Refinance To A Shorter Loan

Has your income increased? If so, you may want to consider refinancing to a shorter term. Refinancing your mortgage allows you to save money on interest without worrying about penalties or scheduling extra payments. It also allows you to fully own your home much faster.

Keep in mind that refinancing your mortgage to a shorter term will increase your monthly payments. Do the math and make sure you can cover the extra financial burden before you make that move.

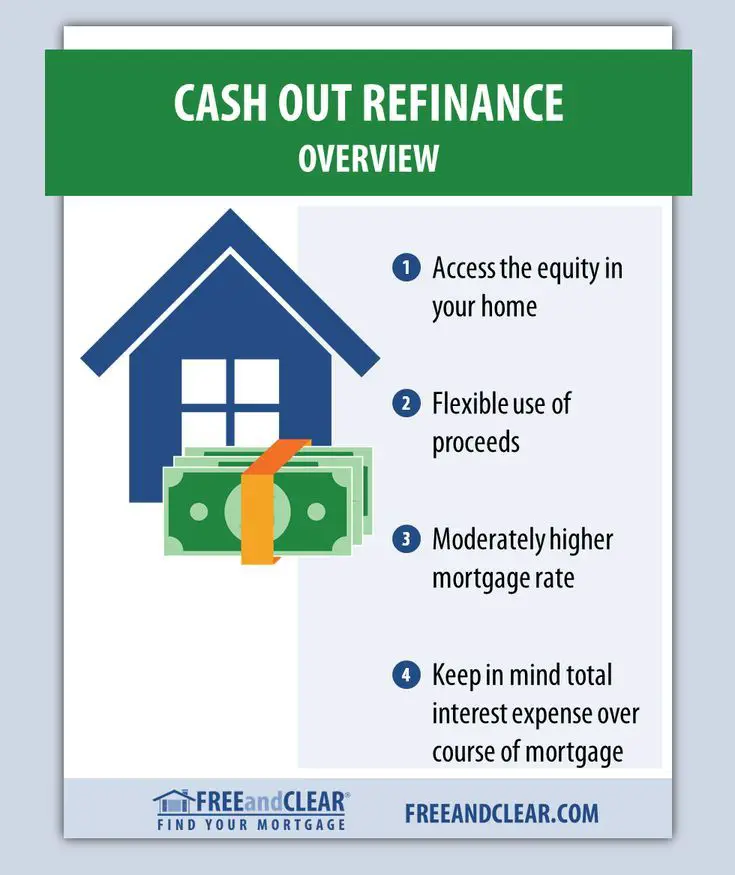

Consolidate debt with a cash-out refinance.

Your home equity could help you save money.

Its A Good Time To Apply For A Mortgage With Assurance Financial

When youre ready to take the exciting step of purchasing a new home, work with Assurance Financial to take advantage of historically low rates.

We make it easy to apply for a mortgage and estimate costs during the process, and you can get prequalified in 15 minutes. Our licensed, approachable, trustworthy loan officers have the industry knowledge and expertise to get you custom competitive rates. And we have just about every type of home loan available, from conventional loans to FHA and VA loans to loans designed specifically for jumbo or modular homes.

Whether youre a first-time homeowner, downsizing, dreamsizing or looking for an investment property or a vacation home, we can make getting started with your loan quick and convenient. And because were an independent lender rather than a mortgage broker, we give you the security and peace of mind of knowing well never pass your loan or personal data on to anyone else.

Apply online, or contact us today for a no-obligation quote.

Benefits Of Making Regular Mortgage Payments

Paying down your mortgage provides you with a couple of different benefits. One is that it reduces the amount of debt you have. As you slowly, steadily make payments, you decrease your debt burden. You increase your debt-to-income ratio, making yourself a more attractive borrower if you decide to take out new loans. You also get a little closer to having your home paid off and having a bit more cash to spend each month.

The second benefit is that you accrue home equity. Home equity is the amount of your home that you have paid off. It equals the value of your home minus the value of your remaining mortgage. So the more of your mortgage you pay down, the more home equity youll have. Maintaining as much home equity as you can is an excellent strategy for maintaining financial stability. You can also borrow strategically against your equity by taking out home equity loans to perform renovations, say, and boost the eventual resale value of your home.

Also Check: How Do You Get Mortgage Insurance

The Bottom Line: Theres A Lot To Learn When You Decide You Want To Own A Home

Becoming a homeowner isnt easy and its certainly not cheap but its worth the effort. Its important to take the time to familiarize yourself with what a mortgage is before you plunge into the market. Ready to take the first step in your home buying journey? Get started on your mortgage approval today! You can also give us a call at 326-6018.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

What Are The Current Terms Of Your Mortgage

Before you attempt to pay off your mortgage early, its important to gain a concrete sense of the conditions you established with your mortgage lender. Knowing the length of your loan term will help you determine how long it will take you to pay off your mortgage if you make the minimum payment each month. Being aware of your interest rate will tell you how much interest youre currently paying on the remaining balance of your mortgage principal.

You should also see whether you agreed to a fixed- or adjustablerate mortgage. If you have an ARM loan, youll want to know how market rates have changed since you first obtained your mortgage. If market rates are higher, paying off your mortgage early may be the right move.

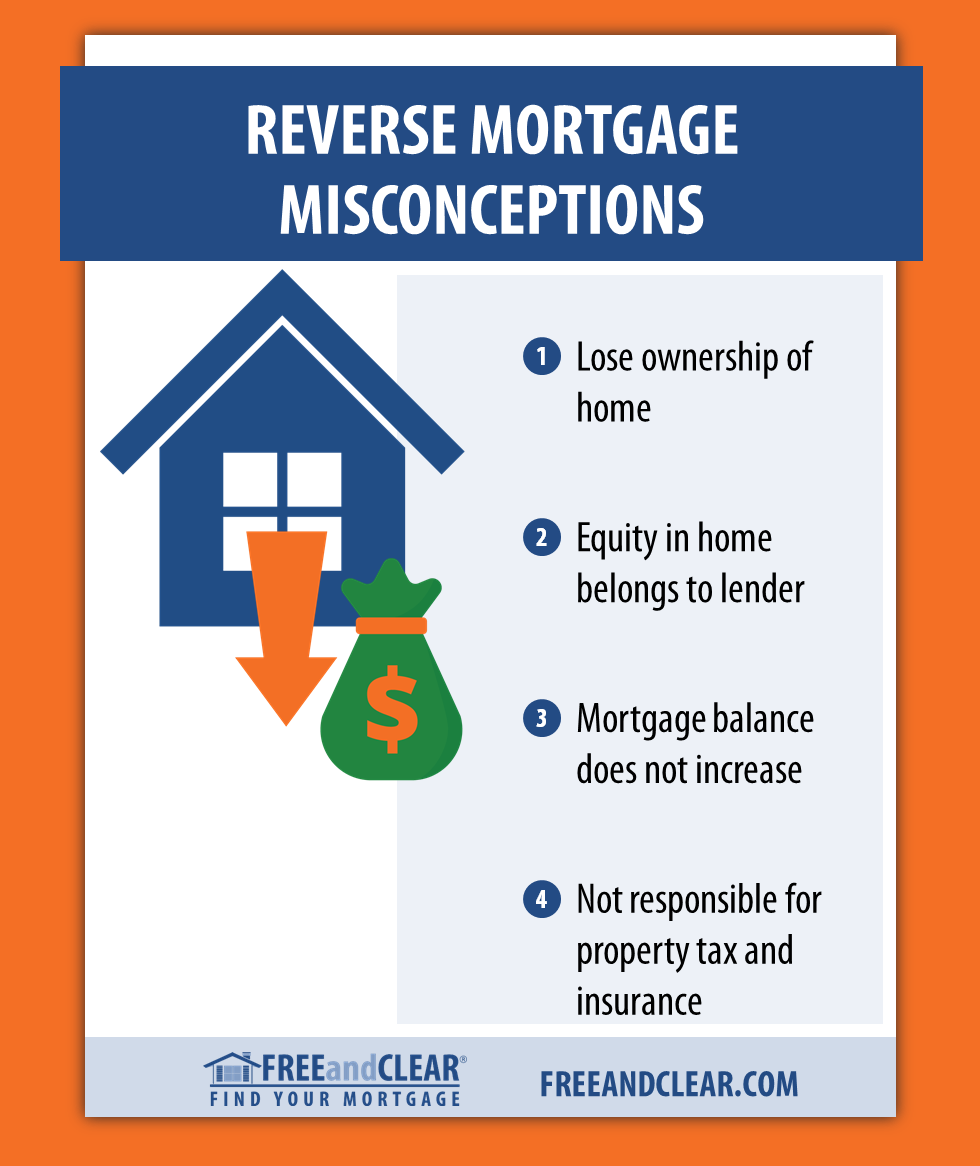

Read Also: Can You Get A Reverse Mortgage At Age 60

Making Biweekly Mortgage Payments

There are some lenders that allow you to automate biweekly payments. This feature makes it easy for you to pay down your mortgage loan faster and for less, without having to even think about the process.

If your lender does not offer such an option, though, youll need to take matters into your own hands. This can be done a handful of different ways heres a look at your three alternatives.

Option 1. You can split your monthly payment in half, logging into your account every two weeks to make a payment. Your savings will be the same as if your lender allows you to schedule biweekly payments.

This option requires you to stay on top of these manual payments, however if you forget to make the second payment one month, you may be charged a late fee by your lender.

Option 2. Automate your regular monthly mortgage payment, taking the legwork out of your lenders requirement. Then, each month you can make an additional principal payment equal to one-twelfth of your monthly amount due at the end of the year, you will have made one extra mortgage payment and significantly reduced your principal balance due.

Option 3. Simply make an additional mortgage payment each year, in the month that works best for you. This one lump payment will go toward reducing your principal balance, though it wont save you as much in interest as if youd made regular contributions throughout the year.

Case Study: Prepayment In Action

Lets take a look at a hypothetical example. Say Joan is 10 years into a 30-year mortgage with an interest rate of 4%, an outstanding balance close to $275,000, and a monthly payment of about $1,300. She is approaching retirement and trying to decide if she should use her savings to pay off the mortgage before she stops working.

Lets say Joan is a conservative investorshe holds about 20% of her portfolio in stocks, about 50% in bonds, and 30% in cash. If she prepays her mortgage, our estimate indicates she will end up improving her financial condition by reducing the risk of running out of money in retirement by about 5%, and improving her median final balance by about 13%.2

But what if she was a more aggressive investor and held 70% of her portfolio in stocks and 25% in bonds and 5% in cash. According to our estimates, if Joan decides to prepay, she would still reduce her risk of running out of money. But in terms of wealth, the outcome would likely change: Instead of increasing her final balance, prepaying the mortgage would actually hurt her wealth. Because her investments would have grown more than savings from repayment, Joan would see her median final balance decrease by about 5%.

You May Like: What Is Mortgage Payment On 600 000

Make One Extra Mortgage Payment Each Year

Making an extra mortgage payment each year could reduce the term of your loan significantly.

The most budget-friendly way to do this is to pay 1/12 extra each month. For example, by paying $975 each month on a $900 mortgage payment, youll have paid the equivalent of an extra payment by the end of the year.

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

Recommended Reading: Can I Get A Mortgage With Student Loans

Why Should You Make Biweekly Mortgage Payments

Anytime you can pay a little extra to lower your principal, youll owe less interest going forward, explains Glenn Brunker, a mortgage executive with Ally Home. Plus, as you pay down the principal balance, less of your payment will go to interest, and more will go toward the principal lowering it even more.

The caveat is that youll need to ensure that extra payment is actually being applied to the loan principal and not the interest.

Lets say you have a 30-year, fixed-rate mortgage for $250,000 with a 3.2 percent interest rate. Your monthly payment would come to $1,081. Assuming you pay once a month, youd pay roughly $139,260 in interest over 30 years.

In the same scenario making biweekly payments or about $540 every two weeks youd cut your total interest down to $119,369, saving you more than $19,800. Youd also pay off the loan in 26 years, instead of 30.

Another reason to make that extra payment is to build equity faster. You can borrow against your homes equity for a variety of purposes and in different ways, such as with a cash-out refinance, home equity loan or home equity line of credit .

Aside from saving you money and attaining more equity sooner, it can make sense to make biweekly payments if you earn biweekly paychecks, Brunker says, noting that an adjusted payment schedule may better align with monthly cash flow.

How To Make A Payment

Just as you might go online to make a car insurance or phone bill payment, you can pay your mortgage in the same way. You can still make payments by mail or phone, but the ease and convenience of paying online makes it a more favorable option among most homeowners. One reason for this is the ability to set up automatic payments, either through your bank or directly with your lender.

You should keep in mind that mortgage payments sometimes change. The amount necessary for taxes and insurance may go up or down every year. The same is true if you’re in an adjustable-rate mortgage at the end of its fixed period. By setting up an automatic payment through a lender as opposed to the bank, you can make sure the payment isn’t too low and that you’re not overpaying when your escrow or rate goes down.

Recommended Reading: How Long Does It Take To Qualify For A Mortgage

How To Find The Best Mortgage

In todays modern age, there is a wealth of resources both online and in-person for finding the best mortgage and lender for you. But knowing where to start and what to come prepared with will help you find the best rate available.

Using an online mortgage calculator will help you compare and contrast estimated monthly payments. These are typically calculated based on the type of mortgage, interest rate, and how much of a down payment you can procure. With a mortgage calculator, you can better determine how much home you can actually afford.

Its also recommended that you assess our financial health to better understand what type of mortgage will be best. Your financial health includes income, credit score, employment, and financial goals.

It never hurts to compare mortgage lenders as well. Some will have different guidelines than others. Make sure you play the field to get the best deal for you.

How Much Interest Do You Pay

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Shorter-term loans like 15-year mortgages often have lower rates than 30-year loans. Although you would have a bigger monthly payment with a 15-year mortgage, you would spend less on interest.

Read Also: How Are Home Mortgage Rates Determined

Understanding How Do Principal Payments Work On Home Mortgages: Principal Payment Explained

As mentioned earlier, there are two components to a monthly mortgage payment: Principal and Interest.

- The principal is the net amount of money you borrower from the mortgage company

- Your principal loan balance is the final purchase price minus the down payment

- If you purchased a home for $300,000 and put a 10% or $30,000 down payment, the principal home loan balance is $270,000

- You have $30,000 in equity and a principal mortgage loan balance of $270,000

- Your monthly mortgage payments are determined by the principal loan balance

- From the day you take out your loan and as time pass, the interest accumulates

- On top of the principal and interest, homeowners are responsible for property taxes and homeowners insurance

Most homeowners with escrow accounts pay the property taxes and homeowners insurance to their lender.

Who Usually Pays For A Buy

Cox: The escrow or buy-down account can be funded by the seller, the buyer, the lender or a third party, such as a Realtor. Getting the seller to accept a concession to fund the account is usually the most beneficial scenario for the buyer.

Melgar: A buy-down can be paid by the buyer, seller, mortgage lender or builder. In my experience, buy-downs are most often used in new home construction and the builder typically pays for it.

You May Like: How Soon Can You Take Out A Second Mortgage

What Is The Benefit Of A Buy

Idziak: Home affordability concerns are at the forefront of many buyers minds in the current environment. The first few years of homeownership are often the most expensive, especially for first-time buyers. Furnishing a home and completing renovations or upgrades are often major expenses for buyers. A temporary buydown provided by the seller allows the borrower to have more money available during these years to handle such costs.

Borrowers often expect their incomes to increase in the future. Lower monthly payments during the first few years of a mortgage can allow a buyer time to adjust to what, for most, will be a higher monthly housing expense. For buyers who qualify for a mortgage but may be worried about their short-term financial picture, a temporary buy-down may give them the confidence to take out a mortgage and purchase the home.

How Do Mortgage Payments Work

When you take out a mortgage, youre borrowing money to buy or refinance a home. You make regular payments to repay this loan, usually monthly. The amount you borrow is the loan principal.

With each payment you make, you’ll be paying off part of the principal amount and part of the interest. The interest is what the lender charges for loaning you money to buy a house.

Depending on the type of mortgage you have, your payments are usually consistent in amount and made monthly. In the beginning, the majority of your payments will be used to pay off the interest on your loan. As this amount reduces, more and more of your payments will start applying to the principal the actual amount you borrowed. This means that for the first few years of your loan, your payments are focused on paying off interest rather than principal.

If you apply additional payments to your principal to bring the amount down, the interest paid on the balance goes down as well because interest is calculated based on the principal balance. The goal for anyone looking to make additional payments on their mortgage should be paying down as much of the principal as possible.

Read Also: How Much Is Mortgage On 150k House

You Must Determine What Type Of Mortgage Suits You Best

Do you plan on making extra payments to completely pay off your mortgage as soon as possible? Then, you should try to get an open mortgage since its more flexible in letting you make prepayments. However, the interest rate for this type of mortgage is usually higher.

A closed mortgage, on the other hand, offers a lower interest rate but limits how much extra money you can add to pay your mortgage faster. This type of mortgage usually charges penalty fees if you try to make prepayments which are more than the limit set by your lender and if you choose to break the mortgage agreement.

Is It Better To Pay Taxes Through Mortgage

Property taxes are frequently paid by homeowners themselves, but rolling your payment into your mortgage payment allows you to avoid paying large sums of money to tax collectors each year.

You Can Deduct Mortgage Interest On Your 2017 Taxes

If you pay mortgage interest on a home in 2017, you may be able to deduct it from your 2017 federal income tax return. Because interest on a mortgage is a ordinary and necessary expense, it is deductible as part of your overall tax liability. You must have an original or expected mortgage balance of at least $1,000,000 if you are eligible for a mortgage. Aside from that, interest paid on first and second mortgages are limited to a maximum of $1,000,000 in deductions. Interest on a mortgage above this amount is not deductible as a charitable contribution. You should be aware of a few important things when attempting to deduct mortgage interest. A deduction of this kind must be accounted for on your tax return in order to take advantage of it. The second requirement is that you must pay your mortgage interest on time and in full each month to be eligible for the deduction. Finally, make sure you understand the limitations on this deduction, as it is not available on all mortgages.

You May Like: Are Mortgage Rates Going Down