Is A Conventional Loan Worth It

In general, conventional loans best fit buyers with financial security. With a high credit score or hefty down payment, a conventional loan can waive costs from mortgage insurance or fees.

That said, depending on your personal finances, every home loan has its pros and cons. Its always best to compare all home loan options. That way, youll find the deal that ensures your homeowner success.

Ballinger, Barbara. Conventional loan rates and requirements for 2021.

Bucyznski, Beth Wood, Kate. Conventional Loan Requirements for 2021.

Federal Housing Administration. FHA Loan Requirements.

US Department of Veterans Affairs. Purchase Loan.

Folger, Jean. What Can I Expect My Private Mortgage Insurance Rate to Be?

Investopedia. Conventional Mortgage or Loan.

Luthi, Ben. What is a Conventional Loan?

US Census Bureau. Quarterly Sales and Price by Financing, 2020 Q4.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

What Is The Difference Between Conventional And Government

When youre thinking about your mortgage options, its important to understand the difference between conventional loans or mortgages and government-backed loans.

Government-backed loans include options like VA loanswhich are available to United States veteransand Federal Housing Administration loans. FHA loans are backed by the Federal Housing Administration, and VA loans are guaranteed by the Veterans Administration.

With an FHA loan, youre required to put at least 3.5% down and pay MIP as part of your monthly mortgage payment. The FHA uses money made from MIP to pay lenders if you default on your loan. The only way to get rid of MIP is if you have more than a 10% down paymentbut even then, youll still have to pay it for 11 years!2 MIP can tack on an extra $100 a month per $100,000 borrowed. That means if youve borrowed $200,000, thats an extra $200 on top of your regular mortgage payment each month.

To qualify for a VA loan, you must be a previous or current member of the U.S. Armed Forces or National Guardor have an eligible surviving spouse. A VA loan requires no down payment, but you must pay a one-time funding fee, which usually ranges from 1.43.6% of the loan amount.3 But keep in mind, when you purchase a home with zero money down and things change in the housing market, you could end up owing more than the market value of your home. Yikes!

Asset Qualifier Home Loan

An asset qualifier home loan is a loan product that allows you to get a mortgage against your liquid assets instead of income. Liquid assets can include your bank accounts, such as checking and savings, retirement, or investment accounts. If you have a lot of assets but generate little to no income, an asset qualifier home loan might be a good option.

Don’t Miss: How Much Of My Budget Should Go To Mortgage

Fha Loans And Mortgage Insurance

To offset a lower required credit score, FHA loans include mortgage insurance as part of the borrowers responsibility.

FHA loans require two types of mortgage insurance payments:

- An upfront mortgage insurance premium of 1.75% of the loan amount, either paid when you close on the loan or rolled into the loan amount.

- A monthly MIP as part of your regular mortgage payments.

If your down payment was less than 10%, youll continue to pay monthly mortgage insurance for the life of the loan.

If your down payment was 10% or more, youll only have to pay mortgage insurance for the first 11 years of the loan before it’s removed.

Is It A Good Idea To Get A Non

Non-traditional mortgage loans come with several benefits: flexible and reduced monthly mortgage payments than traditional loans, making them more appealing. If you need financing for the short term or have a unique situation that requires a low-cost unconventional loan, then this might be right for you.

However, before you get a non-traditional mortgage, ensure that you do your due diligence and determine whether its suitable for you. Also, consider if you can weather the storm if the worst-case scenario happens.

Recommended Reading: How Are Mortgage Interest Rates Determined

What Is A Traditional Mortgage

Basically, a traditional mortgage is fixed-rate, 30-year loan that is not guaranteed by any government agency.

Just to cover the basic terminology, a fixed-rate loan is one which has the same interest rate throughout the course of the entire loan.

Overall, the interest rates of your loan depends on who your lender is, what is going on with the mortgage industry and with Fannie Mae, and others factors specific to your deal.

Make A Final Decision: Fha Or Conventional Mortgage

Youve done your homework and learned the difference between FHA loans and conventional mortgages. Take the next step and work with a loan officer who asks the right questions like the knowledgeable, experienced ones at Capital Bank and can find the loan that fits you best. Then youll have everything you need to make your final decision!

Also Check: How Much Mortgage Can I Afford For 2500 Per Month

What Is A Mortgage

A mortgage is a type of loan used to purchase or maintain a home, land, or other types of real estate. The borrower agrees to pay the lender over time, typically in a series of regular payments that are divided into principal and interest. The property then serves as collateral to secure the loan.

A borrower must apply for a mortgage through their preferred lender and ensure that they meet several requirements, including minimum and down payments. Mortgage applications go through a rigorous underwriting process before they reach the closing phase. Mortgage types vary based on the needs of the borrower, such as conventional and fixed-rate loans.

Qualifying For A Conventional Loan

Your creditworthiness or ability to repay your loan is factored in determining the interest rate. This is the reason why your credit score and history must uphold satisfactory records: it reflects low risk of defaulting on a loan. Lower credit scores, on the other hand, are assigned higher rates because they pose greater risk to lending institutions.

Generally, you may have difficulty qualifying for a conforming conventional loan if your financial records reveal the following issues:

- If you’ve experienced foreclosure or bankruptcy in the last 7 years

- Having less than 10% down payment

- Back end debt-to-income ratio over 43%

There are two important DTI ratios:

Front-end ratio

The percentage of your monthly income that go toward housing costs . Historically a ratio below 28 percent has been considered great.

Back-end ratio

The percentage of your earnings that go toward your home related expenses along with paying off all your other debt payments . Historically a ratio below 36 percent has been considered great.

Your back end debt-to-income ratio is estimated by dividing all your monthly debt payments and home-related expenses by your gross monthly income. The result is the percentage of your income that goes to paying debts. The lower your DTI, the higher your chances of securing a mortgage.

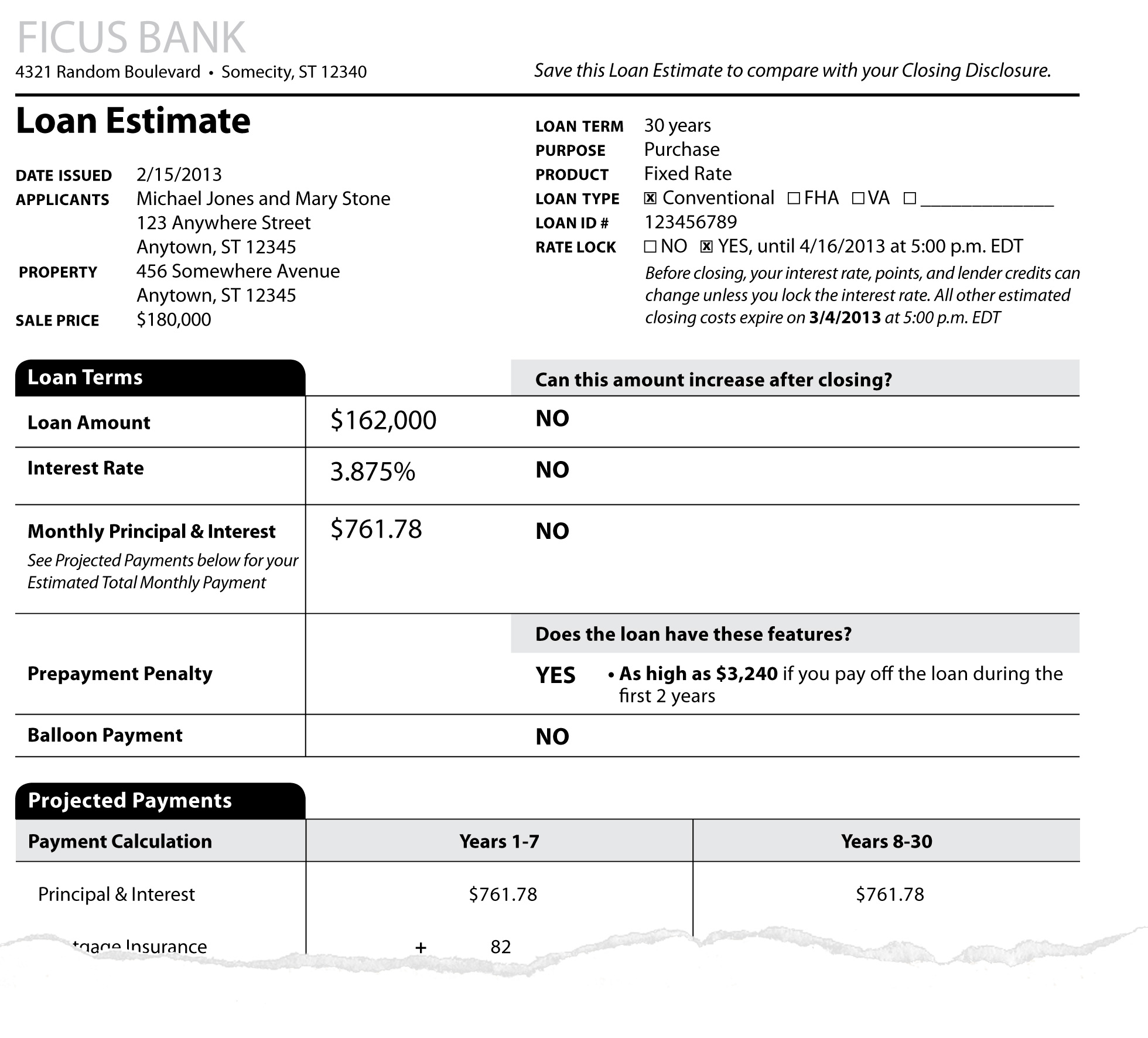

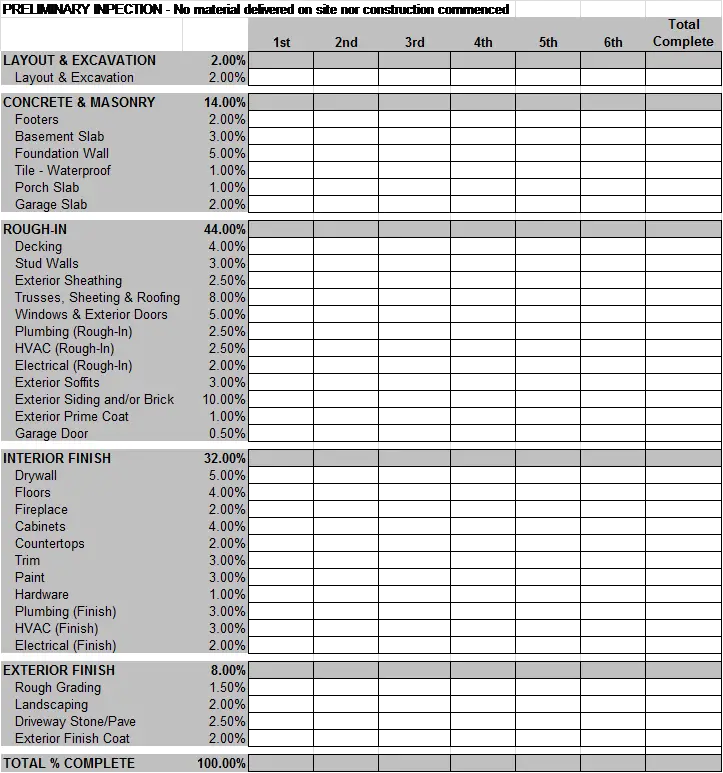

The table below summarizes requirements you’ll need to meet to qualify for a conforming conventional loan:

Don’t Miss: Is 5.375 A Good Mortgage Rate

Compare Fha Loan And Conventional Home Loans

Compare an FHA loan and conventional mortgages. Then see which loan is the better fit for your particular circumstances and financial situation right now.

| 5%-20% is typical | ||

| Upfront costs | Mortgage Insurance Premium of 2.25% of the loans value, which cant be cancelled | Private Mortgage Insurance with < 20% down payment, which can be cancelled when borrowers ownership reaches 80% equity |

Interest Rates For Conventional Mortgages

Conventional loan interest rates tend to be higher than those of government-backed mortgages, such as FHA loans .

The interest rate carried by a conventional mortgage depends on several factors, including the terms of the loanits length, its size, and whether the interest rate is fixed interest or adjustableas well as current economic or financial market conditions. Mortgage lenders set interest rates based on their expectations for future inflation the supply of and demand for mortgage-backed securities also influences the rates. A mortgage calculator can show you the impact of different rates on your monthly payment.

When the Federal Reserve makes it more expensive for banks to borrow by targeting a higher federal funds rate, the banks, in turn, pass on the higher costs to their customers, and consumer loan rates, including those for mortgages, tend to go up.

Typically linked to the interest rate are points, fees paid to the lender : the more points you pay, the lower your interest rate. One point costs 1% of the loan amount and reduces your interest rate by about 0.25%.

The final factor in determining the interest rate is the individual borrowers financial profile: personal assets, creditworthiness, and the size of the down payment they can make on the residence to be financed.

A buyer who plans on living in a home for 10 or more years should consider paying for points to keep interest rates lower for the life of the mortgage.

Also Check: Can You Borrow From Your Mortgage

Heres What You Need To Get A Conventional Loan

Conventional loans have to meet certain baseline requirements set by Fannie Mae and Freddie Mac and can be harder to qualify for than a government-backed loan.

Edited byChris JenningsUpdated January 4, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as Credible.

Conventional loans are one of the most popular types of mortgages: almost all lenders offer them. In August 2020, 82% of all closed mortgages were conventional loans, according to a report by Ellie Mae, making them far more popular than FHA, VA, or other home loans.

Conventional loans tend to have stricter requirements than government-backed mortgages. But with so many homeowners meeting these requirements, a conventional loan might be more accessible than you think.

Heres what you should know about conventional loans before you apply:

Advantages Of A Conventional Mortgage

One big advantage of a conventional mortgage is the borrower has much more flexibility in what property they can purchase compared to a government-backed loan. For example, FHA loans are only available for homes that meet the FHAs minimum property requirements. Other government-secured mortgages have even more specific limitations. U.S. Department of Agriculture mortgages are only available for properties in designated rural areas, and only qualifying veterans and their spouses are eligible for Department of Veterans Affairs mortgages.

Conventional mortgages dont have any of these sweeping limitations. You can even take out a conventional loan for an investment property or a vacation home. And conventional jumbo mortgages are an option if you need to borrow more than the FHFA loan limits for your area.

Also Check: What Is A Point For Mortgage

One Tradition That’s Definitely Worth Keeping

- Ideal for purchases or for refinancing your current home loan, possibly to secure a lower interest rate or to save on interest charges with a shorter term

- Choose loans of 30, 20, 15, 12 or 10 years

- Get pre-approved before you go house-hunting

- Lock in a low rate

- Work with friendly lenders who can guide you through the application process

- See if you’re eligible for VA or FHA loans

Conventional Loan Requirements And Qualifications

Conventional loans often have stricter borrower requirements than government-insured FHA, VA and USDA loans. In general, to qualify for a conventional loan, youll need:

- A 620 minimum credit score

- 3%-5% minimum down payment

- Maximum 43% debt-to-income ratio

- At least two years of consistent employment and steady income

Although these are the minimum standards, there are exceptions . As with any type of mortgage, to qualify for the best rates, youll need a good to excellent credit score.

Some conventional loan programs allow you to put down as little as 3 percent to 5 percent, but the tradeoff is youll need to pay for private mortgage insurance , a cost added on to your monthly mortgage payment. PMI protects the lender not you if you default on your loan, and youll need to pay this until you accumulate 20 percent equity in your home. If you can make at least a 20 percent down payment upfront instead, you wont have to pay this expense.

The down payment requirement for a conventional loan can also depend on what type of property youre financing. If youre buying an investment property, for instance, you might be required to put down at least 15 percent.

Also Check: What Is Aag Reverse Mortgage

When Youll Need To Pay Private Mortgage Insurance

Any borrower with a conventional loan who puts less than 20% down is required to buy private mortgage insurance , which raises the annual cost of the loan. This mortgage insurance can be canceled once the homeowners equity in their home surpasses 20%. Mortgage insurance provides protection for your lender in case you default on your loan.

How Does A Mortgage Loan Work

A mortgage is a loan that is applied for to buy a property. To get a mortgage loan, you’ll deal with either a traditional banking institution or a private mortgage lender. When you apply for a mortgage loan you’ll usually go through a pre-approval process to determine the maximum amount the lender is willing to offer and the interest rate you’ll pay.

A mortgage is a lengthy debt that is typically carried out for 30, 20, or 15 years. You’ll repay both the amount you borrowed and the interest paid for the loan throughout this time, known as the loan’s “term.” You’ll make recurring payments on the mortgage, commonly in the form of a monthly payment that includes both principal and interest costs. The lender can seize your home should you fall behind again on your mortgage payments.

You May Like: How Much Of Gross Income Should Go To Mortgage

Is A Conventional Mortgage Right For You

If youre simply looking for the easiest loan to qualify for, FHA loans might be your best bet for buying a house. Or if you qualify for a special loan program like a VA loan or USDA loan, these are likely the smartest path forward, as they require no down payment and can allow you to secure a mortgage with low interest rates and favorable terms.

However, if youre well-qualified, conventional loans offer a host of advantages. Unlike government-backed loans, you wont have to pay any program-specific fees when taking out a conventional mortgage. And, even if you dont have 20% saved for a down payment, your loan servicer will automatically cancel your PMI once the LTV reaches 78%.

Whatever you decide, make sure you shop around for your loan first. Rates and terms can vary greatly depending on your lender. Credible Operations, Inc. doesnt offer every type of mortgage loan, but you can use us to compare multiple prequalified rates on conventional mortgages. It only takes at once in just a few minutes and wont affect your credit score.

Credible makes getting a mortgage easy

Why Are Conventional Loans Important For Realtors

Conventional loans are a topic every realtor should be discussing with their clients. First time home buyers, especially, will rejoice at the flexible down payment options. Conventional loans can also account for the range in home prices that borrowers will be interested in purchasing because these loans can be either conforming or nonconforming. If a loan amount needed exceeds the loan limit for an area, a borrower can apply for a nonconforming conventional loan for the true amount they need to borrow. The flexibility in choices and options that innately comes with conventional loans is something every realtor should be speaking about with their clients.

Also Check: Can You Do A Reverse Mortgage On A Condo

Also Check: Will Applying For A Mortgage Affect My Credit

Types Of Conventional Mortgages

Conventional mortgages can be broken down into two categories: conforming and nonconforming loans. The main difference between these two types is the amount of money you need to borrow.

A conforming mortgage meets the standards set by the Federal Housing Finance Agency . The FHFA sets the limit for conforming loans every year. In 2022, the limit is $647,200 in most parts of the US. In areas with a higher cost of living, such as Alaska, Hawaii, Guam, and the US Virgin Islands, the limit has been increased to $970,800.

A nonconforming mortgage is for an amount that exceeds the FHFA limit. You also might hear it referred to as a jumbo loan.

To qualify for a nonconforming mortgage, you’ll likely need a higher credit score, bigger down payment, and lower debt-to-income ratio than you would for a conforming loan.

If you need more money than allowed by the FHFA or qualify for the loan, a nonconforming mortgage may be for you. If not, you’ll want to go with a conforming mortgage.

What Is A Conventional Mortgage

A conventional loan is a type of mortgage that isnt backed by a government agency, such as the Department of Veterans Affairs. Conventional mortgages often meet the down payment and income requirements set by Fannie Mae and Freddie Mac, and conform to the loan limits set by the Federal Housing Finance Administration, or FHFA.

You’ll generally need a credit score of at least 620 to qualify for a conventional loan, though a score that’s above 740 will help you get the best rate. Depending on your financial status and the amount you’re borrowing, you may be able to make a down payment that’s as low as 3% with a conventional loan.

Don’t Miss: When Do Mortgage Rates Come Out

Guide To Understanding Conforming Conventional Loans

Having a place of your own takes a while for most people. We dream of what type of house to buy, all while building enough savings to secure it in time. But apart from gathering ample funds, purchasing a home means understanding different financing options that might work for you.

For first-time homebuyers, this process may really be a struggle, especially if you haven’t sorted out your finances. However, once you’re more informed about your options, you’ll have a better idea of how you can make the most of your housing investment.

To help get you started, we’ll talk about one of the most common mortgage types in the country: conforming conventional home loans.

In this article, we’ll define what conforming conventional mortgages are and how these loans are typically structured. We’ll also discuss how it diverges from jumbo mortgages, as well as other government-sponsored mortgages such as FHA loans, USDA loans, and VA loans. Then, we’ll include requirements you need to know about the application process.