How Much Mortgage Can I Afford With A Joint Income Of $50k

With an annual income of $50k, you will be eligible for a mortgage that is worth above $100,000 but below $250,000. Your total monthly payment will fall somewhere slightly above a thousand dollars. Of course, the exact value will vary depending on the loan term, interest rate and lender. Head on over to our calculator to punch those numbers.

Checking Your Credit Score

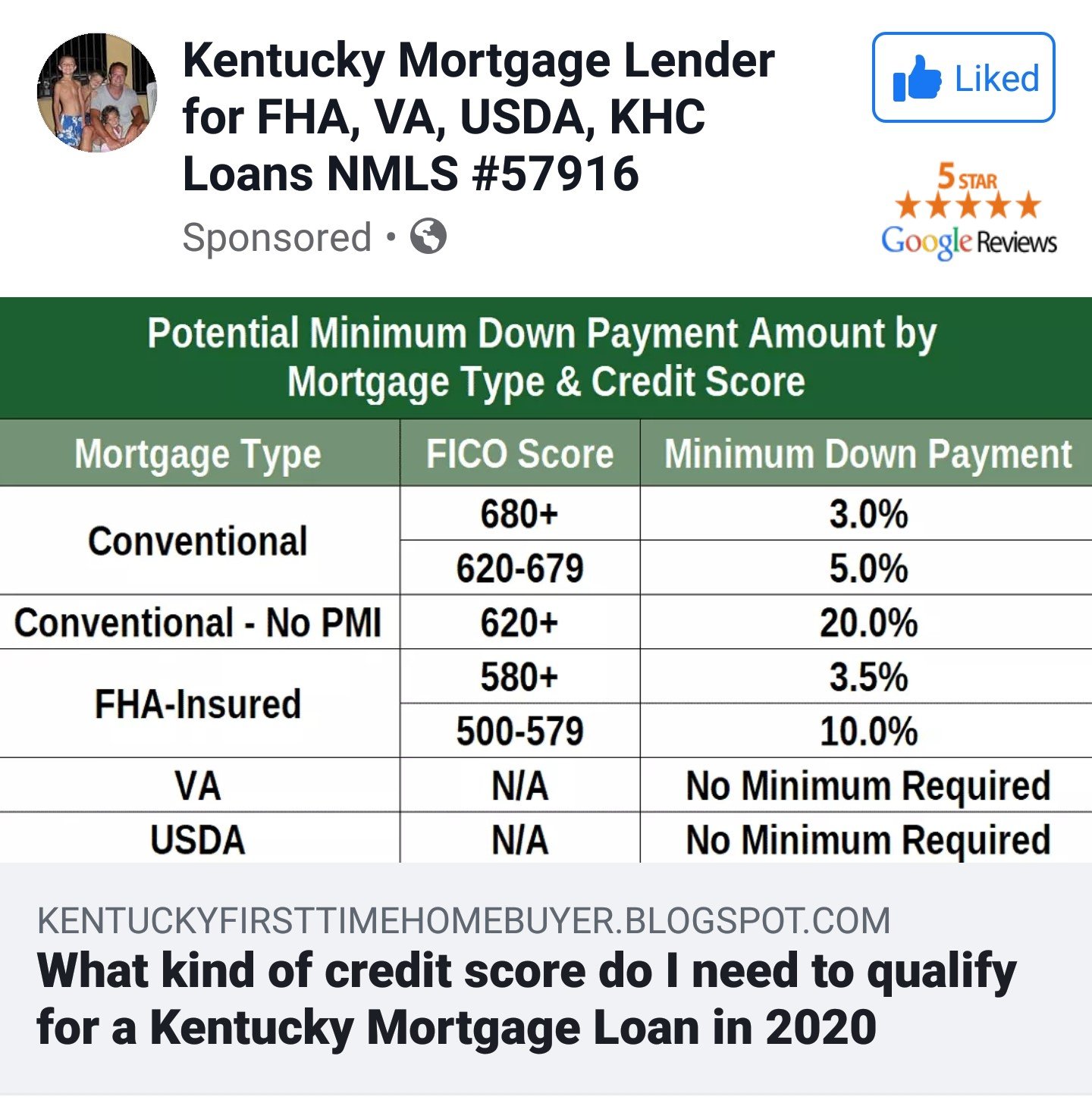

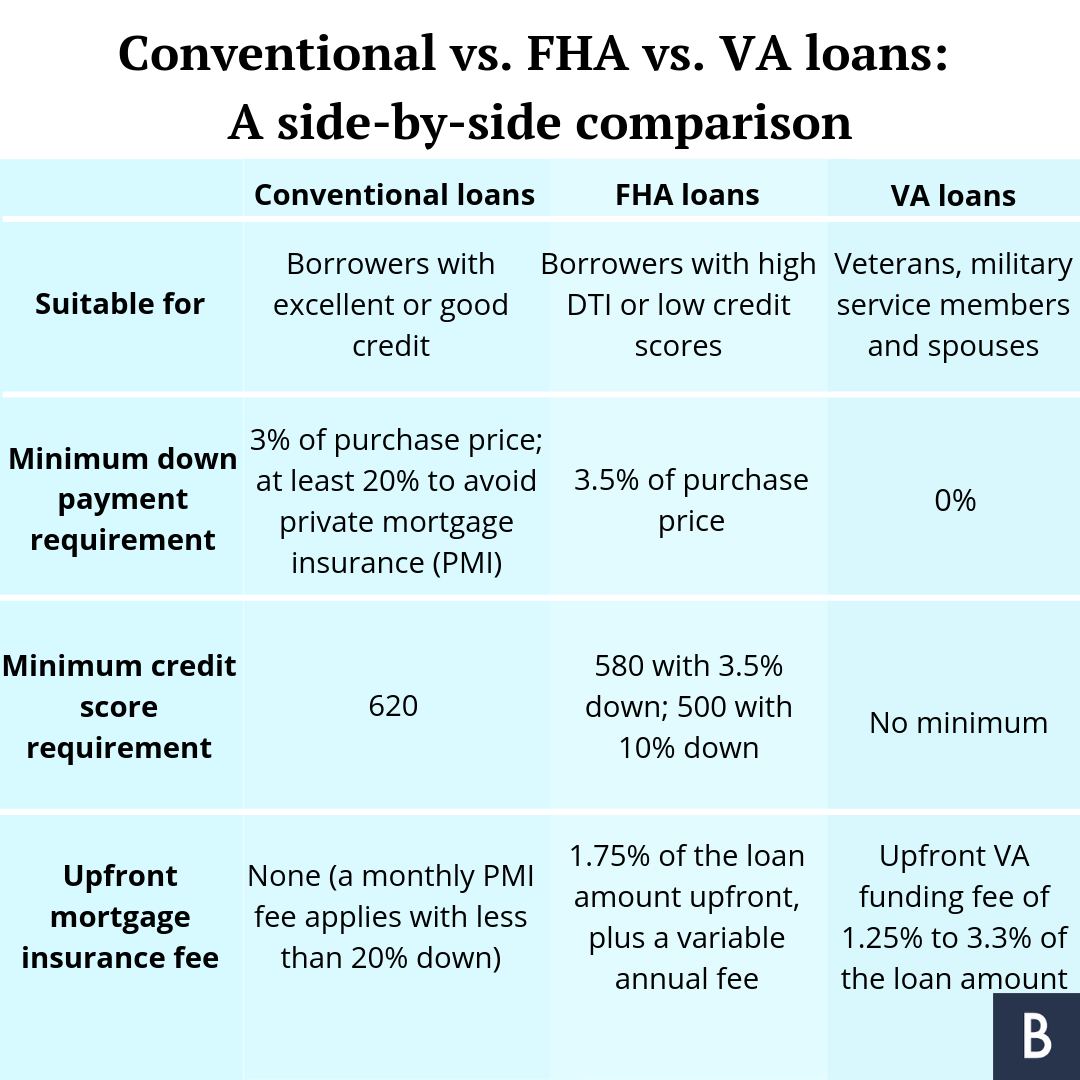

You should check your credit score well before you begin the mortgage process so you will know where you stand and the mortgage rate you could qualify for. You can check your credit score for free through several online services. Many banks, credit unions, and credit card providers offer credit scores as a regular feature. Since most major mortgage lenders use your credit score in their decision, it’s worthwhile to obtain all three of your reports to make sure the information on your record is accurate.

It’s a good idea to research your credit score and your credit reports well in advance of making a major purchase so you have time to address any errors or other issues you might discover.

When Do Consumers Choose An Arm

Adjustable-rate mortgages , on the other hand, have interest rates that change depending on market conditions. ARMs usually start with a low introductory rate or teaser period, after which the rate changes annually for the remaining term.

ARMs come in 30-year terms that can be taken as a straight adjustable-rate mortgage with rates that change annually right after the first year. However, borrowers usually take them as a hybrid ARM, which come in 3/1, 5/1, 7/1, and 10/1 terms. For example, if you get a 5/1 ARM, your rate remains fixed for the first 5 years of the loan. After the 5-year introductory period, your rate adjusts every year for the rest of the payment term.

When does taking an ARM make sense? ARMs are usually chosen by consumers who plan to sell their house in a few years or refinance their loan. If you need to move every couple of years because of your career, this type of loan might work for you. ARMs usually have a low introductory rate which allows you to make affordable monthly payments, at least during the teaser period. Before this period ends, you can sell your home, allowing you to avoid higher monthly payments once market rates start to increase.

Read Also: How Much Should My Mortgage Be Dave Ramsey

How Do I Get A Mortgage

There are four basic steps to getting a mortgage

How Do I Use The Mortgage Qualifying Calculator

The mortgage qualifying calculator allows you to calculate the amount of mortgage you may qualify for in several ways. To select how you’d like to calculate, select one of the options from the drop-downs on “Calculate for.” Your options are:

- Total monthly payment: Calculates the total mortgage you may qualify for to hit a desired monthly payment.

- Annual income: Calculates the total mortgage you may qualify for based on your yearly income.

- Purchase price: Shows how much income you’d need to make to qualify for a mortgage at a specific purchase price.

Recommended Reading: What Is Usda Mortgage Insurance

Who Is The Mortgage Qualifying Calculator For

This calculator is most useful if you:

- Are a potential homeowner needing to know your budget constraints

- Have decided on a new home but want to ensure you can afford it

- Are looking to plan and budget for the future

If you’re ready to connect with a trusted lender and receive exact figures, fill out this short form here and request personalized rate quotes tailored to you. This will give you a better idea of what interest rate to expect and help gauge your ability to qualify for a mortgage.

How Much Is The Monthly Mortgage Payment Can I Qualify For

Determining the monthly mortgage payment you qualify for is similar to calculating the maximum mortgage loan you can afford. All you have to do is enter the value of your annual income and the length of your loan on the mortgage qualifying calculator, and it will display the monthly payment you should expect.

You May Like: How To Check Credit Score For Mortgage

Do Fha Interest Rates Vary By Lender

Yes, FHA loan rates vary by lender, so it can pay to comparison shop. Once youve found a few lenders that seem right for you, compare each one.

If youre approved, each lender will provide you with a Loan Estimate form. This will let you compare not only FHA mortgage rates, but also origination fees, closing costs and everything else youll pay over the life of the loan. Comparing loan estimates from more than one lender will give you confidence that youre getting a good rate and that youre getting the right loan for your situation.

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process, the lender will look at your overall financial profile to determine how much it will lend to you. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI is typically 43%. So if you make $5,000 a month, your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

Don’t Miss: How To Work For A Mortgage Company

How To Compare Mortgage Rates

Mortgage rates like the ones you see on this page are sample rates. In this case, they’re the averages of rates from multiple lenders, which are provided to NerdWallet by Zillow. They let you know about where mortgage rates stand today, but they might not reflect the rate you’ll be offered.

When you look at an individual lender’s website and see mortgage rates, those are also sample rates. To generate those rates, the lender will use a bunch of assumptions about their sample borrower, including credit score, location and down payment amount. Sample rates also sometimes include discount points, which are optional fees borrowers can pay to lower the interest rate. Including discount points will make a lender’s rates appear lower.

To see more personalized rates, you’ll need to provide some information about you and about the home you want to buy. For example, at the top of this page, you can enter your ZIP code to start comparing rates. On the next page, you can adjust your approximate credit score, the amount you’re looking to spend, your down payment amount and the loan term to see rate quotes that better reflect your individual situation.

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

» MORE: Mortgage points calculator

The Major Part Of Your Mortgage Payment Is The Principal And The Interest The Principal Is The Amount You Borrowed While The Interest Is The Sum You Pay The Lender For Borrowing It Your Lender Also Might Collect An Extra Amount Every Month To Put Into Escrow Money That The Lender Then Typically Pays Directly To The Local Property Tax Collector And To Your Insurance Carrier

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, you’ll have an additional policy, and if you’re in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it’s due.

- Mortgage insurance: If your down payment is less than 20 percent of the home’s purchase price, you’ll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

You May Like: What Mortgage Companies Use Experian

Take A Look At Our Mortgage Payment Calculator And Learn How Much Home You Can Afford

With a 30 year fixed mortgage, borrowers have the advantage of knowing the mortgage payments they make each month will never increase, allowing them to budget accordingly.

Each monthly payment goes towards paying off the interest and principal, to be paid in 30 years, thus these monthly mortgage payments are quite lower than a shorter-term loan. You will, however, end up paying considerably more in interest this way.

Year Fixed Mortgage Rates

In a 30 year fixed mortgage, your interest rate stays the same over the 30 year period while you repay the loan, assuming you continue to own the home during this period. Such mortgages tend to be some of the most popular type of home loan thanks to the stability and lower monthly payments they offer borrowers compared to 15 year fixed mortgages.

Read Also: Can I Get A Mortgage On A Foreclosed Home

How Do I Find Personalized 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. Specify the propertys ZIP code and indicate whether youre buying or refinancing. After clicking “Get Started”, youll be asked the homes price or value, the size of the down payment or current loan balance, and the range of your credit score. Youll be on your way to getting a personalized rate quote, without providing personal information. From there, you can start the process to get preapproved for your home loan. Its that easy.

How Are Mortgage Rates Impacting Home Sales

The housing market continues to lose steam as mortgage rates rise. The number of overall mortgage applications ticked down by 0.8% for the week ending September 2, according to the Mortgage Bankers Association.

- The seasonally adjusted number of purchase applications was 1% lower than the previous week and 23% lower than a year ago. Mortgage applications have now declined for nine out of the last 10 months.

“Recent economic data will likely prevent any significant decline in mortgage rates in the near term, but the strong job market depicted in the August data should support housing demand,” said Mike Fratantoni, MBA’s senior vice president and chief economist. “There is no sign of a rebound in purchase applications yet, but the robust job market and an increase in housing inventories should lead to an eventual increase in purchase activity.

- The number of people refinancing their home loans continues to decline. Refinance applications decreased by 1% from the previous week and were 83% lower than the same week last year.

You May Like: Should I Add My Spouse To My Mortgage

How To Interpret The Results

The calculator shows two sets of results:

Most lenders require borrowers to keep housing costs to 28% or less of their pretax income. Your total debt payments cant usually be more than 36% of your pretax income.

Some mortgage programs – FHA, for example – qualify borrowers with housing costs up to 31% of their pretax income, and allow total debts up to 43% of pretax income.

Use our Debt-to-income Calculator to find your DTI ratio and learn more about debts role in your home purchase.

Consider A Shorter Loan Term

When you take out a 15-year fixed-rate mortgage instead of a 30-year fixed-rate mortgage, the interest rate will normally be lower. In mid-September 2020, for example, the 30-year rate was 2.87%, and the 15-year rate was 2.35%.

You also could consider an adjustable-rate mortgage. Its introductory rate may be lower than what you could get on a fixed-rate mortgage. It depends on the market, though: In mid-September, a 5/1 ARM had an interest rate of 2.96%.

Even if you can get a lower rate on an ARM, youâre taking a risk. It might be cheaper in the short term, but it could be more expensive in the long term. Why?

- No one knows what interest rates will look like when the ARMâs introductory period ends.

- Thereâs no guarantee youâll be able to refinance or sell when the ARMâs introductory period ends.

Read Also: What Is The Current Interest Rate For A Reverse Mortgage

Pay Attention To Loan Fees

The catchall term for the fees you pay to get a mortgage is closing costs. Everything from the prepaid property taxes to your appraisal fees fall into this category. Certain closing costs vary by loan size, but overall you can expert to pay 3% to 6% of the total loan balance.. Your closing costs play a crucial role in determining your annual percentage rate . In other words, the higher your closing costs, the higher your APR will be..

Two Types Of Conventional Loans

- Conforming Conventional Loans: Conventional mortgages follow assigned loan limits established by the Federal Housing Finance Agency . In 2022, the maximum conforming limit for a single-unit home in the U.S. continental baseline is $647,200. If this is the maximum conforming limit in your area, and your loan is worth $600,000, your mortgage can be sold into the secondary market as a conventional loan. We publish maximum conforming limits by county across the country.

- Non-conforming Conventional Loans: Also called jumbo loans, non-conforming conventional mortgages exceed the assigned conforming loan limits set by the FHFA. These loans are used by high-income buyers to purchase expensive property in high-cost locations. The conforming loan limit for high-cost areas are 50% higher than the baseline limit, which is $970,800 for single-unit homes as of 2021. Jumbo mortgages have stricter qualifying standards than conventional loans because larger loans exact higher risk for lenders.

PMI on Conventional Loans

Private mortgage insurance or PMI is required for conventional mortgages when your down payment is less than 20% of the homes value. This is an added fee that protects your lender if you fail to pay back your loan. PMI is typically rolled into your monthly payments, which costs 0.5% to 1% of your loan per year. Its only required for a limited time, which is canceled as soon as your mortgage balance reaches 78%.

You May Like: Can A Reverse Mortgage Be Refinanced

What The Forecast Means For You

Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years.

Higher interest rates mean higher monthly payments for borrowers. For example, on a $400,000 home with a 5.10% interest rate, the monthly mortgage payment is around $2,172. This doesnt include insurance, taxes or other loan costs. If the rate rises to 6%, the monthly payment jumps to $2,398.

This means time is running out for homeowners who hope to lock in a lower interest rate by refinancing.

How To Qualify For Todays Best Refinance Rates

Much like when you shopped for a mortgage when purchasing your home, when you refinance heres how you can find the lowest refinance rate:

- Maintain a good credit score

- Consider a shorter-term loan

- Lower your debt-to-income ratio

- Monitor mortgage rates

A solid credit score isnt a guarantee that youll get your refinance approved or score the lowest rate, but it could make your path easier. Lenders are also more likely to approve you if you dont have excessive monthly debt. You also should keep an eye on mortgage rates for various loan terms. They fluctuate frequently, and loans that need to be paid off sooner tend to charge lower interest rates.

Read Also: How Much Mortgage On 200k

Use A Mortgage Calculator To Get The Best Rates

To use a mortgage calculator, you’ll enter a few details about the loan, including:

- Home price. The purchase price of the home.

- Down payment. The cash you pay upfront to buy a home.

- Loan term. The amount of time you have to repay the loan.

- Loan APR . The cost to borrow the money.

- Property taxes. The annual tax you pay as a real property owner, levied by your city, county, or municipality.

- Homeowners insurance. Your annual cost to insure your home and personal belongings against theft, fire, natural disasters, personal liability claims, and other covered perils.

- HOA fees: The monthly amount you pay to your homeowners’ association to help cover the costs of maintaining and improving the properties in the association.

It’s easy to change one or more variables to see how it would affect your monthly mortgage payment, mortgage interest, and the total cost of the loan.

For example, if you choose a shorter loan term, your payments will be higher, but you’ll pay less interest over the life of the loan. And, of course, if you have a higher interest rate, your monthly payment will be higherand so will the total interest.

Using a mortgage calculator is a good resource to budget these costs.