of A Reverse Mortgage

Refinance My Mortgage With Bad Credit

Did you know that Canadian households are carrying around $2.5 trillion in outstanding debt? 2/3 of this debt comes from mortgages while only 1/3 was for every other debt type.

If youre a Canadian homeowner with outstanding mortgage debt, these statistics may not come as a surprise to you. One way to balance out your debt is by refinancing your home.

Even those with bad credit can opt for a mortgage refinance. Read on to learn how.

Also Check: How Much Can I Loan Mortgage

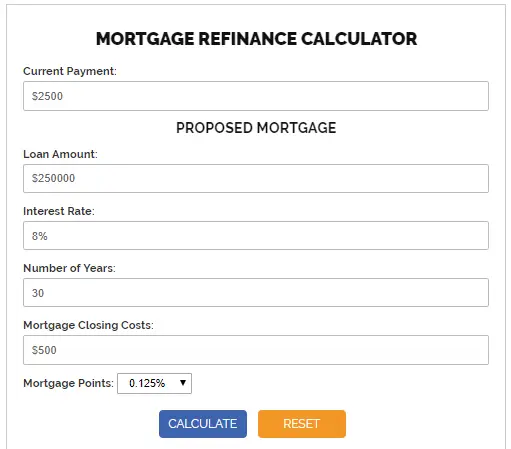

What Is Home Refinancing

A mortgage refinance works by paying off an old mortgage with a new one. It uses the value of your home against how much you have paid off your existing mortgage to release equity.

You then have better terms and can release cash.

To get a possible figure about how much value is in the property, start by determining how much your home is currently worth.

You can do this by looking at similar homes in the area and getting an approximate market value.

From this, calculate 80% of this value. This is the biggest amount you can aim at refinancing for, as this is the standard mortgage amount.

After this, calculate the outstanding balance left on your mortgage. Subtract this away from the 80% value of your home.

This is to account for the money you would need to pay off the existing mortgage.

Your remaining sum is the possible equity left in your home. This means you may be able to refinance for this amount.

Private Mortgage Lenders For Bad Credit

There are plenty ofprivate mortgage lendersthat offer bad credit mortgages in Canada. A few examples include Alpine Credits, Prudent Financial, Clover Mortgage, Canadalend, and Guardian Financing. Forprivate mortgage lenders in Ontario, a few examples include Castleton Mortgages, MortgageCaptain, and MortgageKings. You might be required to go through a bad credit mortgage broker in order to access some private lenders, as some may only work through brokers.

Some private lenders have no minimum credit score requirements, and some even allow you to make interest-only payments on your mortgage. This can help you keep up with your payments if you are having cash-flow issues. Making regular mortgage payments to a private lender can also help improve your credit score, making it easier to eventuallyrefinance your mortgageat a lower mortgage rate with another lender.

You May Like: Is Mortgage Interest Rate Going Up Or Down