Down Payment Assistance Programs

Special programs in your state or local housing authority offer help to first-time buyers. Many of these programs are available based on buyers income or financial need. These programs, which usually offer assistance in the form of down payment grants, can also help with closing costs. The U.S. Department of Housing and Urban Development lists first-time homebuyer programs by state. Select your state then Homeownership Assistance to find the program nearest you.

Faqs About Down Payments

Are zero-down mortgages a good idea? If you have a stable job and income and extra rainy day money in the bank, a zero-down mortgage may be a good way to get your feet wet in homeownership.

What is the minimum down payment for a mortgage? No down payment is required for VA, USDA and doctor loan programs detailed above.

What credit score do I need to buy a house with no money down? No-down-payment lenders usually set 620 as the lowest . You can boost your credit score by keeping your revolving charge card balances to a minimum and paying all your bills on time.

How do I find down payment assistance programs in my area? Check with local or state housing authorities or local housing nonprofits to learn about homebuying assistance in your area.

Can I use a gift for my down payment or closing costs? All the low-down-payment loan programs outlined above allow for gifts for your down payment, plus closing costs up to a set limit. Check with your employer to see if they offer any homebuying benefits.

Do you have to put 20% down on a conventional loan? No. However, a 20% down payment will help you avoid PMI on a conventional loan, and borrowing less means your monthly payment will be lower.

How can I get money for a down payment on a house? Setting up a down payment fund, using a savings app and setting aside tax refunds, bonuses and commission income over time or getting a side hustle for extra down payment income are just a few ways you can save for a down payment.

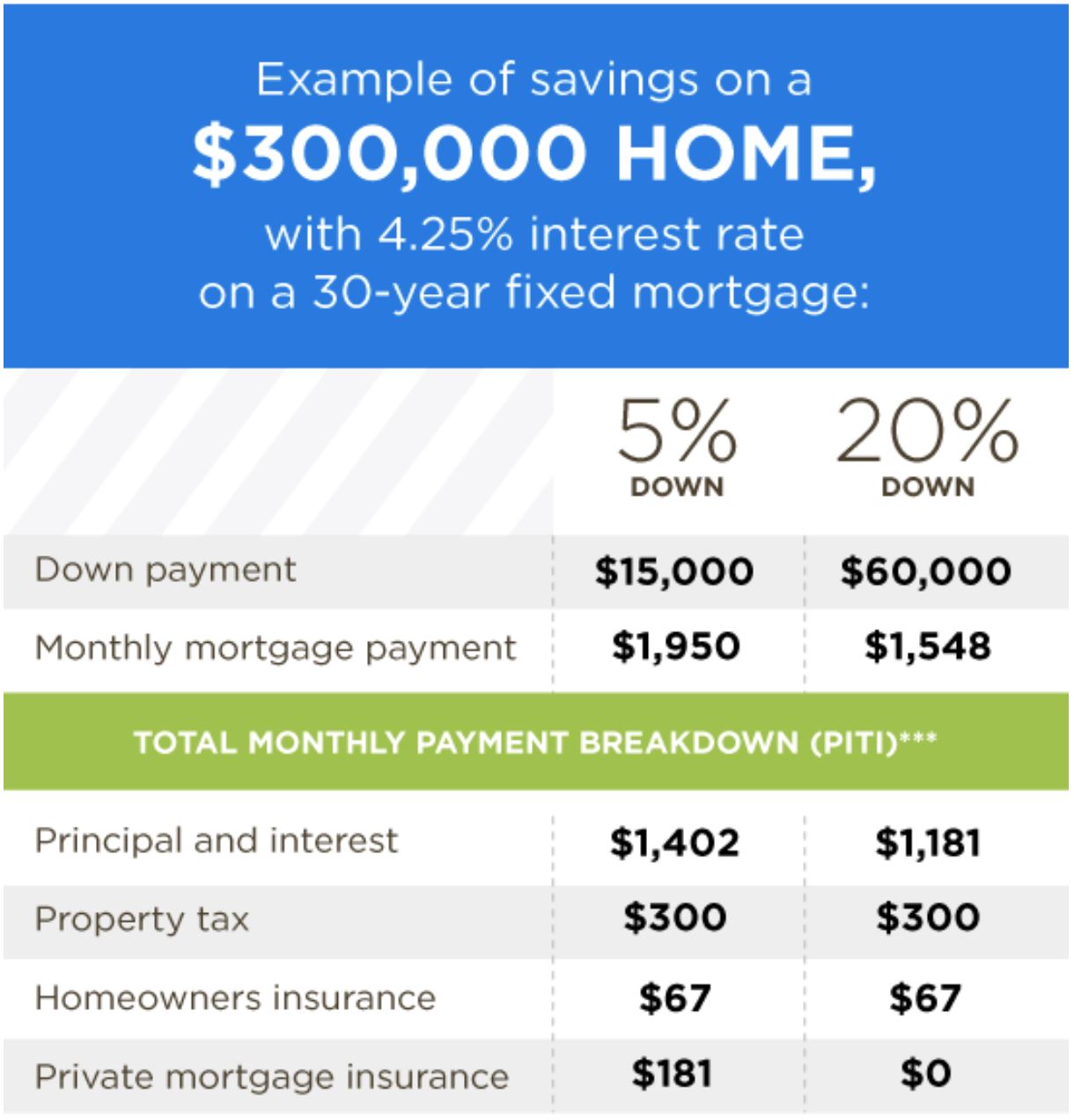

How Would A Down Payment Influence Your Monthly Payments

Use a mortgage calculator to compare monthly payments with and without a down payment. What would happen if you put a small amount down? What if you went all the way to 20% down? Once you have sample payments, see how each fit in with your monthly budget.

A helpful rule of thumb is the 28/36 rule, which says that

- No more than 28% of your gross monthly income should be put towards housing costs, including mortgage payments, insurance, and homeowners association fees.

- No more than 36% of your income should go towards paying all your debts, including your mortgages, other loans, and credit cards.

For example, if you earn $4,000 a month, then you can spend up to $1,200 on housing and up to $1,440 on all debts.

Also Check: Does Fha Offer 40 Year Mortgage

How Much Of A Down Payment Do You Need For A $200000 House

To purchase a $200,000 house, you need a down payment of at least $40,000 to avoid PMI on a conventional mortgage. If youre a first-time home buyer, you could save a smaller down payment of $10,00020,000 . But remember, that will drive up your monthly payment with PMI fees.

We said it before and well say it again: No matter what, make sure your mortgage payment is no more than 25% of your monthly take-home pay on a 15-year fixed-rate conventional loan.

No matter what your down payment is, always follow the 25% rule.

Sticking to a monthly payment thats no more than 25% of your monthly take-home pay can get trickybut stick with us.

As an example, lets assume youre buying a $200,000 house with a 15-year mortgage at a 4% fixed interest rate. Your property tax is at 1.1% of the home value, home insurance is $846 per year, and HOA dues are $86 per month. And if your down payment is less than 20%, your PMI is at 0.5% of your loan.

Using our mortgage calculator, youll notice that a 20% down payment of $40,000 has you paying $1,523 per month. On the flip side, a 5% down payment of $10,000 has you paying $1,824 per month.

In other words, if your monthly take-home pay is at least $6,092, youd be in good shape to buy a $200,000 house with a 20% down payment because you could afford the $1,523 monthly payments .

If your monthly take-home pay is at least $7,296, you could buy a $200,000 house with a 5% down payment because you could afford the $1,824 monthly payments. .

Better Terms Vs Opportunity Cost

The big advantage of going with a smaller down payment is that it allows you to buy a home now, rather than waiting years to save up a 20 percent stake. Meanwhile, you’re continuing to spend money on rent that could be going toward a home.You also could be missing an opportunity in that mortgage rates continue to be unusually low by historic standards. Rates have been low for about a decade now, but there’s no guarantee how long that will continue. So you could be facing significantly higher rates by the time you’re finally ready to buy.

As noted above, one of the big advantages of putting 20 percent down on a home loan is that you avoid the additional cost of mortgage insurance. That’s billed as part of your monthly mortgage statement and typically runs about 0.5 -1 percent of your loan amount per year.

That’s not an insignificant amount, but bear in mind that it’s little different from paying an additional 0.5-1 percent on your mortgage rate. So if rates rise while you’re saving a down payment, those savings from not paying for mortgage insurance could be wiped out.

In addition, private mortgage insurance , the type you get on conventional mortgages backed by Fannie Mae or Freddie Mac, can be canceled once you reach 20 percent equity. FHA mortgage insurance is more difficult to get rid of, but you can still get out of it by refinancing into a new loan once you reach 20 percent equity.

You May Like: What Is Monthly Mortgage Payment On 100k

Usda Rural Development Loans

Though somewhat obscure, this federal program offers mortgages with 0 percent down to eligible borrowers. There are a number of restrictions, however – eligibility is income-based, homes purchased must be modestly priced and borrowers must currently lack adequate housing. Homes purchased under this program technically must be in rural areas, but the definition includes many small towns and suburbs “non-urban” may be a more accurate description. Funds for this program are limited and there may be a waiting list. The number of lenders offering these loans is relatively small check with your closest USDA office to find one serving your area.

Ways To Save More For A Down Payment

It can be a challenge to save money for a down payment on a home. Here are some quick tips to get you there:

Recommended Reading: How To Lower Your Mortgage Payment Without Refinancing

Low Down Payment First

Not everyone will qualify for a zero-down mortgage. But it may still be possible to buy a house with no money down if you choose a low-down-payment mortgage and use a government grant or loan to cover your upfront costs.

If you want to go this route, here are a few of the best low-money-down mortgages to consider.

A Smaller Mortgage Down Payment Can Leave A Helpful Cushion

- You dont necessarily need a large down payment to buy

- Especially if it will leave you with little in your bank account

- Sometimes its better to have money set aside for an emergency

- While you build your asset reserves over time

While a larger mortgage down payment can save you money, a smaller one can ensure you have money left over in the case of an emergency, or simply to furnish your home and keep the lights on!

Most folks who buy homes make at least minor renovations before or right after they move in. They also spend money on moving trucks and/or movers.

Then there are the costly monthly utilities to think about, along with unforeseen maintenance issues that tend to come up.

If you spend all your available funds on your down payment, you might be living paycheck to paycheck for some time before you get ahead again.

In other words, make sure you have some money set aside after everything is said and done.

The lender will probably require that you have some cash reserves in order to close your mortgage, but even if they dont, its wise to make it a requirement for yourself.

Tip: Consider a combo loan, which breaks your mortgage up into two loans. Keeping the first mortgage at 80% LTV will allow you to avoid mortgage insurance and ideally result in a lower blended interest rate.

Or get a gift from a family member if you bring in 5-10% down, perhaps they can come up with another 10-15%.

Read Also: How Do You Buy Back A Reverse Mortgage

How Do I Know If A Zero

If you meet the requirements and can qualify for a USDA, VA, FHA, HomeReady® or Home Possible®loan, not having to pay an enormous down payment is definitely an advantage, especially if you still have to pay closing costs. Avoiding or reducing your down payment means you have savings to fall back on when emergencies arise.

This is a good thing to keep in mind if you’re on the fence about your down payment strategy. It isnt necessarily a better financial decision to put more money down than less. Making the full 20% down payment and avoiding PMI isnt ideal if it means emptying your savings account. Take a close look at your finances and make sure you explore all your options before putting money down on a house.

Bigger Vs Smaller Down Payment Example

Generally speaking, a larger down payment can make it easier for you to get approved for a mortgage and allow you to buy more house for the same monthly payment, or even less. You might also get a lower rate and lower mortgage insurance premiums . Heres a breakdown of a 30-year mortgage with a 5 percent interest rate, using data from Bankrates mortgage calculator and mortgage insurance estimates from Freddie Macs PMI calculator:

| Home price | |

|---|---|

| $0 | $1,288 |

Note there is a trade-off between your down payment and credit rating. Larger down payments can offset a lower credit score higher credit scores can offset a lower down payment. Its a balancing act.

For many first-time buyers, the down payment is the biggest obstacle to homeownership. Thats why they often turn to loans with smaller minimum down payments. Many of these loans, though, require borrowers to purchase some form of mortgage insurance.

However, mortgage insurance is not necessarily a bad thing if it gets you into a home and starts you on the road to building equity. Consider this: If you were to save $250 a month, it would take you more than 12 years to accumulate the $40,000 needed for a 20 percent down payment on a $200,000 house. Thats a long time to keep renting just to save up the money. Plus, by the time that 12-year period is up, that $200,000 house is going to cost a lot more.

Also Check: Can You Add To Your Mortgage For Renovations

Understanding Down Payments On Houses

The amount you designate as a down payment helps a lender determine how much money to lend you and which type of mortgage is best for your needs. But how much is just the right amount for a down payment? Paying too little will cost you in interest and fees over time. Too much could deplete your savings or negatively affect your long-term financial health.

Plus, you still need to factor in closing costs, moving expenses, and other monthly bills. Ultimately, the size of your down payment depends on you: your savings, income, and budget for a new home.

First, you need to figure out your budget and how it can impact your down payment. Investopedia’s free, online mortgage calculator helps you calculate your monthly mortgage payments and make the right financial decisions when buying a house. One of the fields asks for an estimated down payment amount.

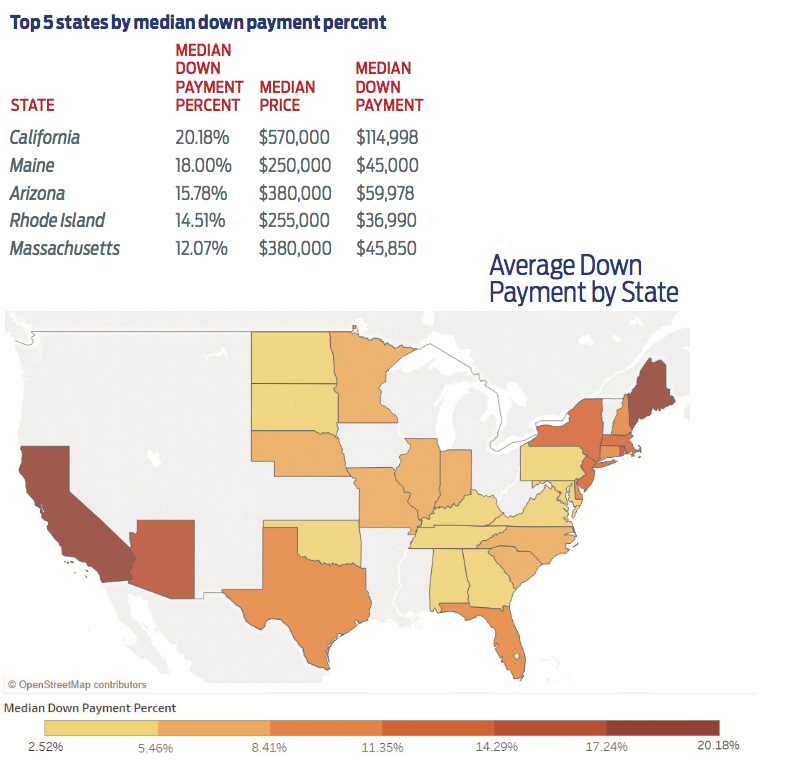

While a 20% down payment was once the standard, the median is now 12% for many homebuyers.

Does A Down Payment Fit With Your Other Financial Goals

Figuring out whether you can afford to put money down or not will depend on your budget and your financial goals, says Langford.

Before applying for a VA loan, take a hard look at your finances and make the decision that will best suit your needs. You need to look at the long-term plan for yourself and for your family and then really write out the pros and cons, she says.

Long-term goals can include saving for retirement or building up a college fund for your kids. If you need the money for those goals soon, it may make sense to hold on to the cash you have. On the other hand, if you have time and can make a down payment, you can take the money you save from lower monthly payments and put it towards achieving your target.

If your top priority is to buy a home and you can afford the monthly payments and home maintenance but dont have enough for a down payment, then the VAs no money down feature can be a great opportunity.

Also Check: How Do I Know If My Mortgage Is Fha

The 20% Myth: What You Really Need For Your Down Payment

While many people still believe it’s necessary to put down 20% when buying a home, that isn’t always the case. In fact, lower down payment programs are making homeownership more affordable for new home buyers. In some cases, you might even be able to purchase a home with zero down.

How much down payment you’ll need for a house depends on the loan you get. While there are benefits to putting down the traditional 20% or more it may not be required.

For many first-time homebuyers, this means the idea of buying their own house is within reach sooner than they think.

What Are The Risks Of Signing A Gift Letter

So long as the gifts intentions and letter are honest, there are no real risks in signing a letter. The only time issues can manifest is when donors provide a loan disguised as a gift. Providing “gift” money that’s actually expected to be repaid is a form of deception that can result in potential mortgage fraud on behalf of both parties involved.

Read Also: What Does Buying Mortgage Points Mean

How Much Could You Put Down If You Had To

If you have the money, its best if you put something down. It doesnt have to be the idealized 20% down either. A payment as small as 5% has a number of short and long term advantages.

With non-VA loans, making a 20% down payment eliminates the need to pay for private mortgage insurance, which protects the lender. With a VA loan, however, there is no PMI, regardless of whether you put money down or not.

Keep in mind, the no down payment benefit also hinges on the appraisal value of the home the sales price cannot be higher than the appraised value. Otherwise, youll need to cover the difference.

How Much Do You Have To Put Down On A House

The amount you should put down on a house is personal. But the amount youll have to put down is more clear-cut.

How much you need to put down on a house depends on your mortgage loan program. Common down payment requirements range from 3% to 20%. You can make the minimum down payment or put more down in order to reduce your loan amount and monthly payments.

Read Also: Can You Get Extra Money On Your Mortgage For Furniture

What Type Of Low

Federal Housing Administration. The F.H.A., which generally insures loans with down payments of 3.5 percent or more, is often a solid option for lower- to middle-income borrowers who have thin or spotty credit histories.

But its not necessarily the cheapest option. All borrowers pay what is known as an upfront mortgage insurance premium of 1.75 percent of the loan amount, which is often added to your mortgage, so you dont actually have to pay it upfront. Then, on 30-year fixed-rate mortgages with less than 5 percent down, for example, theres an annual insurance premium of 0.85 percent of the loan amount, which is broken into monthly payments.

One downside: The F.H.A. does not allow borrowers to drop mortgage insurance once they have built up 20 percent in equity as other loans backed by the government do.

These mortgages are available through F.H.A.-approved lenders. But if youre seeking guidance from an independent expert, housing counselors certified by the U.S. Department of Housing and Urban Development can be a helpful resource to get you started.

Freddie Mac and Fannie Mae. They offer several low-down-payment options through lenders, both under their standard loan programs and those tailored to first-time buyers and lower- and middle-income households. Most of their programs permit down payments as low as 3 percent to qualifying borrowers, slightly lower than F.H.A. loans.