What Are The Different Types Of Arms

There are different types of ARMs that lenders offer. The name of these ARMs will indicate:

- The duration of the initial period.

- How often in a year your rate can adjust during the adjustment period.

Lets look at an example: The most common adjustable-rate mortgage is a 5/1 ARM. This means you will have an initial period of five years , during which the interest rate doesnt change. After that time, you can expect your ARM to adjust once a year .

Most ARMS will also typically offer a rate cap structure, which is meant to limit how much your rate can increase or decrease.

There are three different caps:

- Initial cap: Limits how much your rate can increase when your rate first adjusts.

- Periodic cap: Limits how much your rate can increase from one adjustment period to the next.

- Lifetime cap: Limits how much your rate can increase or decrease over the life of your loan.

Lets say you have a 5/1 ARM with a 5/2/5 cap structure. This means on the sixth year after your initial period expires your rate can increase by a maximum of 5 percentage points above the initial interest rate. Every year thereafter, your rate can adjust a maximum of 2 percentage points , but your interest rate can never increase more than 5 percentage points over the life of the loan.

When shopping for an ARM, you should look for interest rate caps you can afford.

Read Also: How Much Mortgage Do I Qualify For

Will Interest Rates Go Up

Its always difficult to predict when the base rate might change, but in 2022 it has been increasing to the current rate of 3% and many experts predict that we will see further rises going into 2023.

Mortgage interest rates are typically affected across the board, so even the fixed-rate deals available now are much higher than they were last year. If youre currently on a fixed-rate deal, however, you wont be affected by the higher interest rates until it comes to an end.

If you are close to the end of your current deal, especially within the final six months, its a good idea to look at the best options available to you now, as they may not be so competitive in six months time.

Forbes Advisors Insight On The Housing Market

Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future.

To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection. However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection.

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their forever home have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. Thats why its so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

Don’t Miss: How To Pay Off 30 Year Mortgage Early

What Is A Good 10

Mortgage rates will vary between different lenders as well as from day to day. Even if you look at averages from places like Fannie Mae or Freddie Mac, getting a good rate will depend on a few factors, including your credit profile, total loan value, and the lender you ultimately go with. Thats why its important to shop around different lenders to receive customized quotes to find the best one.

Considering borrowers need to make high monthly payments, lenders are more likely to require an excellent credit score. This is in addition to factors such as having a sizable amount of assets, steady income, and a low debt-to-income ratio.

Your DTI, calculated by dividing your total debt payments against your gross income, is a percentage lenders use to determine whether youll be able to easily afford your monthly mortgage payment in addition to your other debt payments. In other words, lenders want to see that youre not at risk of stretching yourself too thin financially.

When you apply for a 10-year loan, lenders will provide you with a loan estimate. This document outlines in detail the initial quote, including the interest rate and any additional fees. That way, you can see what your total costs are throughout the entire loan.

How This Site Works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances and remember we focus on rates not service.

- We don’t as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and it’s rarely made public until it’s too late .

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We often link to other websites, but we can’t be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the Moneysupermarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally binding MSE Editorial Code.

Read Also: What Does Qm Stand For In Mortgage

When Not To Fix For 10 Years

Not every person should fix their rate. A fixed rate is only suitable if your personal situation is unlikely to change in the future. A 10-year fixed rate will be unsuitable if you:

- Are planning to make large lump-sum repayments.

- Plan on selling the property in the first 10 years.

- Require a flexible loan with features such as an offset account or a redraw facility.

Please discuss your needs with an expert mortgage broker they can help you structure your mortgage in such a way that the lack of flexibility does not affect your future plans.

Years Fixed Rate Mortgages Explained

A 10 year fixed rate mortgage is a type of mortgage where your interest rate is fixed for 10 years. The advantage to this type of mortgage is that youll have budgeting certainty for a whole decade, as you know that your monthly payments wont change throughout this period. This could be particularly attractive to someone who wants to be able to budget after the big expense of buying a home.

The stability of 10 year fixed mortgage rates can also work for those who simply like to have certainty in their budget.

The potential downside of this type of mortgage is that youre locked into paying the same amount each month, regardless of changes in interest rates. So whilst you wont have to pay more if interest rates go up, you also wont benefit from a reduction in your monthly payments if interest rates do go down.

You should also bear in mind that most lenders require you to pay an Early Repayment Charge if you want to leave a fixed rate deal early, the cost of which is usually fairly significant. If youre considering a long-term deal, its important to think about any changes that could occur over the next decade. If you need more flexibility but still want some security of payment, you might want to consider a 5 year fixed rate mortgage instead.

Also Check: Do Mortgage Companies Accept Credit Card Payments

Should I Get A 10 Or 15

Products with longer initial fixed terms, such as 10 to 15 year fixed rate mortgages, are relatively new and offer the opportunity for borrowers to freeze their repayments over a longer period. The last few years have seen historically low interest rates, and some people take the view that these cannot last forever consequently, 10 and 15-year mortgages are a way of avoiding interest rate rises in the long-term. Of course, this assumes that interest rates will not fall further but, in any case, borrowers will have the benefit of knowing what their repayments will be for a substantial portion of their whole mortgage term.

Who Should Consider A 10

Homeowners who want to be able to pay off their mortgage quickly and have the means to pay the large monthly payment should consider a 10-year mortgage. Also, since lenders may view these types of borrowers as more high-risk , youll most likely need to have an excellent credit profile in order to qualify.

A 10-year home loan is also best for those who want to refinance their mortgage and have been paying down their existing loan for a while. For instance, those who have close to 10 years until theyre mortgage-free may not want to refinance to a loan with a longer term. That is, unless youre looking to refinance to a longer term to lower paymentskeep in mind youll end up paying more in interest in the long run if you go with the longer loan term.

First-time home buyers who are younger should carefully consider whether a 10-year mortgage is the best choice. Look at your current income and whether it can sustain a larger monthly mortgage payment besides other financial obligations and savings goals. A longer term may be more beneficial so that you can leave room in your budget for expenses such as student loans, creating an emergency fund, or other costs associated with homeownership like repairs.

You May Like: Can You Use Home Equity To Pay Off Mortgage

Which Bank Has The Lowest 10

Finding the cheapest fixed rate is not as simple as a quick Google search because most banks set their fixed mortgage rates weekly or fortnightly.

The table below gives you a general idea by showing the best fixed interest rate and comparison rate currently available in the market:

| Fixed Loan Term |

|---|

Here are three things you need to know about fixed-rate offers in Australia:

- Fixed rate specials: Did you know that there are often specials on long-term fixed rates? Banks tend to offer specials on fixed-rate loans when they get access to a cheap source of long-term funding. Often this funding is only available to one lender, temporarily making them the market leader.

- Lenders to choose from:Currently, only the big four banks are offering 10-year fixed interest rates.

- Hidden conditions:How much extra are you allowed to pay each year? Is there a rate lock available? Can you do interest-only repayments for 10-year fixed investment loans? Mortgage brokers know the hidden rules of each lender and can quickly identify the most suitable loan for your situation.

If you are looking for the cheapest fixed-rate loans then please call us on 1300 889 743 or to speak to one of our fixed-rate mortgage brokers.

When Will Mortgage Rates Go Down

Mortgage rates rose steadily in 2022 before taking a substantial dip in mid-November. But experts are still predicting overall higher rates next year, with near-term drops likely to be only temporary.

We polled eight industry insiders for their 2023 mortgage rate predictions and answers varied widely, from just 5% to over 9% for the 30-year fixed rate.

Experts tend to agree that continued high inflation will keep pushing mortgage rates up, while it would take a serious recession or an unexpected black swan event to push them much lower.

In this article

You May Like: What Is The Average Mortgage Payment In Florida

Sage Mortgage Best Broker

Established in 2020, Sage Mortgage is an online mortgage broker licensed in 20 states, able to connect you with the best rates and loan terms based on your situation. The broker is owned by Red Ventures, parent company of Bankrate.

Strengths: As a mortgage broker that works with several wholesale lenders, Sage Mortgage is able to offer competitive rates, and you can get a custom quote in less than a minute online.

Weaknesses: Sage Mortgage isnt licensed everywhere, so youll need to confirm availability, or potentially work with another broker.

Read Bankrates full Sage Mortgage review

When Is The Right Time To Refinance

The best time to refinance to a 10-year mortgage will depend on whether the potential savings outweigh the fees youll pay and other financial considerations. Keep in mind that you could be paying a higher monthly payment, so homeowners should look at their monthly budget to see if its possible to take this on.

In general, refinancing is a good idea for borrowers with adjustable-rate mortgages looking to stabilize their payments, or for homeowners looking to tap into their equity to fund other projects, like home improvement. You can refinance into any length of loan term, but a 10-year is best for borrowers who want to pay off their mortgage as soon as possible and have the resources to do so comfortably.

Keep in mind that 10-year mortgages tend to have high payments, so its important to look closely at your finances to decide if you can comfortably afford your new loan in addition to your other monthly expenses.

Also, be sure to look beyond the interest rate when refinancing. Lenders may charge appraisal, closing, origination or other types of fees to refinance. Your current lender could also assess penalties for paying off your loan early, so look into the fine print before proceeding.

One way to see whether refinancing makes sense is to calculate how much youll save in interest and subtract it from the fees youll pay. Youll also want to take into consideration how long you plan on staying in your home to find the breakeven point after refinancing.

Read Also: How Much Does A Loan Officer Make On A Mortgage

What Is A Fixed

A ten year fixed-rate is an unusual and lengthy mortgage product. With this you are locked into your mortgage for ten years, and during that period your interest rate will remain the same.

This means youll know exactly what youll repay for a decade. But, its difficult to move home during that period or remortgage without having to pay hefty exit penalties.

What Is A 5/1 Arm Loan

A 5/1 ARM is a type of adjustable-rate mortgage that has a fixed rate for the first five years. After that period, 5/1 ARM rates fluctuate based on your loan terms. A 5/1 ARM may also be called a hybrid mortgage, which means it combines a temporary fixed-rate mortgage with an adjustable-rate mortgage.

The 5 in the 5/1 ARM is the number of years your rate is temporarily fixed. The 1 is how often the rate can adjust after the initial fixed-rate period ends in this case, the 1 represents one year, so the rate adjusts annually.

Read Also: How To Write An Appeal Letter For Mortgage Assistance

What Is The Average Fixed Rate For Mortgages In The Uk

Mortgage rates in general tend to fluctuate from day to day and in some cases from hour to hour so the average fixed rate mortgage is a constantly moving target. However, if you really want to see what kind of fixed rate mortgage products and the cheapest rates – out there are, then just go straight to our fixed rate mortgage comparison charts. Youll be able to get a whole of market view of the choice, as well as being able to find the exact product that suits your individual needs.

Historical Mortgage Rates Chart

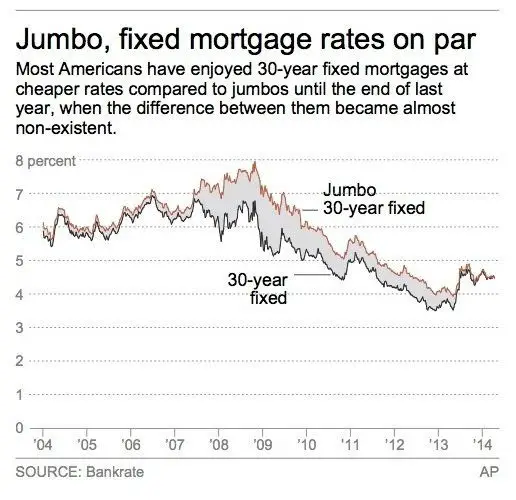

Despite recent rises, todays 30-year mortgage rates are still below average from a historical perspective.

Freddie Mac the main industry source for mortgage rates has been keeping records since 1971. Between April 1971 and August 2022, 30-year fixed-rate mortgages averaged 7.76 percent.

So even with the 30-year FRM above 5%, todays rates are still relatively affordable compared to historical mortgage rates.

Read Also: What Is A Mortgage Quote

How Adjustable Rate Mortgages Are Calculated

The method for calculating interest rates on ARMs is based on a simple mathematical formula: index rate + margin = interest rate.

The index rate typically is based on one of three indexes: the London Interbank Offered Rate the one-year Treasury Bill or the Cost of Funds Index . Some lenders have their own cost of funds index so its important that you ask what index is being used and where it is published so you can keep track of it.

Your lender chooses which index to base your rate on when you apply for the loan, but the LIBOR is the most popular index used.

Your lender also determines the margin you will pay, which is the number of percentage points added to index. The margin percentage varies from one lender to the next and should be a focal point of your research when applying for an ARM. That margin should be constant throughout the life of your loan.

In the spring of 2018, the LIBOR index was 2.66%. The common margin rate was around 2.75%. Using the formula above index rate + margin = an interest rate of 5.41%.

Are Fixed Rate Mortgages Best For First

The answer to this depends on your individual circumstances, as well as the interest rate levels when you are buying your first home. First-time buyers are often attracted to fixed rate mortgage deals as they have the benefit of fixed monthly repayments. This allows first-time buyers to budget effectively especially in the early years of a mortgage when money might be tight.

Don’t Miss: Why Are Mortgage Rates Dropping