Increase Your Credit Score

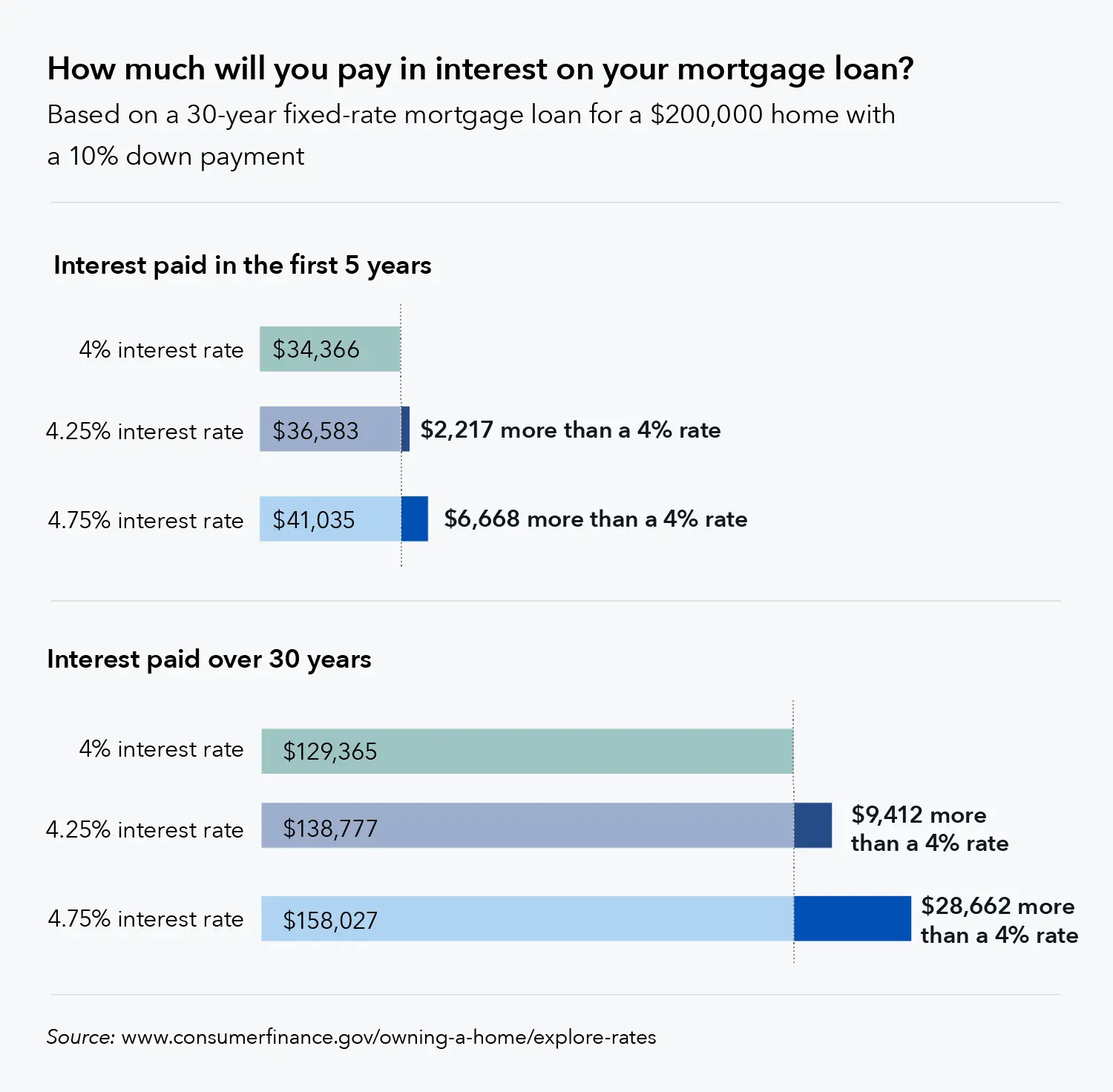

The higher your credit score, the greater your chances are of getting a lower interest rate. To increase your credit score, pay your bills on time, pay off your debt and keep your overall balance low on each of your credit accounts. Don’t close unused accounts as this can negatively impact your credit score.

What Are Mortgage Statements

A mortgage statement outlines important information about your mortgage. Mortgage statements are usually an annual statement, with it being sent out by mail between January and March rather than once every month. You may also choose to receive your mortgage statement online.

For example, TD only produces mortgage statements annually in January, while CIBC produces them between January and March. If you have an annual mortgage statement, it will usually be dated December 31. You may also request a mortgage statement to be sent.

Information on a mortgage statement are up to the end of your statement period and include:

- Current interest rate

Average Monthly Mortgage Loan Payment In Canada In 3rd Quarter 2020 And 3rd Quarter 2021 By Metropolitan Area

| Characteristic |

|---|

You need a Statista Account for unlimited access.

- Full access to 1m statistics

- Incl. source references

- Available to download in PNG, PDF, XLS format

You can only download this statistic as a Premium user.

You can only download this statistic as a Premium user.

You can only download this statistic as a Premium user.

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

…and make my research life easier.

You need at least a Starter Account to use this feature.

Also Check: How Long Does It Take To Do A Reverse Mortgage

There Are A Number Of Factors To Consider

A Tea Reader: Living Life One Cup at a Time

Purchasing real estate with a mortgage is often the most extensive personal investment most people make. How much you can afford to borrow depends on several factors, not just what a bank is willing to lend you. You need to evaluate not only your finances but also your preferences and priorities.

Here is everything you need to consider to determine how much you can afford.

Can I Cancel My Mortgage Life Insurance

Canadas major banks all allow you to cancel your mortgage life insurance at any time, and to receive a refund if you cancel your plan within the first 30 days. This 30-day free look or 30-day review period is important as it lets you change your mind should you decide that mortgage life insurance isn’t right for you.

To cancel, you can call your lender’s insurance helpline, complete a form at a branch, or send a written request by mail.

Read Also: What Is The Mortgage Rate At The Moment

Find A Mortgage Adviser You Trust

A mortgage is like an insanely complicated 3D puzzle. Putting the pieces together requires levels of expertise and experience most people simply dont have. Thats why finding a mortgage adviser who can customize a solution to your unique financial situation is a critical step in the mortgage journey.

A good mortgage broker will take into consideration your long-term financial goals and put you into a loan that helps you achieve them. Interview several brokers until you find one youll feel comfortable with. Keep in mind that youll be sharing a lot of personal and financial details.

What Does Average Represent

The U.S. Census Bureau reports both the mean and the median payment. The mean is the same as average. The median is the middle value in a set of numbers. It divides the lower and higher half of values in the set.

When figuring out a typical monthly mortgage payment, finding the median value can be more useful than finding the average value. Averages can get skewed by extremely high or low values. The median gives a better idea of where the middle is for a broad range of homeowners.

National averages: Looking at averages from another data source, the 2020 National Association of REALTORS Profile of Home Buyers and Sellers, shows a national median home price of $272,500. If we assume a down payment of 10% of the purchase price, we can calculate a loan size of $245,250. Applying current mortgage loan rates, you can estimate the following average monthly mortgage payments:

- $1,700 per month on a 30-year fixed-rate loan at 3.29%

- $2,296 per month on a 15-year fixed-rate loan at 2.79%

First-time homebuyers: The national averages include all homeowners, including those who have built up equity, worked their way up the pay scale and established high credit scores. Those folks are more likely to take on larger loans and get approved for them.

- $1,307 per month on a 30-year fixed-rate loan at 3.29%

- $1,760 per month on a 15-year fixed-rate loan at 2.79%

- $1,077 per month on a 30-year fixed-rate loan at 3.29%

- $1,466 per month on a 15-year fixed-rate loan at 2.79%

Recommended Reading: What Percentage Should My Mortgage Be

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

What Mortgage Payment Options Do I Have

The frequency of your mortgage payments can be monthly, weekly or bi-weekly, depending on your mortgage terms and conditions.

Mortgage payments can be made in the following ways:

- Monthly mortgage payments

- Weekly accelerated payments

- Semi-monthly (twice a month, e.g., on the 1st and 16th of each month.

Accelerated payments help you pay off your mortgage quicker compared to other payment schedules, helping you avoid thousands of dollars in interest. About 350,000 borrowers increased their payment frequency in 2019, found MPC.

When you choose to make accelerated mortgage payments, you end up making the equivalent of 13 monthly payments per year. The result is that you pay off the mortgage years earlier, saving thousands of dollars on interest.

Heres an example of how payments change based on frequency, assuming a $100,000 mortgage at 3% interest amortized over 25 years.

Recommended Reading: How Much Money Can I Be Approved For A Mortgage

Government Incentives In Canada

Canadians who wish to purchase a new home has numerous government incentives to help. Some of these include:

- Home Buyersâ Plan : Individuals can borrow up to $25,000 from their RRSP fund tax free. In some cases, both spouses can borrow, making the total amount $50,000. To qualify for this incentive, borrowers must not have lived in a home they owned within the last 5 years. People are required to have a written agreement to purchase or build a home that they plan to occupy as their principal residence. Individuals need to pay back their RRSP within 15 years. During the second year from the withdrawal, borrowers must begin to pay it back. It will be tax free for the first 15 years. If the money is not paid back, borrowers must begin to pay taxes on it.

- Land Transfer Tax : The Ontario government will give people a refund of up to $4,000 of the land transfer tax they paid on their first home. If the real estate is not in Ontario, buyers need to check because the same offer might be available in other provinces. To qualify for this incentive, people must be at least 18 years of age and cannot have previously owned a home. When individuals register their home purchase, a refund might be granted.

- First Time Home Buyers Tax Credit : Borrowers can receive a tax credit on their tax return. The amount a person can receive varies.

How To Calculate Your Mortgage Payment

Mortgage calculators take into account a variety of different factors when determining your monthly mortgage costs. They can include the price of your home, your down payment, your monthly interest rate and the term length of your mortgage. If your math skills are a little rusty, a mortgage calculator does the hard work for you in order to determine your monthly payment and associated costs.

The basic formula for calculating your mortgage costs: P = A/

- P stands for your monthly payment

- A stands for your loan amount

- T stands for the term of your loan in months

- R stands for the monthly interest rate for your loan

For example, lets say that John wants to purchase a house that costs $125,000 and has saved up a $25,000 down payment. His loan amount is $100,000, the term length is 15 years and the monthly interest rate is 4.20%. In this scenario, Johns monthly mortgage payment will be $749.75.

Johns mortgage cost formula will look like: 749.75 = 100,000[4.2^180/[^180-1)

If John wants to purchase the same house with a 30-year term length, the formula works in much the same way. In this scenario, his loan amount is $100,000, term length is 30 years and monthly interest rate is 4.20%. With a 30-year mortgage, Johns monthly mortgage payment will be $489.02.

Johns mortgage cost formula will look like: 489.02 = 100,000[4.2^360/[^180-1)

You May Like: What Is Current Interest Rate On 15 Year Mortgage

What Happens If You Skip A Payment

Skipping a mortgage payment doesn’t mean that the lender is giving it to you for free. Skipping a payment just means that you’ll be paying it back later. When you skip a mortgage payment, interest that would have been charged would be added to your mortgage balance instead of being paid off. This increases your mortgage balance, which means that you’ll be paying interest on your added interest.

If you dont repay the skipped mortgage amount plus accumulated interest, then youll be paying interest on the interest for the rest of your mortgages amortization. This could make skipping a mortgage payment a very costly option to take. Fortunately, many lenders allow you to repay your skipped payments without any prepayment penalties.

Keep Your Payments The Same When Changing Your Mortgage

When you renew your mortgage, you may be able to get a lower interest rate.

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. Lenders call this early renewal option the blend-and-extend option. They do so because your old interest rate and the new terms interest rate are blended.

When your interest rate is lower, you have the option to reduce the amount of your regular payments. If you decide to keep your regular payments the same, you can pay off your mortgage faster.

Also Check: How Much Does Mortgage Protection Insurance Cost

My Mortgage Payment Plan

This line graph shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.

Find out how much you can save by changing your payment frequency.

This table shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.| Amortization |

|---|

* These calculations are based on the information you provide they are approximate and for information purposes only. Actual payment amounts may differ and will be determined at the time of your application. Please do not rely on this calculator results when making financial decisions please visit your branch or speak to a mortgage specialist. Calculation assumes a fixed mortgage rate. Actual mortgage rates may fluctuate and are subject to change at any time without notice. The maximum amortization for a default insured mortgage is 25 years.

** Creditor Insurance for CIBC Mortgage Loans, underwritten by The Canada Life Assurance Company , can help pay off, reduce your balance or cover your payments, should the unexpected occur. Choose insurance that meets your needs for your CIBC Mortgage Loan to help financially protect against disability, job loss or in the event of your death.

New Mortgages Interest Only Mortgages And Interest Rate Rises

Itll give you a simple, ballpark figure to show you the monthly payments youd pay on:

- intertest only mortgages

- your mortgage if there was an interest rate rise.

You can also adjust the mortgage term, interest rate and deposit to get an idea of how those affect your monthly payments.

To get started all you need is the price of your property, or the amount left on your mortgage.

MoneyHelper is the new, easy way to get clear, free, impartial help for all your money and pension choices. Whatever your circumstances or plans, move forward with MoneyHelper.

Read Also: Can You Buy A House Without A Mortgage

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums. In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

What Are Todays Mortgage Rates

Todays rates are still low, which is good news for home buyers. The lower your interest rate, the more real estate you get for your dollar.

Remember, theres no perfect amount to spend on your home loan. The decision is personal it depends on how much you make, how much you currently spend each month, and how large of a housing payment youre comfortable with.

So explore your options, check your rates, and pick the right mortgage amount for you.

Don’t Miss: How To Compare Mortgage Quotes

How Does The Amount Of My Down Payment Impact How Much House I Can Afford

The down payment is an essential component of affordability. For example, if we include down payment on that $70,000 annual salary, your home budget shrinks to $275,000 with a down payment of 10 percent . By making a larger down payment, you would reduce the loan-to-value ratio, which makes a difference in how your lender looks at you in terms of risk.

Bankrates mortgage calculator can help you explore how different purchase prices, interest rates and minimum down payment amounts impact your monthly payments. And dont forget to think about the potential for mortgage insurance premiums to impact your budget. If you make a down payment of less than 20 percent on a conventional loan, youll need to pay for private mortgage insurance, or PMI.

How Much Should Your Mortgage Be

Your mortgage should be a loan amount you can comfortably afford in your monthly budget.

So when determining the right size, you have to work backwards find the right monthly payment first, and calculate the home purchase price based on that number.

When it comes to monthly mortgage payments, one number is key in determining what you can afford: your debt-to-income ratio .

This number compares your monthly income against your monthly debts to see how much mortgage you could afford alongside your existing payments.

Keep in mind that your loan officer is going to qualify you on gross income. Therefore, if your gross DTI is 43% , you personally may want to consider what it is for your net , says Jon Meyer, The Mortgage Reports loan expert and licensed MLO.

Of course, other factors matter too, like your credit score, mortgage rate, and down payment.

But DTI has a huge impact on affordability. So its important to understand how mortgage lenders look at this number.

Recommended Reading: What Is The Payment On A 140 000 Mortgage