What Is A Mortgage

A mortgage is a type of secured loan used to purchase a home. You pay back the lender over an agreed-upon amount of time, including an additional interest payment, which you can consider the price of borrowing money.

Because a mortgage is a secured loan, it means you put your property up as collateral. Should you fail to make your payments over time, the lender can foreclose on, or repossess, your property. Learn more about how a mortgage works here.

Consider Different Types Of Home Loans

The 30-year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficialdepending on your situation.For example, if you require a lower interest rate, adjustable-rate mortgages offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time . Given that ARM loans are variable, the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. A 15-year fixed rate mortgage, on the other hand, may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed rate mortgage. Consider all your options and choose the home loan that is most comfortable for you.

What Is The Difference Between The Mortgage Interest Rate And Apr

When looking at APR vs. interest rate, at its simplest, the interest rate reflects the current cost of borrowing expressed as a percentage rate. The interest rate does not reflect fees or any other charges you may need to pay for the loan. The APR, also expressed as a percentage rate, provides a more complete picture by taking the interest rate as a starting point and accounting for lender fees and other charges required to finance the mortgage loan.

Also Check: What Percentage Of Mortgage Is Interest

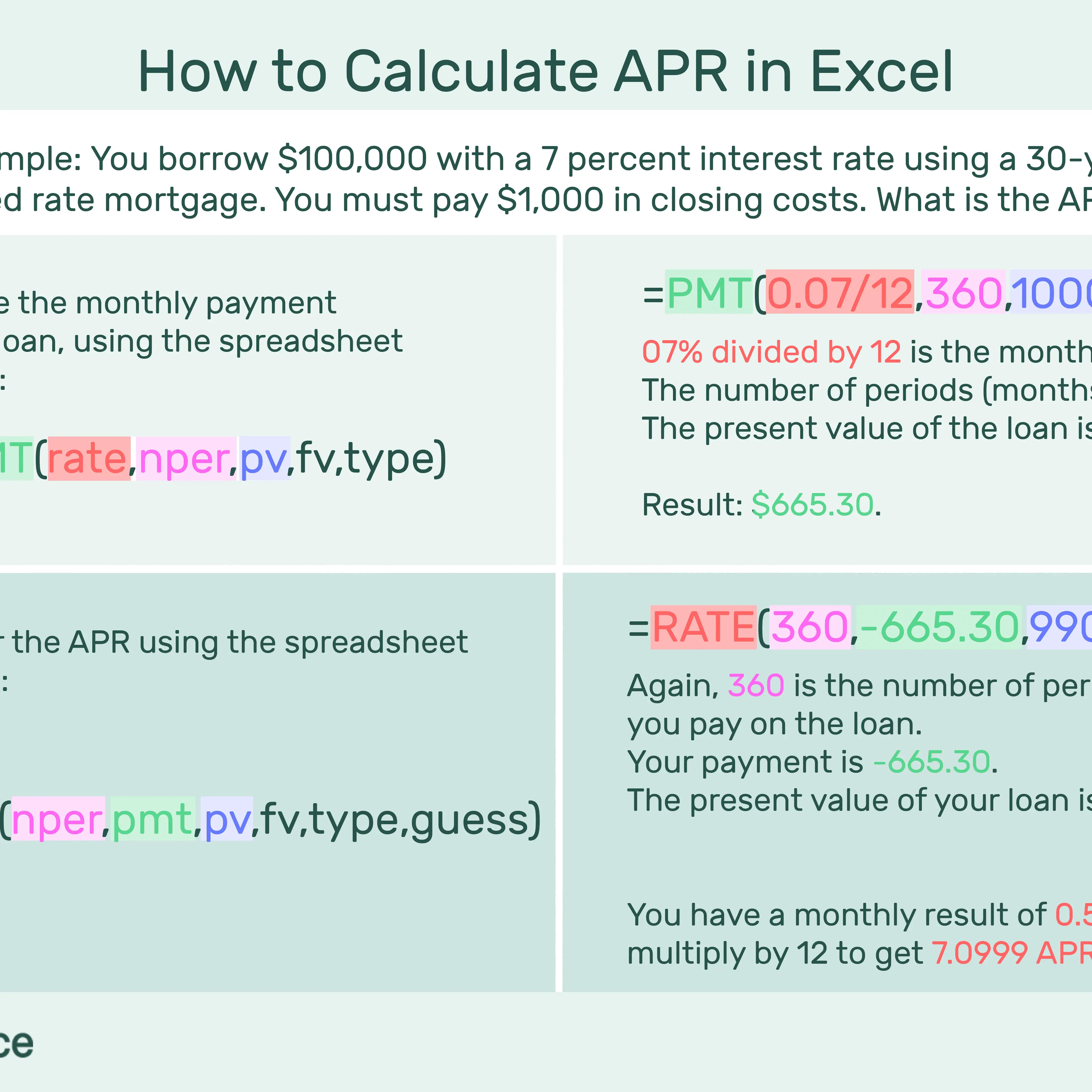

How Is Apr Calculated On A Mortgage

The APR combines fees paid upfront with interest paid every month. It does this by dividing the fees over the future life of the mortgage. In any month, the interest payment, plus the upfront fees allocated to that month, divided by the loan balance at the end of the preceding month, equals the APR.

How To Shop For Jumbo Mortgage Rates

NerdWallets mortgage rate tool can help you find competitive jumbo loan rates. In the “Refine results” section, enter a few details about the loan youre looking for, and youll get a personalized rate quote in minutes, without providing any personal information. From there, you can start the process to get preapproved for your home loan. Its that easy.

Read Also: What Is 1 Point On A Mortgage

Here’s How Discount Points Work

One discount point costs 1% of your loan amount. While one point will typically reduce the interest rate by less than 1%, even a small interest rate reduction can lower your monthly payment and the amount of interest you pay over the life of a fixed-rate loan. Discount points may also be tax deductible .

Before buying discount points, consider:

- How much money you can pay upfront – make sure you have enough money to make a down payment, pay closing costs, and still be able to manage other expenses for your new home.

- How long you plan to stay in your new home – the longer you stay in your home, the more you may be able to benefit from buying discount points.

- How much can you pay each month – if you dont have a lot of money to pay upfront and can handle a slightly larger monthly payment, you might be better off not buying points.

Whats A Good Apr For A Dwelling Mortgage

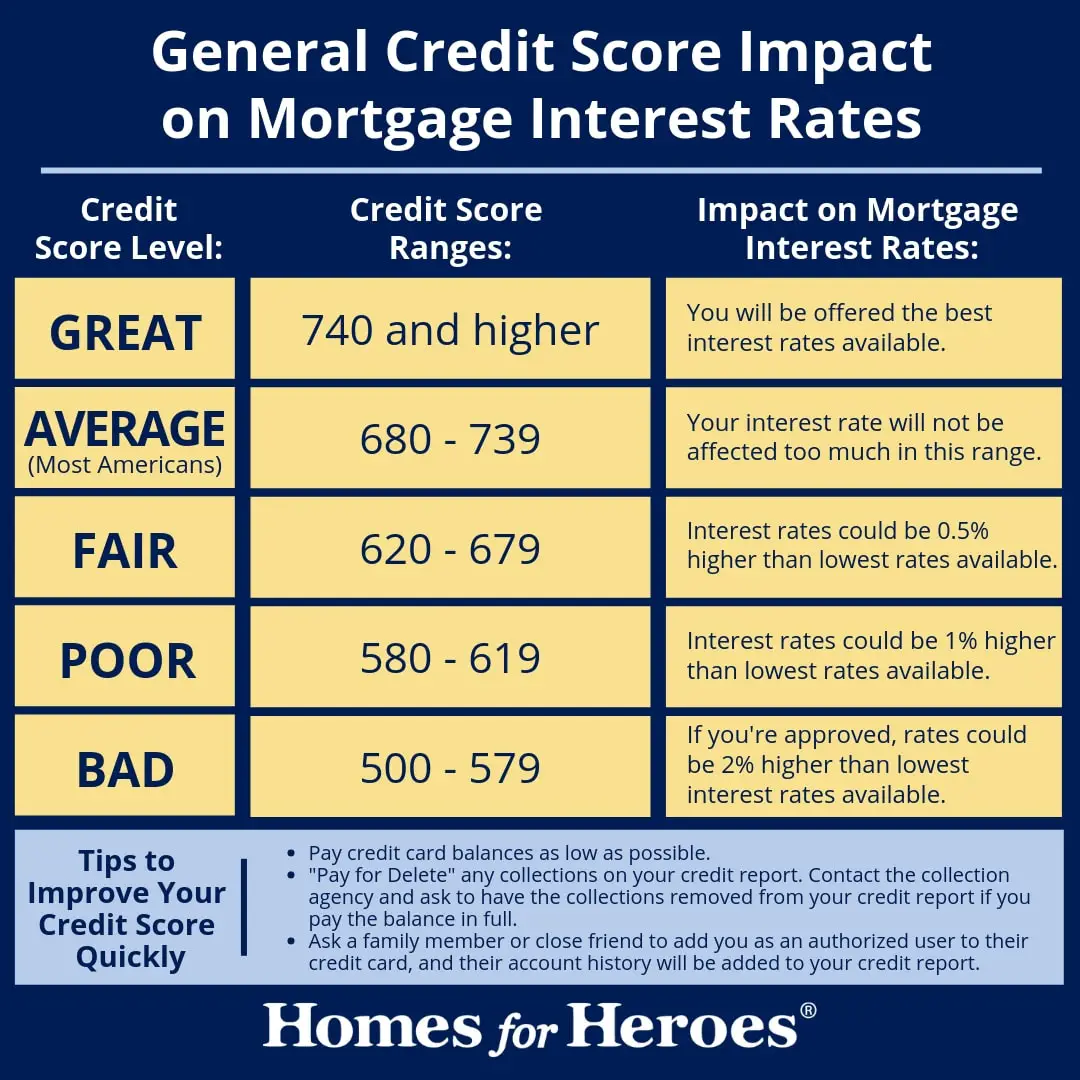

Whats a superb APR for a house mortgage? The reply is relative. Annual share charges fluctuate based mostly on the prime fee and different financial components, so the definition of a superb APR will fluctuate based mostly on whats accessible while you ask the query. As well as, the charges provided to a person rely on their credit score historical past, so a good fee for somebody with a 650 FICO rating would possibly look very completely different from a superb fee for somebody with a 775 FICO rating.

Even a slight distinction in APR can imply a distinction of tens of 1000s of within the quantity you pay to your dwelling all through the mortgage time period. So its value placing within the legwork to make sound monetary selections.

On this article, well go over the fundamentals of rates of interest and the way to make sure youre getting the most effective mortgage APR accessible while youre prepared to purchase.

You May Like: Why Do You Want To Work In The Mortgage Industry

What Is Interest Rate

Your interest rate is the percentage you pay to borrow money from a lender for a specific period of time. Your mortgage interest rate might be fixed, meaning it stays the same throughout the duration of your loan. Your mortgage interest rate might also be variable, meaning it might change depending on market rates.

Youll always see your interest rate expressed as a percentage. Youre responsible for paying back the initial amount you borrow plus any interest that accumulates on your loan.

Lets consider an example. Say you borrow $100,000 to buy a home, and your interest rate is 4%. This means that at the start of your loan, your mortgage builds 4% in interest every year. Thats $4,000 annually, or about $333.33 a month.

Your principal balance is high at the beginning of your loan term, and youll pay more money toward interest as a result. However, as you chip away at your principal through monthly payments, you owe less in interest and a higher percentage of your payment goes toward your principal. This process is called mortgage amortization.

Dont Miss: What Is The Monthly Payment On A 400 000 Mortgage

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score of both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

You May Like: What To Watch For When Refinancing Mortgage

Understanding Mortgage Interest Rates

A mortgage payment is made up of the principal and the interest. The principal is the money you borrowed from your lender. The interest is a percentage-based fee that you pay the lender for borrowing that money. Paying the principal reduces the amount you owe, while paying the interest does not.

Rates can be fixed or adjustable. A fixed rate never changes, but the rate for an adjustable rate mortgage, or ARM, can adjust higher or lower while you have your loan. If your rate adjusts, your monthly payment will change. Adjustable rate mortgages typically have caps that limit how much and how often they can change. Most adjustable rate mortgages have a rate thats fixed for a number of years and then can adjust.

Lenders offer different rates to different borrowers. The rates youll be offered typically depend on the following:

- How much you want to borrow.

- How much youve saved to pay upfront.

- How many years youll have to repay your loan.

- Whether you usually pay your bills on time.

- The type of loan you choose.

- Where you live.

When you apply for a loan, the rates youre offered can be either floating or locked. A floating rate can change before you close your loan. A locked rate shouldnt change for 30, 45 or 60 days, depending on how long your rate lock lasts. If you wont be able to find a home and complete the loan process in that time frame, you can usually pay a fee to get a longer lock.

Also Check: What Are Mortgage Lender Fees

How Are Interest Rates Calculated

Interest rates are partially determined by factors that are completely out of your control, such as inflation, the ups and downs of the broader economy and the lender you choose to work with. Because of these factors, mortgages rates are constantly changing. You might see a rate of 4.98 percent today, only to see 5.25 percent tomorrow. This is why mortgage rate locks can be a valuable tool.

However, you have a big say over your interest rate because lenders take a close look at your financial picture your credit history, your debt-to-income ratio, your plans for a down payment and other pieces of your life to set your rate. There is a simple rule with mortgage rates: The higher your credit score, the lower your interest rate will be.

Recommended Reading: Can You Negotiate A Lower Mortgage Rate

Using The Loan Estimate To Compare Mortgage Offers

When you apply for a mortgage, the lender is required to give you a three-page document called a Loan Estimate. Page 3 of the Loan Estimate has a “Comparisons” section that lists not only the APR but also how much the loan will cost in the first five years: the loan costs, plus 60 months of principal, interest and any mortgage insurance.

In the earlier example, Loan A would cost $62,033 in the first five years, and Loan B would cost $62,290. So Loan A would cost $257 less in the first five years. Even though Loan A has a higher APR, it would be the better deal if you kept the loan for just five years.

When you get multiple loan offers, line up the “Comparisons” sections of the Loan Estimates side by side to help you decide.

Fixed Rate Mortgage Penalty Interest Rate

For fixed-rate mortgages, lenders usually use the greater of three months of interest or an interest rate differential . Each lender has their own IRD calculation. The interest rate that they use for their IRD is usually based on either their current advertised mortgage rates or their posted rates, which can often be much higher.

| Advertised Rate IRD |

|---|

You May Like: Why You Should Get Pre Approved For A Mortgage

What Is An Apr

An annual percentage rate represents the cost of borrowing over the life of the loan expressed as an annual rate. People commonly reference interest rates and APRs when comparing mortgage loans. APRs are typically higher than the interest rate because they include fees associated with getting the loan, like points, origination fees and other charges, as well as interest.

There are two types of mortgage interest rates: Fixed and adjustable. A fixed rate stays the same throughout your loan. A adjustable or variable rate changes with an index such as the prime rate which is based on the Federal Funds Rate outlined by the Federal Reserve Board . This means that if you get a loan with an adjustable rate, your interest rate could change depending on changes in the index The APR for a variable rate loan estimates how the rate could change over time, but actual changes could be very different.

How Do You Shop For Mortgage Rates

First, start by comparing rates. You can check rates online or call lenders to get their current average rates. Youâll also want to compare lender fees, as some lenders charge more than others to process your loan.

Thousands of mortgage lenders are competing for your business. So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate.

Each lender is required to give you a loan estimate. This three-page standardized document will show you the loanâs interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years.

Read Also: How Much Are The Payments On A 200k Mortgage

Mortgage Loan Apr Explained

A mortgage loan APR stands for annual percentage rate, a way of showing the true cost of a home loan or other type of loan. It takes into account not only the interest rate you pay, but also the closing cost fees that are charged as part of the loan and expresses them in terms of an annual percentage. Our mortgage APR calculator makes it easy to calculate the numbers and compare lenders.

FAQ: Shopping for a mortgage can be confusing. Borrowers have to sort through a mix of interest rates, fees, points and all the rest to try to figure out what’s the best deal.Many borrowers make the mistake of focusing solely on the mortgage interest rate when they go shopping for a home loan. But the mortgage rate is only part of the picture. Closing costs and other fees can significantly affect the total cost of a mortgage. Discount points in particular can reduce your rate but mean much higher costs up front. The mortgage APR takes all of these into account and expresses them in terms of an interest rate.

Mortgage APR is defined as the annualized cost of credit on a home loan. It is the interest rate that would produce the same monthly payment on your loan amount with no fees as you would pay if you rolled all your fees into the loan itself.

That’s what this mortgage APR calculator can determine for you, in addition to calculating your interest costs and producing a full amortization schedule.

Why Is Apr Higher Than The Interest Rate

The APR of a loan is higher than the loans interest rate because it considers multiple costs of borrowing. The interest rate of a loan simply describes the rate at which interest will accrue on the loans balance. APR takes interest into account but also adds fees that you have to pay and some other costs. Because you add additional costs to the interest costs, APR will be higher than the simple interest rate.

Also Check: Which Mortgage Lenders Are Most Lenient

What Does The Mortgage Payment Include

Mortgage payments consist of principal and interest. The principal amount is the amount you borrowed. The interest is a specific percentage that you accepted before signing your loan, and this goes directly to the lender. When you make additional principal payments , this reduces the amount of interest you owe.

Mortgage interest rates are fixed or adjustable. While fixed rates remain the same throughout the loan period, an adjustable rate mortgage can increase or decrease throughout the length of your loan. When your rate adjusts, your payment changes too. ARMs have rate caps that limit the amount the interest rate can change each year and over the life of the loan. Most ARMs also have an initial fixed rate period before the rate can start to change. For example, homeowners with ARMs might have a fixed rate of 4% for five years, then it may change each year if the index changes..

The rate lenders offer depends on several factors, including:

- The amount you want to borrow

- How much you plan to put down on the loan

- The length of the loan you want

- Your on-time payment history

- The type of loan you want

High Apr Credit Cards: What To Expect

Many credit cards offer a range of interest rates depending on a customers creditworthiness. If your interest rate is towards the high end of that range, your credit score may be below average. Late payments, high utilization, chargeoffs and other negative credit behaviors hurt your credit score.

Also know that generally charge more interest than those without. And cards for customers with poor credit charge more interest than cards for people with excellent credit.

For example, the Wells Fargo Active Cash® Card lets cardholders earn unlimited 2% cash rewards on purchases and has a 19.24%, 24.24%, or 29.24% variable APR. While the Capital One Platinum Secured Credit Card, which is designed for those with poor/limited credit, has a 28.49% APR.

Even if your credit card has a high APR, you can avoid interest charges by paying off your balance in full each month. Only use your credit card for any purchases you know you can pay for. A good habit is paying off your weekly purchases to avoid your balance getting too high.

Read Also: What Bureau Do Mortgage Lenders Use

Mortgage Apr Vs Mortgage Interest Rate

When looking at your mortgage documents, youll see two percentages pop up: the interest rate and annual percentage rate . These are two distinct percentages, and its important to know the difference.

Your interest rate is the fee the lender charges you for borrowing money, expressed as a percentage such as 3.75%. Along with your mortgage principal, youll pay interest each month.

The is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what youll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When youre shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.