What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively impact your credit score or maintain it so you can give yourself the best chance of qualifying for a mortgage.

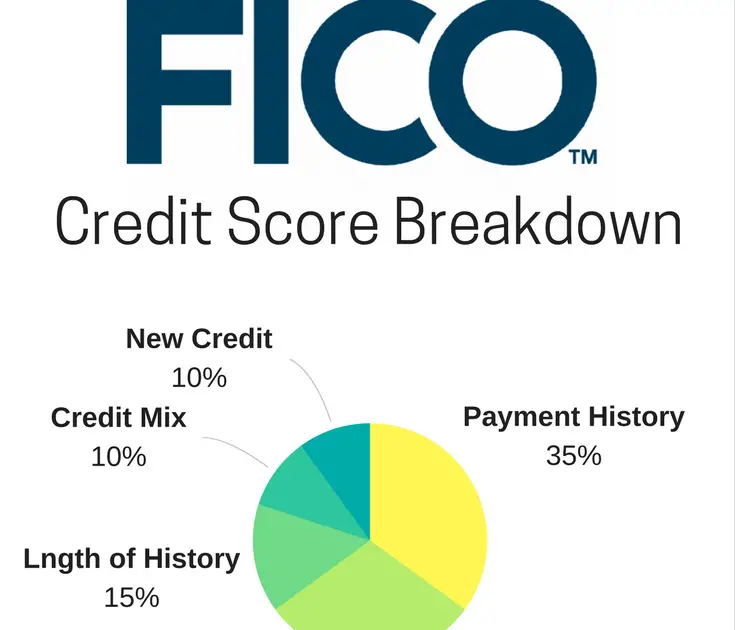

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your credit reports, such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

How Credit Reporting Bureaus Affect Your Score

As many consumers already know, there are three major credit reporting agencies.

While its possible your scores will be similar from one bureau to the next, youll typically have a different score from each agency.

Thats because its up to your creditors to decide what information they report to credit bureaus. And its up to the creditors to decide which agencies they report to in the first place.

Since your credit scores depend on the data listed on your credit reports, more than likely you wont see the exact same score from every credit reporting agency.

Fortunately, most agencies look at similar factors when calculating your credit scores. As long as you manage credit cards and loans responsibly, your credit scores should be fairly similar to one another.

But different credit reporting agencies arent the only challenge. There are also different credit scoring models. And, as if that didnt already complicate matters, there are also different versions of these models.

Why Is It So Important To Get A Low Interest Rate On My Mortgage

You probably already know that a lower interest rate means a smaller monthly payment. But do you know just how big of an effect a smaller monthly payment can have?

Lets look at an example. According to the U.S. Census Bureau, in March 2018 the average sales price of a new home sold in the United States was $366,000. If you were to go to the closing table with a 20% down payment and opted for a 30-year fixed-rate mortgage, heres how much it would cost you over time depending on your interest rates.

Don’t Miss: What Mortgage Rate Would I Qualify For

How To Get Approved For A Mortgage After Bankruptcy

Tips for Approving a Mortgage After Bankruptcy 1 Open a secured credit card account. A secured credit card is easy to obtain and a great way to grow your money again. 2 Pay your bills on time. 3 Apply for a loan carefully. 4 Do not close accounts. 5 Keep your credit reports. Beware of credit repair scams.

How To Maintain A Good Credit Score During Covid

Taking steps to protect and maintain your credit score has always been important. Thats especially true if youre planning on buying a home.

So its important to stay on top of your finances during this challenging time. That includes paying your bills on time, and contacting lenders and service providers if you do run into trouble. Here are a few things you can do:

- Create a budget to know where you stand. The Barclays Budget Planner can help.

- If you foresee problems paying your loan or credit cards, contact them right away to explore your options.

- If you think youll be late paying your phone, utilities or other service providers, contact them to let them know and to discuss a possible arrangement. You can also find helpful advice at Barclays money management.

- To help you manage during this period, you can also find valuable ideas and resources at Barclaycard coronavirus help and support about protecting yourself from fraud and managing your finances.

- Youll also find other information about managing your Barclaycard account during the crisis at the Frequently Asked Questions page.

Read Also: How To Calculate Mortgage Approval

Why Is My Experian Score Higher Than Equifax

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureauswhich is also unusual.

How To Monitor Your Credit Reports

Since the mortgage industry looks at all three credit reports and scores, you may want to consider a paid credit monitoring service that pulls more comprehensive data than a free version would.

The best credit monitoring services offer triple-bureau protection, looking at your information across all three .

Experian IdentityWorks Premium monitors all three of your reports to make you aware of activity including score changes, new inquiries and accounts opened in your name, changes to your personal information and suspicious activity detected. Plus, youll regularly receive updates to your FICO Score.

-

$9.99 to $29.99 per month

-

Experian for Plus plan or Experian, Equifax and TransUnion for Premium plan

Recommended Reading: What Is The Maximum I Can Borrow For A Mortgage

Is Transunion Or Experian Better

TransUnion: The Bottom Line. While both TransUnion and Experian have some similarities, Experian offers a more robust suite of consumer services. It also reveals your FICO Score 8the score most lenders usewhich can give you a better idea of what lenders see than the VantageScore that TransUnion provides.

Small Changes That Can Impact Your Credit Score

If you would like to improve your credit score before applying for a mortgage, or if you are planning on making certain purchases during the process of acquiring a home, there are a few things to know. Paying off credit cards on time, not missing payments on debts and not utilizing a significant portion of your credit are powerful ways to boost your credit.

One of the most detrimental things an individual can do during the home buying process is to begin purchasing furniture and other items on a credit card in preparation for moving in. This will increase your debt to income ratio, which can negatively impact not only your credit score but also your overall financial picture evaluated by lenders.

It is not uncommon for inexperienced buyers to be preapproved, begin putting home-related purchases on a credit card, and then find themselves denied during the later parts of the purchase process due to the credit and financial solvency evaluations that ensue.

You May Like: How Long Is A Mortgage Application Good For

You Ask Equifax Answers: Why Do Credit Scores Look Different To Consumers Than Lenders

Reading time: 3 minutes

Highlights:

- Although your credit scores may vary, the differences don’t mean that any of the scores are inaccurate.

- Your credit scores might be different based on which credit reporting agency your lender uses.

- When you check your credit scores, you may not be seeing the same credit score numbers as your lender.

Question: Why are credit scores different when they are pulled by consumers vs. when they’re pulled by lenders?

Answer: There are a few reasons that the you see when you check on your own may vary from what a lender sees when evaluating you for a credit account. However, it’s important to understand that these discrepancies don’t necessarily mean that either set of scores is inaccurate.

It’s a common misconception that every individual has a single, unique credit score that represents their level of risk when applying for new accounts. In reality, there’s no limit on the number of credit scores that may accurately reflect your financial information and payment history. This is because individual consumer reporting agencies, credit scoring companies, lenders and creditors may use slightly different formulas to calculate your credit scores. They might also weigh your information differently depending on the type of credit account for which you’ve applied.

Which Fico Score Do Mortgage Lenders Use

If you are using a free credit monitoring service and think you know what your credit score is, you might be surprised when you apply for a loan and your mortgage lender comes back with a different set of credit scores.

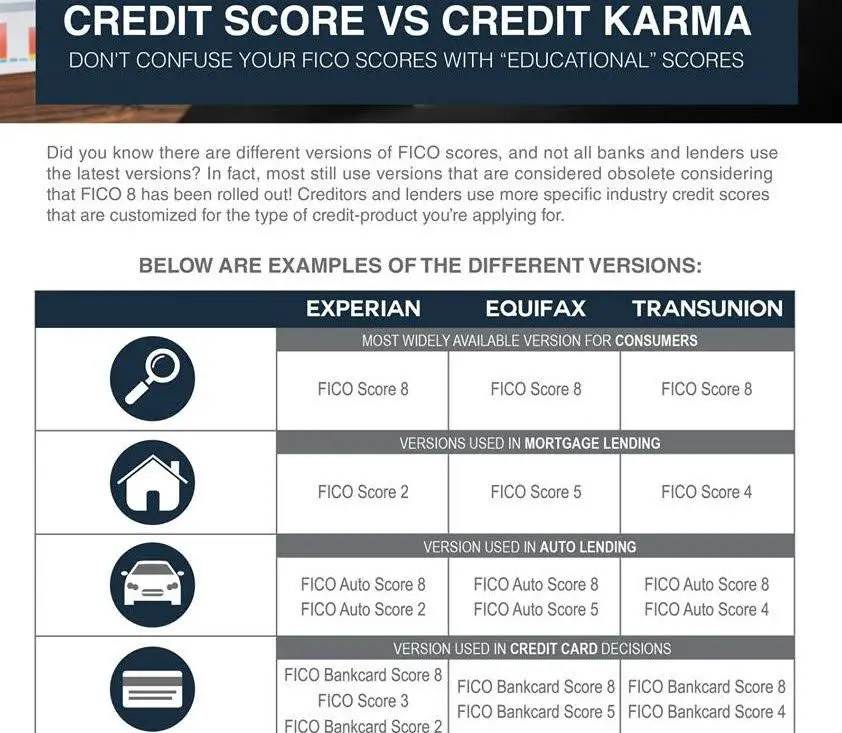

This can happen because there are actually many different credit scoring models used by lenders. In fact, there are 16 different FICO Scores with dozens of variations of each score.

Each credit scoring model interprets the information in your credit profile differently, aiming to give lenders the information they need to approve your home loan application. Most mortgage lenders use the FICO Credit Scores 2, 4, or 5 when assessing applicants.

Mortgage lenders who offer conventional mortgages are required to use a FICO Score when they underwrite your loan application for approval. The specific scores used by each bureau are as follows:

- Experian:FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- TransUnion:FICO® Score 4, or TransUnion FICO® Risk Score 04

- Equifax:FICO® Score 5, or Equifax Beacon 5

Each of these credit scoring models comes from FICO, the company that over 90% of lenders use. Its important to know which model your lender will use because you might be applying for a loan that has a minimum credit score requirement, like an FHA loan or VA loan.

Don’t Miss: When Is A Reverse Mortgage Good

Be Wary Of Companies Offering To Fix Your Credit Score

Be especially wary if they charge an upfront fee these companies are often scams. Never pay in advance. Dont believe promises of anyone who says that they can get negative, but correct, information off your credit report.

- If you need help improving your credit, contact a HUD-approved housing counselor online or by calling 1-800-569-4287.

The Scoring Model Used In Mortgage Applications

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

As you can see, each of the three main credit bureaus use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors , but the categories are weighed a little bit differently.

It makes sense: Borrowing and paying off a mortgage arguably requires a different mindset than keeping track of and using a credit card responsibly.

The FICO 8 model is known for being more critical of high balances on revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on , have proven to be reliable when evaluating good candidates for a mortgage.

You May Like: What Is A 5 1 Arm Mortgage

What Scores And Models Are Used When Applying For A Mortgage

FICO® created different scoring models for each credit bureauExperian, TransUnion and Equifax. The commonly used FICO® Scores for mortgage lending are:

- FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- FICO® Score 5, or Equifax Beacon 5

- FICO® Score 4, or TransUnion FICO® Risk Score 04

Mortgage lenders will often get a single report that contains your credit reports from each of the three credit bureaus and the associated FICO® Scores. It may base the lending decision on your middle credit score or, if you’re applying jointly with a partner, the lower middle score.

Keep this in mind when you’re trying to figure out what . If you’re looking for a mortgage that requires a minimum credit score of 580, you may need your middle score to be at least 580 based one these specific FICO® Score models.

There are exceptions, though. Mortgage lenders could use different credit scoring models for loans that aren’t secured or bought by Fannie Mae or Freddie Mac. You might even be able to get a mortgage if you don’t have a credit history or score at all.

Additionally, there’s a review underway that could open up the use of different credit scoring models for mortgages, even if they’re secured or bought by Fannie Mae or Freddie Mac. However, until there’s a change, many mortgage lenders will continue to use these three classic FICO® Scores.

How Much Deposit Do I Need To Get A Mortgage With A Poor Credit Score

It may be the case that to access your chosen lenders rates and meet their terms, you have to deposit a higher percentage of the properties market value. That being said, the amount of deposit you need to get a mortgage will vary depending on a whole host of factors including your age and the type of property you want to buy.

There isnt a typical deposit size, but some lenders ask applicants to deposit as much as 30% for a mortgage if they have a poor credit score or low affordability.

For a home valued at £200,000 that would equate to a £60,000 deposit. Large deposits arent a viable option for a lot of borrowers and thankfully there are a handful of lenders that appreciate this and may be more willing to lend under more flexible terms.

Recommended Reading: How To Get A Mortgage On A Foreclosure

How Can I Improve My Chances Of A Mortgage

Having a great credit score can no doubt help you to get a mortgage. That said, theres so much more you can do to improve your chances of a mortgage:

- Save as much as you can for a deposit

- Reduce your spending habits at least 3 months before applying

- Clear all of your credit cards as soon as possible

- Settle as much outstanding debt as you can

- Take steps to improve your credit score

- Include all of your income on your application, such as salary, overtime, bonuses and benefits

- Dont use payday loans at least 12 months before applying

Well also check your mortgage application before approaching a lender.

How Your Credit Score Affects Your Mortgage Eligibility

When it comes to getting a mortgage, your credit score is incredibly important. It determines:

- What loan options you qualify for

- Your interest rate

- Your loan amount and home price range

- Your monthly payment throughout the life of the loan

For example, having a credit score of excellent versus poor could fetch lower interest rates, which can save you over $200 per month on a $200,000 mortgage.

And if your credit score is on the lower end, a few points could make the difference in your ability to buy a house at all. So, it makes sense to check and monitor your credit scores regularly, especially before getting a mortgage or other big loan.

The challenge, however, is that theres conflicting information when it comes to credit scores.

There are three different credit agencies and two credit scoring models. As a result, your credit score can vary a lot depending on whos looking and where they find it.

Don’t Miss: How To Qualify For Mortgage Modification

Check Your Credit Score Regularly

Checking your credit score regularly is one of the ways to ensure that the information on your credit score is indeed up to date.

It also informs you on what your credit score is and this allows you to have an idea of which credit providers may lend to you.

If you find any errors on your credit score or report you can contact all of the credit bureaus or the specific credit bureau where the error is mentioned and ask them to make the necessary corrections.

The credit bureaus will check and investigate the matter but in the meantime put a notice of correction on the record entry so that any third parties who are checking your credit score will be aware that the entry may be incorrect.

The credit bureau will usually let you know the outcome of their investigations within 28 days.

If you are unsure of what your credit score is then you should check your credit score from the four credit bureaus in the UK: Experian, Crediva, Equifax and Transunion.

Some of these credit bureaus may charge you a fee to view your credit report so what you can alternatively do is request a statutory credit report which is a free credit report which each credit bureau must provide to you upon you requesting it.

Alternatively, you can also use credit score services such as Checkmyfile and clearscore to check your credit report.

Which Fico Score Generation Do Mortgage Lenders Use

The best-known credit scores are going to fall under either the FICO or VantageScore brands. There are multiple generations of each score brand, as every few years, the score developers create newer versions. So, for example, theres a VantageScore 1.0, 2.0, 3.0, and 4.0.

In most lending environments outside of mortgages, its hard to know which specific credit score a lender will use to evaluate your application. And, even if you knew your lender used a FICO Score or a VantageScore credit score, you still would not know which generation of the score it is using.

For example, you may apply for an auto loan with one lender that checks your FICO Auto Score 8 based on your Experian credit report. Yet, if you apply for financing with a different auto lender, it may opt to check your VantageScore 3.0 score based on TransUnion data.

The only way to know for sure is to ask the lender which credit report and which credit score version it plans to check, but that isnt a guarantee that theyll tell you.

The mortgage industry is different. Because of the aforementioned FHFA mandate, mortgage lenders must use the following versions of FICOs scoring models:

- Experian: FICO Score 2, sometimes referred to as FICO V2 or FICO-II

- TransUnion: FICO Score 4, sometimes referred to as FICO Classic 04

- Equifax: FICO Score 5, sometimes referred to as BEACON 5.0

Don’t Miss: How To Pay Off Mortgage In 5 Years