Income Requirements To Buy A Home

Lenders consider much more than just your paycheck when you buy a home. Your debt-to-income ratio and your ability to make mortgage payments are more heavily considered than how much you make. Theyll also consider your credit score and how much you have for a down payment.

A great place to start is to get a preapproval, especially if you arent sure whether you can get a mortgage on your current income. A preapproval is a letter from a mortgage lender that tells you how much money you can borrow. When you get a preapproval, lenders look at your income, credit report and assets. This allows the lender to give you a very accurate estimate of how much home you can afford.

A preapproval will give you a reasonable budget to use when you start shopping for a home. Once you know your target budget, you can browse homes for sale to see what general prices are. Its a good sign that youre ready to buy if you find appealing options at your price range.

So what do lenders look for when you want to borrow? For starters, theyll take a look at your monthly income and your debt-to-income ratio.

Shop Around For Your Mortgage

Yes, you can get a better mortgage rate when you choose the right type of mortgage. But you could save at least as much sometimes more simply by comparison shopping for your mortgage.

Federal regulator the Consumer Financial Protection Bureau has studied the potential savings:

Mortgage interest rates and loan terms can vary considerably across lenders. Despite this fact, many homebuyers do not comparison shop for their mortgages, said the CFPB.

Research suggests that comparison shopping for a mortgage loan saves the average buyer about $300 per year and many thousands over the life of the loan.

In recent studies, more than 30 percent of borrowers reported not comparison shopping for their mortgage, and more than 75 percent of borrowers reported applying for a mortgage with only one lender.

Previous Bureau research suggests that failing to comparison shop for a mortgage costs the average homebuyer approximately $300 per year and many thousands of dollars over the life of the loan.

Thanks to the internet, comparison shopping doesnt take all that long. You can begin with The Mortgage Reports Find the Best Lender for You” service.

But also check with your bank or credit union and follow up on any recommendations you get from friends and family. Remember, the more quotes you receive from different lenders, the more likely you are to find your lowest possible rate.

How Much House Can I Afford 50k Salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. That’s because salary isn’t the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Also Check: Can You Get A Mortgage If You Filed Bankruptcy

Short History Lessons Of Mortgages

Before the subprime mortgage crisis of 2008-2009, just about anyone could get a mortgage . Lenders pushed sub-prime loans on people with poor credit knowing they probably could not keep up with the payments and would default on their loans and lose their homes.

The lending habits were not healthy and this led to a sharp increase in those high-risk mortgages ending up in default. This contributed to the most severe recession in decades. Some have blamed lenders for inappropriately approving loans for subprime applicants, despite signs that people with poor scores were at high risk for not repaying the loan. By not considering whether the person could afford the payments if they were to increase in the future, many of these loans may have put the borrowers at risk of default.

I used to work in the Underwriting Department at SunTrust in 2012, and the criteria they used to determine whether to make a loan is more rigorous.

However, that does not mean that millennials would have a tough time getting a mortgage it is just important to do your research first and make sure youre financially prepared to take on a mortgage payment.

In order to get a solid grasp on the terms and processes of buying a home. Take the time to understand the process and requirements of being a first-time home buyer.

1. Do the research

Your credit score and any credit issues in the past few years:

How much cash you can put down:

Shop for loan programs:

2. Prepare the paperwork

3. Find a lender

Check Your Credit History

When you apply for a mortgage, lenders usually pull your credit reports from the three main reporting bureaus: Equifax, Experian and TransUnion. Your credit report is a summary of your credit history and includes your credit card accounts, loans, balances, and payment history, according to Consumer.gov.

In addition to checking that you pay your bills on time, lenders will analyze how much of your available credit you actively use, known as credit utilization. Maintaining a credit utilization rate at or below 30 percent boosts your credit score and demonstrates that you manage your debt wisely.

All of these items make up your FICO score, a credit score model used by lenders, ranging from 300 to 850. A score of 800 or higher is considered exceptional 740 to 799 is very good 670 to 739 is good 580 to 669 is fair and 579 or lower is poor, according to Experian, one of the three main credit reporting bureaus.

When you have good credit, you have access to more loan choices and lower interest rates. If you have poor credit, you will have fewer loan choices and higher interest rates. For example, a buyer who has a credit score of 680 might be charged a .25 percent higher interest rate for a mortgage than someone with a score of 780, says NerdWallet. While the difference may seem minute, on a $240,000 fixed-rate 30-year mortgage, that extra .25 percent adds up to an additional $12,240 in interest paid.

You May Like: What Does A Co Signer Do For A Mortgage

Don’t Miss: Is Biweekly Mortgage Payments A Good Idea

Can You Borrow With Your Current Income

Though you may feel that your finances are ready for a new home, the bank may not feel the same way. Mortgage lenders use a complex set of criteria to determine whether you qualify for a home loan and how much you qualify for, including your income, the price of the home, and your other debts.

The pre-qualification process can provide you with a pretty good idea of how much home lenders think you can afford given your current salary, but you can also come up with some figures on your own by learning the criteria that lenders use to evaluate you.

Also Check: What Is A 30 Year Fixed Jumbo Mortgage Rate

How To Get A 200k Mortgage

The homeownership rate ticked up more than 2 percentage points in the last year, to 67.4 percent. And there are many renters eager to join the club, especially since mortgage interest rates dropped to all-time lows during the coronavirus pandemic.

For first-time homebuyers, the process of becoming a homeowner can be intimidating. Its a big purchase that comes with a host of responsibilities and costs. But, its also a long-term investment that can help secure your financial future.

For some, it might take longer to achieve the American dream especially if you have existing debt, live in an expensive area or are just starting your career whereas others may have all the pieces in place to buy a home already. Regardless of how much you earn or what you have in the bank, its always a good time to start thinking about buying a home.

Becoming a homeowner is one of the most important decisions people make in their lifetime. Its not easy, but it can be done with some hard work and dedication. Next, we will discuss how to become a homeowner from finding an affordable home to finally signing on the dotted line.

Here we break down what you need to do to become a homeowner in 2022 and get approved for that $200,000 mortgage loan.

Also Check: How Do I Shop For Mortgage Rates

Is 30k Enough To Buy A House

Surprisingly, YES! It’ll be close, but it’s possible with adequate income and good credit. Even though the median home price around the Bay Area is about $1M and often require $200K in downpayment, there are still plenty of good single family homes in the South Bay, and especially San Jose, that are under $600K.

How Much Of A Home Loan Can I Get With A 720 Credit Score

With fixed-rate conventional loans: If you have a credit score of 720 or higher and a down payment of 25% or more, you don’t need any cash reserves and your DTI ratio can be as high as 45% but if your credit score is 620 to 639 and you have a down payment of 5% to 25%, you would need to have at least two months of …

You May Like: What Do I Need To Get A Mortgage

Income For A $200000 Mortgage: Examples

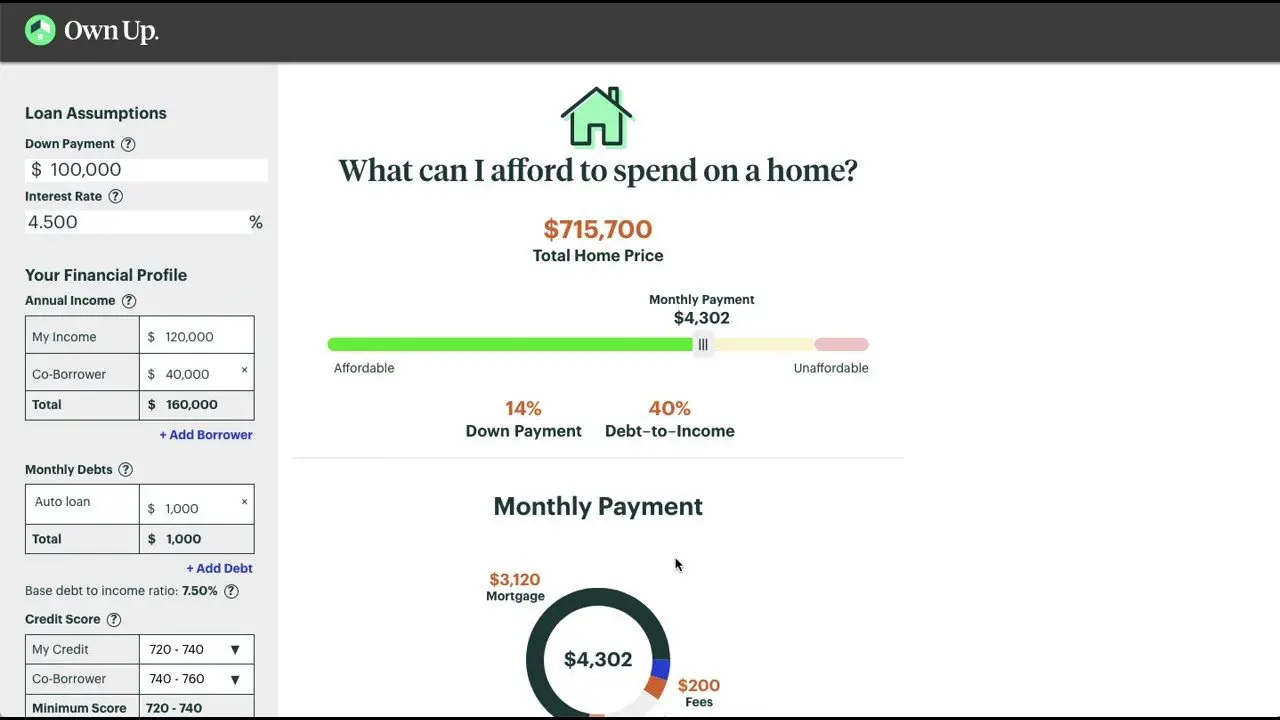

Weve done some calculations to show you the range of incomes that might get you approved for a $200,000 mortgage. Keep in mind, these are only examples and your own situation will be different. But you can use the numbers as a general benchmark.

Here are the lowest and highest annual incomes that qualify for a $200K loan using mainstream criteria for a 30-year, fixed-rate mortgage:

- Salary: $37,500 per year. Mortgage amount: $200,000 This example assumes you have no other debts or monthly obligations beyond your new housing costs, a 20% down payment, and a good credit score. With that down payment, your $200,000 mortgage would buy you a home worth $250,000

- Salary: $94,000 per year. Mortgage amount: $200,000 Whats changed? Your existing monthly debts are $1,500 and your down payment is only 3%. That 3% and your $202,000 mortgage will buy you a $209,000 home. Were still assuming your credit score is good. So you may need an even bigger income if it isnt

Note that these scenarios assume a 36% debt-to-income ratio. Many lenders will approve borrowers with a DTI as high as 43% so if your salary is in the range below you might qualify for a mortgage significantly higher than $200K.

You can run your own scenario using our home affordability calculator. Though keep in mind, youll only know your exact budget after you talk to a lender and get your finances approved.

How Much Is Homeowners Insurance And What Does It Cover

Homeowners insurance is a combination of two types of coverage:

- Property insurance: protects homeowners from a variety of potential threats such as weather-related damages, vandalism, and theft.

- Liability insurance: protects homeowners from lawsuits or claims filed by third parties for accidents that happen within the home.

In 2019, the average annual cost of homeowners insurance was $1,083 nationwide. The cost of homeowners insurance policy will vary depending on the type of property being insured and the amount of coverage the owner desires. Lenders require that buyers obtain homeowners insurance in order for the insurance premium to be included in the monthly mortgage payment.

Recommended Reading: What Do I Need To Become A Mortgage Broker

You May Like: How Much Income To Qualify For 1 Million Mortgage

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that play a role in determining your mortgage rate and, therefore, your payments over time.

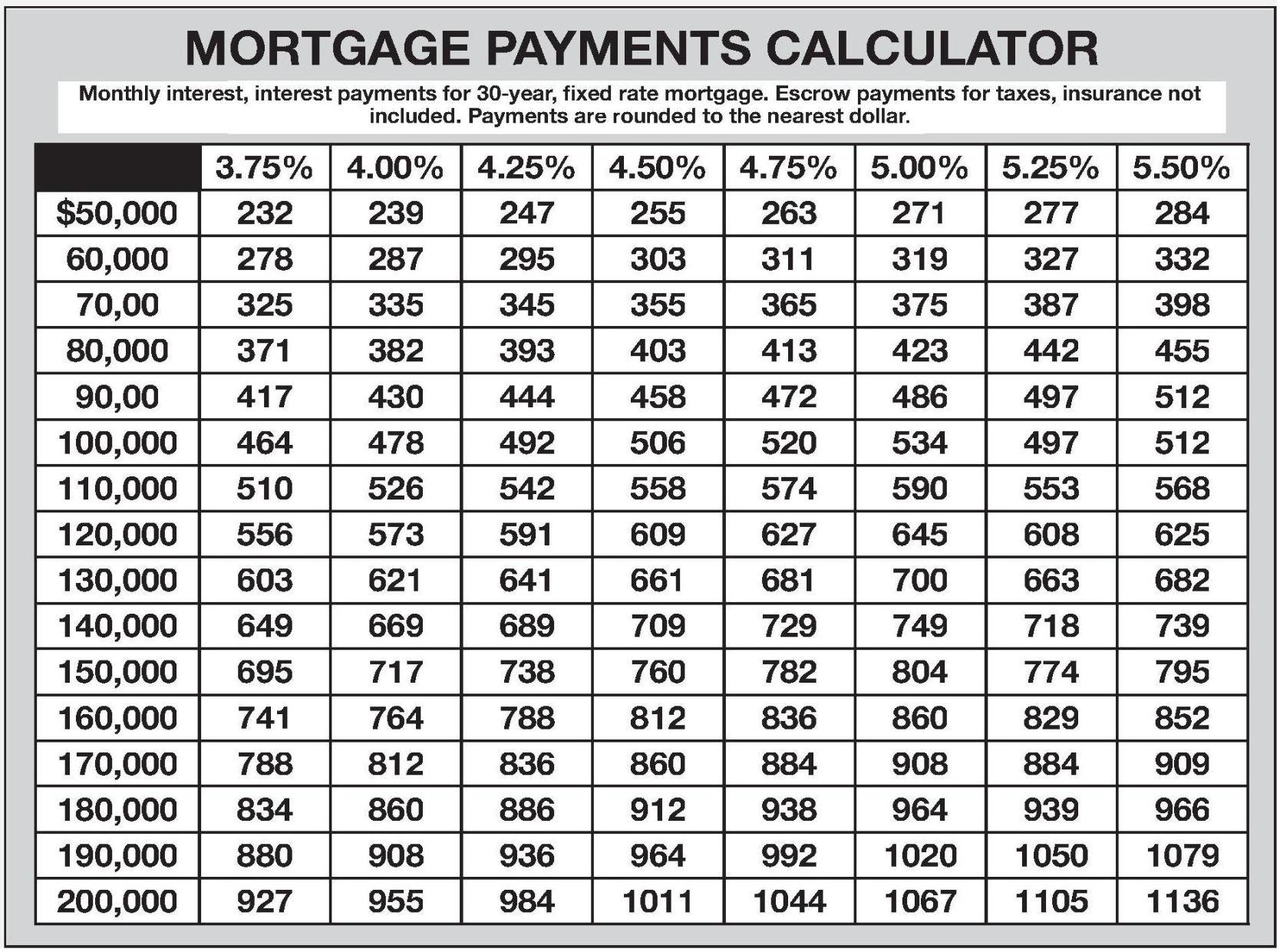

Your Monthly Mortgage Payment Will Depend On Your Interest Rate And The Loan Term You Choose

The monthly payment on a $200,000 mortgage will depend on your mortgage rate and loan term. Lower rates and longer terms mean lower payments.

Home prices have skyrocketed over the past year, with the median price for an existing home now exceeding $360,000, according to data from the National Association of REALTORS®. But home prices can vary widely, and you can find a house for significantly cheaper in many areas.

If youre looking for a $200,000 mortgage, the price you can afford depends on factors like your credit, the type of loan, and the interest rate. Lets go over what the monthly payment on a $200,000 mortgage could be, and what to know before closing on the loan.

Dont make the mistake of only getting one quote for a mortgage rate. Credible makes it easy to compare mortgage and mortgage refinance rates from multiple lenders.

Read Also: Where To Get The Best Mortgage

Mortgages For The Self

Being self-employed is certainly not a barrier to home-ownership, but you may need to look for a specialist lender to get the best rates on a £200,000 mortgage. More conventional lenders often look at self-employed applicants as non-standard, and thus higher risk.

You can read more about self-employed mortgages here.

Also Check: How Long Does Fha Mortgage Insurance Last

At What Age Should My House Be Paid Off

If you want to find financial freedom, you need to retire all debt and yes that includes your mortgage, the personal finance author and co-host of ABCs Shark Tank tells CNBC Make It. You should aim to have everything paid off, from student loans to credit card debt, , OLeary says.

Why you shouldnt pay off your house early? Paying off a mortgage early can free up cash flow and save a lot of money on interest payments. But investors shouldnt view their mortgage in a vacuum. Putting extra money toward a mortgage can be seen as part of an overall investment plan.

Does paying off mortgage early affect credit score?

If youre wondering how much paying off your mortgage early affects your credit score, the answer is: not much. Once your mortgage is paid in full , it shows up on your credit report as a closed account in good standingassuming youve been making on-time payments.

Recommended Reading: What Are The Current Mortgage Rates In North Carolina

What Is The Mortgage On 1 Million Dollars

Monthly mortgage payments on a 1 million dollar home will depend on several factors, including your credit score, down payment, term, and interest rate. Generally speaking, on a 30-year mortgage with 20% down, you can expect to pay around $4,500 in monthly mortgage payments on a million-dollar home.

How Much Mortgage Can I Get If I Earn 30000 A Year

If you were to use the 28% rule, you could afford a monthly mortgage payment of $700 a month on a yearly income of $30,000. Another guideline to follow is your home should cost no more than 2.5 to 3 times your yearly salary, which means if you make $30,000 a year, your maximum budget should be $90,000.

Read Also: How Many Years Of W2 For Mortgage

How Can I Pay A 200k Mortgage In 10 Years

Expert Tips to Pay Down Your Mortgage in 10 Years or Less

How do you calculate a monthly mortgage?

Calculate monthly mortgage payment with formula. To calculate monthly mortgage payment, you need to list some information and data as below screenshot shown: Then in the cell next to Payment per month , B5 for instance, enter this formula =PMT , press Enter key, the monthly mortgage payments has been displayed. See screenshot: 1.

How do you calculate the monthly payment on a loan?

Input -250 and press the key Input 48 and press the key Input 6 and press the key Press the key and the key

Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

Also Check: Can You Write Off Mortgage Interest

How To Pay Less Interest On An Existing Loan

If you already have a mortgage, thereâs an easy way for you to lower its interest rate and save yourself money in the course of paying it off â refinancing. When you refinance, you swap your existing home loan for a new one.

Refinancing generally makes sense when you can shave at least 1% off of your loanâs interest rate. And the higher your credit score, the more likely youâll be to qualify for a competitive refinance rate.

Many homeowners are shocked to see just how much mortgage interest costs them over time. If you want to pay as little of it as possible, make a decent-sized down payment on your home , take out a loan with as short a term as possible, and make an effort to boost your credit score. Doing so could really save you a bundle.