Use A Streamline Refinance

A fourth choice is to consider a Streamline Refinance, available on many FHA, VA, and USDA home loans. With a Streamline Refinance, the lender is not obligated to re-check your income, credit, or employment. That means the loan can close much more quickly and possibly avoid a lot of paperwork.

Whats more, with a Streamline Refi, you can skip the home appraisal. That means you can refinance with little to no home equity accrued and you may lock in a lower rate than you would with other types of low refinancing.

With a Streamline Refinance, the lender is usually not allowed to add closing costs to the loan balance, and the interest rate and monthly payment must be lowered enough to make it worthwhile for the borrower, says Eileen Derks, head of mortgages at Laurel Road.

Essentially, a Streamline refi allows the borrower to obtain a lower rate and payment for very little cost and very little effort, she explains.

Find A Mortgage That Fits Your Life

See what mortgage you qualify for

A house is one of the biggest purchases youll probably make in your lifetime. Who wouldnt want to pay off such a big purchase early? Even with low interest rates on 30-year mortgages, if you pay off your mortgage in less time lets say 15 years, for example youll owe less in overall debt, and youll free up some cash for other investments or purchases.

If you want to pay off your 30-year mortgage in 15 years or less, well walk you through the process of paying off your mortgage early and add in a few tips to take into consideration.

Plan Your New Amortization Schedule Using A Mortgage Early Payoff Calculator

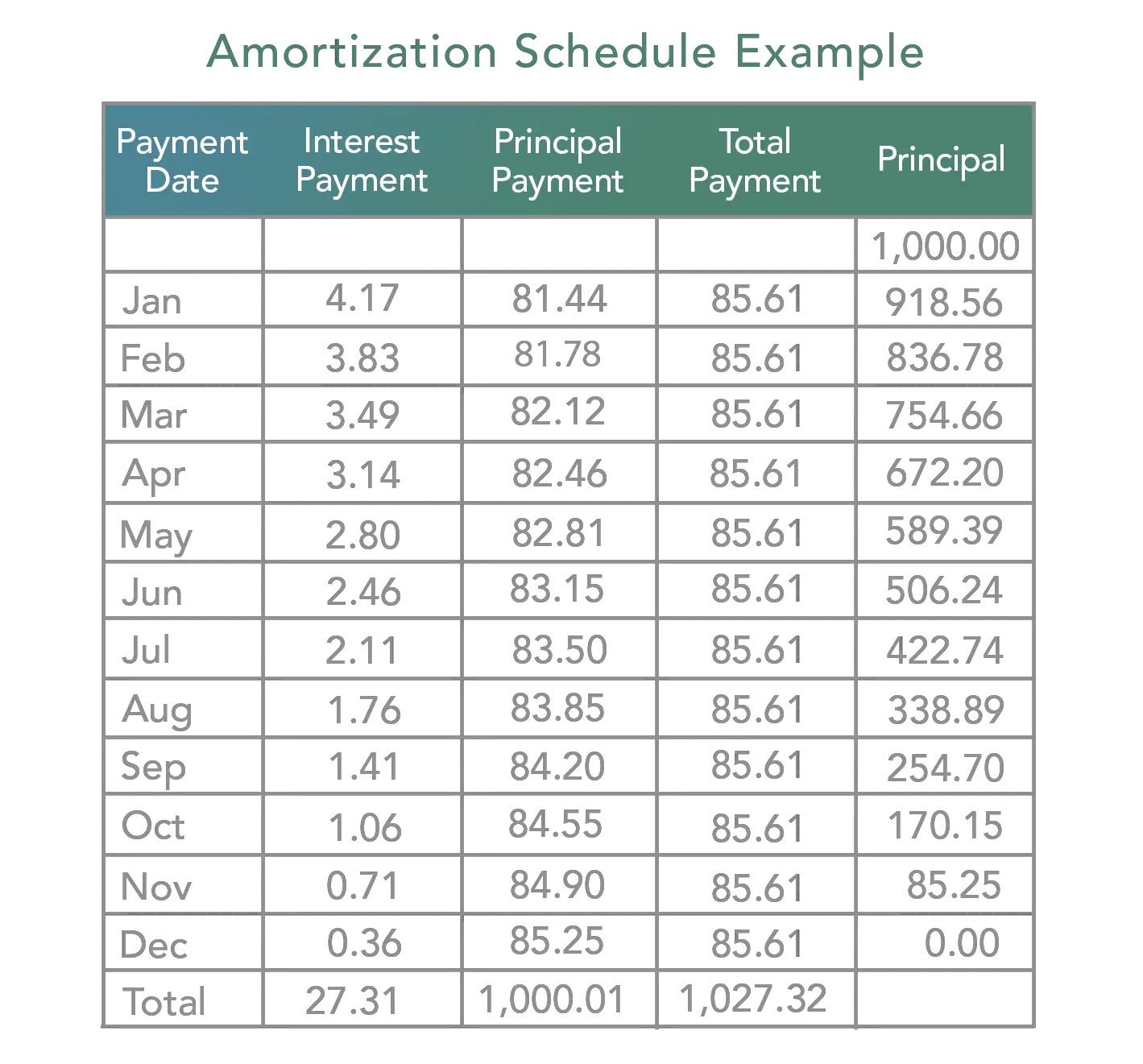

If youve never seen an amortization schedule before, it shows the total amount youll pay over the life of your loan and breaks it down into principal and interest. When you first start paying off your loan, most of your payment will go toward interest. But if you make additional mortgage payments, theyll go directly toward the principal and lower your loan balance.

Making extra principal payments not only helps you pay off your mortgage faster but also reduces the amount of interest youll pay over the life of the loan. The amount of interest you pay is a percentage of your remaining loan balance. If you pay down your mortgage faster and reduce your balance ahead of schedule, youll end up paying less interest often thousands less.

To see how much you can save by making additional mortgage payments and changing your amortization schedule, skip the math and use one of these mortgage early payoff calculators.

Read Also: How Hard To Get A Mortgage

Are All Mortgage Loans Amortized

Almost all mortgages are fully amortized meaning the loan balance reaches $0 at the end of the loan term.

The same is true for most student loans, auto loans, and personal loans, too. Unlike with credit cards, if you stay on schedule with a fully amortized loan, youll pay off the loan in a set number of payments.

Among mortgages, non-amortizing loans include balloon mortgages or interest-only mortgages.

Most lenders dont offer these and most home buyers dont want them because these loans are riskier and dont help the borrower build equity as quickly.

With an amortized loan, your mortgage is guaranteed to be paid off by the end of the term as long as you make all your payments over the life of the loan.

Take Advantage Of Prepayment Privileges

Pay off your home quicker with mortgages that have prepayment privileges. Lenders offer open, closed and convertible mortgages Opens a popup.. Open mortgages usually have higher interest rates than closed mortgages, but they’re more flexible because you can prepay open mortgages, in part or in full, without a prepayment charge. Closed and convertible mortgages often let you make a 10% to 20% prepayment. Your loan agreement explains when you can make a prepayment, so get the details from your lender beforehand. Also, decide which privileges you want before finalizing your mortgage.

Read Also: What To Know About Getting A Mortgage

Should You Pay Off Your Mortgage Faster

This depends on the interest rate for your mortgage. Higher mortgage rates incentivize homeowners to accelerate the payoff process rather than accrue excessive interest. Mortgage rates are climbing, so refinancing may not be a great option for those whove already locked in a decent rate.

Weve broken down some bullets of things to consider when deciding whether to pay off your mortgage early.

In order, the considerations should be:

Early Mortgage Payoff Calculator: How Much Should Your Extra Payments Be

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

One way to pay off your mortgage early is by making larger monthly payments. But how much more should you pay? NerdWallet’s early mortgage payoff calculator figures it out for you.

The mortgage payoff calculator shows you:

-

How much more principal you would have to pay every month to pay off the loan in a certain number of years.

-

How much interest you would save by paying off the loan early.

To fill out the fields, it might help to have one of the following:

-

A recent monthly statement.

Check out tips below in Mortgage payoff calculator help.

Don’t Miss: How To Shave Years Off Your Mortgage

How To Create An Amortization Schedule

An amortization table can provide valuable information for borrowers to consider when taking out a home loan or reviewing their existing mortgage. This useful tool is essential for effective financial planning and greater lifetime savings.

Get Rid Of Mortgage Insurance

You can learn how to lower mortgage payments through understanding your current real estate market. If it is rapidly appreciating, for example, you can potentially refinance your loan. You may be able to refinance your loan with lifetime insurance into a standard loan without mortgage insurance.

Your credit score and the homes increase in value can play a large part in making this work. You would also need to have at least 20 percent in equity in your home to get rid of your mortgage insurance. That requires a lenders appraisal to show a substantial increase in the homes market price, which depends on how much you put down.

You May Like: How Much Do You Need For A Mortgage

Investing The Cash Instead

If you have excess cash burning a hole in your pocket, consider the opportunity cost of paying down your mortgage early instead of using the funds to invest elsewhere. While you will save on a portion of the interest expense, you may be better off investing the money instead, especially if your interest rate is low.

Consider your interest expense relative to your long-term return expectations. If a homebuyer can get a 30-year fixed mortgage for 2.85% and their long-term assumption for investment returns is 6%, theyre using leverage to achieve a better financial outcome. After all, you won’t enjoy the benefits of paying down your mortgage early until you’re living debt-free, but the average buyer only lives in the house for 10 years.

Diy Extra Payment To Prepay Mortgage

Lets say you want to budget an extra amount each month to prepay your principal. One tactic is to make one extra mortgage principal and interest payment per year. You could simply make a double payment during the month of your choosing or add one-twelfth of a principal and interest payment to each months payment. A year later, you will have made 13 payments.

Make sure you earmark any additional principal payments to go specifically toward your mortgage principal. Lenders typically have this option online or have a process for earmarking checks for principal payments only. Ask your lender for instructions. If you dont specify that the extra payments should go toward the mortgage principal, the extra money will go toward your next monthly mortgage payment, which wont help you achieve your goal of prepaying your mortgage.

Once you have built sufficient equity in your home , ask your lender to remove private mortgage insurance, or PMI. Paying down your mortgage principal at a faster rate helps eliminate PMI payments more quickly, which also saves you money in the long run. You can also refinance your mortgage to eliminate PMI altogether.

Read Also: How Long Would It Take To Pay Off My Mortgage

What Other Options Do I Have

If your rising mortgage payment is straining your budget, you may have other options aside from extending your amortization period.

- Look for other ways to reduce your payments. You might be able to lower your payment by getting a different interest rate or a different kind of mortgage product. You might also be able to lower your overall debt payments by using your mortgage to consolidate debt. A mortgage broker is a fantastic resource for exploring your options.

- Use a home equity line of credit to access cash. Depending on your budget, a home equity line of credit may give you the flexibility you need. Rather than reducing your monthly payments, you can use a HELOC to withdraw only the money you need, when you need it. Your mortgage broker can help you understand the benefits and risks of this strategy.

- Make more money. Okay, duh. But if you can increase your income enough to cover the difference in payments, youâll be far better off over the long run. Consider asking for a raise at work, looking for a higher paying job, taking on a side hustle, or renting out a portion of your property.

- Sell your home. If you canât afford your mortgage payments, you may need to reconsider whether owning a home is right for you. Consider whether downsizing to a smaller home, or choosing to rent instead, will be better for you in the long run.

How Mortgage Loan Amortization Works

Most mortgage loans are fully amortized. That means theyre paid off in monthly installments over a set period of time. At the end of that period, the loan balance reaches $0.

Loan amortization is the process of calculating the loan payments that amortize meaning pay off the loan amount, explains Robert Johnson, professor of finance at Heider College of Business, Creighton University.

On a fully amortizing loan, the loan payments are determined such that, after the last payment is made, there is no loan balance outstanding, Johnson explains.

If you have a fixed-rate mortgage, which most homeowners do, then your monthly mortgage payments always stay the same. But the breakdown of each payment how much goes toward loan principal vs. interest changes over time.

As a result, each payment has a different impact on your mortgage balance.

Don’t Miss: What Does 1 Point Mean In Mortgage

How Home Mortgage Amortization Works

When you make your monthly mortgage payment, the lender divides the total amount into two buckets:

- Principal: This is the outstanding balance on your loan.

- Interest: This is the cost of financing your home.

Some mortgage payments may include an amount for escrow, which is used to pay items such as your property tax and homeowners insurance. However, some loans may allow you to pay those amounts on your own and limit your mortgage payment to Principal and Interest only. The following refers to your P& I payment.

At the beginning of your loan pay-off period, the bulk of your payment is applied to the interest bucket with a small portion going toward the principal. As the lender covers the cost of financing your home purchase, the payment allocation begins to change. Over time, a larger percentage of your payment goes toward the principal and less to interest.

If you keep close track of your loan balance, youll notice the amount you owe diminishes slowly at the beginning of your loan. Youll also notice that it drops much faster toward the end of the pay-off period since interest is calculated on the loan balance. The loan balance reduces every month as you pay off your mortgage. Therefore, so does the interest.

Related Topics & Resources

Products underwritten by Nationwide Mutual Insurance Company and Affiliated Companies. Not all Nationwide affiliated companies are mutual companies, and not all Nationwide members are insured by a mutual company. Subject to underwriting guidelines, review and approval. Products and discounts not available to all persons in all states. Nationwide Investment Services Corporation, member FINRA. Home Office: One Nationwide Plaza, Columbus, OH. Nationwide, the Nationwide N and Eagle and other marks displayed on this page are service marks of Nationwide Mutual Insurance Company, unless otherwise disclosed. ©. Nationwide Mutual Insurance Company.

Recommended Reading: What Is Current Fixed Mortgage Rate

Should You Pick A Long Or Short Amortization Schedule

Before deciding on a mortgage loan, its smart to crunch the numbers and determine if youre better off with a long or short amortization schedule.

The most common mortgage term is 30 years. But most lenders also offer 15-year home loans, and some even offer 10 or 20 years.

So how do you know if a 10-, 15-, or 20-year amortization schedule is right for you?

Choose Your Debt Amount

Home > Real Estate > How to Get a Mortgage > Paying off a 30-Year Mortgage Early

Buying a house has never been cheap, but lately, its become more challenging for potential homebuyers to lock in an affordable place to call home.

If you already own a home, paying off your mortgage early can offer benefits like increased cash flow and interest savings. Building equity in your home is enticing, especially for first-time homeowners, however, the rise in housing costs will influence your strategy to pay down your mortgage early.

As of February 2022, housing prices have jumped by nearly 20% from the previous year, and Fannie Mae predicts costs will climb by another 11.2% by December.

For interest rates, as of June 2022, a 30-year fixed-rate mortgage sits at 6.18%, a 3.15% rise from the previous year. A 15-year fixed mortgage sits at 5.38%, a 2.96% rise.

However, getting out from under a monthly mortgage payment 15 years earlier while building equity in your home faster, could still be enticing, especially for first-time homeowners. Once that mortgage debt is wiped out, money used there could be moved to retirement savings or college savings for children.

And then there is the tax benefits of owning the home, which should not be ignored. The more careful the process and analysis, the better informed you can be.

Anyone who is uncertain can find help through a nonprofit credit counselor, who could offer advice on your equity, debts and financial plan.

Recommended Reading: When Does Mortgage Insurance End

Reduce Your Monthly Payment

If youre having a hard time affording your mortgage each month, changing your amortization schedule can reduce your monthly payment. These are the options:

- Refinance to a longer loan term. This gives you more time to pay off your loan, and lowers the monthly payment. However, it also means youll be making payments longer and paying more interest, which increases the total cost of your loan.

- Loan modification. A loan modification changes the terms of your existing loan. A loan modification could help you lower your interest rate or extend your loan term. However, mortgage lenders arent obligated to accept requests for a loan modification.

Estimate Your Monthly Mortgage Payments Total Interest Expense And Payoff Date

Although your monthly payment will be the same each month, the amount going toward principal will increase each month and the amount going toward interest will decrease each month as you pay down your balance. The calculators amortization schedule will show you the details.

Most people need a mortgage to buy a home. The median U.S. home costs more than $350,000 as of February 2022, and few people have that much extra cash lying around. Whats more, mortgage rates are so low that even people with plenty of savings may prefer to borrow for a home purchase to maintain the financial security of having well-funded emergency savings and retirement accounts. And, of course, theres the tax deduction for mortgage interest.

With our mortgage amortization calculator, you can see your estimated monthly payment and how the total cost of your mortgage will change depending on your interest rate. Try out different inputs for home price, down payment, interest rate, and loan term to understand the long-term impact of a mortgage before you sign the paperwork. This calculator can help you whether youre buying a home or refinancing.

A mortgage amortization calculator will show you the long-term cost of a fixed-rate mortgage by compiling the total interest that you will pay over the life of your mortgage. It also itemizes the principal and interest of each monthly payment to show you how your mortgage payments are structured.

Also Check: How To Lower Your Mortgage

Paying Off Your Mortgage

Some homeowners decide to pay off their mortgage early as a way to save on interest payments.

One way to do this is by refinancing into a shorter loan term, like a 10-, 15-, or 20-year mortgage.

But for homeowners who dont want the hassle and cost of refinancing, an alternative is to make extra or accelerated payments toward the loan principal. Early payments can be in the form of:

- One extra payment each year

- Extra money added to each monthly payment

- A one-time, lump sum payment

Early payments toward your loans principal balance can speed up your amortization schedule. Youll save money because you wont have to pay interest on the months or years eliminated from your loan term.

You can use an amortization calculator with extra payments to determine how quickly you might be able to pay off your remaining balance, and how much interest youd save.