Calculate The Number Of Payments

The most common terms for a fixed-rate mortgage are 30 years and 15 years. To get the number of monthly payments you’re expected to make, multiply the number of years by 12 .

A 30-year mortgage would require 360 monthly payments, while a 15-year mortgage would require exactly half that number of monthly payments, or 180. Again, you only need these more specific figures if you’re plugging the numbers into the formula an online calculator will do the math itself once you select your loan type from the list of options.

Calculating The Numbers Yourself

If you dont want to use a premade calculator, you can do the math yourself with a pocket calculator, a calculator app or a spreadsheet program.

First, youll want to compute yourmonthly interest rate. This is found by dividing your annual interest rate by 12, since there are 12 monthly payments in a year. For example, if your annual interest rate is 6 percent, your monthly interest rate is 6 / 12 = 0.5 percent. Once you have that rate, determine how much principal is currently owed on your mortgage. You should be able to see that on your most recent mortgage statement or through an online banking site or app.

Then, multiply the principal amount by the monthly interest rate to get the monthly interest amount. If the principal is $200,000 and the monthly interest rate is 0.5 percent, for example, the monthly interest amount is $200,000 * = $200,000 * = $1,000.

Your monthly mortgage payment minus the interest portion is the amount of principal you are paying down in that particular month.

How A Larger Down Payment Impacts Mortgage Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment calculations above do not include property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that play a role in determining your mortgage rate and, therefore, your payments over time.

Also Check: What Is The Average Mortgage Interest Rate

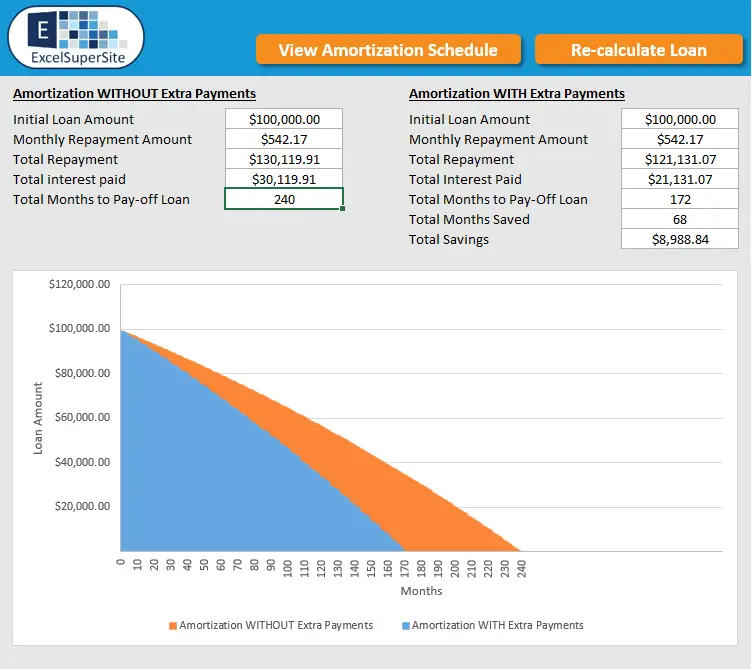

How Do You Calculate A Mortgage Amortization Schedule

A mortgage amortization schedule shows you how many payments you must make from the first payment to the last. Each payment is divided up between interest and principal. The formula to calculate the amortization schedule is Total Monthly Payment . You can also use Investopedia’s amortization calculator to see how much of your payments are divided up between interest and principal.

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.

Also Check: Are Mortgages Cheaper Than Rent

Why Is My Mortgage Payment Different Every Month

Its been decided that the interest rate will be reduced or your escrow payments will be reduced. It could also be because you stopped paying private mortgage insurance. If you have private mortgage insurance, you may see some changes in your monthly payment after you have been able to cancel it. You were charged a new fee for doing so.

Why Does The Principal And Interest Change Every Month

The principal and interest on a loan changes every month because the amount of interest charged is based on the remaining principal balance. The closer you get to paying off the loan, the less interest you will pay each month.

The amount of interest you repay each month typically changes from month to month. This is especially troublesome for those who have a fixed-rate personal loan. The outcome can be determined by two factors: 1.) Quantity and 2.) Quality. Amount owing will be charged interest at the rate of 2.5%. The principal balance of your loan will be reduced as you repay it.

Claudia is expected to pay back $470 on a monthly basis. Based on her first monthly repayment, she divides her interest rate by 12 . As a result, she will have to repay $470, $100 of which will be used to cover interest charges, and the remaining $370 will be used to repay the principal balance.

Also Check: How Much Home Mortgage Can I Afford

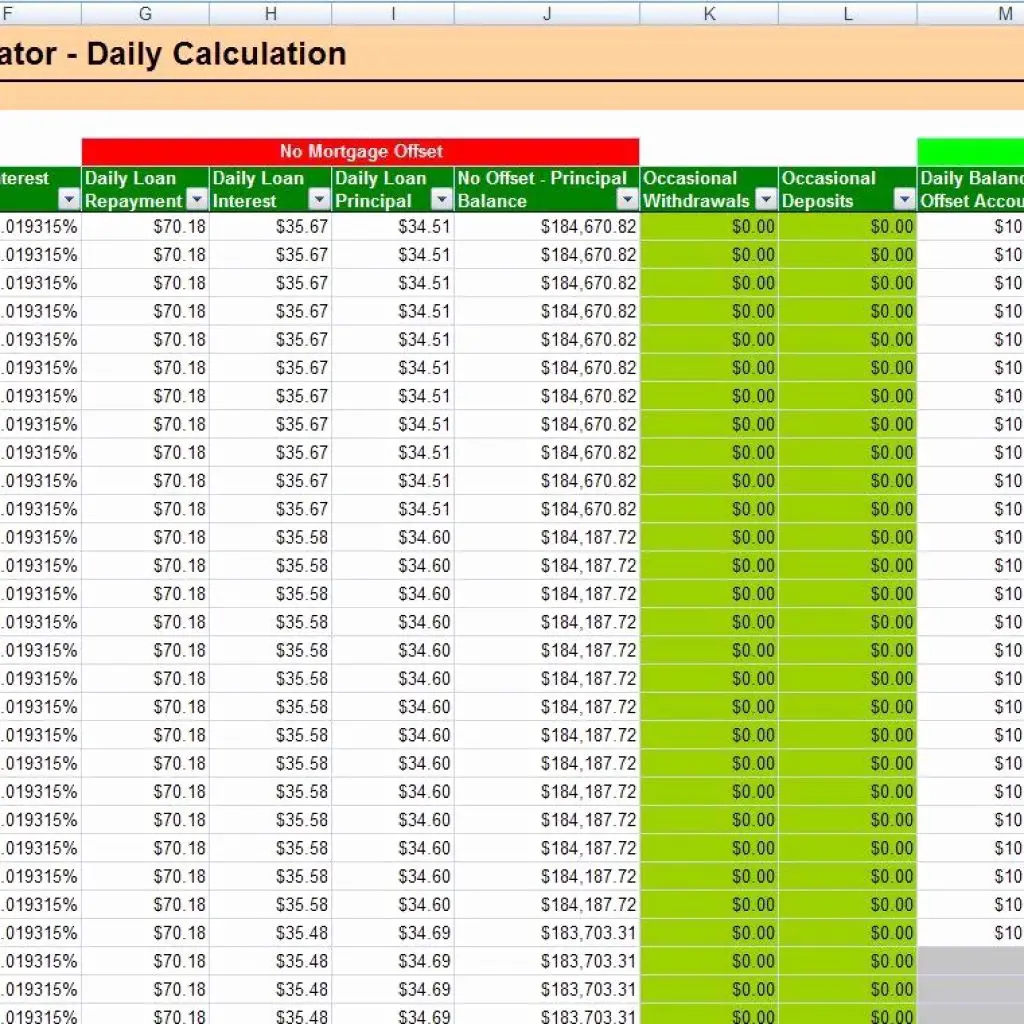

Computing Daily Interest Of Your Mortgage

To compute daily interest for a loan payoff, take the principal balance times the interest rate, and divide by 12 months, which will give you the monthly interest. Then divide the monthly interest by 30 days, which will equal the daily interest.

Suppose, for example, that your uncle gives you $100,000 for a New Year’s Eve present, and you decide to pay off your mortgage on January 5. You know that you will owe $99,800.40 as of January 1, but you will also owe five days of interest. How much is that?

- $99,800.40 x 6% = $5,988.02. Divide by 12 months = $499. Divide by 30 days = $16.63 x 5 days = $83.17 interest due for five days.

- You would send the lender $99,800.40 plus $83.17 interest for a total payment of $99,883.57.

How To Use Our Loan Interest Calculator

There are three main components when determining your total loan interest:

Total Loan Amount. This is the total amount you are borrowing. This does not include any down payment you are making.

Loan Term . This is the total length of the loan. Our calculator uses years to calculate the total interest accrued over this timeline.

Interest Rate. This is the rate charged on the loan. This should be a fixed interest rate.

To use the calculator, you will input these numbers into each section, select CALCULATE, and it will show your estimated monthly payment, as well as the total interest paid over the life of the loan.

-

Note: This calculator is designed for fixed-rate, simple interest loans only.

Don’t Miss: How Does Extra Payment Affect Mortgage

How Much Of My Monthly Mortgage Payment Is Interest

The amount of interest you pay on your monthly mortgage payment depends on the amount of your loan, the interest rate, and the number of years you have to pay off the loan. For example, if you have a $100,000 loan at a 4% interest rate and you have 30 years to pay it off, your monthly mortgage payment would be $477.42, and $377.42 of that would be interest.

Track The Spending In Your Budget

Every dollar counts when cash is tight. Take a moment to review your budget again and get a clear understanding of where the money is going each month.

You should review spending as it pertains to fixed, variable and periodic expenses and be able to quickly recognize areas where you can save. Do you have a recurring subscription for a streaming service you barely use? Unsubscribe from it. Do your grocery receipts add up because youre regularly purchasing nonessential items? Make a list and stick to it for store outings.

Tracking spending also can give you the chance to review any changes in recurring bills. For example, if your Wi-Fi statement has increased, call your provider to discuss it. Find out options to reduce these rates.

In some cases, it may be more financially reasonable to switch to another provider. Continue to track your spending and stay on top of how much money you have coming in and where your money goes each month.

Don’t Miss: What Is Overage Shortage In A Mortgage

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Pay The Minimum Monthly Payment

If you are able to make only the minimum monthly payment on your loans, pay this amount. This may not be enough to make a dent in your balance, but it is the minimum amount required. It keeps lenders and creditors from flagging your account.

Over time, as you can afford it, youll be able to put a little more toward your balance and eventually pay off the debt in full.

Recommended Reading: Can An 18 Year Old Get A Mortgage

How Do I Calculate Monthly Mortgage Payments

- M = the total monthly mortgage payment.

- P = the principal loan amount.

- r = your monthly interest rate. Lenders provide you an annual rate so youll need to divide that figure by 12 to get the monthly rate. If your interest rate is 5 percent, your monthly rate would be 0.004167 .

- n = number of payments over the loans lifetime. Multiply the number of years in your loan term by 12 to get the number of payments for your loan. For example, a 30-year fixed mortgage would have 360 payments .

Dont Miss: What Does Gmfs Mortgage Stand For

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youâll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

You May Like: How Much Usda Mortgage Can I Qualify For

Interest: The Difference 15 Years Can Make

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Say youve decided to buy a home thats appraised at $500,000, so you take out a $400,000 loan with an interest rate of 3.5%. First, lets take a look at a 30-year loan. For quick reference, again, the formula is: M = P /

Our P, or principal, is $400,000.

Remember, with i, we must take the annual interest rate given to us 3.5%, or 0.035 and divide by 12, the number of months in a year. This calculation leaves us with 0.002917, or i.

Our n, again, is the number of payments. And with one payment every month for 30 years, we multiply 30 by 12 to find n = 360.

When alls said and done, for a 30-year loan at 3.5% interest, well pay $1,796.18 each month.

For a 15-year loan, the math is nearly identical. All thats different is the value of n. Our loan is half the length, and so the value for n is 180. Each month well pay $2,859.53, over 60% more than with the 30-year loan.

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay $514,715 in total. With the 30-year, you pay $646,624 total over $100,000 more.

Your decision between these two, quite simply, hinges on whether or not you can float the significantly higher monthly payments for a 15-year loan.

A little math can go a long way in providing a how much house can I afford? reality check.

Which Home Mortgage Option Is Right For You

With so many mortgage options out there, it can be hard to know how each would impact you in the long run. Here are the most common mortgage loan types:

- Adjustable-Rate Mortgage

- Federal Housing Administration Loan

- Department of Vertans Affairs Loan

- Fixed-Rate Conventional Loan

We recommend choosing a 15-year fixed-rate conventional loan. Why not a 30-year mortgage? Because youll pay thousands more in interest if you go with a 30-year mortgage. For a $250,000 loan, that could mean a difference of more than $100,000!

A 15-year loan does come with a higher monthly payment, so you may need to adjust your home-buying budget to get your mortgage payment down to 25% or less of your monthly income.

But the good news is, a 15-year mortgage is actually paid off in 15 years. Why be in debt for 30 years when you can knock out your mortgage in half the time and save six figures in interest? Thats a win-win!

Recommended Reading: What’s A Normal Mortgage Interest Rate

Mortgage Interest Is Paid In Arrears

In the United States, interest is paid in arrears. Your principal and interest payment will pay the interest for the 30 days immediately preceding your payment’s due date. If you are selling your home, for example, your closing agent will order a beneficiary demand, which will also collect unpaid interest. Let’s take a closer look.

For example, suppose your payment of $599.55 is due December 1. Your loan balance is $100,000, bearing interest at 6% per annum, and amortized over 30 years. When you make your payment by December 1, you are paying the interest for the entire month of November, all 30 days.

Calculate Interest Portion Of Mortgage

The typical mortgage loan has a 30-year term, and interest is paid on the outstanding balance until the loan is completely paid off. A homeowner should have an idea of how much total interest will be paid on a mortgage and what portion of each monthly payment goes to pay the interest.

Also Check: How To Shop For A Mortgage

Costs Included In Your Monthly Mortgage Payment

Here are two formulas to visualize the costs that are included in your monthly mortgage payment:

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also homeowners insurance, property taxes, and, in some cases, private mortgage insurance and homeowners association fees. Heres a breakdown of these costs.

Consider The Cost Of Property Taxes

A monthly mortgage payment will often include property taxes, which are collected by the lender and then put into a specific account, commonly called an escrow or impound account. At the end of the year, the taxes are paid to the government on the homeowners’ behalf.

How much you owe in property taxes will depend on local tax rates and the value of the home. Just like income taxes, the amount the lender estimates the homeowner will need to pay could be more or less than the actual amount owed. If the amount you pay into escrow isn’t enough to cover your taxes when they come due, you’ll have to pay the difference, and your mortgage payment will likely increase going forward.

You can typically find your property tax rate on your local government’s website.

Read Also: Can You Get A Mortgage With A Low Credit Score

How Much Interest Will I Pay On My Car Loan Loan Interest Calculator Example

When shopping for a car, you can use this calculator to determine how much interest you will pay on an auto loan. In the example below, well look at a five-year car loan for $30,000, with a fixed interest rate of 6.0%.

Total Loan Amount: $30,000

Loan Term : Five years

Interest Rate: 6.0%

After 5 years, you will pay a total of $4,799.04 in interest on your car loan. If you are able to shop around for a better car loan rate, you can save some money. Lets say you find an auto loan with a 4.0% interest rate, the total interest paid on a five-year loan would be $3,149.74. That is over $1,500 in savings by simply finding a better rate.

Dont Miss:How to Get Pre-Approved for an Auto Loan

How Your Mortgage Payment Is Calculated

SmartAssets mortgage calculator estimates your monthly mortgage payment, including your loan’s principal, interest, taxes, homeowners insurance and private mortgage insurance . You can adjust the home price, down payment and mortgage terms to see how your monthly payment will change.

You can also try our home affordability calculator if youre not sure how much money you should budget for a new home.

A financial advisor can aid you in planning for the purchase of a home. To find a financial advisorwho serves your area, try our free online matching tool.

Also Check: How To Increase Mortgage Score