Keep Your Payments The Same When Changing Your Mortgage

When you renew your mortgage, you may be able to get a lower interest rate.

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. Lenders call this early renewal option the blend-and-extend option. They do so because your old interest rate and the new terms interest rate are blended.

When your interest rate is lower, you have the option to reduce the amount of your regular payments. If you decide to keep your regular payments the same, you can pay off your mortgage faster.

What Happens If You Dont Pay Your Mortgage For 90 Days

If you dont come to an agreement with your mortgage lender, and you miss three mortgage payments, you will not have paid anything off your mortgage debt for 90 days. This is a serious situation to be in. You will receive a letter from the mortgage lender telling you that youre delinquent in your mortgage payments and have 30 days to bring your account up to date.

If you want to stay in your home, you need to speak to the lender in order to try and avoid foreclosure proceedings. They will normally expect full payment of the money thats owed but you may still be able to reach a payment arrangement.

What If I Live In A Mobile Home Park

Governor Walz’s order suspending evictions applied to mobile home park lot rentals. The eviction moratorium ended on June 30, 2021. There are some new protections and rules for evictions you can read about in our fact sheet COVID-19: Renters’ Rights and the end of the Eviction Moratorium.

BUT, the federal freeze on foreclosures does not yet apply to mobile or manufactured homes., This means if you are still buying the home, the seller can start a repossession action to take it back and force you out. This is true if you are buying the home from the mobile home park or somewhere else.

If you are buying your home from the park and can only pay for the home payment and not the rent, write clearly on your payment that the money is for the home payment and not the lot rent. If you pay in cash, give them a letter along with your payment saying that. Make sure it is on your receipt from them too.

Note: In order to repossess a manufactured home, a seller has to give 30 days notice before filing in court.

You May Like: What Questions To Ask A Mortgage Lender

Late Charges And Other Fees Start To Accrue

When taking out a loan to buy a home, a borrower typically signs two primary documents: a promissory note and a mortgage . The promissory note is the personal promise to pay back the money borrowed. The mortgage or deed of trust, on the other hand, establishes the lender’s lien on the property and is recorded in the county records.

The terms of most promissory notes require the borrower to make a payment by a specific day of the month and include a grace period for the payment. If you fail to make the payment before the expiration of the grace period, your bank will assess a late fee. The amount of the late fee is set out in the promissory note you signed when you took out your mortgage, and is typically around 5% of the overdue payment of principal and interest.

Also, if you default on the loan, the terms of your mortgage likely allow your bank to pass on certain expenses to you. These expenses include attorneys’ fees and inspection charges, among others.

After The Second Missed Payment

As above, in most cases, lenders wont report late payments to credit reporting agencies until these payments are at least a month late. However, if you miss a second payment, you will face a second reporting to credit agencies and a second round of late fees. These reports will lead to ongoing negative consequences for a homeowners credit score as each missed payment is reported to credit bureaus.

Again, by now, your lender will probably try to contact you in writing about the consequences of defaulting on the mortgage.

Recommended Reading: How Can I Get Help Paying My Mortgage

How Much Will A Mortgage Late Fee Be

Homeowners usually have a grace period of 15 days after the due date to make their mortgage payment. After that point, you may pay a late fee for each month that you miss a payment.

The late fee is set by state law, but it usually equals 3% to 6% of your monthly payment. So, if your mortgage payment is usually $1,000 and your late fee is 5%, then you may be on the hook for an extra $50 for each month you go without paying.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Don’t Miss: Are Mortgage Rates Based On Credit Score

Fewer Florida Homeowners Are Behind On Their Mortgage

Florida is at the forefront of homeowners that are starting to catch up on their delinquent mortgage payments. Over the past six months, the number of homeowners delinquent in their mortgage payments dropped by one-third. Florida was outpaced by only Rhode Island and Nevada. There is less than one percentage point that separates the Sunshine State from the other two.

Currently, there are 1.45 million borrowers in the country that are 90 days or more past due on their mortgage, but are not yet facing foreclosure. That stat is startling and has many people wondering just how many mortgage payments you can miss before the foreclosure process starts in Broward County. Generally speaking, you can miss four mortgage payments before falling into foreclosure, but the exact amount depends on other factors, as well.

When Does Foreclosure Happen

This depends on the state in which you reside. In New York, a loan servicer or lender may not file for foreclosure until 120 days have passed from a missed mortgage payment. This time frame allows the delinquent borrowers time to explore their loss mitigation options.

However, there is currently an ongoing moratorium on foreclosures and evictions in New York, under Governor Cuomos orders. This doesnt mean that you should relax if you are behind on your mortgage payments consider this as an extension of the loss mitigation phase.

Keep in mind, also, that being late on your mortgage isnt the only thing that could initiate a foreclosure. If you are late on your property taxes, this could also cause you to lose your home. However, property tax lien sales in NYC are also postponed.

Also Check: How Much To Pay Mortgage Off Early

What If I Have A Reverse Mortgage And Cant Afford My Property Taxes Or A Repayment Plan I Have

Normally, not paying your property taxes or repayment plan can put you in danger of foreclosure. For reverse mortgages backed by the federal government and HUD, foreclosures and post-foreclosure evictions were suspended through July 31, 2021. Most reverse mortgages are backed by the federal government and HUD.

If you are having trouble making your property tax payments or repayment plan payments and your servicer is threatening to put your loan into “due and payable status,” or if it is already in “due and payable status,” you can ask for a forbearance. Forbearance means your payments are not due until the end of the forbearance period. You have until to ask your reverse mortgage servicer for a forbearance. If you had your forbearance on or before June 30, 2020, your forbearance can last up to 18 months. If you got your forbearance after June 30, 2020, you can get up to a 12 month forbearance.

Call Legal Aid if your servicer is refusing to do this for you.

First Missed Mortgage Payment

Lenders typically offer a grace period of 10-15 days after the mortgage payment due date. If you make your full payment within that period, you wont be charged a late fee, and most importantly, the lender wont report a late payment to the credit bureaus.

Once this grace period is up, however, youll be charged a late fee if youve missed the payment or have only made a partial payment. This fee is usually a fairly substantial percentage of your mortgage payment, such as 4% to 6% of the monthly payment amount. Refer to your mortgage loan documents for the exact fee.

Youll receive an overdue notice, and perhaps a phone call, after your first missed payment. In addition, the lender will report the delinquent payment to the credit bureaus, which can affect your credit score and stay on your credit report for up to seven years.

Depending on the type of foreclosure your state uses, the lender might send you a notice of its intent to foreclose or a pre-foreclosure notice after the first missed payment, although most wait until youve missed two or more payments.

Don’t Miss: What Is 1 Point On A Mortgage

Tips To Help You Pay Off Your Mortgage Faster

Looking for ways to pay off your mortgage faster? Thats great even small steps over time can make a big impact on helping you be mortgage free faster.

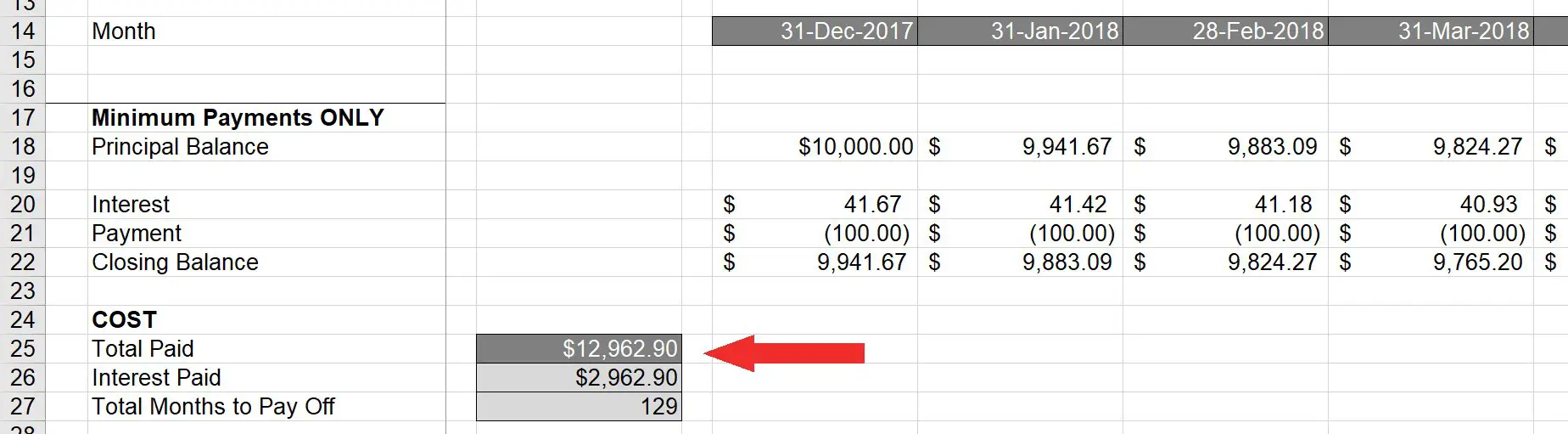

There are two parts to each mortgage payment the principal and the interest. The principal is the remaining balance of what you originally borrowed, while the interest rate is what youre charged while that principal is outstanding. You may be looking to pay as much as you can toward the principal to reduce the amount of interest youll pay over the life of your mortgage.

Well walk you through what you need to know to start paying off your mortgage faster.

During your mortgage term, youll have opportunities to make changes that will help you pay off your mortgage faster. There are some changes you can make at any point during your term, while others you can make when you renew your mortgage.

Keep in mind, its important to understand the terms of your mortgage agreement before making any changes to your payments. Your mortgage may come with certain prepayment privileges. At TD, we make it easier to pay off your mortgage faster with flexible mortgage payment features.

The Impact Late Mortgage Payments Have On Credit

The effect of a single late payment on your credit report varies. If you have a particularly high and suddenly miss a payment, you can see a steeper drop than someone with a lower score of 640 and a few late payments, according to Experian®.

Heres some good news: FICO® says one late payment is not a score killer. Your score considers late payments only as part of your overall payment history. If youve paid your bills in the past and continue to pay all your bills going forward, you should be able to make up the drop more quickly. Creditors cant report a late payment to the credit bureaus until 30 days past due. However, you should know that any late payment will stay on your credit history for 7 years.

The credit hit gets worse the more you push the payment back. A payment thats 90 days late is worse than one thats 60 days late, which is worse than one thats 30 days late, and so on. The biggest detriments to your credit are collection items such as bankruptcies, foreclosures and liens.

Also Check: How Do You Figure Out Mortgage Interest

Make Extra Principal Payments

Another way to pay off your home loan faster is to simply pay extra when youre able.

Most mortgage loans issued after Jan. 10, 2014, do not charge prepayment penalties.

This means you can pay extra money toward your mortgage balance each month or make a larger, lump sum payment on your principal each year without facing a penalty for paying off your loan early.

Many homeowners make extra payments on their loans principal when they get an income tax refund. Extra principal payments can have a big impact.

Heres an example.

- Lets say you took out a home loan for $300,000 on a 30-year term and rate of 4%

- Thats a principal and interest payment of $1,370

- 360 payments of $1,370 per month means youll have paid $492,500 over the life of the loan thats $192,500 in interest payments over 30 years

Using the same numbers for the loan amount and interest rate:

- If you make extra principal payments of $250 per month, youd shave seven years and four months off your term

- And, youd save more than $59,000 total in interest payments

There are benefits aside from interest savings, too.

Paying off your mortgage early lets you use the money you would have paid each month for other purposes, like investing.

Lets continue with the example above. Instead of paying $1,370 per month on the mortgage, you could put the same amount of money in an investment account.

Second Missed Mortgage Payment

If you miss your second mortgage payment, your mortgage is likely considered to be in default. If it hasnt already, the lender will probably contact you to find out why you havent made your payments. This is a good opportunity to explain your situation your lender may be able to put you on a plan to temporarily reduce or suspend your payment.

Your mortgage servicer will usually become increasingly aggressive about getting paid if you miss your second mortgage payment, but it gets even worse if you continue missing payments.

Recommended Reading: How Does The Interest Work On A Mortgage

How Does A Missed Mortgage Payment Affect Your Credit Score

The good news is that one late mortgage payment will not completely destroy your credit score. But, keep in mind that if you let your late payment become a rolling late, by never catching up, you will see a significant drop in your credit score. The longer a payment is late the worse it is for your credit score and overall financial health. A payment thats 30 days late is bad, but a payment that is 90+ days late is even worse and could lead to other more serious financial issues.

Each of the two credit reporting bureaus in Canada has their own specific formula for calculating your credit score. This makes it difficult to predict exactly how a late or missed mortgage payment will affect an individuals credit score. But, what we do know is that payment history is given the most weight. 35% of your credit score can be tied to your history of payment.

Its also important to note that late and missed mortgage payments will also show up on your credit report and stay there for up to 7 years. This means that while your credit score might recover rather quickly from a missed payment, any future lenders will continue to see the evidence of your missed payment for the following 7 years.

Looking for information on breaking a mortgage contract? Read this.

Speed Up Your Payments

What it is: If youre currently making monthly mortgage payments, you might be able to switch to a more accelerated payment schedule. For instance, you can pay monthly, semi-monthly, biweekly or weekly, which over time, may make your mortgage disappear faster and potentially save you thousands of dollars in interest over the life of your mortgage.

Try our handy calculator to see how much your interest payments would be on a more frequent payment schedule and how much you can save over your amortization period.

How to do it: You can make this change at any time by talking to a Mortgage Specialist by phone or by making an appointment at a branch.

Recommended Reading: How Interest Is Calculated On Mortgage

How Many Mortgage Payments Can You Miss

The mortgage delinquency rate has shot up significantly due to the economic turmoil brought about by COVID-19. If you are finding yourself falling behind on mortgage payments, read on to find out how long can pass before a house goes into foreclosure. If you find yourself facing foreclosure, our legal experts would be happy to provide you with a free consultation simply fill out our contact form.

Why Pay Off Your Mortgage Early

Few people keep a 30-year loan for its full term. In fact, homeowners stay put just 13 years on average and their loans might have an even shorter lifespan if they refinance at some point.

Homeowners who plan to sell their home or refinance soon usually arent concerned about paying off their mortgage early.

But what about homeowners who stay put for the long haul? Those 30 years of interest payments can start to feel like a burden, especially compared to the payments on todays lower-interest-rate loans.

You may find yourself wondering how to pay your mortgage off faster so you can live debt-free and have full ownership of your home.

Here are five strategies you can use to meet those goals.

Recommended Reading: What Is A Mortgage Insurance Disbursement

Three Missed Mortgage Payments

After three missed payments, your loan servicer will likely send another letter known as a demand letter or notice to accelerate. The letter acts as a notice to bring your mortgage current or face foreclosure proceedings.

Additionally, your loan servicer will report the late payment to the credit bureaus, which may cause your credit score to drop even more.