I Have A Reverse Mortgage And I No Longer Wish To Live In My Home What Should I Do

Living in the mortgaged property as your primary residence is a condition of any reverse mortgage loan. If you no longer wish to live in your home or doing so is no longer possible, you should speak to your lender/servicer as soon as possible to discuss your options. You should also speak to an attorney or housing counselor. To locate a free housing counselor in your area, please visit the Departments website.

How Do You Pay Back A Reverse Mortgage

A reverse mortgage is commonly paid back by using the proceeds from the sale of the home. If the loan comes due because youve passed away, your heirs will be responsible for handling the repayment and will have a few options for repaying the loan:

- Sell the home and use the proceeds to repay the loan.

- Refinance into a traditional mortgage or use their finances to purchase the home for the amount due on the loan or 95% of the appraised value of the home whichever is less.

- Sign the title over to the lender and walk away from the loan.

Your Home Has Sentimental Value

When the last reverse mortgage borrower dies, the loan becomes due and payable. Heirs who want to keep the house have the opportunity to pay the reverse mortgage balance to the lender. They’ll need cash or another mortgage to pay off the loan.

If your heirs can’t or wont repay the loan, the lender will sell the home to recoup what the borrower owed. Any positive balance between the sale proceeds and the loan balance goes to the borrower’s estate. If theres a negative balance, Federal Housing Administration insurance covers it. The heirs receive nothing, but they don’t owe anything, either.

Read Also: How To Qualify For More Money For A Mortgage

You Want To Switch To A Different Reverse Mortgage Type

There are three types of reverse mortgages. Borrowers who have a change of needs may want to refinance a reverse mortgage to move to a different loan type.

- Single-purpose reverse mortgages: These loans are available through some state and local government agencies or nonprofit organizations. They are usually for smaller amounts and may only be used for specific purposes, for example, home improvement or property taxes.

- Proprietary reverse mortgages: Some private lenders offer reverse mortgages that the government does not guarantee. Often, these reverse mortgages enable homeowners to borrow above FHA limits.

- Home Equity Conversion Mortgages : These reverse mortgages are insured by FHA and are subject to established loan limits.

What A Reverse Mortgage Costs

The cost of the loan depends on:

- how much you borrow

- how you take the amount you borrow

- the interest rate and fees

- how long you have the loan

Over time, your debt will grow and your equity will decrease .

See how much a reverse mortgage would cost over different time periods, such as 10 or 20 years.

Your lender or broker must go through reverse mortgage projections with you, showing the impact on your home equity over time. Get a copy of this to take away, and discuss it with your adviser. Ask questions if theres anything youre not sure about.

You May Like: Can You Refinance Your Mortgage With Bad Credit

Where To Get A Reverse Mortgage

A quick online search for reverse mortgage lenders will produce tons of results. But remember, not all lenders can be trusted, and some options you see can be scam artists disguised as mortgage companies available to help you pull cash out of your home and set you free from monthly mortgage payments.

A better idea: take a look at what AAG, the leading home equity conversion mortgage lender in the U.S., has to offer. Its an approved lender of the U.S. Department of Housing and Urban Development and holds accreditation from the Better Business Bureau . Both credentials indicate that AAG is a reputable lender you can trust.

Heres a closer look at AAGs reverse mortgage loan offerings:

To learn more or take the next step towards securing a reverse mortgage, visit the website today. You can request a free information kit or connect with a home equity specialist by phone.

Someone Lives With You

If you have friends, relatives, or roommates living with you and they’re not co-borrowers on your reverse mortgage, they’ll need to be prepared to move out if you die before them. Your co-residents may also have to vacate the home if you move out for more than a year.

Moving into a nursing home or an assisted living facility for more than 12 consecutive months is considered a permanent move under reverse mortgage regulations. Seniors often make unplanned moves for medical reasons, and household members should be aware of this possibility.

Reverse mortgages require borrowers to live in the home as their primary residence. In fact, borrowers have to certify in writing each year that they still live in the home they’re borrowing against in order to avoid foreclosure.

If someone relies on you for housing , you may want to forego the reverse mortgage and leave your home to them in your will or trust. Adding someone to your home’s title will not protect them from reverse mortgage foreclosure .

You May Like: How Are Mortgage Approvals Calculated

When Do You Pay Back A Reverse Mortgage

A reverse mortgage does not require you to make any monthly repayments until the loan comes due. This generally happens when you do any of the following:

- No longer use the home as your primary residence

- Transfer the title of the home into someone elses name

- Default on any of the terms or conditions of your reverse mortgage

Consult your contract to see what might make your loan come due.

These maturity events may come about in unconventional ways, so be sure to think your actions through ahead of time. For example, if you plan to travel for more than a year, your lender may execute the early payback clause. Likewise, your permanent residence may change if you ever move to an assisted living facility or nursing home. Your reverse mortgage could even come due if you fail to keep your home in good condition or pay your homeowners insurance or property taxes on time.

However, if you pass away and your spouse is not a co-borrower of the loan, they may be able to continue living at the property without having to repay the loan until it otherwise reaches maturity. If you have a HECM from on or after Aug. 4, 2014, the U.S Department of Housing and Urban Developments non-borrowing spouse rule helps protect your spouse as long as they meet certain criteria. Earlier HECMs or proprietary reverse mortgages may not have these protections for spouses, though.

What Are The Different Types Of Reverse Mortgages

Home Equity Conversion Mortgage

The HECM is the most popular reverse mortgage. HECMs are insured by the Federal Housing Administration , which is part U.S. Department of Housing and Urban Development . The FHA guarantees that lenders will meet their obligations. HECMs are only offered by federally-approved lenders, who are required to follow strict rules imposed by the federal government. The FHA tells HECM lenders how much they can lend you, based on your age and your home’s value. Further, you must undergo reverse mortgage counseling as a condition to obtaining this type of loan.

For more information regarding the HECM, visit the U.S. Department of Housing and Urban Development’s website.

Single-Purpose Reverse Mortgages

Payments received through these reverse mortgages can only be used for certain purposes, such as home repairs, home improvements, or paying property taxes. These types of reverse mortgages are offered by state and local governments, or nonprofit lenders, and are usually the least expensive reverse mortgages. They are often only available to low to moderate income homeowners.

Other “Proprietary” Reverse Mortgages

Some banks and financial institutions offer their own reverse mortgages. These loans are backed by the private companies that provide them they are NOT insured by the federal government.

You May Like: What Is The Mortgage Rate In Florida

Reverse Mortgage: What Are The Different Types

There are three different types of reverse mortgages:

1: HECM. This is the most popular form of reverse mortgage, which is federally insured and often comes with higher up-front costs. On the plus side, however, the money you receive can be used for anything and you decide how to withdraw the funds, i.e., a line of credit, fixed monthly paymentsor both. While they are widely available, HECMs are offered solely through Federal Housing Administration-approved lenders.

2: Proprietary reverse mortgage. This type of reverse mortgage is not federally insured. If you have a home that is of high value, you can usually get a bigger loan advance from a proprietary reverse mortgage.

3: Single-purpose reverse mortgage. This type of mortgage is less common than the previous two mentioned. It is typically offered by local and state government agencies and non-profit organizations. However, it is also the least expensive. The only catch is that borrowers can only use the loan to cover one specific thing, like a handicap accessible remodel, for instance.

Whether you opt for a HECM, a proprietary reverse mortgage, or a single-purpose reverse mortgage will depend on your financial situation. It is important to do your research beforehand to understand which one will work best for you, see our best in mortgage for the info on who may be best broker or agency in your area to contact.

How To Refinance A Reverse Mortgage

If you decide to refinance a reverse mortgage, you will follow a similar process to the one you went through with your first reverse mortgage. This time, youll want to shop around to find rates and terms that would improve your current situation. Youll also want to evaluate whether your property value has changed since your first reverse mortgage and if you have enough equity to qualify for a refinance.

From there, think about what your end goal is. For example, if its to lower your borrowing costs, youll be mainly focused on lowering your interest rate. If your primary goal is to add on a co-borrower, then you might be less concerned about savings because the objective is more about providing security for your partner.

Once you get a sense of where you stand and what your options are, you should do some calculations, work with a trusted advisor, and talk to your loved ones to determine your next steps. If you move forward, be prepared to share identification, tax returns, and other financial statements, including income and asset information.

Also Check: How Do I Qualify For A Zero Down Mortgage

Consult With Professionals Before Making A Decision

Taking out a reverse mortgage should not be an impulse decision. Instead, its important to speak with professionals who can provide more information to help you make the best decision for your financial future.

To qualify for an HECM, youll need to speak with a U.S. Department of Housing and Urban Development -approved counselor first. But dont stop there. If you have a financial planner or an estate planning attorney, speak with them as well to see how a reverse mortgage will affect not only your current finances but also any financial assets that you plan to leave your heirs. Talking with a consumer protection lawyer is also a good idea to make sure that you know the ins and outs of using a reverse mortgage to prevent foreclosure.

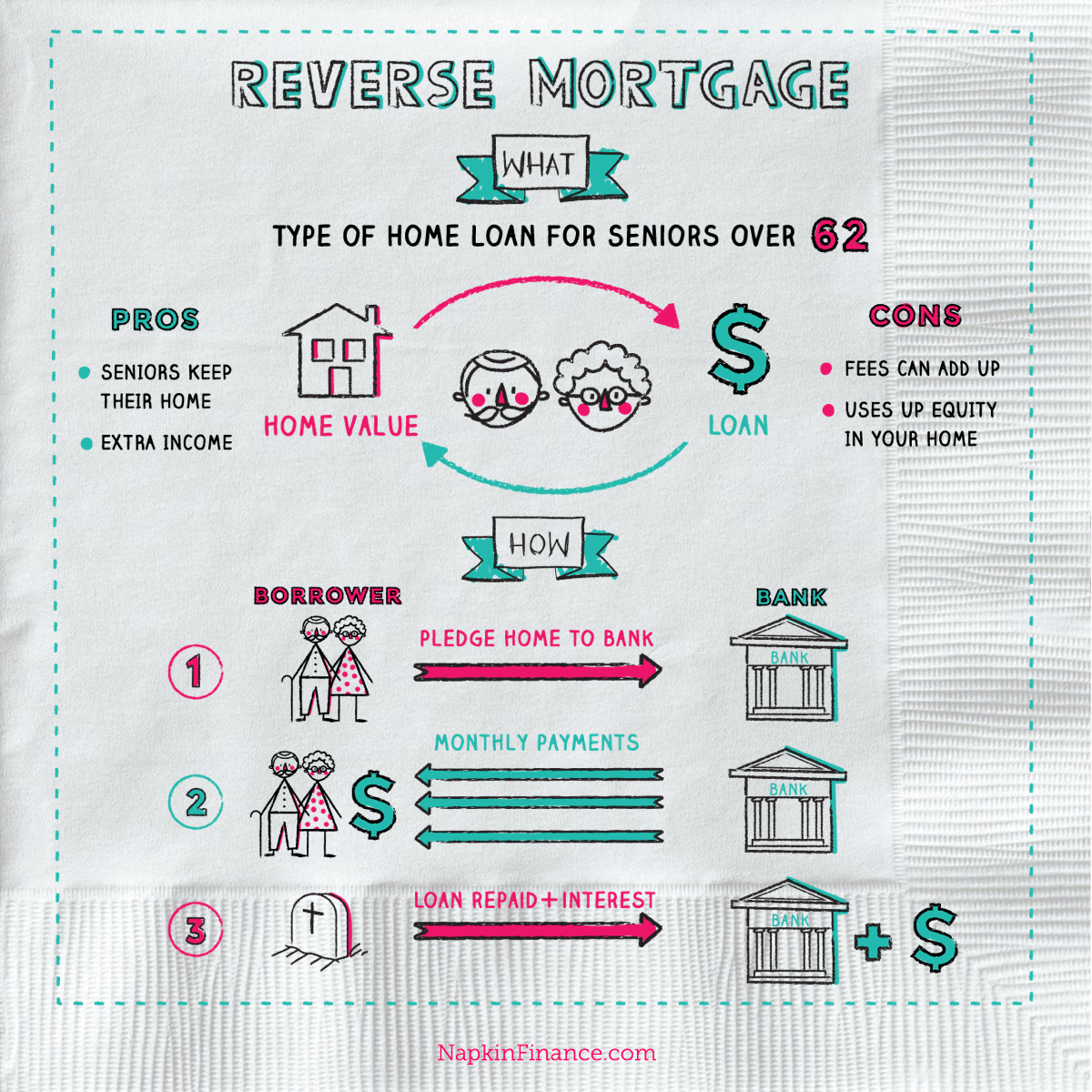

Traditional Vs Reverse Mortgages

Its important to know how a reverse mortgage works before applying for one. With a traditional forward mortgage, you borrow money to buy your home. You then repay that money over the loan termusually 15 to 30 yearsin monthly installments. As you make your monthly payments, you pay down the loan balance and increase the amount of equity that you own in the home.

With a reverse mortgage, you borrow money against your home, meaning that your home guarantees the loan. If you fail to pay back the loan, you forfeit your home. You can use the proceeds of the reverse mortgage to pay off your existing mortgage. Any remaining proceeds are yours to use as needed. Over time, the loan balance on the reverse mortgage increases and the amount of equity that you own decreases. A reverse mortgage is repaid when you no longer live in the homeby selling the home, moving out, or dying.

Don’t Miss: When Will Home Mortgage Rates Go Up

How To Sell A House With A Reverse Mortgage

You must repay your reverse mortgage loan when you sell the home, after which your lender will close the account. Here’s a rundown of the basic steps:

- Contact your lender. Request a payoff quote , including any money you have received, accrued interest, and other fees. The lender will mail a due and payable letter within 30 days, specifying the current loan balance, options for repayment, steps to avoid foreclosure, and the number of days to respond. The lender will send an appraiser to determine the property’s value.

- List and sell the home. When determining the price, consider your mortgage balance and closing costs. A real estate agent, broker, or Realtor can help set the price, handle showings, negotiate with potential buyers, and ensure a smooth closing. If your state requires it , hire a real estate attorney to assist with the process.

- Close and transfer the funds. At closing, your reverse mortgage lender receives the loan payoff amount, and you receive any excess proceeds minus closing costs.

Interest, mortgage insurance premiums , and homeowners insurance continue to accrue until the loan is paid and settled, so your loan balance will keep growing during the settlement period.

If You Would Lose Too Much Equity

Whenever you add more costs onto a home loan, you lose equity. In the case of a reverse mortgage refinance, it would mean decreasing the proceeds that surviving relatives may get after selling and paying off the reverse mortgage.

If youve already taken a significant amount of money from a reverse mortgage, it could be harder to meet the equity requirements for a refinance.

Recommended Reading: 10 Year Treasury Yield And Mortgage Rates

Recommended Reading: How To Get Prequalified For A Mortgage With Bad Credit

How Can Reverse Mortgage Funds Be Used

The money you receive from a reverse mortgage can be used in any way you like. There are several methods for receiving funds and how you use this money depends on your retirement goals and personal financial situation. If there is an existing mortgage on your home, the money from the HECM is first used to pay off the balance. The remaining funds can be taken in any of the following distribution methods:

- A one-time payment, income tax-free.4

- Steady, tax-free monthly payments.4

- A line of credit, as a safety net for later use if needed.

- A combination of these methods.

Each homeowner is different, and our customers have found creative ways to use a reverse mortgage to improve their incomes, lifestyles, and monthly cash flow. These are just a few examples of how reverse mortgages work to your advantage:

- Keep more money on hand to pay for everyday bills and expenses.

- Eliminate or reduce credit card balances or other debts.

- Help with healthcare expenses, making it easier to age in place.

- Set aside funds to help pay for long-term care in the future.

- Make updates, repairs, or modifications to your home to live more comfortably.

- Lower your taxable income: avoid making taxable withdrawals from 401 or other retirement plans by replacing the money with income tax-free reverse mortgage funds4.

- Establish a line of credit for emergencies or occasional expenses.

- Help a child or grandchild with major expenses, like college tuition or a down payment on a home.

Types Of Reverse Mortgages

As you consider whether a reverse mortgage is right for you, also consider which of the three types of reverse mortgage might best suit your needs.

Single-purpose reverse mortgages are the least expensive option. Theyre offered by some state and local government agencies, as well as non-profit organizations, but theyre not available everywhere. These loans may be used for only one purpose, which the lender specifies. For example, the lender might say the loan may be used only to pay for home repairs, improvements, or property taxes. Most homeowners with low or moderate income can qualify for these loans.

Proprietary reverse mortgages are private loans that are backed by the companies that develop them. If you own a higher-valued home, you may get a bigger loan advance from a proprietary reverse mortgage. So if your home has a higher appraised value and you have a small mortgage, you might qualify for more funds.

Home Equity Conversion Mortgages are federally-insured reverse mortgages and are backed by the U. S. Department of Housing and Urban Development . HECM loans can be used for any purpose.

HECMs and proprietary reverse mortgages may be more expensive than traditional home loans, and the upfront costs can be high. Thats important to consider, especially if you plan to stay in your home for just a short time or borrow a small amount. How much you can borrow with a HECM or proprietary reverse mortgage depends on several factors:

Read Also: How Much Would My Mortgage Payment Be

Who Should Avoid A Reverse Mortgage

While there are some cases where reverse mortgages can be helpful, there are lots of reasons to avoid them. A reverse mortgage isnt a good option if:

- You cant find a trustworthy lender or a reputable loan program

- You have outside savings or life insurance that you can tap to cover expenses

- You have heirs who want to inherit your property or family members who live with you and who need to stay in the property after the term of a reverse mortgage