Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Other Mortgage And Financial Calculators

In addition to the standard mortgage calculator, this page lets you access more than 100 other financial calculators covering a broad variety of situations. Choose from calculators covering various aspects of mortgages, auto loans, investments, student loans, taxes, retirement planning and more.

All rights reserved. Mortgageloan.com® is a registered service mark of ICB Solutions, a division of Neighbors Bank, Equal Housing Lender Member FDIC, NMLS # 491986 ICB Solutions or Mortgageloan.com does not offer loans or mortgages. Mortgageloan.com is not a lender or a mortgage broker. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. We do not engage in direct marketing by phone or email towards consumers. Contact our support if you are suspicious of any fraudulent activities or if you have any questions. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers.

By Brandon Cornett | Copyright © HBI 2022 | All Rights Reserved

How Much Interest Can Cost

Your interest rate and how its calculated affects your regular mortgage payments. A mortgage is usually a large amount of money. Therefore, small differences in the interest rate can have a significant impact on your costs.

Figure 1: Example of monthly mortgage payment for a mortgage of $300,000.00 with an amortization of 25 years at various interest rates

| Interest cost over 5 years | Interest cost over 25 years |

|---|---|

| 2.50% | |

| $73,097.91 | $233,738.23 |

Make sure your home is within your budget. Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, you may be overextending yourself.

Recommended Reading: What Does It Mean To Be Prequalified For A Mortgage

How A Mortgage Calculator Can Help

As you set your housing budget, determining your monthly house payment is crucial it will probably be your largest recurring expense. As you shop for a purchase loan or a refinance, Bankrate’s Mortgage Calculator allows you to estimate your mortgage payment. To study various scenarios, just change the details you enter into the calculator. The calculator can help you decide:

Understanding The Basics Of Mortgage Interest

Buying a home is one of the biggest decisions you will make in your lifetime. For most people, buying a home also means getting a mortgage. When you borrow money under a mortgage, the lender will charge you interest based on the borrowed amount and the time it takes for you to repay them.

Heres what you need to know about mortgage interest and how it works at ATB.

Read Also: Can You Change Your Mortgage Rate After Locking

What Is A Mortgage Principal

A principal is the original amount of a loan or investment. Interest is then charged on the principal for a loan, while an investor might earn money based on the principal that they invested. When looking at mortgages, the mortgage principal is the amount of money that you owe and will need to pay back. For example, perhaps you bought a home for $500,000 afterclosing costsand made a down payment of $100,000. You will only need to borrow $400,000 from a bank or mortgage lender in order to finance the purchase of the home. This means that when you get a mortgage and borrow $400,000, your mortgage principal will be $400,000.

Your mortgage principal balance is the amount that you still owe and will need to pay back. As you make mortgage payments, your principal balance will decrease. The amount of interest that you pay will depend on your principal balance. A higher principal balance means that youll be paying more mortgage interest compared to a lower principal balance, assuming the mortgage interest rate is the same.

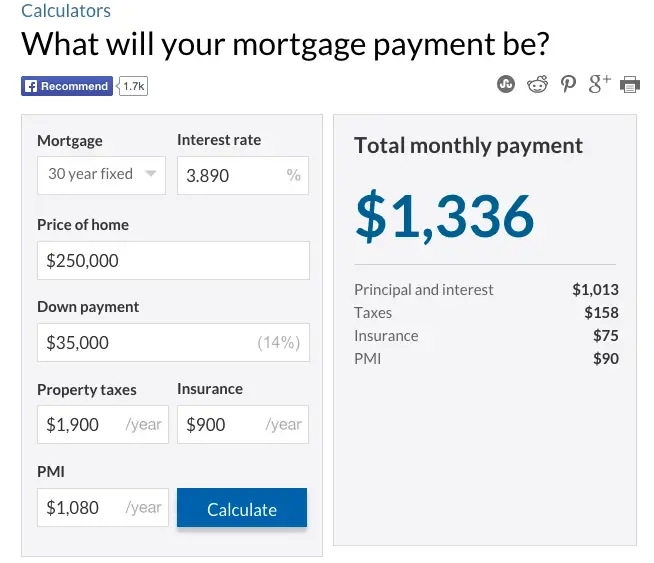

Don’t Forget Taxes Insurance And Other Costs

If you’re buying a home, you’ll also need to consider some other items that can significantly add to your monthly mortgage payment, even if you manage to get a great interest rate on the loan itself. For example, your lender may require that you pay for your real estate taxes and insurance as part of your mortgage payment. The money will go into an escrow account, and your lender will pay the bills as they come due. These costs are not fixed and can rise over time. Your lender will itemize any additional costs as part of your mortgage agreement and recalculate them periodically.

Recommended Reading: What Is The Amortization Schedule For A 30 Year Mortgage

The General Interest Rate Market

Mortgage rates are more sensitive to market fluctuations than most other loans. See, these days most mortgage loans are sold on the secondary market and securitized into large pools of loans with similar characteristics. These pools of loans, known as Mortgage Backed Securities , are bonds sold to investors and whose prices are determined by market conditions. As the prices of MBSs fluctuate in the market, so do mortgage interest rates. And since no investment is analyzed in a vacuum, because investors have choices when it comes to where they invest their money, MBS prices are heavily influenced by the prices of other bonds.

So now lets take a deeper look into bond pricing

Bond prices are typically analyzed relative to market benchmarks. These benchmarks tend to be risk-free treasuries backed by the U.S. government . In the case of MBSs, for example, the most commonly-used benchmark is the 10-year Treasury.

However, since the majority of bonds are not risk-free , there are several premiums used in bond pricing to compensate investors for expected and unexpected risks to which investors in risk-free investments are not exposed . These are:

How To Beat Mortgage Interest Rate Rises

If youre on a variable-rate deal such as a discount or tracker mortgage, changes to the Bank of England base rate or your banks standard variable rate will have an immediate impact on how much youre paying each month.

If this happens, its worth investigating whether you could save money by remortgaging.

A rate rise can also hit you hard when you reach the end of an initial deal period for example, if youve reached the end of your fixed-rate mortgages introductory period, which might be two or five years.

When this period runs out, youll usually revert to your lenders standard variable rate , which is likely to be a lot higher.

In most cases, youll be able to get a better deal if you remortgage your home at this point, as youll have built up more equity in your property and introductory rates on new deals will almost always be cheaper than your current lenders SVR.

Recommended Reading: How Do Lenders Determine Mortgage Loan Amount

Consider The Cost Of Property Taxes

A monthly mortgage payment will often include property taxes, which are collected by the lender and then put into a specific account, commonly called an escrow or impound account. At the end of the year, the taxes are paid to the government on the homeowners’ behalf.

How much you owe in property taxes will depend on local tax rates and the value of the home. Just like income taxes, the amount the lender estimates the homeowner will need to pay could be more or less than the actual amount owed. If the amount you pay into escrow isn’t enough to cover your taxes when they come due, you’ll have to pay the difference, and your mortgage payment will likely increase going forward.

You can typically find your property tax rate on your local government’s website.

How Mortgage Interest Rates Are Calculated In Canada

Canadian Mortgage Interest Rate Fundamentals

For most Canadians, the biggest financial transaction they will undertake is buying a home. Very few Canadians can afford to purchase their home outright, meaning, most have to qualify for a mortgage. Unfortunately, few Canadians fully understand how mortgages work and are priced. Most know they want a low interest rate, but dont appreciate what kind of impact a seemingly small 0.25% mortgage interest rate hike will have on the total cost of their mortgage or how it will impact their day-to-day living.

A quarter point rate hike might not seem like a lot, but it adds up. If you have a $200,000 mortgage and an interest rate of 2.8%, you would pay around $926 monthly. With a mortgage rate of 3.6%, that same mortgage will now cost $1,009 per month.

Fixed-Rate or Variable-Rate Mortgages?

One big factor that dictates mortgage interest rates is whether you have a fixed-rate or variable-rate mortgage. The majority of Canadian homeowners have a fixed-rate mortgage with this, you make the same interest rate mortgage payments each month.

Homeowners like fixed-rate mortgages because they like knowing how much they pay each month and the security of knowing they are protected if interest rates rise.

Nothing is fool proof though, fixed-rate mortgages often come with harsher penalty fees should you break the mortgage.

How Is Mortgage Interest Calculated in Canada?

To figure out your interest rate:

Do mortgage payment go down over time?

Read Also: How To Create A Mortgage Note

Mortgage Effective Annual Rate Formula

To account for semi-annual compounding, you can calculate your mortgages effective annual rate . The number of compounding periods in a year is two. To use the effective annual rate formula below, convert your interest rate from a percent into decimals.

For example, if your mortgage lender quotes a mortgage rate of 3%, then your effective annual rate will be:

If your mortgage lender quotes a mortgage rate of 5%, then your effective annual rate will be:

This calculation assumes that interest will be compounded semi-annually, which is the law for mortgages in Canada. For a more general formula for EAR:

Where n is the number of compounding periods in a year. For example, if interest is being compounded monthly, then n will be 12. If interest is only compounded once a year, then n will be 1.

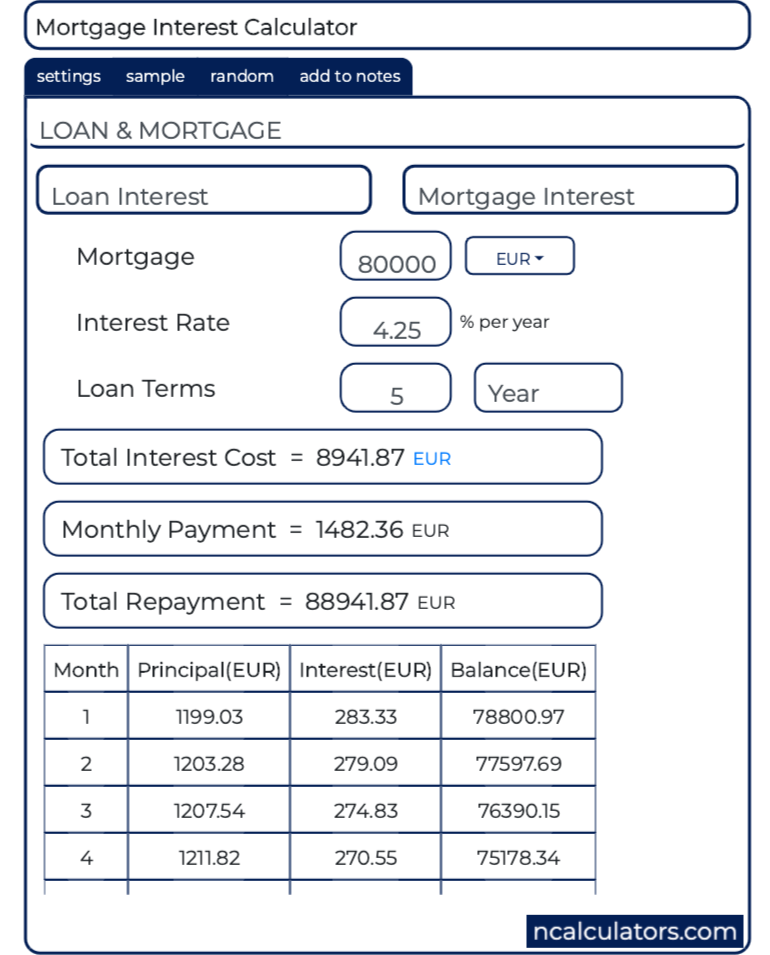

Mortgage Interest Calculator Canada

When you make amortgage payment, you are paying towards both your principal and interest. Your regular mortgage payments will stay the same for the entire length of your term, but the portions that go towards your principal balance or the interest will change over time.

As your principal payments lower your principal balance, your mortgage will become smaller and smaller over time. A smaller principal balance will result in less interest being charged. However, since your monthly mortgage payment stays the same, this means that the amount being paid towards your principal will become larger and larger over time. This is why your initial monthly payment will have a larger proportion going towards interest compared to the interest payment near the end of your mortgage term.

This behaviour can change depending on your mortgage type. Fixed-rate mortgages have an interest rate that does not change. Your principal will be paid off at an increasingly faster rate as your term progresses.

On the other hand,variable-rate mortgageshave a mortgage interest rate that can change. While the monthly mortgage payment for a variable-rate mortgage does not change, the portion going towards interest will change. If interest rates rise, more of your mortgage payment will go towards interest. This will reduce the amount of principal that is being paid. This will cause your mortgage to be paid off slower than scheduled. If rates decrease, your mortgage will be paid off faster.

Recommended Reading: Does Navy Federal Sell Their Mortgages

What Is A Fully Amortizing Arm

Adjustable-rate mortgages that are fully amortizing have a maximum interest rate which they cannot exceed. They are therefore different from standard ARMs, where the rate is fully adjustable according to the index rate at the time. ARMs are described by writing how long the rate is fixed for, and how often it will adjust for the remainder of the term. For example, a 10/1 ARM would be fixed for 10 years, and adjust every 1 year from that point onward.

When Should You Consider Refinancing To A Fixed

Switching from an adjustable-rate mortgage to a fixed-rate mortgage is one of the most common reasons homeowners choose to refinance.

You may want to refinance your ARM into a FRM if:

- Your ARM is scheduled to adjust soon. This is especially important if you cannot afford a higher monthly mortgage payment.

- Mortgage rates are low. This will help you lock in a low rate and take advantage of the stability of a fixed-rate mortgage.

Alternatively, if you plan to move soon, it may make financial sense to stick with an ARM.

Before you make plans to refinance later, its important to take into account the costs of refinancing which are similar to what you pay when you purchase a home and any penalties you may face if you refinance too soon.

Some ARMs may require you to pay fees or penalties if you refinance or pay off the ARM early, usually during the initial period of the loan. Prepayment penalties can total several thousand dollars. Its important to know about these potential extra fees before you take out an ARM.

Use our fixed- or adjustable-rate calculatorto better understand what mortgage may be right for you.

When it comes to mortgages, you have options. To determine the right mortgage for your situation,lean on your lenderor financial professional for guidance. Be sure you know the details of how and when this type of loan may change your monthly payments.

Recommended Reading: What Are Mortgage Rates Tied To

Also Check: Are There Different Types Of Reverse Mortgages

The Fully Indexed Rate

Recap: To calculate the mortgage rate on an adjustable loan, you would simply combine the index and the margin. The resulting number is known as the fully indexed rate, in lender jargon. This is what actually gets applied to your monthly payments.

Heres the calculation again:The fully indexed rate is the most important number to you, as a borrower. It determines the size of your monthly payments and the total amount of interest youll pay over time. But it also helps to know where it comes from, and how it gets calculated.

The lender should provide you with all of this information when you apply for the loan. In fact, they are required to do so. According to the Federal Reserves guide to adjustable-rate mortgages:

The information must include the index and margin, how your rate will be calculated, how often your rate can change, limits on changes , an example of how high your monthly payment might go, and other ARM features

So thats how adjustable mortgage rates are calculated. The index plus the margin equals the actual rate that you pay on the loan. Now lets look at some actual examples. This will help you comparison shop for the best deal.

Fixed Payments With A Variable Interest Rate

If the interest rate goes up, more of your payment goes towards the interest, and less to the principal.

If the interest rate goes down, more of your payment goes towards to the principal. This means, you pay off your mortgage faster.

If the market interest rates increase to a certain percentage or trigger point, your lender may increase your payments. This payment increase will make sure that you pay off your mortgage by the end of the amortization period. The trigger point is listed in your mortgage contract.

Recommended Reading: How To Pay Off My Mortgage Faster Calculator

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

Recommended Reading: Should I Refinance My Mortgage With My Current Lender

What Is An Apr On A Mortgage

The APR is the cost of borrowing money from the bank as an annualized percentage. Your APR can include how much interest youll pay, points to lower your interest rate, mortgage insurance, loan origination fees and closing costs. It can also help you understand how much youll pay for your mortgage if you keep it for the entire term.

When shopping around for mortgages, its good to look at the APR, not just the interest ratethe APR is designed to show homebuyers their complete cost of borrowing. The Truth In Lending Act requires that buyers get a clear disclosure of whats entailed in the APR of their loan.

Read Also: Is Paying Points On A Mortgage Worth It