How Do You Qualify For A 10

Qualifying for a 10-year mortgage is the same as qualifying for other types of mortgages, but income and credit score requirements will be stricter to ensure you can afford to make the higher monthly payments.

Make sure you have all of your financial documents like tax returns and pay stubs in order because the lender will factor in almost every aspect of your financial life to determine whether or not you can pay back the loan. Things like your income, credit score, how much debt you’re carrying and your loan-to-value ratio all affect the rate a lender will offer you.

Whats The Difference Between A 10

A 10-year fixed mortgage and a 10/1 ARM may both have the number ten in the name, but theyre two very different products. With a 10-year fixed mortgage, the loan term is 10 years and the interest rate is fixed for the life of the loan. After ten years, the loan will be paid off completely.

A 10/1 ARM, on the other hand, is a 30-year mortgage whose interest rate is fixed for the first ten years and then changes yearly based on the market rate afterwards. After the first ten years, you will still have 20 years left on your loan. However, the interest rate for the rest of those 20 years may be different from the interest rate you paid the first ten years.

A 10-year mortgage will likely have a significantly higher monthly payment than a 10/1 ARM, because youre paying off the loan in a much shorter period of time. A 10-year mortgage typically offers lower interest rates than a 10/1 ARM, although the exact rate youll get may vary depending on the lender you use, your credit score, and other financial factors.

How Does A 40

The loan repayment term directly impacts your monthly payment, interest rate and total loan cost. A 40-year loan term will require smaller monthly payments than a 30-year loan, but the total paid over the course of the loan will be higher.

When deciding between a 40-year mortgage and a 30-year mortgage, its helpful to look at the loans side by side. Below, we look at both loan options for a $440,300 home with a 13% down payment. In our example, there is no difference in the interest rate a best-case scenario and the monthly payment amounts reflect principal and interest only.

| Loan amount | |

|---|---|

| $1,923.86 | $923,451.30 |

While youd save $200 per month on your mortgage payments by going with a 40-year loan, you would end up spending about $100,400 more for the privilege.

The interest youd pay over those 40 years would also exceed the homes sale price, which isnt true for the 30-year loan.

Finally, its worth taking a look at how much more slowly youll build equity with a 40-year loan. The chart below compares the equity-building timelines for 30- and 40-year mortgages.

As you can see, with a 30-year loan, you would build 20% equity in five years, but with a 40-year loan, youd have to wait nearly nine years to build that much equity. And depending on other terms of the loan , it could take even longer to build equity.

Don’t Miss: Will Life Insurance Cover Mortgage

Can You Get A 40

Yes, its possible to get a 40-year mortgage. While the most common and widely used mortgages are 15- and 30-year mortgages, lenders can and do offer a wide variety of payment terms. For example, a borrower looking to pay off their home quickly may consider a 10-year loan. On the other hand, a buyer seeking the lowest monthly payment may choose a 40-year mortgage.

Traditionally, 40-year loans have been used as a loss mitigation option offered to homeowners who are in mortgage default or forbearance and struggling to make their house payments. This type of loan isnt a common option for borrowers simply looking for a longer loan term on a new purchase.

THINGS YOU SHOULD KNOW

In April 2022, as part of its ongoing response to the COVID-19 pandemic, the Federal Housing Administration joined Fannie Mae, Freddie Mac and other entities in offering a 40-year loan modification option.

Not all lenders offer 40-year mortgages, even as loan modifications, though. The U.S. Department of Veterans Affairs , for example, doesnt allow mortgage terms over 30 years and 32 days, even for homeowners in financial distress.

Strategies For Buying Or Refinancing As Rates Rise

Caught watching mortgage rates rise as Treasury yields go up? The good news is that there are strategies and solutions which you can implement to offset potential increases in the amount of your monthly mortgage payments as well. For instance, you might utilize a mortgage rate lock to help safeguard against upticks in interest rates. If youre able to act quickly enough, a cash-out refinance at a lower rate can also help you offset against future interest rate gains. Alternately, using a home equity line of credit may provide flexibility by allowing you to borrow against equity that youve already accumulated in your current home. Rocket Mortgage® does not offer HELOCs.

Read Also: Does Discover Bank Do Mortgages

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners’ insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score of both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Read Also: How To Calculate Mortgage Insurance On A Conventional Loan

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rates and an annual percentage rate . Thats understandable since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing the money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a $300,000 loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

How Are Mortgage Rates Set

At a high level, mortgage rates are determined by economic forces that influence the bond market. You cant do anything about that, but its worth knowing: Bad economic or global political worries can move mortgage rates lower. Good news can push rates higher.

What you can control are the amount of your down payment and your credit score. Lenders fine-tune their base interest rate on the risk they perceive to be taking with an individual loan.

So their base mortgage rate, computed with a profit margin aligned with the bond market, is adjusted higher or lower for each loan they offer. Higher mortgage rates for higher risk lower rates for less perceived risk.

So the bigger your down payment and the higher your credit score, generally the lower your mortgage rate.

» MORE: Get your credit score for free

You May Like: How Long After Bankruptcy Can You Get A Mortgage

Do Different Mortgage Types Have Different Rates

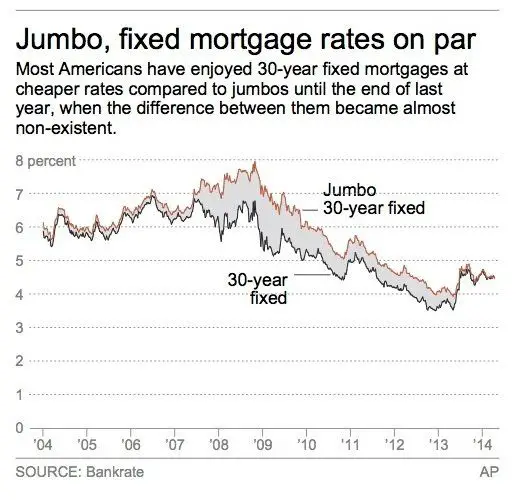

Fixed and adjustable rates loans have different rates. ARMs have interest rates that are usually lower for the initial fixed-rate period, but usually go up once that period is over . Fixed-rate mortgages may have higher initial interest rates compared to ARMs, but remain the same throughout the lifetime of the loan.

There are also different loan terms for both fixed-rate and ARMs such as a 10-year, 15-year, 20-year, or 30-year loan. The longer the term, the higher interest rates tend to be.

Why Go With A Fixed Rate

A fixed mortgage rate is advantageous to a homeowner because the rate of interest for the home loan taken will not vary throughout the loan period. If interest rates fall significantly the homeowner can choose to refinance their loan. If interest rates rise their low rate is locked in for the duration of the loan.

It is a fact that most people prefer an interest rate that doesn’t change through out the entire loan period. It is also true that fixed rates are initially higher than adjustable rates. But whatever the market is subjected to, those fluctuations will not affect your fixed rate.

As inflation tends to drive up wages and asset prices the cost of the fixed monthly payment goes down in relative terms even if the nominal number does not change.

There are different kinds of fixed loans depending upon the requirement of the homeowner and how much they can afford & are willing to pay. The vast majority of homeowners finance home purchases with a 30-year fixed rate. The reason most homeowners choose a 30-year term is it offers the lowest monthly payment.

Homes are typically the largest consumer lifetime purchase. Building equity faster is a great way to offset periods of poor savings or get ahead for retirement. Those who have relatively high incomes or who live in low-cost areas may choose to try to build equity and pay off their home loan quicker by choosing a shorter duration loan.

Also Check: Should I Refinance With My Current Mortgage Company

/1 Arm Rates May Come At A Slight Discount

- While interest rates will vary over time and by mortgage lender

- Expect a 10/1 ARM to price slightly below a comparable 30-year fixed

- Perhaps just .125% to .25% cheaper in rate depending on the company

- The discount is marginal because 10 years is still a long time to offer a fixed interest rate before the first adjustment

Now lets discuss 10/1 ARM rates, which generally come cheaper than 30-year fixed rates.

However, the interest rate may only be .125% or .25% cheaper because you get a fixed rate for a full decade before any adjustment takes place.

Many folks dont even stay in the same home or keep their mortgages for a decade, so the 10/1 ARM could make sense and save you some dough with little to no downside.

However, this also explains the lack of a large discount relative to the 30-year fixed.

If youre not comfortable with a loan program that features adjustable rates, steer clear. The savings may not be worth the stress.

Assuming you plan to move within 10 years , going with a 10-year ARM should provide you with a discounted fixed rate for a significant period of time while you figure things out.

Of course, if you know you wont stay even five years, it could be even smarter to look to the 5/1 ARM instead, which will come with an even lower interest rate.

Money’s Average Mortgage Rates For September 9 2022

Mortgage rate moved lower across all loan categories today. The average rate for a 30-year fixed-rate loan was down for the second day in a row, decreasing by 0.136 percentage points to 6.731%.

- The latest rate on a 30-year fixed-rate mortgage is 6.731%.

- The latest rate on a 15-year fixed-rate mortgage is 5.601%.

- The latest rate on a 5/6 ARM is 6.395%.

- The latest rate on a 7/6 ARM is 6.422%.

- The latest rate on a 10/6 ARM is 6.393%.

Money’s daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each day’s rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

These rates are different from Freddie Macs rates, which represent a weekly average based on a survey of quoted rates offered to borrowers with strong credit, a 20% down payment and discounts for points paid.

You May Like: Could I Qualify For A Mortgage

Tempted By A 10 Year Mortgage

The 10 year mortgage, where your rates are fixed for a whole decade, is still a rare beast but has started to hit the headlines. On the face of it they may appeal to some people but is such a mortgage really worth considering, and who might want one? Matt Harris of Dalbeath Financial Planning doubts the hype.

Taking out a mortgage is typically stressful and you may find the greatest stress can be the level of uncertainty involved. Will interest rates rise, how soon might they rise, and by how much? Will I be able to afford the higher repayments? These are questions that no-one can answer with 100 per cent certainty. So the prospect of a mortgage with a rate fixed for 10 years may initially seem very attractive. The obvious benefits are as follows:

- Complete certainty about how much your mortgage payments will be for the next 10 years.

- Interest rates are at a historic low, so you may be locking in a great rate at the perfect time.

- Remortgaging can involve fees, which you will avoid for 10 years.

However, there are downsides to consider too:

- You will not be able to repay the mortgage in full within the first 10 years, without incurring potentially large penalty charges. You may still be able to move house, but only if you take the mortgage with you, which is only possible if the lender approves it.

- Your monthly payments will be higher than under a shorter term fixed rate.

Weighing up your options

Which of these should she go for?

£27,249 under the 2 year deal

Could You Get A Lodger

The Government allows you to rent out a room pretty much tax free if you have a spare under the Rent a Room scheme. This way you can earn £7,500 per year without having to tell HMRC about it. This is halved if you share the income with your partner or someone else.

Only in the most expensive rental areas in the country will you earn above this, but if you do, you only have to pay tax on any income above. Mark Harris, chief executive of SPF Private Clients brokers, says some smaller lenders will allow this income to be used as part of the affordability assessment, enabling you to get a bigger mortgage.

Recommended Reading: How To Become Mortgage Agent

Save Money With Or Without 10

There are plenty of ways to turn your dream of being mortgage-free in 10 years into a reality.

If you can afford the higher payments of a 10-year fixed loan, you can shorten your loan term, lower your interest rate, and greatly reduce your total interest payments.

But even without a 10-year mortgage or refinance, its possible to save on your home loan.

15- and 20-year mortgages offer similar low rates but slightly lower monthly payments.

Or, you can use one of the above strategies to pay extra on your mortgage and pay it off early.

The only question is, what will you choose to do?

110-year and 30-year fixed mortgage rates sourced on 10/23/2020 from US Bank, Realtor.com, Bankrate, Zillow, and mortgagecalculator.com. Advertised rates based on a borrower with excellent credit and a sizeable down payment. Your own rate will vary.

Best Rates On The Market

The best two-year fixed deal on the market right now is with Natwest which is offering a rate of 4.22 per cent.

Meanwhile, the best five-year fix is also with Natwest with a rate of 3.78 per cent.

Those looking for a variable deal could go with First Direct which offers a rate of 4.19 per cent if you have a 25 per cent deposit, though you would need a very good reason for that to be viewed as a good deal given the inevitability of rate rises next month.

For those remortgaging, as a rule of thumb for every £100,000 of mortgage, youll pay around £600 a year more for every 1 per cent interest rate rise. .

Also Check: Where Are Mortgage Rates Trending