When Should You Lock In Your Mortgage Rate

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires.

If you dont lock in right away, a mortgage lender might give you a period of timesuch as 30 daysto request a lock, or you might be able to wait until just before closing on the home.

Once you find a rate that is an ideal fit for your budget, its best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While its not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

If you dont lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs.

Recent History Of Mortgage Interest Rates: 1980

In the early 1980s, when interest rates on mortgages went as high as 18%, many buyers opted for adjustable rate mortgages. Those came with introductory rates that allowed borrowers to pay reduced interest for a set amount of time before the interest rate adjusted to a bigger percentage. In times of high interest, the appeal of adjustable rate mortgages was substantial.

Interest rates have moved lower for years. For home loans closed in February 1982, the average interest rate was of 15.37%. The average fell to 9.31% in February 1989 and continued to drop. In February 2006, the average was 6.3%. In August 2017, the average was 3.99%.

At todays low rates, adjustable loans arent very popular. So when you are shopping for a loan, consider that the small amount that you might save now on an ARM might backfire if interest rates increase substantially when the loan adjusts five or seven years from now.

Does The Federal Reserve Decide Mortgage Rates

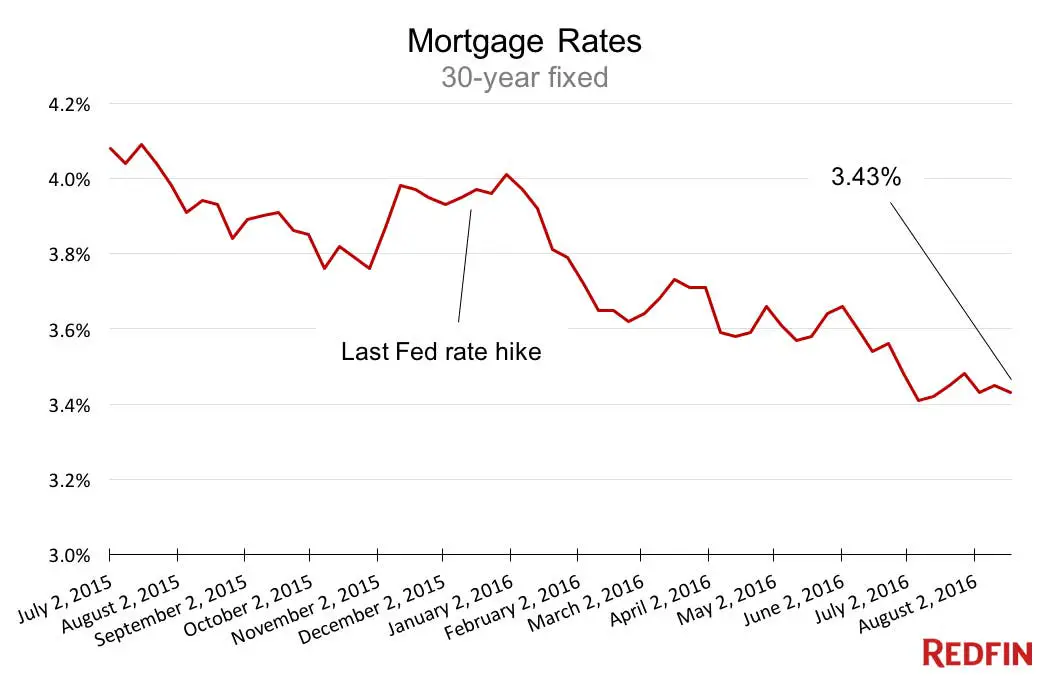

While the Federal Reserve doesnt decide mortgage rates, it does influence the rate indirectly. The Federal Reserve helps to guide the economy by keeping inflation under control and encouraging growth. That means the decisions the Federal Open Market Committee makes in raising or lowering short-term interest rates may influence lenders to raise or lower theirs.

Recommended Reading: How Much It Costs To Refinance A Mortgage

Mortgage Rate Trends: Where Rates Are Headed

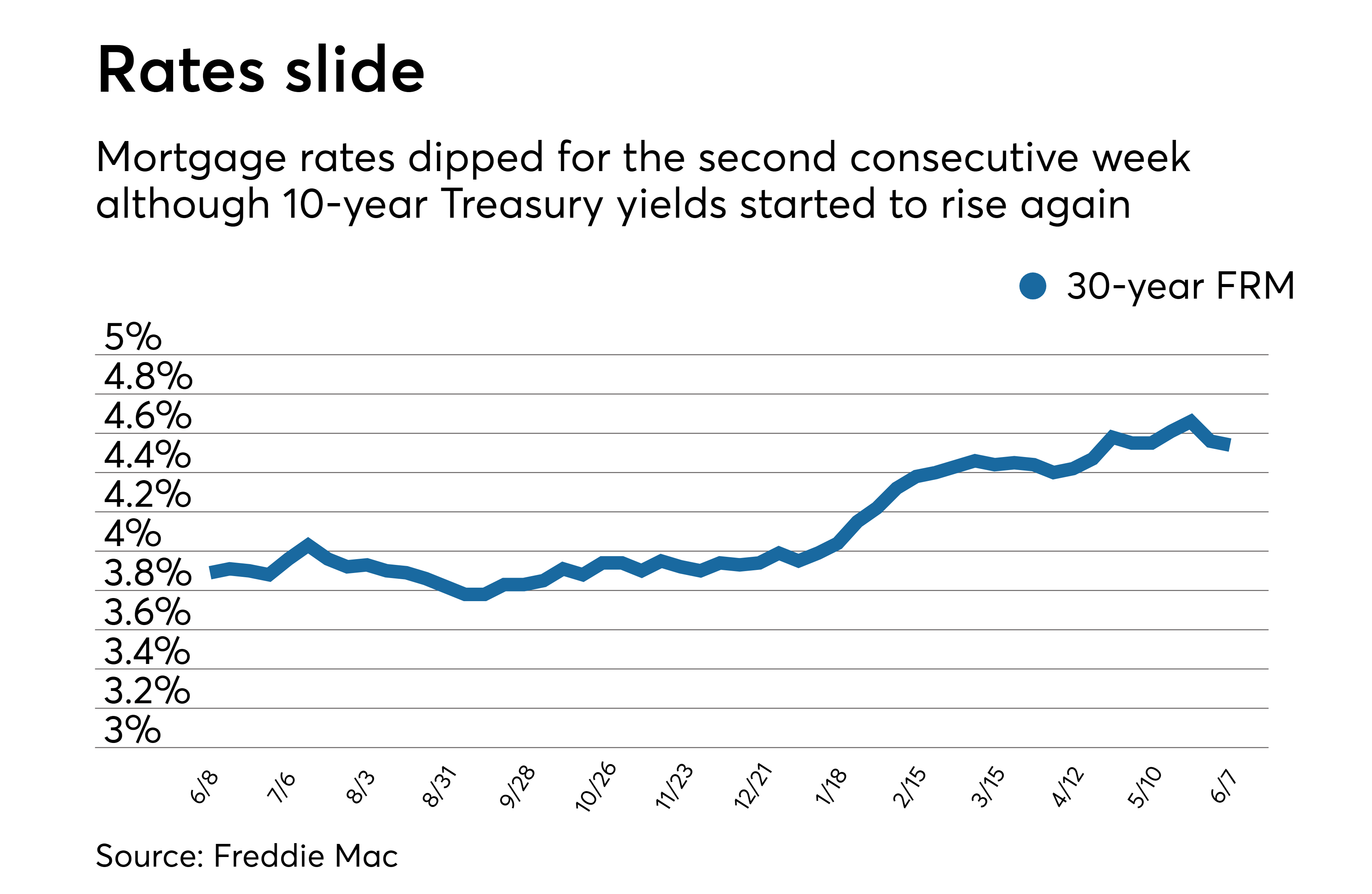

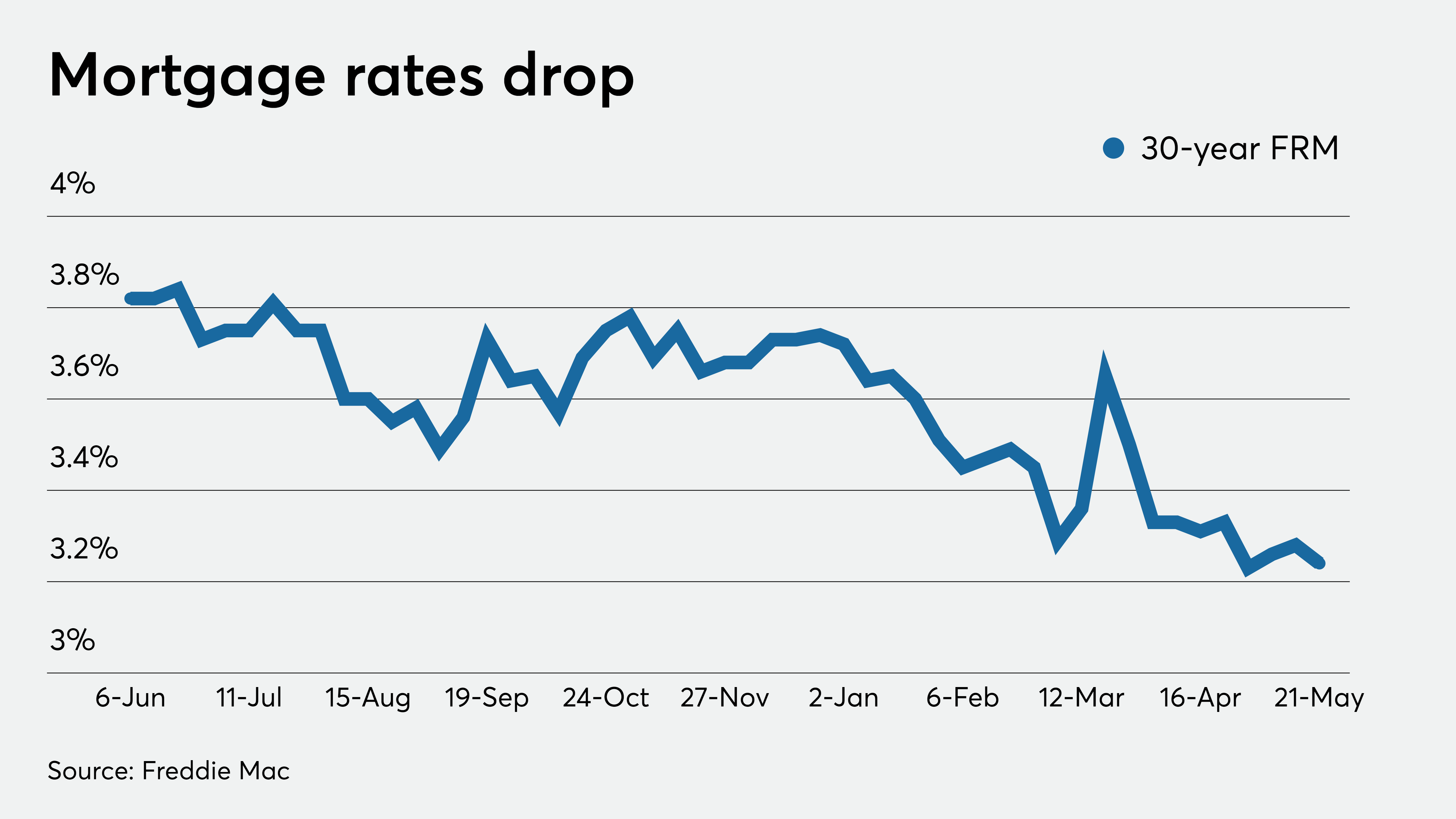

Mortgage rates plunged early in the pandemic and scraped record lows below 3 percent at the start of 2021. The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and rates rose past 5 percent in 2022.

Low interest rates were the medicine for economic recovery following the financial crisis, but it was a slow recovery so rates never went up very far, says Greg McBride, CFA, Bankrate chief financial analyst. The rebound in the economy, and especially inflation, in the late pandemic stages has been very pronounced, and we now have a backdrop of mortgage rates rising at the fastest pace in decades.

What Is A 30

A 30-year fixed-rate mortgage is repaid over a 30-year period and its interest rate never changes. The long repayment period means youll have smaller monthly payments compared to shorter-term loans, which helps make this the most popular type of loan. In recent years, roughly eight out of 10 conventional mortgages are 30-year fixed rate loans, according to Freddie Mac.

Don’t Miss: How Much Home Can I Afford Rocket Mortgage

Should I Choose A Fixed Or Variable Rate

Variable rates allow you to take advantage of future decreases in interest rate. On the other hand, fixed rates are preferable if interest rates rise in the future. Unfortunately, long-term fluctuations in the prime rate are difficult if not impossible to predict.

However, a2001 studyfound that between 1950â2000, choosing a variable interest rate resulted in lower lifetime mortgage cost than a fixed rate up to 90% of the time. According to the study, if you are comfortable with the risks involved, a variable rate may reduce your long-term mortgage cost.

Historical Canada Mortgage Rates

Looking at historical mortgage rates is a good way to understand which types of mortgage attract higher rates. They also make it easier to understand whether weâre currently in a low or higher rate environment, relatively speaking.

Here are some of Canadaâs lowest mortgage rates of the year for different types of mortgages over the past five years.

| 2017 |

You May Like: What Is The Average Mortgage Interest Rate

How To Use Our Mortgage Rate Tool

You need six pieces of information to start comparing rates:

Should I Use A Mortgage Broker Or Lender

Many borrowers have traditionally gone directly to a mortgage provider, such as one of Canadas big banks, to get a mortgage. There are certain advantages to applying for a mortgage this way: You may have an established relationship with the bank or mortgage provider, which can simplify the application process, and the institution may be able to offer you other financial products in addition to a mortgage.

However, there are many reasons to consider working with a mortgage brokera licensed professional who negotiates with a network of lenders to help you find the best mortgage rate.

Mortgage brokers act as an intermediary between lenders and borrowers, and their services are typically free for the borrower mortgage brokers are compensated via a commission fee paid by the mortgage lender that you ultimately choose to sign a contract with. You should still do your due diligence to ensure the mortgage broker is licensed, working on your behalf and offering you a mortgage that is suitable for you.

Generally, its a good idea to compare mortgage rates from a range of mortgage providers and brokers. Some brokers only work with a small selection of lendersand some lenders choose not to work with mortgage brokers at allmeaning you could be missing out on potential savings. Comparing offers from a range of sources is one of the best ways to get a competitive mortgage rate.

What does the * mean?

Read Also: Can You Buy Two Properties With One Mortgage

What Is A 15

A 15-year fixed-rate mortgage maintains the same interest rate and monthly principal-and-interest payment over the 15-year loan period.

While the loans provide a fixed principal and interest payment, youre not stretching out the payments for as long as the traditional 30-year mortgage and that saves a great deal of interest.

What Are Today’s Mortgage Rates

Although mortgage rates fluctuate daily, 2020 and 2021 were years of record lows for mortgage and refinance rates across the US.

While low average mortgage and refinance rates are a promising sign for a more affordable loan, remember that they’re never a guarantee of the rate a lender will offer you. Mortgage rates vary by borrower, based on factors like your credit, loan type, and down payment. To get the best rate for you, you’ll want to gather rates from multiple lenders.

| Mortgage type |

Also Check: How Long Does A Mortgage Take

Money’s Average Mortgage Rates For August 5 2022

Interest rates on almost all loan categories are starting the day lower than yesterday. Borrowers looking for a 30-year fixed rate mortgage can expect to see rates averaging 6.231% with no points paid, down 0.395 percentage points.

- The latest rate on a 30-year fixed-rate mortgage is 6.231%.

- The latest rate on a 15-year fixed-rate mortgage is 4.823%.

- The latest rate on a 5/6 ARM is 5.73%.

- The latest rate on a 7/6 ARM is 6.124%.

- The latest rate on a 10/6 ARM is 6.182%.

Summary Of Current Mortgage Rates

Average mortgage rates are lower this week

- The current rate for a 30-year fixed-rate mortgage is 4.99% with 0.8 points paid, down 0.31 percentage points from a week ago. The 30-year rate averaged 2.77% this week last year.

- The current rate for a 15-year fixed-rate mortgage is 4.26% with 0.6 points paid, a decrease of 0.32% percentage points week-over-week. A year ago, the 15-year rate averaged 2.10%.

- The current rate on a 5/1 adjustable-rate mortgage is 4.25% with 0.3 points paid, 0.04 percentage points higher/lower compared to last week. The average rate on a 5/1 ARM was 2.4% a year ago.

- Categories

Also Check: How Much Is A Mortgage On 1.4 Million

How Do I Find Current 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start start the process of getting approved for your home loan. Its that easy

A 30-year fixed-rate mortgage is the most common term of mortgage. It provides the security of a fixed principal and interest payment, and the flexibility to afford a larger mortgage loan because the payments are more affordable theyre spread out over three decades.

Primary Vs Second Mortgages

Your mortgage rate will also be affected if you take out a second mortgage. Some homeowners take out a second mortgage to access their home equity, or the amount of the home they own. Because your first mortgage takes priority, your primary mortgage will be paid off first if you run into financial trouble.

Due to the increased risk associated with these loans, second mortgages have slightly higher rates than primary ones. By contrast, in a cash-out refinance, you take out equity based on your primary mortgage and you can get a lower rate. In addition, you can roll your second mortgage into your refinanced primary mortgage.

Recommended Reading: Can You Include New Appliances In A Mortgage

Are Low Frills Mortgages Worth It

Restricted mortgages have boomed in popularity the last five years. Lenders realize that consumers want the lowest rate, so theyve tried to strip out features from their mortgages to get the pricing lower. For some borrowers who plan no financing changes for five years, low-frills mortgages may make sense. For most Canadians, the small rate savings isnt worth the much higher potential costs after closing. Those costs can bite you if you break, port, increase or otherwise refinance before your mortgage maturity date. Hence, for the majority of homeowners, its worth the small premium for a full-featured mortgage

Why Does My Mortgage Interest Rate Matter

Your mortgage interest rate impacts the amount youll pay monthly as well as the total interest costs youll pay over the life of your loan. While it may not seem like a lot, a lower interest rate even by half of a percent can add up to significant savings for you.

For example, say a borrower with a good credit score and a 20 percent down payment takes out a 30-year fixed-rate loan for $300,000. In this case, an interest rate of 4.75% instead of 5.25% translates to more than $90 per month in savings in the first five years, thats a savings of $5,500.

Its equally important to look at the total interest cost of your loan. In the same scenario, a half percent decrease in interest rate means a savings of almost $33,000 in total interest owed over the life of the loan.

Read Also: How Much Is A 230k Mortgage

Qualifying For A Lower Mortgage Rate

It may be helpful to improve your credit score before applying for a mortgage so you can qualify for a lower mortgage rate and save tens of thousands of dollars over the life of the mortgage. The money you save on your mortgage is well worth the time and effort to improve your credit score.

If you have a low credit score, review your credit reports to see the items that are affecting your credit score. You can raise your credit score by making timely payments on all your bills, paying down your credit card debt, removing errors from your credit report, and paying off outstanding delinquent balances. In some cases, just a few points can make a big difference in your mortgage rate.

Continue to monitor your credit score in the weeks leading up to your mortgage application to see how your credit score improves.

Mortgage Rates By Credit Score

Your credit score is one of the most important factors when applying for a mortgage. It influences your monthly mortgage payment, the total amount of interest you pay on your mortgage loan, and ultimately the total amount you pay for your home. Because your interest rate is based on your credit score, you should make sure your credit is in the best shape possible before applying for a mortgage.

Read Also: Can I Get A Mortgage And Rent The Property

How Long Can You Lock In A Mortgage Rate

Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesnt process the loan before the rate lock expires, youll need to negotiate a lock extension or accept the current market rate at the time.

Even if you have a lock in place, your interest rate could change because of factors related to your application such as:

- A new down payment amount

- The home appraisal came in different from the estimated value in your application

- There was a sudden decrease in your credit score because you are delinquent on payments or took out an unrelated loan after you applied for a mortgage

- Theres income on your application that cant be verified

Talk with your lender about what timelines they offer to lock in a rate as some will have varying deadlines. An interest rate lock agreement will include: the rate, the type of loan , the date the lock will expire and any points you might be paying toward the loan. The lender might tell you these terms over the phone, but its wise to get it in writing as well.

What Is Happening With Mortgage Rates Today

In recent decades, Canadian home owners have enjoyed some of the lowest rates in history. Interest rates reached their high point in the 1980s and have gradually fallen since then.

Unfortunately for new mortgage applicants, it appears the reign of ultra-low rates is coming to an end. Since early 2022, the rates on both fixed- and variable-rate mortgages have been climbing as the Bank of Canada tries to get inflation under control.

On June 1, 2022, the Bank raised the benchmark rate by 50 basis points , bringing the target rate to 1.5%only 0.25% short of where it was prior to the COVID-19 pandemic. This represents the quickest rate hikes in more than two decades, and experts predict further increases in 2022.

Don’t Miss: What Is A Mortgage Insurance Disbursement

Factors That Can Affect Your Personal Interest Rate

Itâs important to understand that the best mortgage rate you qualify for may change depending on your unique borrowing profile. Here are some of the factors that influence what mortgage rate you qualify for:

The type of mortgage: If your mortgage is for a refinance, rather than a purchase or renewal, youâll be eligible for higher rates. For individuals with an existing mortgage who have good credit and more than 20% equity in their homes, in addition to refinancing, you can also explore a home equity line of credit .

Your down payment: If youâre purchasing a home andyour down payment is less than 20% of the purchase price and the value of the home you are purchasing is less than $1 million, youâll be required to purchase mortgage default insurance . This insurance is added to your mortgage amount and, while it will cost you money, it will result in a lower mortgage rate as your mortgage is less risky for your lender. If youâre renewing your mortgage, in order to be eligible for the lowest mortgage rates you would have needed to purchase CMHC insurance on the original mortgage.

Your intended use of the property: Your mortgage rate will be higher if you plan to rent your property out vs. live in it as your primary residence.

What Term Should I Choose

The most common term length in Canada is 5 years. Unless you have specific concerns, a 5-year term generally works well. Longer terms will have higher mortgage rates, which can be bad for those struggling to pass themortgage stress testas you may be tested at a higher mortgage rate. This is a particularly significant issue for homebuyers inTorontoâs housing marketor inVancouverâs housing market. However, you wonât have to worry about requalifying for a mortgage as often as a short mortgage term. Each lender will offer different options for term length and rates contact your lender or broker for more details.

Recommended Reading: Can You Get Rid Of Fha Mortgage Insurance