Check Your Credit Reports To Understand Your Scores

Its a good idea to check your credit reports periodically to make sure there arent any errors or mistakes that could be affecting your scores. Its also important to check your reports so you can spot any potential signs of identity theft.

If you do spot any inaccuracies, you can dispute them directly with the credit bureaus. Credit Karma even lets you dispute errors on your TransUnion report directly with our Direct Dispute feature.

Conventional Loans: Minimum Credit Score 620

Non-government conventional mortgage loans charge higher interest rates and fees for borrowers with low credit scores.

Fannie Mae and Freddie Mac, the agencies that administer most of the conventional loans in the U.S., charge loan-level price adjustments, or LLPAs.

These fees are based on two loan factors:

- Loan-to-value : LTV is the ratio between the loan amount and home value

As your LTV rises and your credit score falls, your fee goes up.

For instance, a borrower with 20% down and a 700 credit score will pay 1.25% of the loan amount in LLPAs. But an applicant with a 640 score and 10% down will be charged a fee of 2.75 percent.

These fees translate to higher interest rates for borrowers. That means lower-credit score applicants will have higher monthly mortgage payments and will pay more interest over the life of the loan.

The majority of lenders will require homeowners to have a minimum credit score of 620 in order to qualify for a conventional loan.

Conventional loans are available to lower-credit applicants, but their fees often mean FHA loans cost less for borrowers with bad credit scores.

What Is A Typical Credit Score For A Mortgage

A lot of mortgage lenders like your credit score to be as high as possible because it shows them that you’ve been good with credit in the past. But because there isn’t a universally recognised ‘typical’ credit score, and because of this, there isnt a ‘typical’ credit score for a mortgage. There are specialist lenders who will consider your mortgage application even if you dont have a typically good credit score.

Often, mortgages for people with bad credit arent available directly to you as a borrower. Theyre only available from specialist lenders via bad credit mortgage brokers who work closely with them.

Our Mortgage Experts are all specialists who deal with bad credit mortgages every day. Make an enquiry and one of them will call you back.

You May Like: What Is The Usual Mortgage Interest Rate

With A Credit Score Of 550 Will I Be Approved For A Home Loan

One of the most significant decisions well make in life is renting or buying a house.

It can be cheaper to rent in many places in the country than to own a home. In a study by LendingTree, they found that the average difference in cost can climb up to $606 monthly. But homes can be very personal for many people, and this means that homeownership has an unquantifiable value compared to renting.

Of course, once youve paid off your mortgage, you are left with an investment. This is something that you can never earn no matter how much cheaper renting can become.

If you dont have the money to buy a house upfront, there is usually only one answer: getting a home loan. So how exactly does one qualify for a mortgage? Will a 550 credit score be enough, and what will your options be at this point?

Lets answer these and more in the sections below.

Give Yourself A Credit Cushion

The second-largest component in your credit score is: How much credit do you have in your name, and its good to have a lot of it!

Its a counter-intuitive concept.

Lenders want you to have vast amounts of credit because they know life is unpredictable. When things go sideways for you, those large credit lines can keep you afloat, so you have money to keep paying on your mortgage.

Play this to your advantage. On the back of every credit card you own, youll find a customer service number. Call it and request an increase in your credit limit.

You could reap 50-point gains or more.

Don’t Miss: What Documents Do I Need To Get A Mortgage

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, Experian and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate a credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

What Do I Need To Qualify For An Fha Loan

- An FHA-approved lender

- A down payment of at least 3.5% of the homes purchase price if you have a 580 credit score

- A down payment of at least 10% if you have a credit score of 500-579

- Extra money to cover mortgage insurance

Anytime someone puts down less than 20% on the purchase of a home, the lender will add Private Mortgage Insurance . This is basically extra money added to your monthly mortgage payment. You pay until youve paid off 20% of the homes value then PMI drops off and your payments will be reduced.

You May Like: What Is Llpa In Mortgage

Things To Consider For Home Loans With A 550 Credit Score

Fortunately, there is a lot more than just a credit score that goes into purchasing a house. There are lenders that will loan you money with this type of score, but you will almost certainly need to meet their other criteria. Read on to find out more about purchasing a home with your 550 credit score.

Requirements To Take Out A Car On Credit

More than one of you will have heard the expression passing the credit score in reference to the loan you have applied for. But what is credit scoring? After reading this post there will be no doubts about what a credit score is, what information it needs and how it works.

In some institutions the scoring is merely informative, and serves as a contrast test with respect to the human decision. In others they can condition such decision in certain cases, and in many others the scoring is decisive, unless there is an intervention of a superior with attributions to the manager who feeds the scoring.

It is often said that good scoring improves delinquency rates compared to human decisions. In fact, accounting regulations reward those risks granted under this model as opposed to the traditional one of the analyst or the committee.

Don’t Miss: How Do Commercial Mortgages Work

Working On Your Credit

Debt is not for everyone. In fact, some people will go so far out of their way to make sure they are not racking up debt. Unfortunately, this is a tough road to take with not many benefits, obligating you to pay in cash all the time and using more unorthodox ways of borrowing money. The bad news is, for many people, including those who would prefer to stay out of debt, emergencies can happen at any time. And if you dont have any credit history to show lenders, it can be so much harder and a lot more expensive to borrow the money you absolutely need.

Hear us out. You must work on your credit. Regardless of whether youre considering a car or home purchase soon, its better to be ready for such an eventuality. However, we also recommend you dont rest on your laurels, no matter how low or high your credit score gets. Credit scores can change so fast. A higher credit score will not only give you more savings, but it will also give you peace of mind thats very valuable during these times.

Alternatives To Personal Loans When You Have Bad Credit

If you’re having trouble getting approved for a personal loan or find you’re only getting approved for loans with unreasonable rates and terms, consider a few alternative financing options:

Additional options depend on why you need a personal loan. For example, if you need money for rent, you might want to ask your landlord for an extension or see if they’ll lower your rent in exchange for working on property repairs or maintenance. Or, if you’re struggling to afford a medical bill, you may be able to negotiate a low- or no-interest payment plan with the health care provider.

You May Like: What Is The Recommended Percentage Of Income For Mortgage

If I Have A Low Credit Score Do I Need A Large Income To Get A Mortgage

When a mortgage lender is deciding whether you meet their criteria for a loan, they will look at the factors that affect affordability. Your income certainly impacts your ability to repay your mortgage and having a sufficient income is important.

Lenders will look at the amount you earn against your outgoings which may include debt repayments, bills, car insurance or other travel expenses. If your current income could comfortably cover your current outgoings as well as your new mortgage repayments and any associated costs, a lender may decide to approve you.

Having a lower income that may not stretch to cover the above, may cause concern for some lenders, especially if you already have a low credit score. Your broker can take the time to listen to what you need from mortgage and can calculate the most affordable and viable route.

Homebuyer Assistance Programs: 580 Minimum Credit Score

Homebuyer assistance programs rarely enforce credit score minimums. Instead, they adopt the standards of their accompanying mortgage.

For example, if youre a home buyer who uses a conventional mortgage with a 620 credit score requirement, the homebuyer assistance program you use for a down payment will also use the 620 minimum.

For more information about homebuyer assistance programs and grants for first-time home buyers, visit us in the chat.

Get pre-approved for a mortgage today.

Also Check: Should You Refinance To 15 Year Mortgage

Can You Get A Home Loan With A 550 Credit Score

When youre trying to buy a house, mortgage lenders tend to rely heavily on your credit score in determining whether or not you will qualify for a mortgage loan. Typically, lenders consider scores in the mid-700s and above to be quality scores for lending purposes however, qualifying for a mortgage and purchasing a house with a lower credit score, such as 550, is possible. Read on to find out more, including some tips to help you get qualified.

Invest Your Own Money

Another great way to qualify for a home loan despite a low credit score is to make a larger down payment. By investing more of your own money up front, lenders may feel youre more invested in your home and therefore less likely to stop making your mortgage payment.

A larger down payment may help you to overcome your lower credit score.

From the data below, you can see that among those approved borrowers with a 550 credit score, of those approved, 18% were able to provide 20% down.

Approved Home Buyers and Down Payment amounts

| 13% | 18% |

Recommended Reading: What’s Needed To Apply For A Mortgage

Is There A Minimum Credit Score For A Mortgage

One of the most common mortgage myths we hear is that there is a minimum credit score needed to get a mortgage. Put simply – that isnt true.

Your credit score can certainly impact your choice of lenders as banks use it to get a better understanding of your financial history and the likelihood of your defaulting on your loan.

Usually a higher score suggests that you’re more likely to be a responsible borrower and make your payments on time and in full.

However, every lender has different rules which affect what they define as a low credit score or bad credit and other factors such as your income and age can affect a lenders decision too.

Home Loans For Bad Credit

- There are actually plenty of options for homeowners with questionable credit

- Including popular government home loans like FHA, USDA, and VA loans

- Along with non-government mortgages such as those backed by Fannie Mae and Freddie Mac

- However you might pay a premium for the privilege, so good credit should always be a priority

To get back to my point, you need to assess how low your credit score is to determine your chances of getting approved for a mortgage.

In short, if your score is closer to the bottom of that aforementioned range, your chances of landing a mortgage will become slimmer and slimmer, even for so-called bad credit home loans.

Conversely, if your score is simply imperfect and youre a perfectionist, you might not have anything to worry about. Other than lacking perfection

Regardless, there are plenty of home loan options for those of us with imperfect credit, or dare I say, bad credit.

In fact, you technically only need a 500 credit score to get an FHA loan, which is actually a popular choice among homeowners these days for its equally low 3.5% down payment requirement. You dont even have to be a first-time home buyer.

And lets get one thing straight, a 500 credit score is pretty abysmal. Its bad credit, no ifs, ands, or buts. Im not here to judge, but Im going to give it to you straight.

You dont just wind up with a 500 credit score after racking up some credit card debt, or because you have student loans. It doesnt happen by accident.

Also Check: What Is The Monthly Mortgage On A 350 000 Home

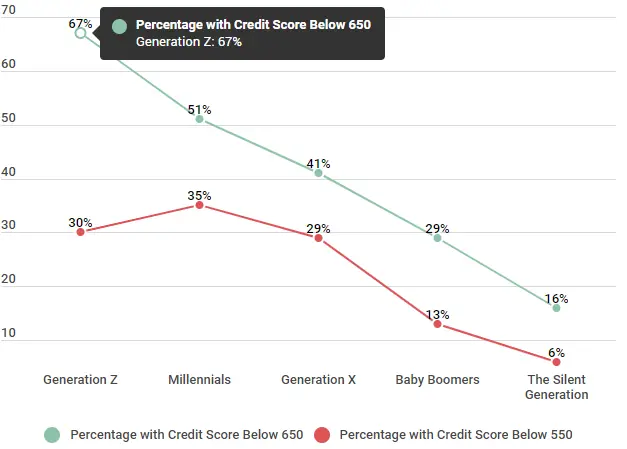

Bad Or Poor Credit Score Ranges

A credit score represents âa snapshot of a personâs creditworthiness,â the Consumer Financial Protection Bureau says. And thatâs why the CFPB says potential lenders might use your credit score to make decisions about things like approving loans and extending credit.

Credit-scoring companies use different formulas, or models, to calculate credit scores. There are many different credit scores and scoring models. That means people have more than one score out there. Most range from 300 to 850, according to the CFPB. And the CFPB says some of the most commonly used credit scores come from FICO® and VantageScore®.

But how they determine scores and their definitions of what constitutes poor credit differ. Itâs important to remember that credit decisionsâand whatâs considered a bad scoreâare determined by potential lenders. But here are some more details about how FICO and VantageScore generally view credit scores.

Can You Buy A House With A 500 Credit Score

Yes, the FHA mortgage carries a credit score minimum of 500. However, if youre not buying a home in the next 30 days, you have time to improve your credit score. Get a mortgage pre-approval to see your current mortgage credit score. Let us help you get to a 580 score, then 620, then even higher to maximize your mortgage options.

Don’t Miss: What Is The Lowest Mortgage Amount You Can Borrow

Increase The Length Of Your Credit History

The longer you have a credit account open and in use, the better it is for your score. Your credit score may be lower if you have credit accounts that are relatively new.

If you transfer an older account to a new account, the new account is considered new credit.

For example, some credit card offers come with a low introductory interest rate for balance transfers. This means you can transfer your current balance to this new product. The new product is considered new credit.

Consider keeping an older account open even if you dont need it. Use it from time to time to keep it active. Make sure there is no fee if the account is open but you dont use it. Check your credit agreement to find out if there is a fee.

Read Also: Chase Recast

New Mortgage Can Improve Credit

Once you get a loan, work on improving your credit from here on in by always making your mortgage payments on time. You need to show the lender that you are trustworthy and able to repay the loan. By improving your credit score, eventually you will be able to refinance your mortgage at a lower interest rate.

Recommended Reading: What To Know About Getting A Mortgage

How Much Extra Will A Low Credit Score Cost You

Mortgage lenders check your credit score when deciding whether to approve your loan application. It doesnt just impact whether youre approved, though it also plays a major role in the interest rate you receive. The best mortgage rates are reserved for the borrowers who present the lowest risk.

Lenders consider other factors, as well, including loan-to-value and debt-to-income ratios, but credit scores are especially important.

The examples below are based on national averages for a 30-year fixed loan in the amount of $282,240 80 percent of the national median home price, according to the National Association of Realtors, reflecting a 20 percent down payment.

| $1,412 | $226,205 |

While it might not seem like there is a big gap between a 2.8 percent APR and a 4.3 percent APR, there is a dramatic difference more than $90,000 in interest over the life of the loan. Although this example doesnt go below 620, the data is clear: Credit scores lower than that result in even higher financing costs.