Is Mortgage Insurance Compulsory For Hdb

Compulsory for HDB flat owners who are using their CPF savings to pay their monthly housing loan instalments. Optional for HDB flat owners who have private life insurance or mortgage-reducing insurance that can sufficiently cover the outstanding housing loan. Compulsory for flat owners with outstanding HDB loans.

Finding An Accurate Quote Is A Challenge

When you buy a house, you may get offers from your lender and by mail for mortgage life insurance. But it can be hard to comparison shop on your own. You may find it challenging to get mortgage life insurance quotes online. Many insurers donât offer quotes online, making it difficult to compare policies without having to speak with someone directly.

Solid Reasons Why You Should Have Mortgage Protection Insurance

Soon after taking on the responsibilities of a mortgage that usually spans several years, many people consider getting mortgage protection insurance. A mortgage protection insurance helps homeowners protect their biggest asset home from foreclosure in case they dont meet the monthly mortgage premiums because of a health issue, death, loss of a job, or any other reason. With this coverage, they usually have peace of mind and safety from foreclosures, which is quite common.

Buying a home comes at a huge price. You will have to pay your property taxes, homeowner insurance, and in all likelihood, private mortgage insurance. These three expenses alone can put pressure on your savings and leave you in a financial bind.

Here are a few reasons why you should get mortgage protection insurance:

A mortgage is probably the biggest investment an average American makes in their lifetime. This makes their home the biggest asset, which is why ensuring it is of the utmost importance. With mortgage protection insurance, you can protect your home from foreclosure in the event of your death, health issues, or loss of a job.

Unlike other types of insurance, mortgage insurance is designed to offer a seamless and hassle-free experience to borrowers. Its premiums are generally cheaper and do not increase as you age. The expense consideration is if the program covers all partners under the same policy.

Contributor

Don’t Miss: What Is The Monthly Mortgage

How To Avoid Paying For Mortgage Insurance

If you qualify, a VA loan could allow you to buy a home with no down payment and no mortgage insurance. Otherwise, the most straightforward way to avoid paying for mortgage insurance is to get a conventional loan and make a down payment of at least 20%. If you can’t afford 20% down, you can look for a lender that offers lender-paid PMI, but the loan may have a higher interest rate.

You may also be able to find a piggyback, or 80-10-10, loan to avoid PMI. With this arrangement, you put 10% down, get a loan to cover the other 10% of your down payment and take out the mortgage for 80% of the purchase. These types of arrangements aren’t as common as they used to be, however, and the cost for the 10% loan might be more than you’d wind up paying for PMI.

How Long Do I Need To Have Mortgage Insurance

The good news about PMI is that in most cases, you wont have to continue paying it for the entire length of your home loan. Most mortgage insurance plans allow you to cancel your policy once youve paid off more than 20% of the full loan amount of your home.

Typically, your lender would remove it once you have 22% equity. We suggest looking ahead to find out when youll have made it to the 20% benchmark to request a PMI cancellation and avoid paying unnecessary premiums.

Some mortgage insurance types require upfront payments that are also refundable when your mortgage insurance is canceled.

Also Check: What Is Mortgage Interest Deduction

What Is Mortgage Insurance How It Works When Its Required

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The traditional target for a home down payment is 20% of the purchase price, but thats out of reach for many buyers.

Mortgage insurance makes it possible to hand over a much smaller down payment and still qualify for a home loan. It protects the lender in case you default on the loan.

With a conventional mortgage a home loan that isnt federally guaranteed or insured a lender will require you to pay for private mortgage insurance, or PMI, if you put less than 20% down.

With an FHA mortgage, backed by the U.S. Federal Housing Administration, youll pay for mortgage insurance regardless of the down payment amount.

USDA mortgages, backed by the U.S. Department of Agriculture, and VA mortgages, backed by the U.S. Department of Veterans Affairs, don’t require mortgage insurance. But they do have fees to protect lenders in case borrowers default. So you’ll still face an extra cost with these home loans in exchange for the low down payment requirement.

Where To Get Mortgage Life Insurance

You can buy mortgage life insurance through your mortgage lender, or through another insurance company or financial institution. Shop around to make sure youre getting the best insurance to meet your needs.

Your lender can’t force you to buy a product or service as a condition for getting another product or service from them. This is called coercive tied selling.

Recommended Reading: How Many Months Bank Statements For Mortgage

Benefits Of Mortgage Insurance

While mortgage insurance primarily benefits the lender, it does serve a purpose for the borrower because it allows you to get a mortgage with limited down payment savings. Putting down 20 percent can be challenging, especially with home values on the rise, so by paying for mortgage insurance, you can still get a loan without needing a large down payment.

Waiting until you have a 20 percent down payment also runs the risk of missing out on favorable mortgage rates. Mortgage insurance offers the ability to get those rates now, meaning you can save on interest over time, despite borrowing more money with a smaller down payment at first.

However, there are downsides to mortgage insurance, as well, mainly that its an extra expense you wouldnt otherwise have to pay, and that it can be difficult to get out of if you have an FHA loan.

Which Of Your Needs Are Met By Each Product

If youre buying a home or renewing an existing mortgage, you may be offered group insurance by your lender or broker. You put a lot of money towards your home, so its worth taking steps now to protect your investment.

Mortgage life insurance is typically marketed towards new homeowners who may be concerned that an unexpected death or illness could leave their loved ones with a large mortgage.

Personal life insurance can perform a similar function for you, but isnt tied to just covering your mortgage. Its designed to provide your beneficiaries with money in the event of your death. Its flexibility allows your beneficiaries to use the money for whatever purpose they wish. Its an individual insurance product.

Mortgage life insurance is different from mortgage loan insuranceOpens in a new window. If you buy a house with less than a 20% down payment, the lending institution requires you to get mortgage loan insurance to protect against the risk of default. Mortgage life insurance, on the other hand, pays down or pays off the mortgage if the borrower dies.

Don’t Miss: How Much Interest Do I Pay On A Mortgage

Federal Housing Administration Mortgage Insurance

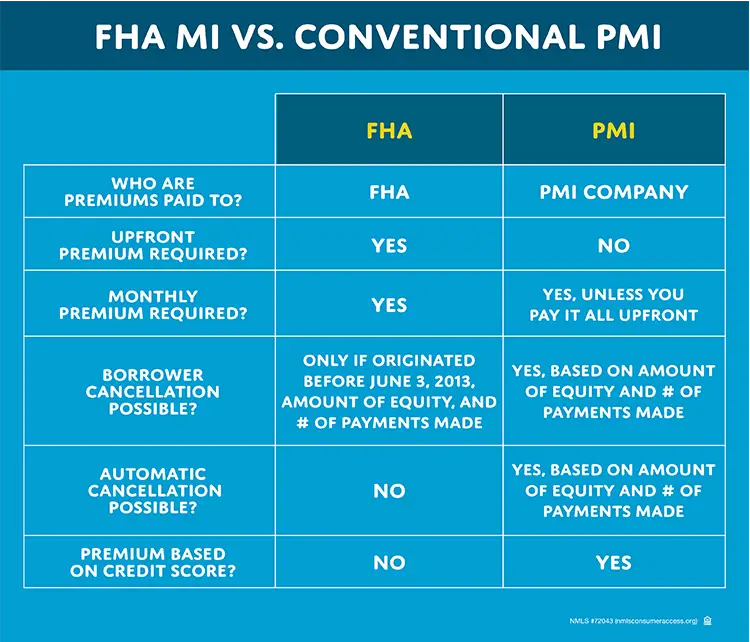

Mortgage insurance works differently with FHA loans. For the majority of borrowers, it will end up being more expensive than PMI.

PMI doesnât require you to pay an upfront premium unless you choose single-premium or split-premium mortgage insurance. In the case of single-premium mortgage insurance, you will pay no monthly mortgage insurance premiums. In the case of split-premium mortgage insurance, you pay lower monthly mortgage insurance premiums because youâve paid an upfront premium. However, everyone must pay an upfront premium with FHA mortgage insurance. What is more, that payment does nothing to reduce your monthly premiums.

As of 2021, the upfront mortgage insurance premium is 1.75% of the loan amount. You can pay this amount at closing or finance it as part of your mortgage. The UFMIP will cost you $1,750 for every $100,000 you borrow. If you finance it, youll pay interest on it, too, making it more expensive over time. The seller is permitted to pay your UFMIP as long as the sellers total contribution toward your closing costs doesnt exceed 6% of the purchase price.

With an FHA mortgage, youâll also pay a monthly mortgage insurance premium of 0.45% to 1.05% of the loan amount based on your down payment and loan term. As the FHA table below shows, if you have a 30-year loan for $200,000 and youâre paying the FHAâs minimum down payment of 3.5%, your MIP will be 0.85% for the life of the loan. Not being able to cancel your MIPs can be costly.

Us Department Of Agriculture Loan

If you get a US Department of Agriculture loan, the program is similar to the Federal Housing Administration, but typically cheaper. Youll pay for the insurance both at closing and as part of your monthly payment. Like with FHA loans, you can roll the upfront portion of the insurance premium into your mortgage instead of paying it out of pocket, but doing so increases both your loan amount and your overall costs.

Recommended Reading: How To Calculate Upfront Mortgage Insurance Premium

How Do Mortgage Repayments Work

For most of us, buying a property will involve taking out a mortgage. It’s one of the biggest loans we will take out, so it’s really important to understand just how your repayments work and what your options are for reducing them.

When you buy a property, what you pay will be made up of two parts – your deposit and your mortgage. The larger your deposityou have in place, the smaller the mortgage you will need to borrow.

So for example, if your deposit is worth 10% of the purchase price, then you will need to take out a mortgage for the remaining 90%.

The amount that the mortgage will cost you to pay off will be determined by two additional factors – the term of the mortgage and the interest rate.

You will then make a monthly repayment towards the mortgage so that it is paid off when you reach the end of your mortgage term.

This newsletter delivers free money-related content, along with other information about Which? Group products and services. Unsubscribe whenever you want. Your data will be processed in accordance with our Privacy policy

Types Of Mortgage Insurance

There are four kinds of PMI:

- Borrower-paid monthly. This is just what it sounds likeâthe borrower pays the insurance monthly typically as part of their mortgage payment. This is the most common type.

- Borrower-paid single premium. Youâll make one PMI payment up front or roll it into the mortgage.

- Split premium. The borrower pays part up front and part monthly.

- Lender paid. The borrower pays indirectly through a higher interest rate or higher mortgage origination fee.

You might choose one type of PMI over another if it would help you qualify for a larger mortgage or enjoy a lower monthly payment.

Thereâs only one type of MIP, and the borrower always pays the premiums. But FHA loans donât just have monthly MIPs. They also have an up-front mortgage insurance premium of 1.75% of the base loan amount. In this way, the insurance on an FHA loan resembles split-premium PMI on a conventional loan.

Don’t Miss: What Is Better Fixed Or Adjustable Rate Mortgage

Is Mortgage Life Insurance Mandatory In Canada

Yes, you do. Homebuyers will need to buy home insurance if they want a mortgage in Canada.

For most people, a home is likely to be the biggest purchase of their lives, so it is only natural to want to protect it. At Dundas Life, we have you covered, whatever your insurance needs.

There are several insurance products that new homebuyers need to know about. However, knowing which mortgage life insurance product is right for you, is not always easy. That is why we have put together this post, in which we will answer your mortgage insurance questions and more. So, let us dive right in.

You’ll learn:

Qualifying For A Mortgage

First off, the bank looks at your score to determine whether they want to loan you money or not. Those with low credit scores will not qualify for mortgages. Cutoff ranges vary from bank to bank, so if youre turned down by one bank, you still stand a chance of getting a mortgage from another bank. However, you may need to spend a few years building up credit before you can get your mortgage.

Sometimes, your score is low, not because youve made a lot of mistakes, but because you dont have a long history. This is particularly true for those who are new to Canada. Well talk more about this later, but its possible to build your score relatively quickly.

Don’t Miss: What Is The Mortgage Payment On 1.5 Million

Do Conventional Mortgage Loans Require Insurance

Conventional mortgages offered by private lenders may require PMI if you put down less than 20% when you buy a home. However, some lenders offer mortgages with lender-paid PMI, which means you won’t have to pay for the insurance. Instead, you may have to pay a higher interest rate, which can wind up costing you more money in the long run.

If you have to pay for PMI, you may be able to pay the full amount upfront, pay it monthly or use a combination of the two. Monthly payments are the most common option, and your insurance payment will be bundled with your mortgage payment

You’ll have to continue paying for PMI on your conventional loan until one of the following scenarios occurs:

- You reach the date when the loan balance is 80% or less than the home’s original value, and you request PMI cancellation.

- You request an earlier PMI cancellation because you’ve made extra payments and the loan balance is 80% or less than the home’s original value before the expected date.

- The PMI is automatically removed because your loan balance is 78% of the home’s original value.

Paying for PMI upfront means your monthly payment will be lower and you won’t need to request a cancelation later, but it will add to your upfront costs as the fee could be equivalent to several years’ worth of premiums. An upfront payment could wind up costing you less in the long run than making monthly payments until you build 20% equity in the home, but it depends on the upfront fee and your down payment.

Reverse Mortgage Insurance Explained

A federally-insured reverse mortgage comes with the assurance that as the borrower you will receive certain loan payments as agreed upon by the terms of your loan. Whats more, you or your heirs will never be forced to repay more than your home is worth to pay off the loan regardless of the balance of the loan.

Those benefits are guaranteed by the Federal Housing Administration through its Home Equity Conversion Mortgage program, which includes the vast majority of reverse mortgages out there.

In order to receive that guarantee, borrowers pay for it through the reverse mortgage insurance premiums. The first is a one-time insurance payment that is made upfront, and the other is an annual insurance premium that is paid to the FHA.

You May Like: How Do I Go About Getting A Mortgage

Do Conventional Loans Require Mortgage Insurance

If youre getting a conventional mortgage and your down payment isnt up to the 20% mark, youll need to pay for a private mortgage insurance policy. Private mortgage insurance premium rates vary based on the loan-to-value ratio on the home, your credit score and whether your mortgage is fixed-rate or variable-rate. The loan-to-value ratio is the amount of money youve borrowed for the home compared to the value of the home. The more money you use as a down payment, the less you have to borrow and the more favorable this ratio is in the eyes of the lender.

Because PMI is tied to the loan-to-value ratio on your home, the amount of PMI you pay each month will decline over time as you build equity. Dont think youre locked in to paying PMI for the life of the mortgage, either.

Thanks to the Homeowners Protection Act of 1998, when your loan is scheduled to reach 78% of the home value or sales price the bank has to cancel your PMI. If youve paid on time and you think your homes value has changed since the time of purchase, you may even be able to negotiate an earlier cancellation of your PMI. If you discover that your PMI wasnt canceled when it should have been you may be eligible for a mortgage insurance premium refund.

Do Va Loans Require Mortgage Insurance

VA home loans are for buyers who are military veterans, currently serve in the military or are qualified spouses. These loans have no down payment options and no mortgage insurance requirements.

Its important to note that there’s a funding fee between 1.4 3.6% of the loan amount that exists to fund the VA loan program. The percentage depends on several factors, including whether it’s a purchase or a VA Streamline refinance service status down payment and whether it’s the first time obtaining a VA loan.

The VA makes exceptions on the funding fee for veterans and servicemembers who are eligible for or already receiving compensation for a service-connected disability surviving spouses who meet the eligibility requirements and active duty service members who have been awarded the Purple Heart.

Also Check: Can I Get A 30 Year Mortgage