How Much Can I Afford

Everyone knows you cant spend 100% of your income on housing. You still have to pay for food, utilities, and actually having fun every once in a while.

Mortgage lenders and the Canadian Mortgage and Housing Corporation know this too, which is why they have two guidelines they follow when deciding whether to approve your mortgage: gross debt service and total debt service ratios.

You May Like: What Lender Has The Lowest Mortgage Rates

Can You Afford A 100000 Mortgage

This will depend on how the mortgage lender you approach calculates affordability. Most will base this on a multiple of your annual income, typically 4.5 or 5, though some go higher than this.

Try our mortgage affordability calculator below to work out whether youd qualify for a mortgage of this amount based on the standard income multiples that lenders use.

How Much Does It Cost To Buy A House With A 20% Down Payment

Assuming you have a 20% down payment , your total mortgage on a $100,000 home would be $80,000. For a 30-year fixed mortgage with a 3.5% interest rate, you would be looking at a $359 monthly payment. Please keep in mind that the exact cost and monthly payment for your mortgage will vary, depending its length and terms.

Recommended Reading: How Do I Get A Second Mortgage

New Mortgages Interest Only Mortgages And Interest Rate Rises

Itll give you a simple, ballpark figure to show you the monthly payments youd pay on:

- interest only mortgages

- your mortgage if there was an interest rate rise.

You can also adjust the mortgage term, interest rate and deposit to get an idea of how those affect your monthly payments.

To get started all you need is the price of your property, or the amount left on your mortgage.

MoneyHelper is the new, easy way to get clear, free, impartial help for all your money and pension choices. Whatever your circumstances or plans, move forward with MoneyHelper.

How To Get A $100000 Mortgage

Getting a $100,000 mortgage isnt as complicated as it seems.

Once youre ready to apply, just follow this nine-step process, and youll be well on your way to buying the home of your dreams:

Also Check: How To Cut 30 Year Mortgage In Half

Also Check: What Is The Current Va Mortgage Rate

How Much Is A $100k Loan

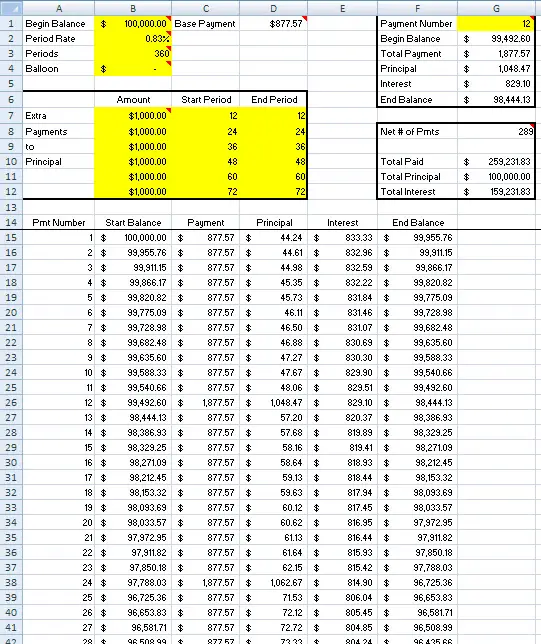

The monthly payments for a $100K loan are $589.94 and $112,378.74 in total interest payments on a 30 year term with a 5.85% interest rate. There might be other costs such as taxes and insurance.Following is a table that shows the monthly mortgage payments for $100,000 over 30 years and 15 years with different interest rates.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the Include Options Below checkbox. There are also optional inputs within the calculator for annual percentage increases under More Options. Using these can result in more accurate calculations.

Non-Recurring Costs

These costs arent addressed by the calculator, but they are still important to keep in mind.

Recommended Reading: How To Get Preapproved For A Mortgage With Bad Credit

Recommended Reading: How Long After Bankruptcy Can You Get A Mortgage

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

How A Broker Can Help With A 100000 Mortgage

As there are so many lenders, and criteria vary so much between them, it would be incredibly labour intensive to establish which one would offer the income multiple necessary to achieve the mortgage you need. The brokers we work with are experts in this area and know how much each specific lender would expect you to earn in order to get a £100,000 mortgage.

As they have access to every lender on the market, they can ensure that you only approach those whose criteria you are likely to meet for this level of borrowing. Whether youre looking for a lender who will consider self-employed income more favourably or maximise the length of term available to you, we can match you with an expert who will tailor their advice to help you achieve the loan you need.

Recommended Reading: What Are Points Paid On A Mortgage Loan

What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

What Is The Monthly Repayment On A 100000 Mortgage

Customers often ask us what are the average repayments on a £100K mortgage? and the answer comes down to a number of factors.

For instance, interest rates need to be considered and they can vary from one lender to the next, since they are based on your credit rating, affordability and general eligibility. Then theres term length to take into account the longer the term, the less youre likely to pay each month.

Play with our calculator here for an accurate measure of what a mortgage will cost, and you can also check how much you can borrow as well as get approved by the best lender, with our partners Mojo, for FREE!

The table below illustrates how the typical repayments on a £100,000 mortgage loan can vary based on these two factors.

| Interest Rate | |

|---|---|

| £438.50 | £497.63 |

The above data is for illustration purposes only. Consult your mortgage lender or broker for the most up-to-date information and rates.

The interest rate you end up on if you borrow a £100k mortgage will depend on the level of risk the lender is taking on, which theyll determine based on factors such as how much deposit youre able to put down and your profile as a borrower.

If youre still unsure about how much the repayments are on a £100k mortgage, get in touch and the advisors we work with will work with you to give you an idea of the kind of rates you might be able to get, based on your specific circumstances, affordability and eligibility.

Also Check: Rocket Mortgage Loan Types

Also Check: Why Do You Want To Work In The Mortgage Industry

What To Consider Before Applying For A $100000 Mortgage

Whether youre applying for a $100,000 mortgage or a different amount, its crucial that you understand the full costs of the loan to make sure it aligns with your budget, current financial situation and financial goals.

To get a clearer picture of how the loan might affect your short-term and long-term financial future, you should know how much youll need for the down payment and closing costs, the monthly mortgage payment and the total interest youll pay on the loan.

Keep in mind, the amount of interest youll pay depends on your interest rate among other factors. The higher the interest rate, the more youll pay in interest.

For example, a $100,000 loan with a 3% interest rate will incur interest charges totaling $51,777 on a 30-year fixed-rate loan, while a similar loan with a 4% interest rate will result in $71,870 in total interest charges.

The length of your mortgage loan also plays a factor in the amount of interest youll pay. In the previous calculation, a 30-year mortgage loan for $100,000 with a 3% interest rate will cost you $51,777 in interest. But if you cut the mortgage term in half with a 15-year loan, the total interest amount drops to $24,305.

Credible can help you see how much home you can afford, and help you compare rates from multiple lenders.

How Much Difference Does 1% Make On A Mortgage Rate

The short answer: It can produce thousands or even potentially tens of thousands in savings in any given year, depending on the purchase price of your property, your overall mortgage rate, and the total amount of the mortgage being financed.

By way of example, say that Taylor, a 30-year-old who is a first-time home buyer, wishes to obtain a 30-year fixed FHA loan on a new home with a 20% down payment. Below, you can get a sense of just how much that they stand to save given a 1% difference in interest savings on their 30-year mortgage.

You May Like: Why Do I Pay Escrow On My Mortgage

How Much Does The Average Mortgage Cost

Knowing when youve got a good mortgage deal is hard, isnt it? Every house is different, every households income and outcomes are differentbut if you know some of the average costs and interest rates when it comes to mortgages, youd at least have a start.

So, thats what weve gone away and done collected some averages and written up some pointers to help you decide how to manage your mortgage.

You May Like: How Much Does Getting Pre Approval Hurt Credit

What Is The Molecular Shape Of If 4

Step 4: The shape of a molecule is based on its molecular geometry: when determining molecular geometry, atoms and lone pairs are treated differently. There are 4 atoms and 2 lone pair around the central atom, which corresponds to AX4E2 or square planar. The molecular geometry of IF4- is square planar .

Don’t Miss: How To Get A Mortgage If Self Employed

How To Lower Your Monthly Payments

If your mortgage calculator results are not yielding the lower monthly payments you hoped for, here are several techniques to try:

- Lower purchase price: The less you borrow, the lower your mortgage payment

- Bigger down payment: Putting more money down means youll borrow less. Also, the best mortgage rates generally go to borrowers with larger down payments, among other qualifying factors

- Avoid private mortgage insurance: When you put at least 20% down on a conventional loan or 20% home equity on a refinance you can avoid paying monthly private mortgage insurance premiums

- Longer loan term: A longer loan term means lower monthly payments. However, you will pay more in total interest over the life of the loan

- Shop for a lower rate: Rate shopping doesnt have to take long, and its well worth the savings. Here are tips to get your best mortgage rate

How Much Does A 100000 Mortgage Cost Per Month

For purely example purposes, a £100,000 mortgage with a 25 year term and an interest rate of 2.75% would work out at £461 per month.

However, the exact figure will depend on the interest-rate and mortgage term available from the lender you choose to deal with. Small differences in your personal circumstances, or the options a lender offers, could all have an effect both directly and indirectly to the monthly repayment cost on a £100k mortgage.

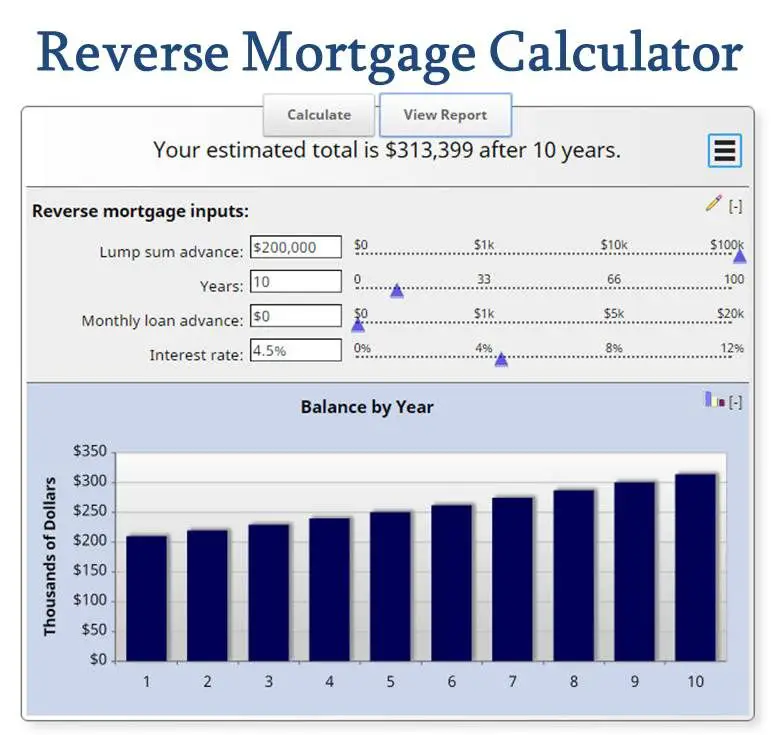

If youd like to get an idea of your potential monthly repayments, just input the amount youre looking to borrow into our calculator below, along with an interest rate and preferred term for your mortgage.

Also Check: Can I Consolidate My Debt Into My Mortgage

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

Your Debt To Income Ratio Is %

Good news! Most mortgage lenders will class your debt-to-income ratio as low. Youre unlikely to be declined for a mortgage based on your outgoings, but speaking to a mortgage broker before applying is still recommended as they can improve your chances of getting the best deal.

Most mortgage lenders will class your debt-to-income ratio as moderate, which means some of them might view your application with caution. Some lenders are much more strict than others when it comes to affordability and debt, so its important for you to find a lender whos more lenient. You should speak to a mortgage broker before you apply to ensure youre matched with a lender whose criteria you fit.

Most mortgage lenders will class your debt-to-income ratio as high. But thats where we can help! With so much of your monthly income going towards debt repayments, you could struggle to get approved for a mortgage without the help of a mortgage broker. We can help you find a lender whos more lenient on debt and affordability, and could still secure a mortgage approval.

Read Also: How Much To Pay Mortgage Off Early

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.

Monthly Payments On A 100000 Mortgage

At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £477.42 a month, while a 15-year might cost £739.69 a month.

Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

-

See your monthly payments by interest rate.

Interest

Don’t Miss: How Do I Know If I Have Mortgage Insurance

Mortgage Calculations And Mortgage Considerations

Use the free online Mortgage calculator to calculate your monthly repayments, compare Mortgage repayments over different periods and define what is the most affordable option for your financial situation. The Mortgage calculator will provide you a monthly interest repayment over 1 year,2 years,3 years,4 years,5 years, 10 years and compare them to a monthly repayment period of your choosing .

How Much Do You Pay A Month Student Loans Mortgage

Student loan. Mortgage. You can have both. Mortgage lenders dont look at how much your total student debt is, they look at how much you pay each month towards your loans. To put it into perspective, the average student loan debt in 2020 was $32,731, but as recently as 2019, people were borrowing an average of $37,782 for new cars.

Recommended Reading: Where Are Mortgage Rates Trending