When Does Mortgage Insurance Fall Off The Loan

Once the borrower has built up a certain amount of equity in the house, typically 20% equity, private mortgage insurance usually may be canceled which will reduce your mortgage payment and allow you pay less money every month. The lender usually wont automatically cancel PMI until youve reached 22 percent equity based on the original appraised value of the home, or unless you contact them to request cancellation at 20 percent of the current market value. So if you own a home with a value of $100,000 and have paid down $20,000 in principal, you can request to cancel your PMI. Be sure to contact your lender once youve hit 20 percent equity.

Fha Mortgage Insurance Premium

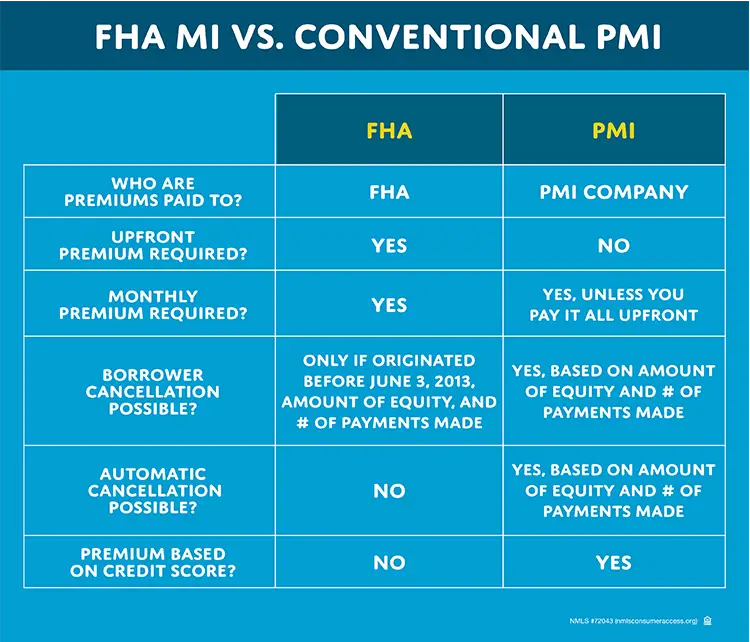

If you cant qualify for a conventional loan product, you might consider an FHA loan. Like some conventional loan products, FHA loans have a low-down payment optionas little as 3.5% downand more relaxed credit requirements.

Lenders require mortgage insurance for all FHA loans, which are paid in two parts: an up-front mortgage insurance premium, or UFMIP, and an annual mortgage insurance premium, or annual MIP. Both costs are listed on the first page of your loan estimate and closing disclosure.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if youâre in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Donât Miss: Which Lender Has The Best Mortgage Rates

Read Also: How Much Second Mortgage Can I Afford

What Is Private Mortgage Insurance How It Works And How To Avoid Paying Pmi

Private mortgage insurance, or PMI, allows borrowers to purchase a home without making a 20% down payment on a conventional mortgage. PMI also adds to the cost of your mortgage, and how much you pay depends on the size of the loan and your .

Lets take a look at private mortgage insurance, how much it impacts the cost of your mortgage, and how to avoid paying PMI.

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Donât Miss: Can I Have Multiple Mortgages

Also Check: Can You Get A Mortgage To Include Renovations

Department Of Veterans Affairs

If you get a Department of Veterans Affairs -backed loan, the VA guarantee replaces mortgage insurance, and functions similarly. With VA-backed loans, which are loans intended to help servicemembers, veterans, and their families, there is no monthly mortgage insurance premium. However, you will pay an upfront funding fee. The amount of that fee varies based on:

- Your type of military service

- Your down payment amount

Mortgage Insurance Vs Home Insurance

Mortgage insurance doesn’t cover you or your home. It’s not a substitute for a home insurance policy, which protects the structure of your home, personal belongings, and your pocketbook in case you’re financially liable for something. Home insurance is typically required by your lender no matter the size of your down payment and is highly recommended even after you pay off your home. Mortgage insurance, however, is only required if you’re unable to make a 20% down payment on a new home loan or refinance.

If you’re going through the home-buying process and have additional questions about insurance, check out our guide to home insurance for first-time buyers.

Don’t Miss: Where To Find Mortgage Note

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Should I Pay Off My Pmi Early

Its very important that you cancel your mortgage insurance as soon as you can because the savings can be significant for your monthly payments. If you have a 30-year fixed-rate loan for $300,000, you’ll have nine payments left between reaching 20% equity and having your PMI automatically canceled at 22% equity. If you cancel early, you could save thousands of dollars, depending on your interest rate.

Recommended Reading: How To Get A Va Mortgage

How Do You Calculate Amortization

An amortization schedule calculator shows:

This means you can use the mortgage amortization calculator to:

To use the calculator, input your mortgage amount, your mortgage term , and your interest rate. You can also add extra monthly payments if you anticipate adding extra payments during the life of the loan. The calculator will tell you what your monthly payment will be and how much youll pay in interest over the life of the loan. In addition, youll receive an in-depth schedule that describes how much youll pay towards principal and interest each month and how much outstanding principal balance youll have each month during the life of the loan.

Mortgage Principal Payment Vs Total Monthly Payment

Together, your mortgage principal and interest rate make up your monthly payment. But you’ll also have to make other payments toward your home each month. You may face any or all of the following expenses:

- Property taxes: The amount you pay in property taxes depends on two things: the assessed value of your home and your mill levy, which varies depending on where you live. You may end up paying hundreds toward taxes each month if you live in an expensive area.

- Homeowners insurance: This insurance covers you financially should something unexpected happen to your home, such as a robbery or tornado. The average annual premium in the United States in 2019 was $1,015, according to the most recent data from S& P Global.

- Mortgage insurance:Private mortgage insurance is a type of insurance that protects your lender should you stop making payments. Many lenders require PMI if your down payment is less than 20% of the home value. PMI can cost between 0.2% and 2% of your loan principal per year. Keep in mind, PMI only applies to conventional mortgages, or what you probably think of as a regular mortgage. Other types of mortgages usually come with their own types of mortgage insurance and sets of rules.

You may choose to pay for each expense separately, or roll these costs into your monthly mortgage payment so you only have to worry about one payment every month.

Read Also: How Do I Get Mortgage Insurance

Mortgage Insurance In Canada

The Bank Act which governs banks as well as provincial laws governing credit unions and caisse populaires prohibit most regulated lending institutions from providing mortgages without loan insurance if LTV is greater than 80%. The typical premium rates provided by Canada Mortgage and Housing Corporation are between 1% and 2.75% of the loan principal.

Qualified Mortgage Insurance Premium

When you get a U.S. Federal Housing Administration -backed mortgage, you will be required to pay a qualified mortgage insurance premium, which provides a similar type of insurance. MIPs have different rules, including that everyone who has an FHA mortgage must buy this type of insurance, regardless of the size of their down payment.

Recommended Reading: Can You Roll Down Payment Into Mortgage

What Is Principal Interest Taxes Insurancepiti

Principal, interest, taxes, insurance are the sum components of a mortgage payment. Specifically, they consist of the principal amount, loan interest, property tax, and the homeowners insurance and private mortgage insurance premiums.

PITI is typically quoted on a monthly basis and is compared to a borrower’s monthly gross income for computing the individual’s front-end and back-end ratios, which are used to approve mortgage loans. Generally, mortgage lenders prefer the PITI to be equal to or less than 28% of a borrower’s gross monthly income.

Should I Purchase Mpi

Again, unlike PMI, this type of insurance is purely voluntary. If you’re in good health, relatively secure in your job, have no unusual lifestyle risks, and are adequately otherwise insuredfor example, you have life insuranceyou might not want or need to purchase this type of insurance.

But if you think that your particular circumstances or risk factors could warrant getting this type of insurance, consider contacting an insurance agent.

Read Also: Is Meridian Home Mortgage Reputable

How To Avoid Borrower

Borrower-paid PMI is the most common type of PMI. BPMI adds an insurance premium to your regular mortgage payment. Lets take a look at what home buyers can do to avoid paying PMI.

Make A Large Down Payment

You can avoid BPMI altogether with a down payment of at least 20%, or you can request to remove it when you reach 20% equity in your home. Once you reach 22%, BPMI is often removed automatically.

Take Out An FHA Or USDA Loan

While its possible to avoid PMI by taking out a different type of loan, Federal Housing Administration and U.S. Department of Agriculture loans have their own mortgage insurance equivalent in the form of mortgage insurance premiums and guarantee fees, respectively. Additionally, these fees are typically around for the life of the loan.

The lone exception involves FHA loans with a down payment or equity amount of 10% or more, in which case you would pay MIP for 11 years. Otherwise, these premiums are around until you pay off the house, sell it or refinance.

Take Out A VA Loan

The only loan without true mortgage insurance is the Department of Veterans Affairs loan. Instead of mortgage insurance, VA loans have a one-time funding fee thats either paid at closing or built into the loan amount. The VA funding fee may also be referred to as VA loan mortgage insurance.

Take Out A Piggyback Loan

Acceptance Rates And Insurance Premiums

Secondly, MPI policies have guaranteed acceptance. When you buy a term life insurance policy, the cost you pay each month depends on factors like your health and occupation. You get to skip the underwriting process with an MPI policy, as most policies typically don’t require policyholders to submit a medical exam. This can be very beneficial if youre sick or work in a dangerous or high-risk job. However, it also means that the average MPI premium is higher than a life insurance policy for the same balance. For adults in good health who work in low-risk jobs, this can mean paying more money for less coverage.

Also Check: What Is The 30 Year Fha Mortgage Rate

Homebuyers Can Avoid Paying Pmi If Their Down Payment Is Large Enough

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

When you apply for a mortgage, the lender will typically require a down payment equal to 20% of the home’s purchase price. If a borrower can’t afford that amount, a lender will likely look at the loan as a riskier investment and require that the homebuyer take out PMI, also known as private mortgage insurance, as part of getting a mortgage.

PMI protects the lender in the event that you default on your primary mortgage and the home goes into foreclosure.

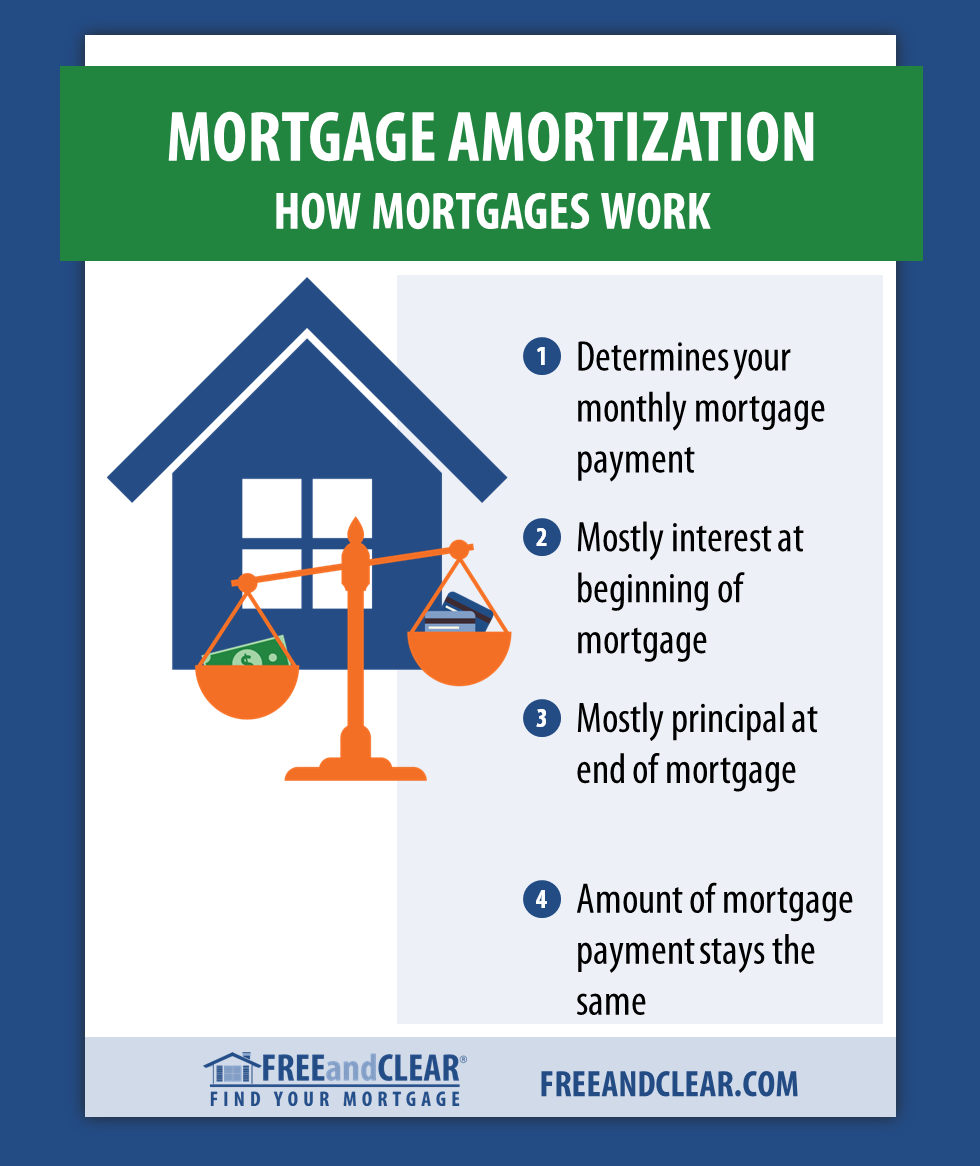

What Is Amortization

Amortizing a mortgage allows borrowers to make fixed payments on their loan, even though their outstanding balance keeps getting lower. Early on, most of your monthly payment goes toward interest, with only a small percentage reducing your principal. At the tail end of repayment, that switchesmore of your payment reduces your outstanding balance and only a small percentage of it covers interest.

Also Check: What Does Apr Mean For Mortgage

How Much Pmi Costs

The cost of PMI varies but is usually around one-half of 1% of the loan amount. So, it’s well worth the effort to get rid of it as soon as you can, if you can. Also, keep in mind that mistakes often happen, and the servicer might not remember to cancel PMI once your loan balance gets to 78% without you reminding them.

Payoff In 14 Years And 4 Months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

If Pay Extra $500.00 per month

| Remaining Term |

| 24 years and 4 months |

| Total Payments |

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options.

You May Like: Is The Payoff Amount On A Mortgage Less Than Balance

You May Like: Is Quicken Loans A Mortgage Company

How To Remove Pmi

There are three ways you can remove private mortgage insurance.

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Read Also: What Type Of Mortgage Do I Have

See What Goes Towards Your Principal

When you buy your first home, you may get a shock when you take a look at your first mortgage statement: You’ll hardly make a dent in your principle as the majority of your payment will apply toward interest. Even though you may be paying over $1,000 a month toward your mortgage, only $100-$200 may be going toward paying down your principal balance.

The amount that you pay in principle each month depends on a number of variables, including:

- Amount of the loan

- Length of the loan

- How many months you have already paid in to the loan

The reason that the majority of your early payments consist of interest is that for each payment, you are paying out interest on the principle balance that you still owe. Therefore, at the beginning of your loan, you may owe a couple hundred thousand dollars and will still have a hefty interest charge. With each payment, you will reduce the principle balance and, therefore, the amount of interest you have to pay. However, since your loan is structured for equal payments, that means that you’re just shifting the ratio, not actually paying less each month. With each successive payment, you are putting in a little more toward principle and a little less toward interest. By the end of your loan term, the majority of each payment will be going toward principle.

Making Extra Payments Early