Tips To Get The Best Mortgage Interest Rates

If youre planning to buy a home, then knowing how to get the lowest mortgage rate matters. Remember, the lower your rate, the more money you can save on interest over the life of your home loan.

Each lender sets rates differently, so its important to shop around for mortgage loan options. While youre comparing loan terms and rates, also consider what lenders are looking for in terms of:

- Debt-to-income ratio

- Employment history

- Savings and other assets

- Down payments

As far as what is a good credit score for a mortgage, it can depend on the loan and the lender. Your down payment, the size of the mortgage, and the type of the property can also come into play.

With an FHA loan, for example, its possible to get approved for a mortgage with a FICO credit score as low as 580. But if youre interested in a conventional mortgage or another government-backed mortgage like a USDA loan, you may need a higher minimum credit score to qualify. VA loans, designed for veterans and their families, have no minimum credit score requirement.

The takeaway?

Putting your best foot forward, credit-wise, can help with getting the lowest mortgage rates. So that means doing things like:

- Paying bills on time

Fixed And Variable Mortgage Rates Compared

The table below lays out some of the key differences, as well as the pros and cons of fixed and variable mortgage rates.

| Fixed mortgage rate | ||

|---|---|---|

| Description | Set for the duration of the mortgage term. Mortgage interest rate and payments are fixed. | Fluctuates with the market interest rate, known as the ‘prime rate.’ Mortgage payments either fluctuate with fluctuations in the prime rate, or the interest portion of the payment varies. |

| Pros | Can essentially ‘set it and forget it’, regardless of whether rates rise or fall. Eases budgeting anxiety and offers stability. | Examined historically, variable rates have proven to be less expensive over time. |

| Cons | If the difference between the variable and fixed rate is significant, it may not be worth paying a premium for the stability protection of a fixed rate. | Consider the financial uncertainty: significant increases in the prime rate will increase your interest payable and, thus, financial burden. |

Factors That Affect Your Mortgage Rates

Mortgage payments comprise two parts: Principal and interest payments. The principal is the part of your payment that goes directly toward your balance, while the interest is the cost of borrowing the money. Your home loan balance and mortgage interest rate determine your monthly payment.

Mortgage rates can vary widely from one borrower to the next. That’s because mortgage lenders base them on a slew of factors, including:

Generally speaking, the higher your credit score, the better your mortgage rate. Lenders typically reserve their lowest rates for borrowers with 740 credit scores or better, documents from mortgage giant Fannie Mae show.

Down payment: A larger down payment means the lender has less money on the line. Lenders typically reward a sizeable down payment with a lower interest rate. Small down payments are riskier and come with higher rates.

Loan program: There are many types of mortgage loans, and some offer lower rates than others. A VA loan, for example, typically has the lowest interest rate, though they’re only available to veterans, military service members and surviving spouses. An FHA loan can offer a lower down payment and credit score but is only available to first-time homebuyers.

Read Also: Mortgage Rates Based On 10 Year Treasury

How Low Can Mortgage Rates Go

In theory, there’s no limit to how low mortgage rates could go, because central banks could theoretically introduce negative rates into the bond market. In reality, there is a floor at which financial institutions would no longer find it profitable to offer mortgages as a loan product, but each lender has to make that decision for themselves. According to the Federal Reserve, the average 30-year fixed-rate mortgage dropped to an all-time low of 2.65% in January 2021.

/1 Arm: Your Guide To 7

A 7/1 ARM can provide you with some stability at the outset of your loan and help you save money on interest.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as Credible.

When shopping for a mortgage, its common to look for fixed-rate loans. However, adjustable rate mortgages may offer lower interest rates because the rate will adjust after the initial fixed period.

Some ARMs are hybrids, offering a lower fixed rate for a set period of time. The 7/1 ARM is one of these types of mortgages, providing you with a lower fixed rate for the first seven years of the term and making it an attractive option for homebuyers.

Heres what you need to know about 7/1 ARM loans:

Recommended Reading: Bofa Home Loan Navigator

Constant Maturity Treasury Rates

Constant Maturity Treasury rates, or CMT rates, refer to a yield thats calculated by taking the average yield of different types of Treasury securities with varying maturity periods, and using it to adjust for a number of time periods.

Some lenders will use this rate to determine interest for adjustable-rate mortgages . If the CMT goes up, you can expect any loans tied to it to increase their interest rates as well.

What Does It Mean When The Federal Reserve Cuts Interest Rates

The fed funds rate is the prescribed rate at which banks lend money to each other on an overnight basis.

When the fed funds rate is low, the Fed is attempting to promote economic growth. This is because the fed funds fate is correlated to Prime Rate, which is the basis of most bank lending including many business loans and consumer credit cards.

For the Federal Reserve, manipulating the fed funds rate is one way to manage its dual-charter of fostering maximum employment and maintaining stable prices.

Federal funds rate and Consumer Price Inflation, 1970-2018.

However, a low fed funds rate creates wage pressure and promotes risk-taking, both of which can quickly lead to inflation .

For this reason, the Federal Reserve ended its zero-interest-rate policy in December 2015, raising rates by 25 basis points for the first time in more than a decade.

However, the Fed move did not lead to an increase in consumer mortgage rates. On the contrary, mortgage rates dropped more than 50 basis points after the Feds late-2015 move.

This is because U.S. mortgage rates arent set or established by the Federal Reserve or any of its members. Rather, mortgage rates are determined by the price of mortgage-backed securities , a security sold on Wall Street.

The Federal Reserve can affect todays mortgage rates, but it cannot set them.

Read Also: How Much Is Mortgage On 1 Million

What Does 3/6 Or 5/6 Arm Mean

The first number indicates the number of years your initial rate is in effect.

The second number indicates how often the rate will adjust after that initial period.

In other words, a 3/6 ARM will have the initial interest rate for three years after that, it will adjust every 6 months. Similarly, a 5/5 ARM will have the initial interest rate for five years and adjust every five years after that.

Adjustable rate mortgages are available in 3/6, 5/6, and 7/6 ARM terms with 30-year amortization terms, as well as 5/5 30-year and 5/5 15-year terms.

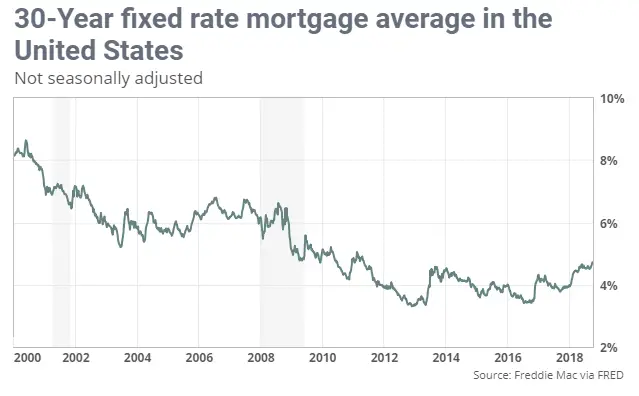

Why Compare 30

Its important to shop around when youre looking for a mortgage to make sure youre getting the best deal. Bankrates mortgage amortization calculator shows how even a 0.1 percent difference on your rate can translate to thousands of dollars you could have to pay out over the life of the loan.

Bankrate can help you connect with below-average rate offers to help you save even more.

You May Like: Reverse Mortgage For Mobile Homes

How Does A 30

When you apply and are approved for a 30-year fixed-rate mortgage, two things are certain. Your interest rate will not change and your mortgage will be broken down into a series of payments over the course of 30 years. The payments include interest and principal together and remain the same throughout the loan.

Many homeowners also pay their property tax and homeowners insurance premiums with their mortgage payments. If you put down less than 20% of the price of the home, you will also have to pay private mortgage insurance premiums until youve paid off enough of the principal to equal 20% of the homes value.

How Does The Prime Rate Affect Mortgage Rates

There are two main types of mortgage rates in Canada fixed and variable. When you get a fixed mortgage rate, you agree to pay the same rate over the entire course of your mortgage term regardless of what happens in the outside market. Fixed mortgages are a good option if youre worried mortgage rates will go up, or if you want to enjoy the stability of paying the same mortgage rate until its time to renew.

When you get a variable mortgage rate, the rate will be expressed as the prime rate plus or minus a certain percentage. When the prime rate goes up or down, your mortgage rate will go up or down by the same amount. Variable mortgages usually come with a lower rate vs. fixed-rate mortgages when you sign up, but theres the risk that the rate could go up during your mortgage term. Many lenders will allow you to convert a variable-rate mortgage to a fixed-rate mortgage at any time, but you will have to pay the fixed rate as of the time you decide to switch.

Lets look at an example. If the prime rate is 3.0%, and you get a variable-rate mortgage at prime minus 0.8%, your effective interest rate will be 2.2%.

The prime rate can rise and fall over time, and variable-rate loans will rise and fall with it. To continue this example, if the prime rate were to increase by 0.25% to 3.25%, the interest rate on your mortgage would rise by the same amount, to 2.45%.

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

An Overview Of How Mortgage Interest Rates Are Determined

Several factors affect how mortgage rates are determined today, but you can only control one aspect: the personal factors. Lenders look at your qualifying factors to determine your risk level. The better your qualifying factors, the better the interest rate theyll offer.

But it all starts with the current market rates, so you may wonder how the market affects interest rates.

Mortgage rates are affected by the overall economy. When the economic outlook is good, rates tend to increase, and rates fall when theyre not so great. It seems somewhat backward, but heres the reasoning.

When the economy is doing well, borrowers can afford more. Without increased rates, the demand for mortgages could exceed the bandwidth of most lenders. Slightly rising rates keep everyone on the same level.

Conversely, when the economy declines and unemployment rates increase, interest rates fall to make it more affordable for borrowers to take out loans.

The Global Economy Matters

Many Canadian banks borrow money in other countries, particularly the United States. And keep in mind that the worlds financial markets are interconnected. Interest rates in Canada respond to what happens elsewhere. For example, foreign interest rates fell during 2019. Interest rates for Canadian five-year fixed mortgages dropped in response.

Recommended Reading: Recast Mortgage Chase

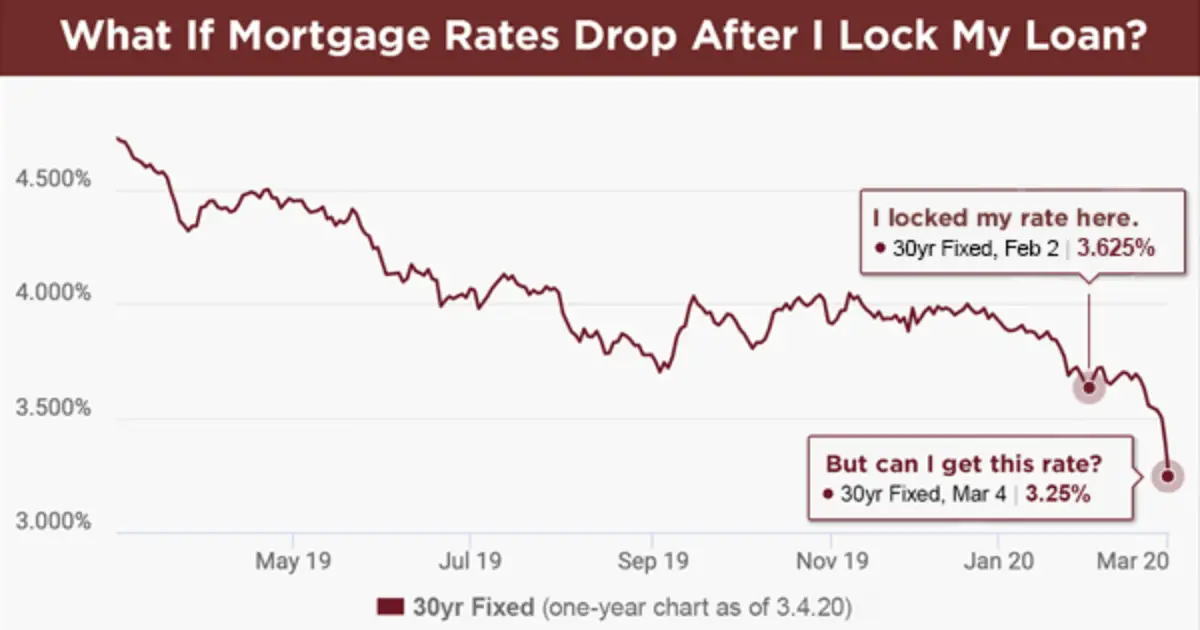

How Do I Lock In A Mortgage Rate

Once youve selected your lender and are moving through the mortgage application process, you and your loan officer can discuss your mortgage rate lock options. Rate locks can last between 30 and 60 days, or even more if your loan doesnt close before your rate lock expires, expect to pay a rate lock extension fee.

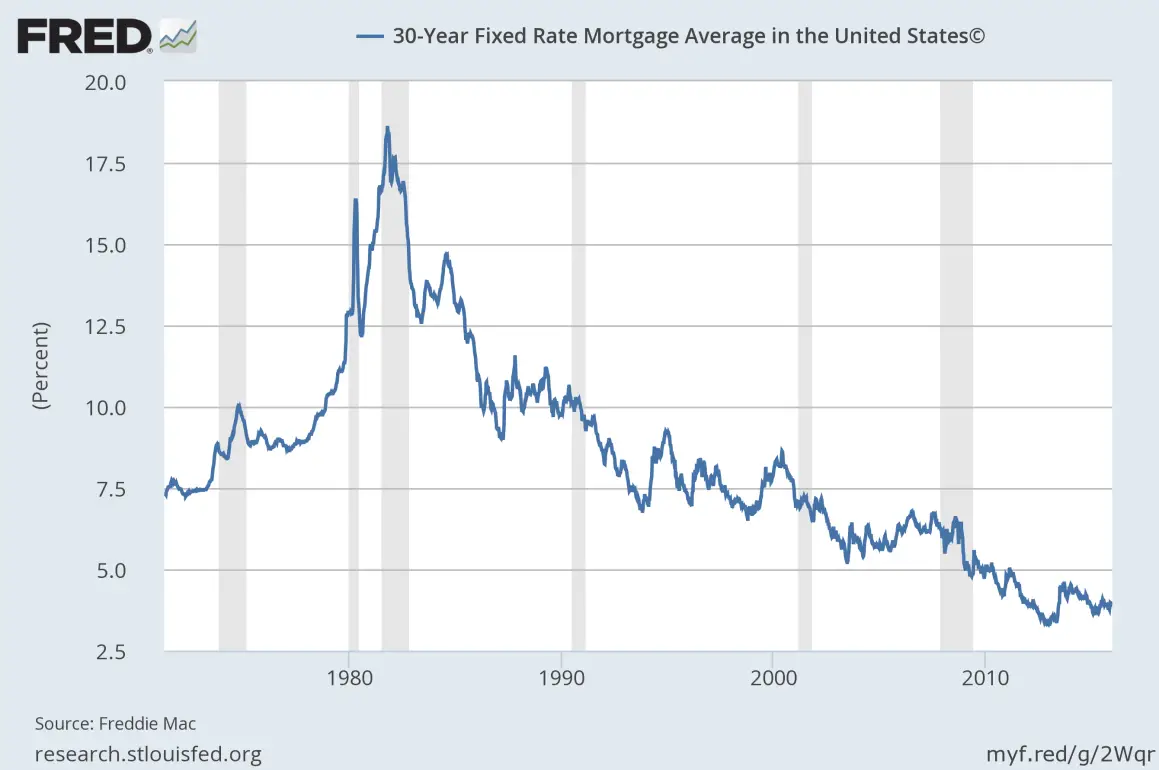

The History Of Mortgage Rates

The modern history of mortgage lending in the U.S. began in the 1930s with the creation of the Federal Housing Administration. From the 1930s through the 1960s, a combination of government policy and demographic changes made owning a home a normal part of American life. During this time, the 30-year fixed-rate mortgage became the standard for home buying.

When discussing the fluctuation of mortgage rate trends, analysts usually refer to the average 30-year fixed-rate mortgage. Heres a look at the trend of these mortgage rates since the 1970s.

You May Like: Recasting Mortgage Chase

Freddie Macs Weekly Mortgage Rate Survey

Below are Freddie Macs average mortgage rates, updated weekly every Thursday morning.

This should give you a decent idea of current mortgage rates, though as mentioned, theyre just averages and your rate may vary considerably depending on the many factors mentioned above.

The data is collected Monday through Wednesday, so they arent necessarily going to match up with todays mortgage rates if rates increased or fell from then until now. Consider this a starting point:

| Loan Program |

-Mortgage rates are currently trending UP–

* signifies a record low

Since 1971, Freddie Mac has conducted a weekly survey of consumer mortgage rates.

These are average home loan rates gathered from banks and lenders throughout the nation for conventional, conforming mortgages with an LTV ratio of 80 percent .

Note that these averages dont apply to government home loans like VA loans or an FHA mortgage.

The numbers are based on quotes offered to prime borrowers, those with high credit scores, meaning best-case pricing for the most part.

I believe the property type in the survey is for a one-unit primary residence as well, so expect a rate rise if its a vacation home or rental property, or multi-unit property.

Freddie uses HMDA data to establish regional weightings in five regions of the country, then aggregates that market data to compute a national average for their weekly rate update.

During the week ending January 7th, 2020, 30-year fixed mortgage rates hit new all-time lows.

How Do I Compare Current Mortgage Rates

When comparing current mortgage interest rates, start by comparing rates for the same type of loan. Compare 15-year loans to other 15-year loans, and fixed-rate mortgages to other fixed-rate mortgages.

Don’t just read about rates online — apply for prequalification at multiple lenders. When you apply for prequalification, lenders look at factors unique to you, such as your credit score and down payment, when determining your mortgage rate. This can help you more accurately compare different lenders.

Shopping around for the best mortgage lenders is best done in a short time frame. The three major encourage borrowers to shop around within a period of 45 days, depending on the bureau. You can apply with any number of lenders within this time frame. No matter how many applications you submit, these credit bureaus will only count one credit inquiry against your credit score.

Each lender you apply with provides a loan estimate. This document outlines a loan’s terms and fees. It includes the interest rate, closing costs, and other fees such as private mortgage insurance . Be sure to compare all of these fees and costs to get a picture of which offers you the best overall deal.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

How Often Are The Rates Adjusted On A 3/6 Arm

Unlike its cousin, the 3/1 ARM, a 3/6 ARMs interest rates are adjusted every 6 months after the variable-interest rate portion of the mortgage starts. Just like other hybrid ARMs, 3/6 ARMs have both lifetime and periodic caps, which limit how much and how fast your interest rate can increase. Most 3/6 ARMs also have floors, as well, which limit how low your interest rates can go.

Also Check: Mortgage Rates Based On 10 Year Treasury

What Is A Discount Point

A discount point also called a mortgage point is an upfront fee paid at closing to reduce your mortgage rate. One point is equal to 1% of your loan amount. So if youre borrowing $300,000 for example, one point would cost you $3,000.

Each mortgage point can lower your rate 12.5 to 25 basis points, which equals 0.125% to 0.25%.

Also Check: How Much Is Mortgage On A 1 Million Dollar House

When Is An Adjustable

Adjustable-Rate Mortgages begin with a fixed interest rate and then adjust up or down after the initial term. ARMs are a good option for buyers who dont plan to stay in their home for more than 5 years and want to keep their monthly payment low.

ARM products contain 2 numbers:

- The first refers to the number of years the interest rate will remain fixed.

- The second is the number of years between interest rate changes after the initial fixed term expires.

For example, a 5/5 ARM would have the same interest rate for the first 5 years, and then the rate would adjust every 5 years after that.

Am I Better Off With A Fixed

Generally speaking, an ARM makes more sense when interest rates are high and expected to fall. Conversely, if predictable payments are important to you and interest rates are relatively stable or climbing, a fixed-rate mortgage might be your best option.

Popular methods to potentially gauge the future direction of interest rates include studying the yield curve, keeping tabs on the 10-year Treasury bond yield, and paying close attention to Fed monetary policy.

Also Check: Chase Recast Calculator

How Fed Statements Can Impact Mortgage Rates

The Fed does more than just set the fed funds rate. It also gives economic guidance to markets.

For rate shoppers, one of the key messages to listen for is what the Fed says about inflation. Inflation is the enemy of mortgage bonds and, in general, when inflation pressures are growing, mortgage rates are rising.

The link between inflation rates and mortgage rates is direct, as homeowners in the early-1980s experienced.

High inflation at the time led to the highest mortgage rates ever. 30-year mortgage rates went for over 17% , and 15-year loans werent much better.

The Fed doesnt control mortgage rates, but the link between inflation and mortgage rates is direct.

Inflation is an economic term describing the loss of purchasing power. When inflation is present within an economy, more of the same currency is required to purchase the same number of goods.

We experience inflation at the grocery store.

A gallon of milk used to cost $2. Today, it costs $3. More money is required to purchase the same amount of milk because each dollar holds less value.

Meanwhile, mortgage rates are based on the price of mortgage-backed securities and mortgage-backed securities are U.S. dollar-denominated. This means that a devaluation in the U.S. dollar will result in the devaluation of U.S. mortgage-backed securities as well.

When inflation is present in the economy, then, the value of a mortgage bond drops, which leads to higher mortgage rates.