Choose The Right Type Of Title

Turns out theres more than one way to own a house, and taking title the right way is especially important for unmarried couples. Options vary from state to state but generally include:

Sole ownership. Only one name is recorded on the deed, and that person has all the rights and responsibilities of ownership.

-

Pros: Sole ownership may yield tax savings if your incomes are drastically different. And, if your partner has bad credit, applying for a home loan in your name only may help with approval. Remember, however, that ownership rights are determined by names on the deed, not the mortgage, Anna Fabian, vice president of product at SoFi, said in an email.

-

Con: If the relationship ends and youre not on the title, youll risk walking away with nothing, even if you contributed money to the purchase or mortgage payments.

» MORE: Down payment strategies for first-time home buyers

Joint tenancy. Each person owns 50% of the property. If a tenant dies, their share automatically transfers to the other joint tenant.

-

Pro: Joint tenants enjoy right of survivorship, so you wont have to worry about fighting estates or relatives for the house in the event of your partners death.

-

Con: An unfriendly breakup could spell trouble, especially if one partner cant or wont buy the other out.

Tenants in common. Allows unequal ownership, so you could own a 75% stake while your partner owns 25%.

How Does Marriage Affect Your Mortgage

Applying for a mortgage as a single man, single woman or as a married couple has no bearing on your ability to qualify. In fact, marital status is a protected category under the Equal Credit Opportunity Act. According to the Consumer Financial Protection Bureau “financial institutions and other firms engaged in the extension of credit” are required to “make credit equally available to all creditworthy customers without regard to sex or marital status.”

When it comes to qualifying for a loan, it doesnt matter if youre applying as a married couple or as two unmarried individuals, because the loan terms and approval criteria are the same. The likelihood of being approved for the loan depends on income, credit and assetsnot marital status. There are pros and cons to using just one persons credit and income information versus a joint-application.

The Pros of a Single Application

- If your credit score is significantly higher than your partners, it will be the only one considered in the credit decision.

- If your credit history is free of derogatory information while your partners is not, yours will be the only information considered.

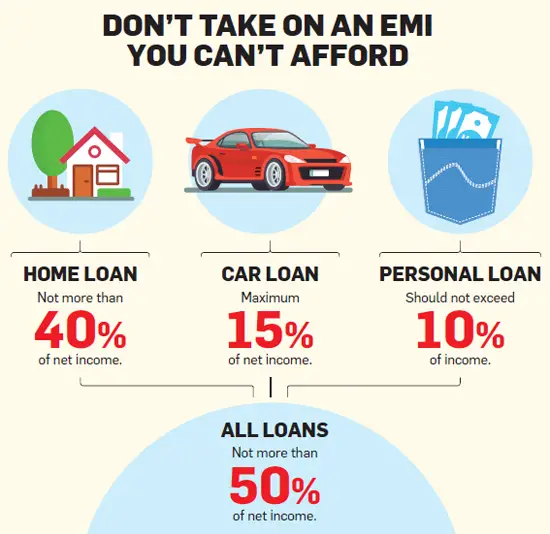

- If your debts and other obligations are significantly lower than your partners, only yours will be used to calculate your debt-to-income ratio.

The Cons of a Single Application

- Your partner’s income cannot be considered part of your debt-to-income ratio and will not be used in the credit decision.

The Pros of a Joint Application

How Can We Split The Ownership

Even if youre not listed on the mortgage, you can still have an ownership stake in the home. You would just need to make sure youre named in the deed. The deed lists the rightful owner of a piece of real estate and is separate from the mortgage.

There are two options for splitting ownership: joint tenancy and tenants in common.

Also Check: Can You Refinance Your Mortgage

What Could Go Wrong If You Buy A House With A Boyfriend Or Girlfriend

Unfortunately, not all relationships last forever. The biggest risk of buying a house with an unmarried partner is the possibility of a breakup without all of the legal protections that would come into play during a divorce.

Of course, there are horror stories out there. But there are also unmarried couples happily buying homes together that enjoy the experience for the long term.

Property Rights For Multiple Buyers

Home ownership is recorded through the deed, not the mortgage, so whether you acquire a property jointly or obtain a mortgage in just one persons name, you can still choose how to divide ownership. Depending on your local laws, you can record title in the following ways:

Sole Ownership

Under sole ownership, you have complete control over the property and no one else can sell or take out loans against it. Also called ownership in severalty, this method of vesting is used by single individuals and married individuals whose spouse has signed a quitclaim deed removing their ownership interest in the property. The vesting information will read “sole and separate property” on the deed.

A will can designate inheritance, or the property can end up going through probate upon the death of the owner. One of the drawbacks is that in the unfortunate event that something diminishes your capacity, no one else can act on behalf of the property. In the event of your death, the property is required to go through probate to be transferred to heirs. This is a lengthy, expensive and public process.

Joint Tenancy

Under joint tenancy, any two or more people can hold title to the property. Also called tenancy by the entireties, this method of vesting is used by co-owners who take title at the same time and own equal shares. This title grants the surviving co-owner ownership of the property in the event of their partner’s death.

Tenancy in Common

Community Property

Living Trust

Also Check: Can You Get A Second Mortgage With An Fha Loan

Consider The Difference Between Buying A Home Married Vs Unmarried

While buying a house as a married couple is often viewed as the more traditional route to homeownership, the process of buying a home as an unmarried couple isnt vastly different. The most notable difference is that, unlike married couples who often apply for mortgages together, unmarried couples typically apply as individuals.

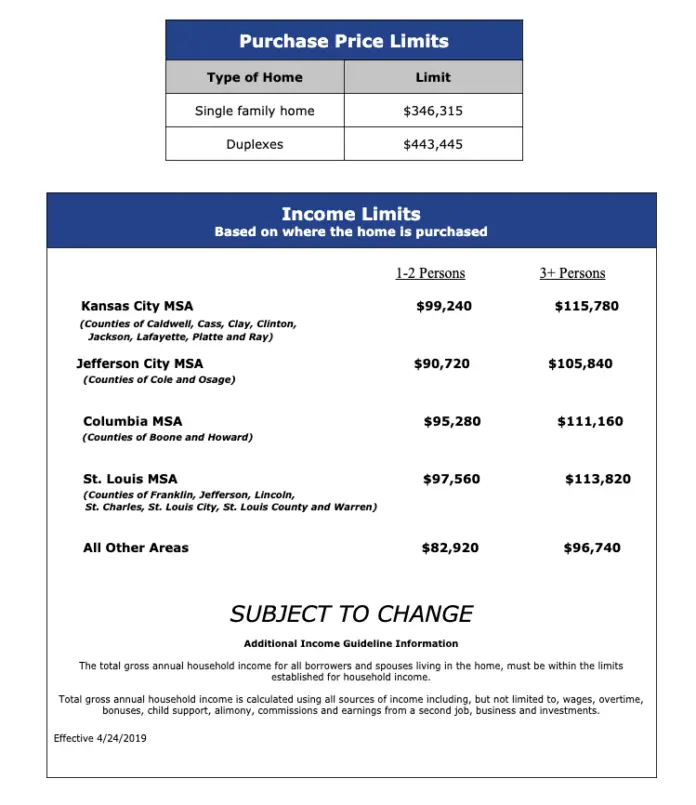

This means that the lender may only take one partners income into consideration, thereby limiting the amount of house you can actually afford. That said, some lenders allow co-borrowers and take both borrowers assets, income and credit score into account when evaluating the mortgage application.

How To Remove A Name From A Mortgage

Its possible to remove a name from a mortgage, but that doesnt mean its easy. Most lenders wont be excited to take someones name off the loan because it means theres now one less person to pay the loan back.

If the lender is willing, though, youll likely have to requalify for the loan on your own. If you have an assumable loan, this process can be a little bit easier.

Another option is to refinance the mortgage without the co-borrower. Of course, youll need to qualify for a refinance, just like any other mortgage.

If youre not tethered to the property, you can also try to sell the home. Youre then free to purchase another home without a co-borrower.

You May Like: What License Do You Need To Sell Mortgage Insurance

Do Unmarried Couples Have Rights

Couples who are unmarried have no automatic entitlement to financial support from each other when they separate. Nor can they register home rights to prevent their partner from selling the house without having an interest in the property in their own right. The fact of their long-term cohabitation is irrelevant.

Can My Boyfriend Claim My Mortgage Interest

There is no specific mortgage interest deduction unmarried couples can take. … To claim your mortgage interest deduction, even though you did not receive the 1098 you will need to complete Form 1040, Schedule A. Completing form 1040 requires that you itemize your taxes and not take the standard deduction.

Recommended Reading: How To Get Your Mortgage Credit Score

Changing Title To A House

What happens if you take title in one legal format and later jointly agree you want to change it to another? For instance, because one of you makes a larger down payment, you decide to take title as tenants in common. Several years later, after the birth of your child, you both decide it makes sense to change to joint tenants so as to avoid probate if one of you dies. This can be accomplished by purchasing a blank deed form and then making and recording a new deed granting the property “from Andrew West and Joanne Yu as Tenants in Common, to Andrew West and Joanne Yu as Joint Tenants With Right of Survivorship.” You will also need to prepare and record a new deed if one partner is sole owner of a house and the other partner will become a co-owner . Check with an experienced real estate lawyermake sure you’re using the proper deed and language and to determine whether this will trigger any tax liabilities. If your home is in California, see the Nolo book Deeds for California Real Estate, by Mary Randolph.

Can Two People Be On A Mortgage If They Are Not Married

Its possible to apply for a first or second mortgage loan as a couple even if youre not married. Lenders will check the creditworthiness of both borrowers, including their credit scores, incomes, and debts, to ensure that they have the ability to repay what they borrow. Two names can also be on a mortgage in situations in which one borrower needs a parent or other relative to co-sign for the loan.

Don’t Miss: How Does The 10 Year Bond Affect Mortgage Rates

Agree To A Cohabitation Property Agreement

Since you and your partner arent married, it may be a good idea to think about signing a cohabitation property agreement as well. Sometimes called a no-nup, this agreement is a legal document created by you and your partner outlining who will be financially responsible for what and how your shared assets will be distributed should the two of you break up.

You should also consider outlining an exit strategy in the agreement, should the relationship end. Will one of you buy out the others share or will you both sell the house and move? Although its unpleasant to think about, these are things you should definitely plan for and make sure your decisions can be enforced. Once youve drafted up a cohabitation agreement, you should take it to a real estate attorney to make sure everything is in writing.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: How Do You Get A Second Mortgage On Your House

What Is A Uniform Residential Loan Application

The Uniform Residential Loan Application is used by lenders to determine your creditworthiness for a home loan. It’s known within the mortgage industry as Fannie Mae Form 1003, and borrowers enter income, asset credit and other personal financial information into the redesigned form’s nine sections.

Can An Unmarried Couple Get A Va Loan

One of the most common questions VA loan officers hear is, Can I get a VA loan with my girlfriend ? And the unsatisfying answer is it depends.

VA loans come with lots of benefits, including 0% down payment options and the ability to purchase multi-family residential buildings with up to four units . But these benefits are reserved for qualified military service members, veterans, and their spouses. If youre not legally married, your partner doesnt qualify for your VA benefits. But that doesnt necessarily mean you cant buy a home together. It just means you may need to think outside the box to make VA loan requirements work for you.

So lets take a deeper look and explain the answer to the question, Can an unmarried couple get a VA Loan?

Recommended Reading: What Is A Reverse Mortgage Canada

What Happens If One Person Wants To Move Out Or Dies

Whether its a breakup or one person gets a job in another state, having a plan in place is essential. The house can be sold, or one partner can buy out the other. This is assuming that both partners are on the title to the home. Its possible that if you decide to break up, the bank may force the sale of the property. If the party keeping the property isnt able to buy out the partner whos moving on, the best option would be to sell.

Depending on your agreement, any party who owns a portion of the property can force a sale. If you own 70% of the home and your partner wants to move out or break up, you may have to pay them 30% of ownership. If youre both on the mortgage, then you may have to consider refinancing.

In the unfortunate event of one partner passing away, the title will determine what happens to the home. If the title states joint tenancy, the surviving partner will receive the deceased partners share of the property. If the title is joint tenants in common, the percentage of the home owned by the deceased partner will go to their heirs.

In this case, the deceaseds share of the property will have to be distributed depending on their wishes. That said, you may need to buy out the deceased partys share of the home or sell the home completely depending on what the heirs decide.

When Should I Use A Co

As we mentioned above, adding either one to your application could ultimately help you qualify for a more attractive loan program or even obtain a lower interest rate. If you have someone in mind who wants to share property rights and assist you with making mortgage payments, consider a co-borrower. Alternatively, a co-signer makes more sense if you want someone to have rights to your property but don’t want to rely on them for repayment.

Also Check: Do Mortgage Rates Fluctuate Daily

Three Things To Consider Before Moving Forward

Regardless of how solid your relationship is, there are always potential pitfalls that could occur when you’re buying a house with someone you’re not married to. Here are three things you should be thinking about.

How To Handle The Title

Title is the legal documentation that lists property details and demonstrates who owns it this typically comes in the form of a deed. When a mortgage is attached to a home, the lender holds title to the property until the loan is paid off. Even so, if only one partner is on the mortgage, both parties can be on the deed. In fact, there are several ways for one or multiple owners to hold title to a property including:

When deciding how to handle the title, keep in mind that each approach comes with its own tax implications. For that reason, we recommend consulting with a tax advisor or real estate attorney before making a decision.

Likewise, if you and your partner get married after purchasing a home together, review your deed and consult with a real estate attorney to update the ownership structure as appropriate.

Don’t Miss: Can You Combine 2 Mortgages Into One

What Happens If Someone Dies

If one of the people on the mortgage dies, the other will continue to be responsible for paying the loan. Another issue is who will own the property. Depending on how you take title, the survivor could own the property in full or partial ownership could pass to the deceased party’s heirs. Consult a lawyer before buying with another person to make sure you understand your options. A joint mortgage is a great option for anyone who wants to buy a home with a partner. Joint mortgages mean combined incomes, assets and responsibility. Contact a Home Lending Advisor to talk about whether a joint mortgage is the right option for you.

Understand How Your Mortgage Application Will Be Considered

If you apply for a mortgage jointly with someone else, whether you are married or not, lenders evaluate your mortgage application as co-borrowers. Collectively, youll need to have enough income to make the payments and demonstrate that youll be able to make payments in the future. If one person doesnt have an income or doesnt have much income, thats okay as long as the other person has enough.

Lenders typically use the credit scores of the person with the lowest credit scores to evaluate the mortgage application. If one person has a low credit score, you can apply for the mortgage without that person, but then the lender typically wont consider that persons income.

Don’t Miss: Can I Qualify For A Mortgage With A New Job