What Are The Benefits Of Having Multiple Mortgages

There are a few benefits to having multiple mortgages. One of the benefits is that you can get a lower interest rate on your mortgages. This is because when you have multiple mortgages, you are considered to be a low-risk borrower. Another benefit is that you can get a higher loan amount. This is because the bank will see that you are able to handle multiple mortgage payments each month.

Do Your Homework Before Taking Out Multiple Mortgages

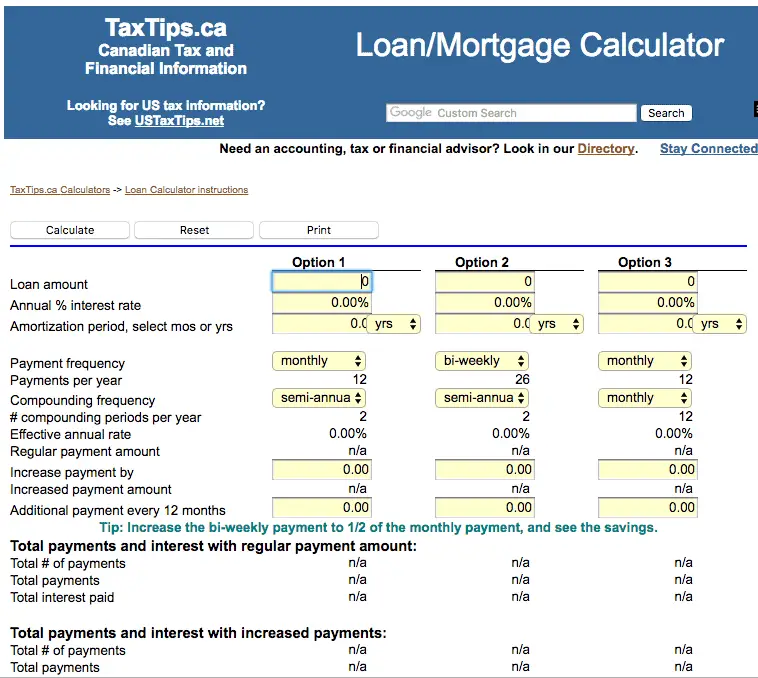

Whether youre looking to purchase a second home for vacations or are interested in getting into real estate investing, its important to do your homework before taking out additional mortgages. Asking, How many mortgages can you have? is an excellent place to start.

For the most part, you arent allowed more than 10 mortgages. Requirements can vary based on lenders, though they tend to get stricter as you seek to take out additional mortgages as you take on more debt, you become riskier to lenders. Theyll want to ensure you have enough cash on hand to cover your payments, taxes and insurance. The lending requirements become particularly difficult once you begin applying to hold five or more mortgages.

If youre looking to learn more about how to manage your finances, be sure to . We deliver the latest financial news, tips and tricks directly to your inbox to help you reach your financial goals.

To get the benefits of a Tally line of credit, you must qualify for and accept a Tally line of credit. The APR will be between 7.90% and 29.99% per year and will be based on your credit history. The APR will vary with the market based on the Prime Rate. Annual fees range from $0 – $300.

Ways Multiple Personal Loans Can Affect Your Credit

Any time you open a new loan, the repercussions ripple out to your credit report in a few different ways. First, opening a loan produces a hard inquiry on your credit report, and remains on it for two years.

Too many hard inquiries will affect your credit score, because the credit scoring models most commonly used will verify how recently and how often youve applied for credit. An uptick in both can, in turn, affect the interest rate available to you for a new loan.

Recommended: Can Personal Loans Hurt Your Credit?

Juggling multiple payments is another issue. An additional loan means another bill to pay every month. If you miss any payments whether on your student loans, mortgage, credit cards, or personal loans it can have consequences for your credit score. Payment history counts for a whopping 35% of your total FICO® Score. Beware of overborrowing when considering multiple loans.

Read Also: What Is A Residential Mortgage Loan Originator

Getting Multiple Loans From The Same Lender

Some lenders have a maximum number of loans you can have, a maximum amount you can borrow or both.

This table shows the number of personal loans some popular lenders will provide to a single borrower:

|

Lender |

|---|

| Pre-qualify on NerdWallet and receive personalized rates from multiple lenders. |

Some lenders require that a borrower make a certain number of payments before applying for another loan. LendingClub, for example, requires borrowers make payments for three to 12 months before getting a second loan. SoFi requires three consecutive payments toward an existing loan before applying again.

Upstart requires borrowers make six on-time payments before applying. Upstart borrowers have to wait 60 days before reapplying if they pay off the loan in under six months or if they recently paid off a loan and any of the last six payments were not on time.

Having a personal loan from another lender isn’t an automatic disqualification, lenders say. If youve almost paid off one loan and don’t have a lot of other existing debts, you may be approved for another loan.

» MORE: How to manage your personal loan

Disadvantages Of Multiple Mortgages

Now that you know how many mortgages you can have and you know the advantages of multiple mortgages, letâs consider the disadvantages.

If you have more than one mortgage, refinancing may be difficult. With more than one mortgage your LTV ratio is likely to be high, making it harder to get the loan.

When you have multiple mortgages, you may also have multiple fees such as closing costs, a home appraisal, and origination fees. Sometimes the fees overshadow the benefits of getting another mortgage.

But the main disadvantage of multiple mortgages is that you are using your home for collateral, and your home could wind up being repossessed if you canât meet your multiple mortgage payments.

Read Also: When To Refinance Your Mortgage Dave Ramsey

Cons Of Refinancing Student Loans With A Cosigner

First of all, refinancing a federal student loan with a private lender means you will lose eligibility to forgiveness and other government relief programs, as previously noted.

There are both pros and cons of refinancing with a cosigner. While adding a cosigner to your refinancing application could benefit you, it might not be so advantageous to your cosigner. For one thing, your cosigner becomes just as responsible for the debt as you are. If you miss payments, a debt collector could call your cosigner and demand that they pay. Plus, their credit will get damaged if you miss payments or your loan goes into default. Cosigning on debt will also increase their debt-to-income ratio. A high DTI ratio could make it harder for your cosigner to take out additional loans, whether they want to borrow a mortgage, business loan, or student loan for your sibling. If your cosigner has no plans to open a loan or new credit card in the future, this may not be an issue. And if you make consistent, on-time payments on your refinanced student loan, this could actually help your and your cosigners credit. But its important to keep in mind that missing payments on your student loans will hurt the both of you. Before asking someone to cosign, make sure youre both on the same page about what cosigning means and whos responsible for paying off the student loan. By clarifying expectations upfront, you can avoid hurting your cosigners finances or straining the relationship.

Adam Mccann Financial Writer

@adam_mccann02/06/20 This answer was first published on 02/22/19 and it was last updated on 02/06/20.For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

You can have 1-3 personal loans from the same lender at the same time, in most cases, depending on the lender. But there is no limit to how many personal loans you can have at once in total across multiple lenders. The number of loans you can have is really only limited by your income relative to your expenses, including existing debt obligations.

Every loan application you submit will also temporarily lower your credit score, due to a hard inquiry on your credit report, potentially making it harder to get approved for the next loan you decide apply for. So the more loans you have open, the more difficult it will become to open any more.

Assuming you have good enough credit and income to get more than one personal loan, its helpful to know just how many of them different lenders will allow you to have at once. WalletHub reached out to some of the most popular personal loan providers to find out their policies.

How Many Personal Loans You Can Have at Once From One Lender:

|

Lender |

|

|

SoFi |

|

|

Wells Fargo |

No limit |

How much of a personal loan can I get?

How Much Personal Loan You Can Get by Lender:

Personal Loan Requirements

Recommended Reading: How Much Mortgage Can I Get With 80k Salary

Reasons To Include More Than One Name On A Mortgage

There are a few reasons a borrower might want to include more than one name on a mortgage:

- Applying with a co-borrower might make it easier to qualify for a loan. If the co-borrower has good credit and steady income, for example, this can help strengthen your application and improve your chances of getting approved.

- Applying with a co-borrower allows you to put the co-borrowers name on the title. This is important if you plan to jointly own the home. .

Remember co-borrowers are both wholly responsible for loan payments. If one borrower stops paying their share of the loan, the other must continue to pay to avoid damaging their credit or losing the home.

Bank Vs Mortgage Broker

Similar to when you took out the mortgage on your principal residence, you can choose to have either a bank2 or a mortgage broker help you get pre-approved and then approved for investment property financing. With investment property mortgages, it could be even more important to consider working with a mortgage broker because of their experience with other investors and familiarity with the special financing conditions required by individual lenders.

The other benefits of working with a mortgage broker are obvious: they only need to pull your credit report once, they shop around for you and they look for a product and rate that will match your financial situation. The best part is that you don’t have to pay them for their services – instead, the lender you end up getting financing from pays the mortgage broker a fee.

Also Check: Where Can I Buy Mortgage Insurance

Speak To An Expert Broker

Maximise your chance of approval with a a dedicated specialist broker

Ask Us A Question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

We are an information-only website and aim to provide the best guides and tips but cant guarantee to be perfect, so do note you use the information at your own risk and we cant accept liability if things go wrong. Please email us at if you see anything that needs updating and we will do so ASAP.

*OMA Mortgage Approval Guarantee is subject to you providing satisfactory documentation. See T& Cs.

Can You Refinance Student Loans If You Had A Co

Refinancing your student loans can lead to better rates and terms on your education debt. But if you dont have good credit, its tough to qualify for a lenders best rates. Thats where a cosigner comes in. By applying with a creditworthy cosigner, you can boost your chances of qualifying for the lowest rates. Adding a cosigner can also help you get approved if you cant meet a lenders criteria on your own.

However, there are both pros and cons to refinancing student loans with a cosigner, which are worth reviewing before you sign on to share debt. And the new federal student loan forgiveness program announced by President Biden can impact your situation as well. Lets take a closer look at refinancing student debt with a cosigner, including both the advantages and potential disadvantages.

You May Like: What Percent Of Your Salary Should You Spend On Mortgage

Lendcity The Home Of Unlimited Rental Properties

The solution we recommend to our readers to unlock the ability to buy unlimited rental properties is LendCity. When you apply for a mortgage, they take a look at your entire portfolio to determine exactly where you are at in order to get you approved with the best lender for you. That means not only bypassing mortgage limits but securing the best available mortgage rates for each of your investments.

How Many Mortgage Holidays Can You Have

The First Mortgage Vs The Second Mortgage: The landlord may occupy their holiday homes for a part of the year. Holiday homes are typically bought with a second residential mortgage. Still, if you plan to rent it out while you are not there, you’ll need a specific holiday-let mortgage, a subset of buy-to-let, and you will have to talk to your lender to know in detail about it.

Every subsequent mortgage makes it difficult to repay and raises concerns about requirements and suitability. So, you can legally have as many mortgages as you like, but it is rare to find people with more than four mortgages.

Read Also: How Much Dti For Mortgage

Qualifying For 6 Or Fewer Mortgages

Financing six or fewer mortgages is the most common multiple mortgage scenario and generally comes with less stringent qualifications. Fannie Maes requirements for each additional home loan up to six are typically the same as the requirements to finance your first mortgage.

To get approved for a second property , your lender will likely want you to have:

- A good or excellent credit score

- A loan-to-value ratio less than 80%

- Demonstrated rental property performance and good cash flow and reserves

- Proof of income, financial statements, income tax returns or property lease agreements

- Information about other existing mortgages

An investment property for rental, vacation or any purpose other than a primary residence rules out a few financing options. If youre not living on the property, you wont be able to qualify for Federal Housing Administration or Department of Veterans Affairs loans that come with lower and down payment requirements. Youll probably also have to deal with higher mortgage rates for investment properties.

Meet with your local bank or mortgage broker to discuss the requirements for your situation.

Why You Cant Get More Than Two Mortgages

Finding a bank that is willing to take the third lien position for a residential home is difficult, if not impossible. And even if a bank or lender decides to give you a loan for a third mortgage, the rates may be astronomical for good reasons so you may not be able to meet the demands.

The reason is that third-position mortgages get paid last in foreclosures and may sometimes not get paid at all. Banks may not be willing to take up this kind of risk.

For example, in the great financial crisis of 2008 and 2009, there was a 120% increase in foreclosures from the previous years, and many second-position lenders didnt get paid in foreclosures. Thats not to speak of the third position mortgages. Because of the high risk involved in giving out loans for a third mortgage, banks generally do not give third mortgages or do so at astronomical rates.

The bottom line? For a residential home, youre open to just two mortgages.

However, getting a second mortgage on your home also comes with its challenges and disadvantages. If after taking a second mortgage you want to access more equity out of your home to fund other projects or pay an outstanding bill, there are other options that you can take in the absence of a third mortgage.

The next sections get you up to speed on how first and second mortgages work, how they interact with each other and the different types of second mortgages.

Also Check: Why Get A Reverse Mortgage

Is Taking Out Multiple Personal Loans Bad

Having multiple personal loans out isnt inherently a bad thing, unless you have trouble making your monthly payments on time. Missed payments or a default can seriously hurt your credit score. More loans can also mean a higher DTI for you, potentially affecting your rates on future loans you take out.

The trickiest part of having multiple loans out can be remembering what payments are due when. Debt consolidation can help to simplify this by ensuring you only have one monthly payment to worry about.

Ready To Improve Your Financial Life?

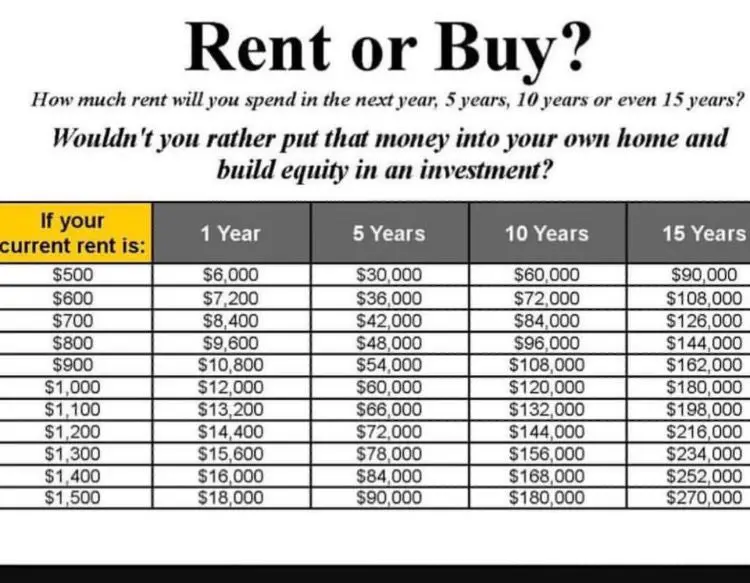

What To Consider Before Getting Multiple Mortgages

If you can get approved for multiple mortgages, consider the advantages and disadvantages of taking on so many financed properties. Take a good look at your finances and your financial goals before financing another property.

Financing multiple mortgages is a serious, costly, time-consuming undertaking but it can come with rewards. Check out some of the pros and cons.

Read Also: What Do You Need To Provide To Get A Mortgage

What Do You Need To Qualify

Even when applying for the first time, receiving a mortgage is a multi-step process. A mortgage is a loan, so your lender wants to have assurance you can pay them back. The process can get more challenging depending on how many mortgages you have and the type.

For example, getting a second mortgage for a home you live in is very different from mortgaging your fourth rental property. With traditional lenders, the process of mortgaging an additional residential property will be similar to applying for your first home. However, expect more paperwork when investing in a third or fourth vacation or commercial property.

Your mortgage lender will require information to provide pre-approval. From verifying your identity to calculating your affordability, your lender will want to get to know you. Some details your lender or mortgage broker will consider may include:

What Is A Home Equity Loan

A home equity loan is cash equivalent to the portion of your home equity you want to mortgage. The loan is given to you as a lump of cash to spend for whatever you want.

For example, after getting 50% equity on a $100,000 property, you can get a home equity loan for 60% of your equity. This will be equal to $30,000 given to you in cash.

The home equity loan becomes a second-position loan. And alongside your first-position loan, you have to make monthly payments for a specific period of time to pay off the principal and an added interest.

Also Check: How To Shop For Mortgage Loans