Do Local Banks Offer Better Mortgage Rates

Image taken by: fbchomeloans

Local banks typically offer lower mortgage rates than large national banks. They may also be able to offer more personalized service and more flexible terms. However, local banks may have less experience with certain types of loans, such as jumbo loans, and may not offer as many loan programs.

Advice On Mortgage Rates

Mortgage rates have rocketed since the government’s mini-budget on 23 September.

If you’re thinking of buying a home or need to remortgage this is likely to impact you.

For the latest news and advice on dealing with inflated mortgage rates, see the below stories, which are regularly updated:

If you’re worried about making your mortgage payments, see our guide on what to do if you can’t pay your mortgage.

The Best Mortgage Rates Ranked

The following banks and mortgage lenders have the best mortgage rates on average, based on nationwide data filed by lenders under the Home Mortgage Disclosure Act. These averages are from 2021, the most recent data available at the time of writing.

Rates have risen in 2022, and the average rates you see here do not represent mortgage interest rates on offer today. However, historical mortgage rates can be a useful guide to help you find the banks with the lowest mortgage rates on average. The lists below are a great starting point if youre shopping for a new home loan.

You May Like: How To Report A Private Mortgage To Credit Bureau

Is The Prime Rate In Canada Going Up In 2023

Between March 3, 2022 and December 19, 2022, the prime rate in Canada went up by 3.75%, from 2.70% to 6.45%.

The prime lending rates of most lenders have been going up as a result of the Bank of Canada raising its target for the overnight rate in an effort to control high inflation. When the Bank of Canada increases its key interest rate, most banks and lenders follow suit and raise their own prime rates.

In its December 7th announcement, the last of 2022, the Bank of Canada both raised the target for the overnight rate by 0.50% and signalled that it will likely pause further rate hikes to evaluate whether the target for the overnight rate needs to rise further. However, many experts believe that the prime rate will continue to rise into 2023 should the Bank of Canada make another rate hike.

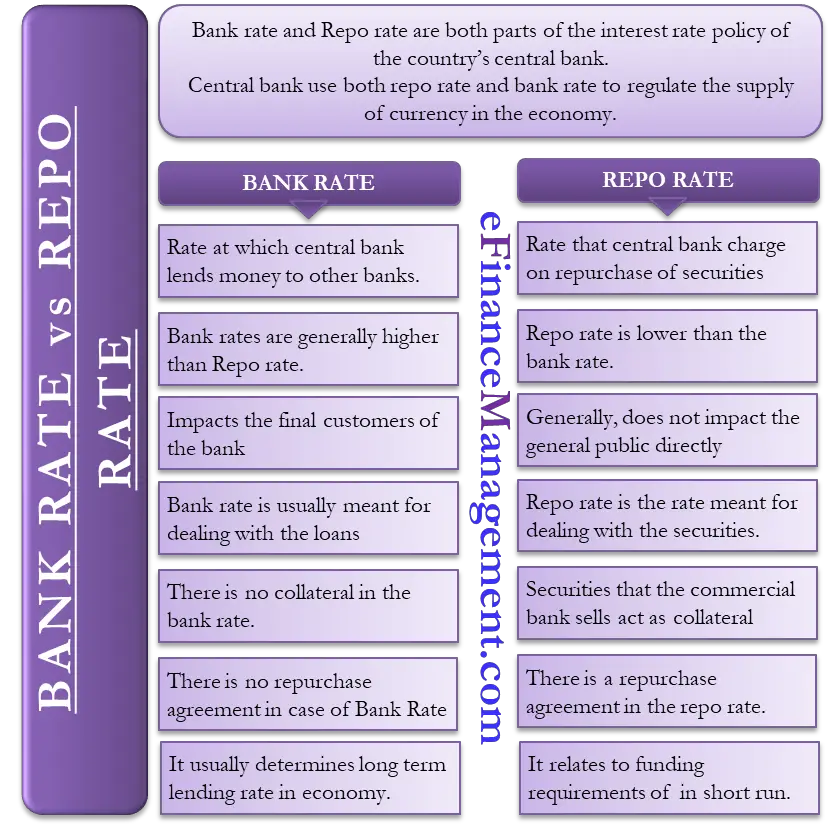

How Is The Prime Rate Related To The Bank Of Canadas Key Interest Rate

When the Bank of Canada raises its target for the overnight rate , it becomes more expensive for banks and lenders to borrow money so, in turn, they raise their respective prime lending rates to cover their additional costs. Similarly, when the Bank of Canada lowers the policy interest rate, it becomes cheaper for banks and lenders to borrow money. As a result, they lower their respective prime rates accordingly.

Also Check: When Paying Off A Mortgage Early

What The Forecast Means For You

Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years.

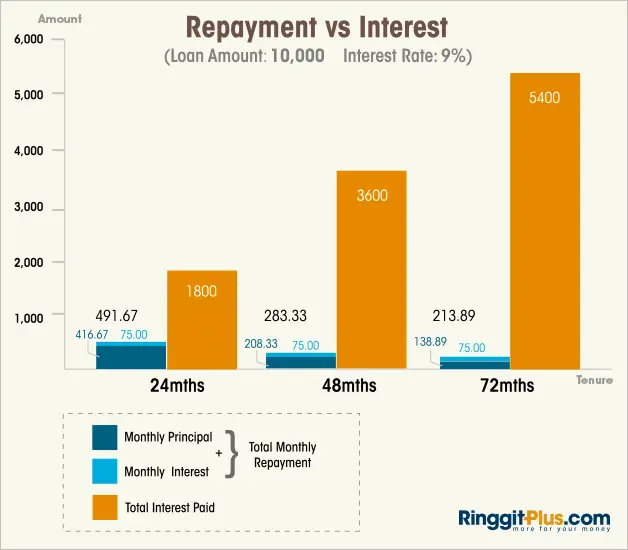

Higher interest rates mean higher monthly payments for borrowers. For example, on a $400,000 home with a 5.10% interest rate, the monthly mortgage payment is around $2,172. This doesnât include insurance, taxes or other loan costs. If the rate rises to 6%, the monthly payment jumps to $2,398.

This means time is running out for homeowners who hope to lock in a lower interest rate by refinancing.

How Is The Prime Rate Set In Canada

Each bank sets its own prime rate, but the Big Five Banks usually all have the same prime rate. The prime rate is primarily influenced by the policy interest rate set by the Bank of Canada , also known as the BoC’s target for the overnight rate. When the BoC raises the overnight rate, it becomes more expensive for banks to borrow money, and they raise their respective prime rates to cover the added costs. Conversely when the BoC lowers the overnight rate, banks usually lower their prime rates by the same amount.

Read Also: Is It Hard To Get Pre Approved For A Mortgage

Best For Flexible Down Payment Options

Who’s this for? Chase Bank provides several options for homebuyers who would prefer to make a lower down payment on their home. The traditional advice has been to make a down payment that’s about 20% of the price of the home, however, Chase offers a loan option called the DreaMaker loan that would allow homebuyers to make a down payment that’s as low as 3% .

This option is made for those who can only afford a smaller down payment, but it also comes with stricter income requirements compared to their other loans , according to the Chase team). If you meet the income requirements for the DreaMaker loan, this option could be very attractive for those who would prefer to make a down payment that’s as small as possible so they can have more money reserved for other homebuying expenses.

In addition to the DreaMaker loan, Chase also offers a conventional loan, FHA loan, VA loan and jumbo loan . Much like other lenders, Chase has a minimum credit score requirement of 620 for their mortgage options.

Chase offers mortgage terms that range from 10 years to 30 years, as well as fixed rate and adjustable-rate mortgages . This lender also offers discounts for existing customers, but the requirements are rather high: For $500 off your mortgage processing fee, you need to have $150,000â$499,999 between Chase deposit accounts and Chase investment accounts $500,000 or more in these accounts can get you up to $1,150 off the processing fee.

So How Do Mortgage Lenders Measure Risk

One method is to analyze the borrowers past credit history. Credit scores essentially rate borrowers based on their previous borrowing history . A borrower who makes all payments on time will have a higher score. A borrower with a pattern of missed payments or delinquencies will have a lower score.

Statistically speaking, a person with a lower credit score is more likely to default on a mortgage loan. So they are seen as a bigger risk, and charged a higher mortgage rate as a result.

Mortgage lenders use other factors to measure risk, as well. They might consider the size of the down payment, the borrowers employment and income history, the amount of total debt they have, and more.

As mentioned, lenders have different methods for assessing risk and pricing loans:

- One company might look at your financial situation and view you as an extremely low-risk borrower, with a very low probability of default.

- Another company might see that you have a great credit score, but have an issue with the amount of debt you carry in relation to your income.

- A third lender might put more emphasis on down payments, reserving their best mortgage rates for borrowers who put down 20%.

So, risk-based pricing is one reason why lenders offer different mortgage rates to different borrowers. The type of home loan being used also plays a role. So lets explore that topic next.

Don’t Miss: How Much Does Biweekly Mortgage Payments Save

How To Negotiate Mortgage Rates

The excitement of getting approved for a mortgage may tempt some homebuyers to jump right into the shopping stage of the homebuying process. However, buyers who pause and consider how to negotiate mortgage rates stand to save money over the life of the loan: The interest rate on a home loan is a significant factor in your monthly payment and the total loan cost.

Heres how to get the best mortgage rate with your lender.

Why Will Different Lenders Offer Different Rates To The Same Borrower

Every lender will start with a similar model when assessing risk. These models have been set by the industry giants such as Fannie Mae and Freddie Mac who actually will purchase loans once they have been made by the bank. If the bank has not met these standards, they will not be purchased.

In addition to the qualifications that were discussed earlier, every individual lender has their own set of qualifications and standards in addition to those that have already been set. In simplest terms, every lender has their own model to assess the individual risk of an applicant that is requesting a loan.

One lender may be more concerned with a credit score whereas another may be more concerned with the applicants debt to income ratio, additionally, another lender may focus on the size of the down payment, it will all be relative to the lender. These specifications are known as mortgage overlays, these are specific rules that the lender has put in place above the general standard.

The type of loan is also going to make a difference on the interest rate that will be offered. A lender will typically place a higher interest rate on a mortgage that features a longer life term. For example, loans with a 30 year term are going to have a higher interest rate than those that are 15 years. Additionally, a zero down loan is going to have a higher interest rate as opposed to a traditional mortgage.

Also Check: Can You Refinance A 30 Year Mortgage

Do Mortgage Lenders Have Better Rates Than Banks

Image taken by: wp

Mortgage lenders typically have access to a wider range of loan products and programs than banks. They also generally have lower interest rates than banks. However, its important to compare rates from multiple lenders before choosing one.

Where can I find a mortgage? According to WalletHub, the lowest 30-year mortgage rate ever was recorded here. According to Bankrate.com, the lowest 30-year mortgage rate was 2.5% in January 2021. The price is unlikely to fall below this level for a long time, as it is a new record low. At this time, it is a good time to lock in a mortgage rate that is as low as it gets. Even though interest rates will most likely rise in the future, it is still a good time to obtain a mortgage.

Factor: Your Property Type

Youll generally get better mortgage rates if you live in the property being financed. Non-owner-occupied properties, for example, tend to have higher rates due to the added risk to the lender. Thats especially true if theyre rented out.

As well, properties that are less liquid rarely qualify for the lowest rates due to potential resale risk if a customer defaults.

You May Like: How Do You Know If You Can Get A Mortgage

Recommended Reading: How Much Mortgage Can I Afford On 200k Salary

What Are Current Mortgage Rates

Mortgage rates have risen from the record lows seen in 2020 and 2021. That means its more important than ever to shop around for your best deal.

Comparing lenders and negotiating for a better mortgage rate can save you thousands of dollars even tens of thousands in the long run. So its well worth the effort.

Ready to get started?

1Top 50 mortgage lenders for 2021 based on 2020 Home Mortgage Disclosure Act data via Bundle Loan and 2021 data sourced directly from the HMDA data browser

2Rate and fee data were sourced from self-reported loan data that all mortgage lenders are required to file each year under the Home Mortgage Disclosure Act. Averages include all 30-year loans reported by each lender for the previous year. Your own rate and loan costs will vary.

How Do Mortgages Work

A mortgage is a type of loan that you can use to purchase a home. It’s also an agreement between you and the lender that essentially says that you can purchase a home without paying for it in-full upfront â you’ll just put some of the money down upfront and pay smaller, fixed equal monthly payments for a certain number of years plus interest.

For example, you probably can’t pay $400,000 for a home upfront, however, maybe you can afford to pay $30,000 upfront a mortgage would allow you to make that $30,000 payment while a lender gives you a loan for $370,000 and you agree to repay that amount plus interest to the lender over the course of 15 or 30 years.

Keep in mind that if you choose to put down less than 20%, you’ll be subject to private mortgage insurance payments in addition to your monthly mortgage payments. However, you can usually have the PMI waived after you’ve made enough payments to build 20% equity in your home.

Recommended Reading: Can My Mom Cosign On A Mortgage

You Are Leaving The Wells Fargo Website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

Key takeaway

Consider exploring different types of mortgage providers to find the one that best fits your needs, factoring convenience, service and products, rates, technology, and educational content and services into your decision.

Do All Mortgage Brokers Get The Same Rates

There is absolutely no way they can charge more to give you a higher rate compensation amounts are set with each lender and cannot change depending on the interest rate you receive. Brokers work with wholesale lenders and receive wholesale fees, which are much lower than those charged by retail banks.

There is absolutely no way they can charge more to give you a higher rate compensation amounts are set with each lender and cannot change depending on the interest rate you receive. Brokers work with wholesale lenders and receive wholesale fees, which are much lower than those charged by retail banks. As noted, mortgage brokers work with many different lending partners, which means that interest rates can vary from lender to lender. This has to do in part with your compensation.

Compensation is one of the key differences between mortgage brokers and direct lenders. Mortgage brokers are paid according to a fee. In most cases, the loan origination fee charged by the bank is paid to the broker. Because mortgage rates from lenders vary, it’s wise to look for a mortgage from multiple lenders, as it could save thousands of dollars over the life of the loan.

References

Also Check: Is It Worth Refinancing Mortgage

State Of The Overall Economy

Its hard to describe the overall state of the economy when youre talking about a country as large and varied as the U.S. But the general sense of how the American economy is doing does ultimately impact interest rates.

For example: During the early days of the COVID-19 pandemic, the economy for Americans was almost universally bad. As a result, interest rates stayed low to incentivize people to borrow and spend money, despite the rough market conditions. Now its the opposite: The economy is overheating, and interest rates have increased to try to cool things down.

Best For Saving Money

Who’s this for? SoFi offers homebuyers a number of discounts that can help them save as much money as possible throughout their home buying process. When you lock in 30-year rate for a conventional loan, you can receive a 0.25% discount. And when you purchase a home through the SoFi Real Estate Center, which is powered by HomeStory, you can receive up to $9,500 in cash back. Another appealing perk is that SoFi members can get a $500 discount on their mortgage loan.

This lender offers an online-only experience for those looking to qualify for a conventional loan, jumbo loan, or HELOC . Terms range from 10 to 30 years and are both fixed and adjustable-rate. Similar to most other lenders, SoFi considers applicants with a minimum credit score of 620.

Homebuyers can also take advantage of a host of resources from SoFi, like a home affordability calculator, a mortgage calculator and a home improvement cost calculator, which can really come in handy if you’re purchasing a home that needs some work done and you need to figure out ahead of time how much to budget for renovations.

Just keep in mind, though, that SoFi’s mortgage loans are only available in 47 states and Washington, D.C. â residents of Hawaii, New York and New Mexico would be unable to apply.

You May Like: How To Become A Mortgage Broker In Massachusetts

How Does An Interest

Interest-only mortgages used to be really popular among first-time buyers, but since the 2008 credit crunch its been difficult to get your hands on one. And laws which came into effect in 2014 mean interest-only mortgages will only be offered where theres a credible plan to repay the capital, making them even rarer.

Heres how they work in brief:

- With an interest-only mortgage you just pay the interest during the term. Your monthly payment doesnt chip away at your actual debt it just covers the cost of borrowing that money. So for example, when the term is up on a £150,000 mortgage, you would still owe £150,000.

- You have to pay back the amount you borrowed in one lump sum at the end of the mortgage term. So if you get an interest-only mortgage, you NEED to have a separate plan to pay off your debt.

If youre considering an interest-only mortgage, the lender will want to see evidence of a convincing method youve set up to build up enough cash to pay off the actual cost of the property.

The Constant Maturity Treasury Rate

Constant Maturity Treasury rates, or CMT rates, refer to a yield thats calculated by taking the average yield of different types of U.S. Treasury securities with varying maturity periods, and using it to adjust for a number of time periods.

Some mortgage lenders will use this rate to determine interest for adjustable-rate mortgages . If the CMT rate goes up, you can expect any loans tied to it to increase their interest rates as well.

You May Like: Do I Need To Get Prequalified For A Mortgage