Get A Home Inspection

This isn’t a requirement, but it’s a smart move. Get your home inspected before you buy. The inspector will look for any issues with the foundation, roof, plumbing, electrical wiring, heating and cooling systems, etc. You may also be able to negotiate the sales price or even ask the seller to make repairs as part of the negotiations.

Button Up The Details With Your Lender

Once you have found a home and made an offer, it’s time to submit your mortgage application.

You have to submit a complete application with all the supporting documentation. The lender will verify your documents and check your credit. Getting financing will be determined by the underwriter, who evaluates the risk of the borrower, and determines the amount to be borrowed.

Start Your Own Mortgage Loan Processing Business

- Learn to start and run your own Mortgage Loan Processing business.

- Understand how to close an entire file with a complete loan processing example.

- Become a business owner and hire other loan processors.

- Learn to read and understand a loan approval.

- Learn who you need to contact when processing a mortgage loan.

- Understand what documents need to be completed and included in a loan file before submitting to underwriting.

- Learn how to determine your loan processing fees.

- Discover how to find lenders and mortgage brokerage companies that will work with you.

Also Check: How To Get A Mortgage Modification

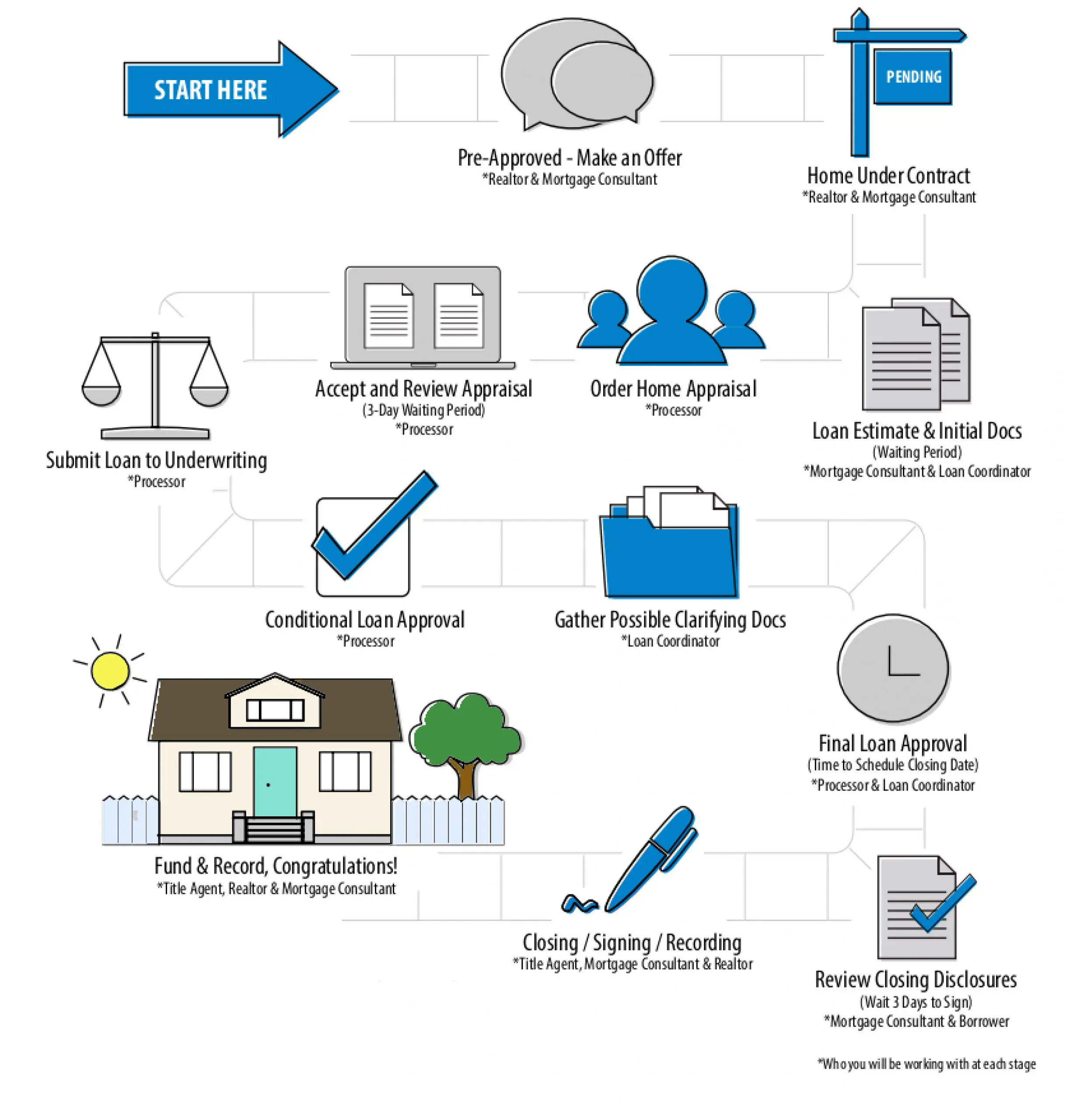

How Long It Could Take To Get A Loan

The entire process of getting a mortgage loan comprises several processes. These include getting pre-approved and getting the home appraised before you get the loan. Because of the many steps in this process, it is impossible to put a definite time frame. In the usual market, it takes an average of 30 days to get a mortgage.

If there are problems with your application, getting your loan approved could take much longer. It is advisable to start the mortgage application process as soon as possible to shorten this process. You don’t have to wait until you find the perfect property before you begin the mortgage process. You can save time by starting the process to get pre-approved first.

Possible problems that might arise in the loan approval process include delayed appraisal, delayed tax transcript verification from the IRS, delayed verification of employment by employers, and provision of incomplete or incorrect information to the lender by the borrower. Although you may not have much control over most of these, you should ensure all documents provided to the lenders are submitted in a timely fashion and as detailed and accurate as possible. Doing this would speed up the approval process and shorten the time it takes to get a loan.

Is There A Minimum Credit Score

The minimum credit score required to get a mortgage depends on the type of mortgage you get and the lender you use.

Conventional mortgages backed by Fannie Mae or Freddie Mac have a minimum credit score requirement of 620, although individual lenders may set their own, higher credit score requirements on top of that.

FHA loans typically require a minimum credit score of 580. However, you can get an FHA loan with a lower credit score if you have a higher down payment if you put down 10% , you can get a loan with a credit score as low as 500.

USDA loans and VA loans dont list official credit score requirements. Instead, lenders will look at your application as a whole when deciding whether to approve you for a mortgage. However, your credit score is still a major factor in that decision.

Keep in mind that even if you qualify for a mortgage with a low credit score, your interest rate will likely be higher, increasing your total cost of borrowing in the long run.

Recommended Reading: What Questions Should I Ask Mortgage Lender

How Much Down Payment Is Required For A First

How much you have to put down on a home depends on the type of loan youâre considering. While youâll need to put down at least 3% of the homeâs purchase price for a conventional loan or 3.5% for an FHA loan, USDA and VA loans donât require a down payment.

If you canât afford a down payment, you might qualify for a down payment assistance program. These programs are often geared toward first-time or low-income home buyers and can be issued as a low-interest loan or grant that doesnât have to be repaid.

There are also some lenders that offer no-money-down mortgages, though these types of loans arenât as common as they were before the 2008 financial crash.

Mortgage Processing And Underwriting

Once your full loan application has been submitted, the mortgage processing stage begins. For you, the buyer, this is mostly a waiting period.

But if youre curious, heres what happens behind the scenes:

First, the Loan Processor prepares your file for underwriting.

At this time, all necessary credit reports are ordered, as well as your title search and tax transcripts.

The information on the application, such as bank deposits and payment histories, are verified.

Respond ASAP to any requests during this period to make sure underwriting goes as smoothly and quickly as possible.

Any credit issues, such as late payments, collections, and/or judgments, require a written explanation.

Once the processor has put together a complete package with all verifications and documentation, the file is sent to the underwriter.

During this time, the underwriter will review your information in detail. Its their job to nitpick the information youve provided looking for missing items and red flags.

Theyll primarily focus on the three Cs of mortgage underwriting:

- Capacity: Will your income and current debt load allow you to make the loans payments each month?

- : Does your credit history show that you pay debts on time?

- Collateral: Is the value of the property youre buying sufficient collateral for the loan?

During the underwriting process, your loan officer may come back with questions. You should respond as quickly as possible to ensure a smooth underwriting process.

Read Also: How To Calculate P& i Mortgage

Things To Do Before You Apply For A Mortgage

Every homebuyer should make sure they are fully prepared before beginning the mortgage application process. If not, it can take much longer.

“When it comes to homeownership, your credit score, along with your debt-to-income ratio, is a major factor in determining what your loan terms will be,” says Shelby McDaniels, channel director of corporate home lending at Chase. “That is, whether you’ll be approved for a mortgage, and if so, at what rate.”

How To Start The Mortgage Pre

You don’t have to be pre-approved for a mortgage to buy a house. But it’s smartespecially in a seller’s marketto be: A pre-approval means that a lender has already determined that you’re qualified to borrow the money needed for a mortgage, which puts you in a better position to act quickly on a house that you love. In turn, that makes you a more attractive buyer to a seller, experts say. “If you’re serious about buying a home, having a pre-approval letter in hand will let the seller know that you’ve done your due diligence, and your credit and income qualify you to purchase the home,” says Mary Babinski, senior loan originator for Motto Mortgage Champions. In fact, many real estate agents won’t even take you to look at homes unless you’ve been pre-approved.

Here’s everything that you need to know to start the pre-approval process.

Westend61 / Getty Images

Recommended Reading: How Much Is Mortgage Origination Fee

Go Through Underwriting Process

The next stage is for your application to be assessed by underwriters.

Though you are unlikely to deal with them directly, mortgage underwriters are actually the key decision-makers in the mortgage approval process and are the people who will give final approval for your mortgage.

Underwriters will check every aspect of your mortgage application and carry out a number of other steps. For instance, borrowers are required to have an appraisal conducted on any property they take out a mortgage against. The underwriter orders this appraisal and uses it to determine if the funds from the sale of the property are enough to cover the amount you will be lent in your mortgage.

Once underwriters have assessed your application, they will give you their decision. This will either be to accept the loan as it is proposed, reject it, or approve it with conditions. Your mortgage might be approved, for instance, on the condition that you supply more information about your credit history.

If your application is approved, you will then lock in your interest rate with your lender. This is the final interest rate you will pay for the remainder of your mortgage term.

Know How Much Mortgage Can You Afford

To get a good idea of what your monthly mortgage payment will look like, you can use NextAdvisors mortgage calculator to estimate your monthly payments. But keep in mind that how much you feel you can comfortably fit into your budget may be more or less than what a bank is willing to lend to you.

One of the ways your mortgage lender determines how much you can borrow is by looking at your debt-to-income ratio . The maximum DTI you can have varies depending on the type of mortgage, but typically its in the 45% range. So if you make $6,000 a month, you may be able to secure a mortgage with a payment of up to $2,700 a month, if you have no other debt.

But just because you can borrow that much doesnt mean you should. A good rule of thumb is to have a DTI thats no higher than 36%. That includes not just your mortgage payment, but all of your other monthly debt payments. To keep a DTI of 36% or less on that same $6,000 a month income, you could have up to $2,160 combined monthly debt and mortgage payments.

You May Like: How To Qualify For A Mortgage On A Second Home

Heres How The Mortgage Process Works From Start To Finish

Estate agent shaking hands with his customer after contract signature

Getty

Many buyers, especially first-timers, have a lot questions as to how the mortgage process works. To that end, Ive laid out the process from start to finish. Read over the steps below to get a sense of what you need to do in order to be approved for a home loan.

Getting a pre-approval letter

The first step is the mortgage process is getting a pre-approval letter. This letter tells you how much the bank is willing to lend you, based on your current financial situation. Many buyers find it helpful in letting them know how much they can afford to spend on a home, so its a good idea to start this process before beginning your home search.

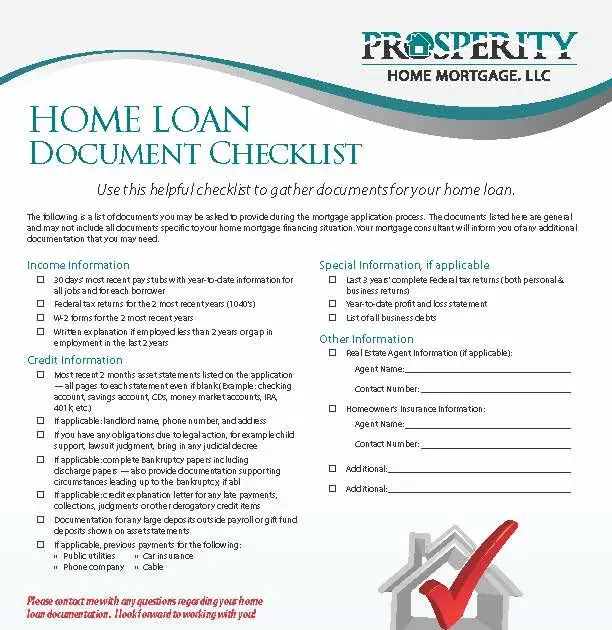

With that in mind, here are the documents that you need to provide in order to be pre-approved for a loan:

- Two years of W-2s

- A recent pay stub with your year-to-date income listed

- Recent statements from any bank accounts

- Recent statements from any investment accounts

Submitting a mortgage application

Once youve found a home and your offer is accepted, the next step is to officially apply for a loan. For the most part, this involves working with your lender to fill out a fairly straightforward application, which includes information about the property, your loan program, and your financial history.

Shortly after you submit your application, youll receive the following documents from your lender:

A loan estimate

Find Your Real Estate Agent

A good real estate agent is a valuable asset. They can answer questions, help you look for homes within your budget and assist you throughout the homebuying journey. Without a real estate agent, you could find yourself to be at a disadvantage to a buyer that has an Agent representing them. Realters are there to help make things as easy as possible and the seller is responsible for paying the majority of their fees.

Don’t Miss: Do You Pay Interest On A Reverse Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Get Preapproved For A Mortgage

Getting preapproved for a mortgage gives you a good idea of how much you can borrow and shows sellers you are a qualified buyer. To get a preapproval, a lender will check your credit score and proof of your income, assets, and employment. Even though a preapproval letter doesnt guarantee youll qualify for financing, it shows the seller you have your finances in a place to pass an initial cursory examination from a lender.

Most preapproval letters are valid for 60-90 days, and when it comes time to apply for a mortgage all of your information will need to be reverified. Also, dont confuse preapproval with prequalification. A prequalification is a quick estimate of what you can borrow based on the numbers you share and doesnt require any documentation. So its less rigorous than a preapproval and carries less weight.

Recommended Reading: How To Calculate Net Rental Income For Mortgage

The Buyers Employer Or Job Title Changed

Changing jobs even for higher pay can ruin your pre-approved mortgage.

If you plan to make any of the following changes in your job or career, ask your mortgage lender before making the change:

- Becoming a partner in a company

- Starting a new business

- Switching from a salaried position to a salary + bonus position

- Changing industries

- Accepting payment in cryptocurrency

Its okay to make changes in your career. Be sure to speak with your lender to avoid unintended consequences.

Can You Get A Second Mortgage To Buy Another House

Yes, you typically can use a second mortgage to buy another home, though this will depend on the lender. A second mortgage allows you to borrow against the equity of your home without actually refinancing. With this type of loan, you can access up to 85% of your total home value . Youâll typically need at least 20% equity in your home to qualify.

There are two main types of second mortgages:

- Home equity loan. With this kind of loan, youâll receive a lump sum to use how you wish, which youâll pay off in fixed installments over a period of timeâsimilar to a personal loan.

- Home equity line of credit . Unlike a home equity loan, a HELOC is a type of revolving credit that lets you repeatedly draw on and pay off a credit lineâsimilar to a credit card.

Keep in mind that while interest rates tend to be lower on second mortgages compared to personal loans and credit cards, these types of loans are secured by your home. This means you risk foreclosure if you canât keep up with your payments.

Also remember that taking out a second mortgage means youâll have to make payments on two loans at once.

Don’t Miss: How To Go About Getting Pre Approved For A Mortgage

Bank Statements And Other Assets

When assessing your risk profile, lenders may want to look at your bank statements and other assets. This can include your investment assets as well as your insurance, such as life insurance.

Lenders typically request these documents to make sure you have several months worth of reserve mortgage payments in your account in case of an emergency. They also check to see that your down payment has been in your account for at least a few months and did not just show up overnight.

The Mortgage Process From Start To Finish

by Mortgage Jon | Apr 20, 2022

Today, Ill go over the entire mortgage process from start to finish. If youve never had a home loan or never purchased a home, you should go through this to know what to expect from the first time you reach out to a mortgage lender to the very last day when you sign and take ownership of the property.

Ill cover all the tiny details that might be surprising if youve never done it before. In the end, you will be fully prepared.

You May Like: Can You Have A Second Mortgage With A Va Loan

Gather The Documents Needed For Your Mortgage Application

Your finances are in good shape and you know how much you can borrow. Now here comes the real work.

Lenders require quite a bit of documentation as part of the mortgage approval process, so itâs a good idea to gather everything up before youâre ready to apply. Hereâs what youâll need:

Income verification. First, youâll need to prove you have the income to support your mortgage payment. Lenders will likely want to see tax returns for the last two years, as well as recent W-2 forms or pay stubs. If youâre self-employed, youâll need to verify your income with 1099s or profit and loss statements from the past couple of years instead.

If you receive income from alimony or child support, youâll also be expected to provide court orders, bank statements and legal documentation that shows youâll continue receiving that income.

Proof of assets. In addition to income, additional assets can help you secure a mortgage. Expect to provide bank statements for checking and savings accounts, retirement accounts and other brokerage accounts from the past 60 days.

List of liabilities. Lenders may also ask you to provide documentation related to outstanding debts, such as credit card balances, student loans or any existing home loans.